What Are Medicare Supplements?

Medicare Supplement Insurance (Medigap) is extra insurance

you can buy from a private insurance company to help pay your

share of out-of-pocket costs in Original Medicare.

You can only buy Medigap if you have Original Medicare. Generally, that

means you have to sign up for Medicare Part A (Hospital Insurance) and

Part B (Medical Insurance) before you can buy a Medigap policy.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private insurance company to help pay your share of out-of-pocket costs in Original Medicare.You can only buy Medigap if you have Original Medicare. Generally, that means you have to sign up for Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) before you can buy a Medigap policy. Other types of supplemental insurance (besides Medigap ) include: Medicare Advantage Plans (also known as Part C) Medicare drug plans (Part D) Medicaid Employer group health plans (including theFederal Employees Health Benefits (FEHBP) Program, retiree or COBRA coverage) or union plans.TRICARE Long-term care insurance policies Indian Health Service, Tribal, and Urban Indian Health plans

KEY POINTS

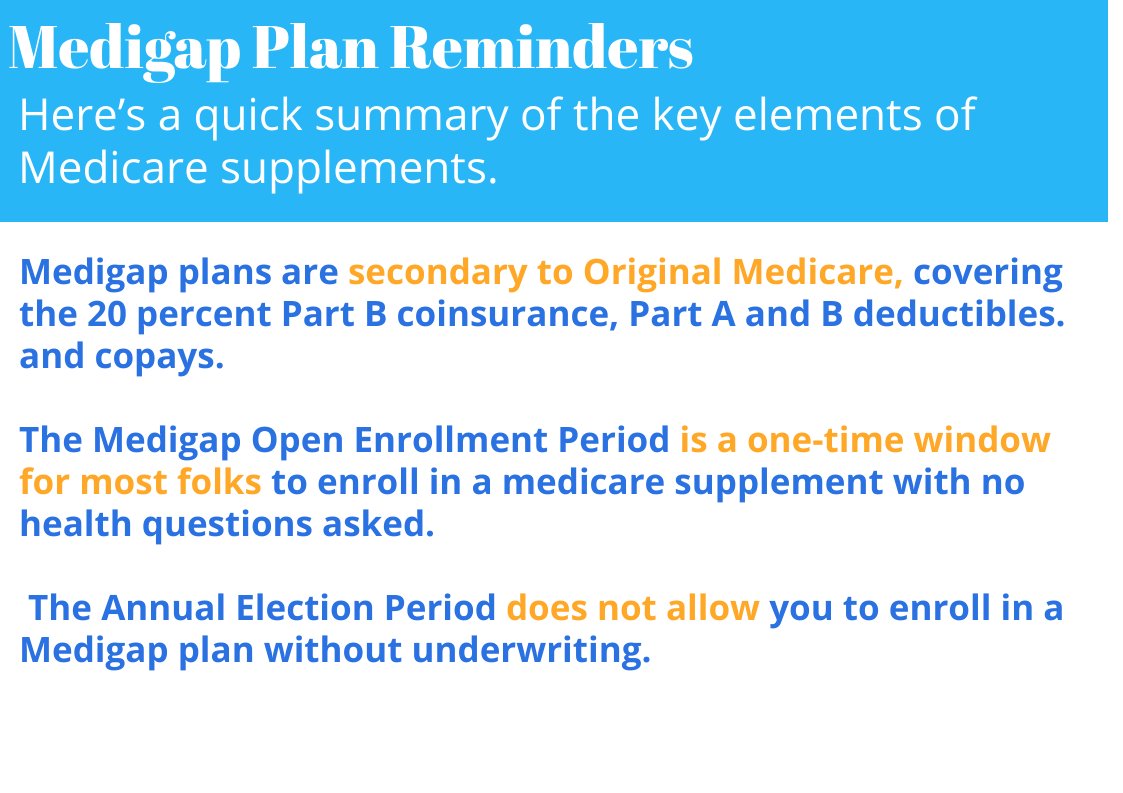

* Medicare Supplement plans help beneficiaries pay for the remaining expenses Medicare leaves them with.

* You must be enrolled in Medicare Part A and B to purchase a Supplement plan.

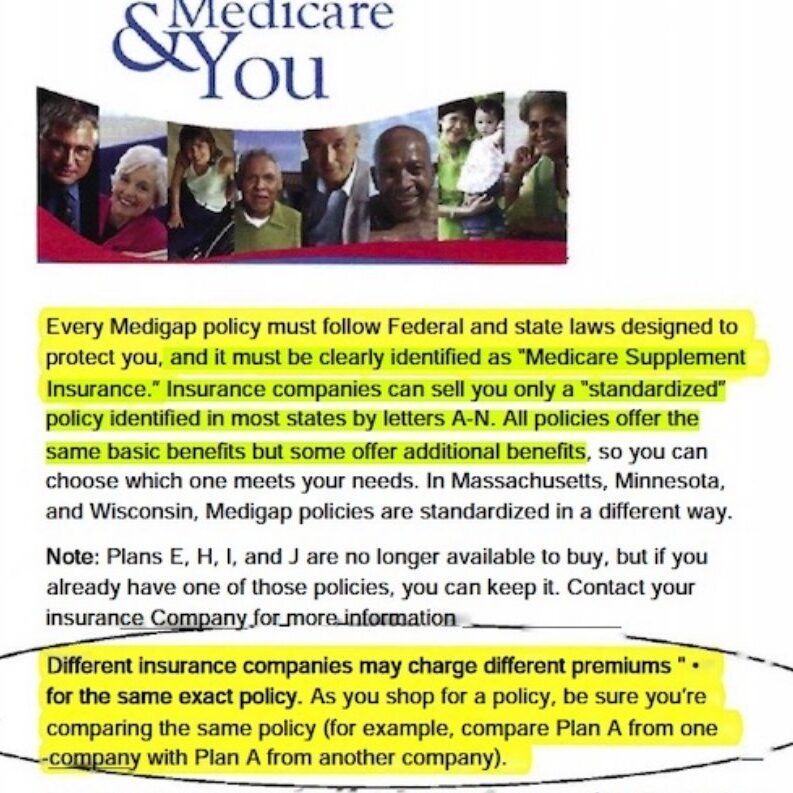

* There are 10 Medicare Supplements on the market, each with standardized coverage regardless of the insurance carrier you select.

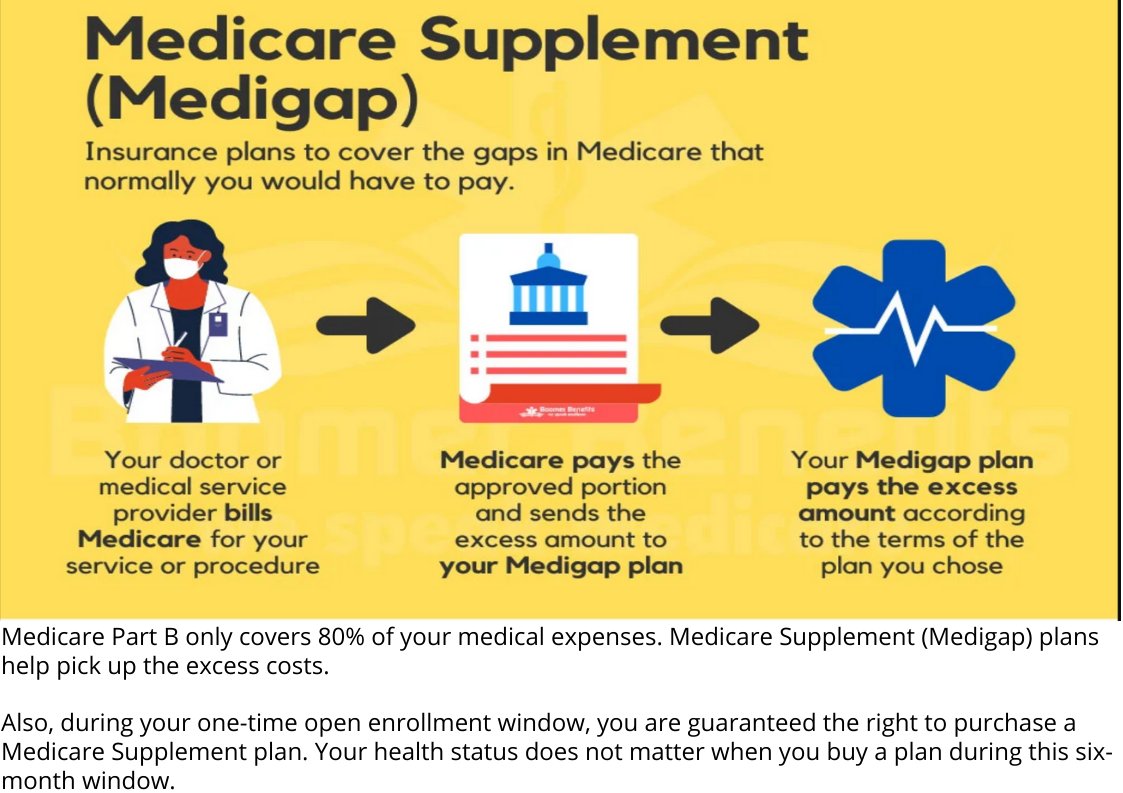

With a medicare supplement policy your traditional red, white and blue card pays first. Your doctor or medical provider bills medicare for you procedure

Medicare pays the approved portion (Pays the 80 percent of all Part B costs such as outpatient surgery, doctors bills, and all services done outside the hospital) and then they send the excess amount straight to your medicare supplement company and they must pay the rest regardless of what medicare supplement company you have your policy with.

Don’t worry if you doctor or provider says, “we don’t take that insurance.” Ask them if they accept medicare and if they say yes then don’t worry about them saying we don’t take your insurance. They do take it because they accept medicare and if they accept medicare they must accept any and all medicare supplement plan regardless of what carrier it is with

Your medicare supplement will pay the other 20 percent of services once medicare sends them the portion of the bill that original medicare does not pay.

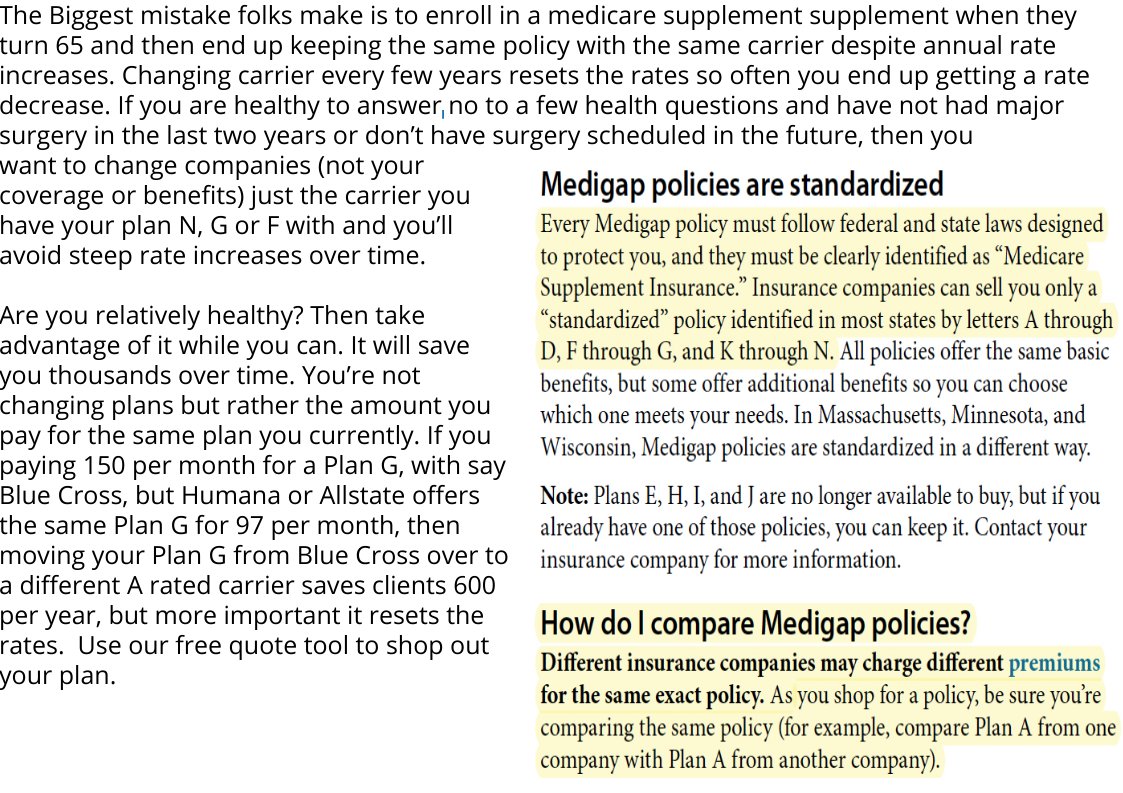

Watch Video Below and Learn About the Biggest Mistake Folks Make After Enrolling in a Medicare Supplement.

If you are healthy Change Carriers Often. Reset those Rates!!

Request A Quote

Some of the primary advantages of a Traditional

Medicare Supplement policy are:

• Freedom to choose your own doctors and hospitals

• No referrals are required to see a specialist

• Predictable out-of-pocket expenses for Medicare-covered services (and zero out-of-pocket with Plan F)

• Nationwide coverage – you can use it anywhere in the United States

• Guaranteed renewability – the insurance company can never drop you or change your coverage due to a health condition

Supplemental insurance for seniors with Medicare is the most predictable back-end coverage you can buy. You will know exactly what’s covered for every inpatient or outpatient procedure based on which Medigap plan you choose.

Some other things to know about Medicare

Supplement insurance

• You must have Part A and Part B to buy a Medigap policy.

*Medicare Supplement plans cover only one person. Your spouse must have his or her own individual policy.

* You can change your supplement at any time. There is no annual election period for Medicare Supplement plans.

* The Annual Election Period in the fall is for drug plans. It does not apply to Medicare supplements in any way.

* Many carriers offer household discounts if two or more people enroll in Medicare supplemental plans from the same company.

*Plans do not include Part D, so you’ll add a separate standalone Part D

drug plan.

* Do not confuse open enrollment for Medicare Advantage Plans which is from January 1st to March 31st with Medicare Supplement Open Enrollment which is the one time in your medicare life where you can enroll in a medicare supplement with no health questions or underwriting required.

Request A Quote

Medicare Supplemental Plans Coverage

Medicare Supplement plans pay after Medicare approves and pays its share of your claim. They are Medicare gap insurance, helping to cover the gaps in Medicare that normally you would have to pay. This includes things like deductibles, coinsurance, and copays. You can use your Medicare Supplement plan at any provider in the nation that accepts Medicare. This makes Medicare Supplements great for travel or for people who live in more than one state throughout the year. Medicare Supplement plans do not include retail drug coverage, so you’ll want to purchase a standalone Part D drug plan for your medications. A Medicare Supplement also does not cover routine, dental, vision, or hearing services. Since Medicare itself does not cover these items, your supplement cannot pay anything toward them either.

Medicare Supplements Plans

Standardized Plans

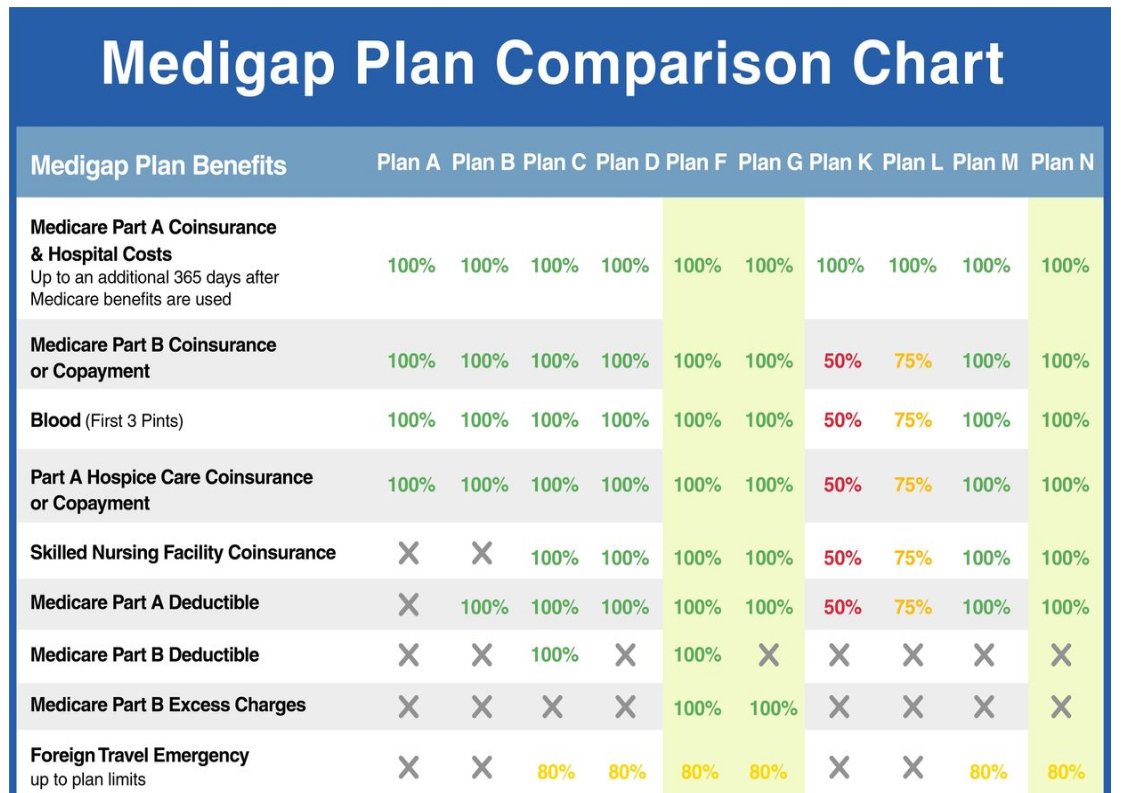

To see a list of all the Medicare supplemental plans available – take a look at our Medigap supplement chart below. This chart appears in the “Choosing a Medigap,” booklet published by Medicare itself. It details the benefits covered by each different plan. Some of our clients have found Medicare’s handbook hard to read, so here on our site, we’ve tried to use simpler terms. Our pages about the different Medicare Supplements include examples of how the coverage would pay. This will help you understand how they work in real situations.

Request A Quote

Steps to picking a Medicare Supplement plan.

There are a number of helpful steps

you can take to find the best plan for you.

1. Decide which benefits you want and may need in the future. Make a list of your current healthcare needs and costs. Next, try to think of any future healthcare needs and costs and add them to the list.

2. Review and compare Medicare Supplement plans. Explore available Medigap policies to see which 1 best meets your needs. You can review the policies in your area a Medicare.gov or search the list of contacts for your state on Medicare.gov.

3. Compare insurance companies. You may find a few companies that offer Medigap plans you like. First, research each company’s history and customer reviews. Then, get an official quote from each company and ask them the same set of questions to compare their answers.

Here are a few suggestions to help get you started:

“Do you use medical underwriting for this Medigap policy?”

“Do you have a waiting period for pre-existing conditions?”

“I’m ___ years old. What would my premium be

under this Medigap policy and is the rating community, issue-age or attained-age?”

“Has the premium for this policy increased in the last 3 years due to inflation or other reasons?”

“Do you offer any discounts or additional benefits?”

“Can you tell me if I’m likely to qualify for the Medigap policy?”

Medigap Plan F and Plan G are also offered as high-deductible

*Medigap Plan F and Plan G are also offered as high-deductible plans (HDF or HDG) by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2,800 in 2024 before your policy will pay anything.

**For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($240 in 2024), the Medigap plan pays 100% of covered services for the rest of that calendar year.

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission. You can find this chart as well as other great info in Medicare’s Choosing a Medigap booklet as well, which you can find here.

Request A Quote

What are the different Medicare Supplement Plans?

Each Medicare Supplement plan in the chart above has a letter, A – N. Each plan letter provides a different set of benefits. However, each lettered plan must have the same standardized coverage regardless of which insurance company you choose. For example, Medicare Supplement Plan N at Blue Cross Blue Shield has the same benefits as Plan N from United Healthcare.

The Medicare Supplement chart below shows the 10 standardized Medicare Supplement plans. These plans can be offered by insurance companies in most states. Wisconsin, Minnesota, and Massachusetts have different options though.There is one supplemental insurance plan that covers ALL OF the gaps, leaving you with nothing out of pocket, Plan F. There are others where you agree to do some cost-sharing and in return, you get a lower monthly premium. If you prefer something like this, in the middle, you could look at Plans G or N where you pay a few things yourself, in exchange for lower premiums. An insurance agent specializing in Medicare supplemental insurance for seniors with Medicare can help you determine which one best fits your needs

Medicare Supplemental Plans Open Enrollment

How do I pick a Medicare Supplement plan?

Most people enroll in Medicare Supplement Plans F, G, or N. That’s because these offer the most coverage. However, the reason for the choices is to let you decide what is most important to you. Some beneficiaries want a plan that covers all the gaps and leaves them with no worries about the cost of medical procedures. Other beneficiaries prefer a Medicare supplement plan in which they cover some of their deductibles and copays out of pocket in order to achieve lower premiums.

There is no right or wrong here. Ask your broker to provide quotes for several plans and see what makes the most sense to you.

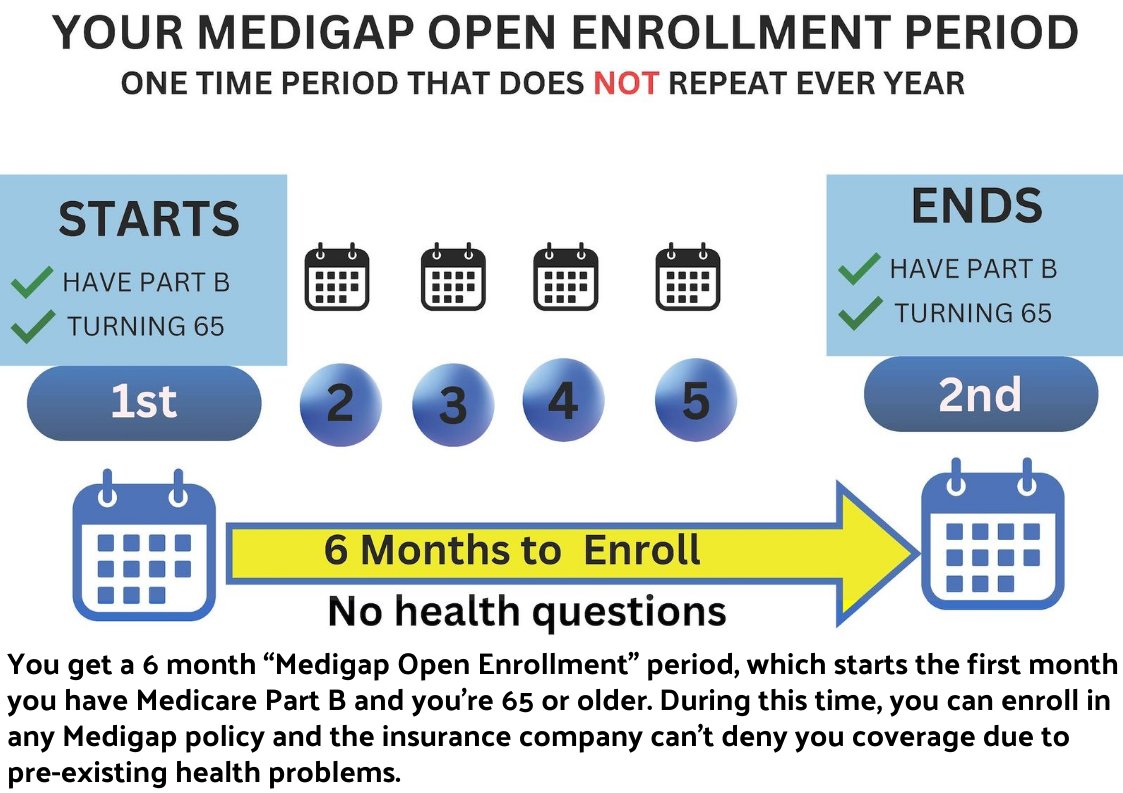

After this period, you may not be able to buy a Medigap policy, or itmay cost more. Your Medigap Open Enrollment Period is a one-timeenrollment. It doesn’t repeat every year, like the Medicare Open Enrollment Period.

If you enroll in a medicare advantage plan when you turn 65 for the first time you have a one year trial right meaning you have one whole year to test drive the advantage plan the month you turn 65 lasting 12 months to change to a medicare supplement with no health questions asked. This is none as your one year trial right

Medicare Supplemental Plans – Open Enrollment Your best time to buy a Medigap policy is during your Medigap Open Enrollment Period. This is a one‐time enrollment period; it doesn’t repeat every year. Your 6‐ month Medigap Open Enrollment Period starts the first month you have Medicare Part B and you’re 65 or older. Some states have additional Open Enrollment Periods, including those for people under 65. During the Medigap Open Enrollment Period, you:

• Can enroll in any Medigap policy. An insurance company can’t refuse to sell you any Medigap policy it offers.

• Will generally get better prices and more choices among policies. An insurance company can’t charge you more for a Medigap policy than they can charge someone with no health problems.

• Can buy any Medigap policy sold in your state. An insurance company can’t use medical underwriting to decide whether to accept your application—they can’t deny you coverage due to pre‐existing health problems.

• Don’t have to wait for coverage to start. An insurance company can’t make you wait, except for coverage related to a pre‐existing condition. A pre‐existing condition is a health problem you have before the date a new insurance policy starts. In some cases, the Medigap insurance company can refuse to cover your out of pocket costs for these pre‐existing health problems for up to 6 months. This is called a “pre‐existing condition waiting period.” After 6 months, the Medigap policy will cover the pre‐existing condition.

Request A Quote

Medicare Supplement Plans Guaranteed Issue

Some people delay enrollment into a supplement because they have group health coverage through an employer. Later, when you retire or lose that coverage, you have the right to purchase certain Medigap policies within the 63 days following the loss of your group coverage. This is called your Medicare supplement guaranteed issue rights.

A guaranteed issue window works just like open enrollment, except that it is a shorter period of time and that your plan choices are limited to Plan F or C (if you became eligible for Medicare before 2020). If you became eligible for Medicare after January1st, 2020, your GI plan options are Plan G. The insurance company cannot deny your application for any health reasons.

Some other circumstances create a guaranteed issue window as well, such as losing Medicare Advantage coverage when moving out of state. Guaranteed issue rules can vary by state, so be sure to check with a licensed agent who can inform you about the laws that apply in your state. Our agency is licensed in 49 states, so feel free to contact us if you want us to check for you.

You will want to keep any notices from your prior carrier that show proof of your creditable coverage for guaranteed issue windows and also so that you do not incur the Part D late enrollment penalty.

There are certain guaranteed issue rights folks can use to get a medigap plan without answering health questions. Learn about these special medical protections and how, when, and why to use your GI rights. Also learn why Insurance companies offering medicap plans must accept chronically sick and dying folks into either the Plan G or possibly the Plan F with no underwriting or health questions asked. They must let you enroll in either the Plan G or the Plan F is you use your guaranteed issue right. Folks that turned 65 after January 1 of 2023 when the Macro Bill went into effect can only enroll in the Plan G with no underwriting but not the Plan N. The Plan N supplement does not accept these Guaranteed Issue Rights folks but the Plan G must absorb the high cost of these folks with high claims and those claims will force Plan G premiums to skyrocket compared to the Plan N.

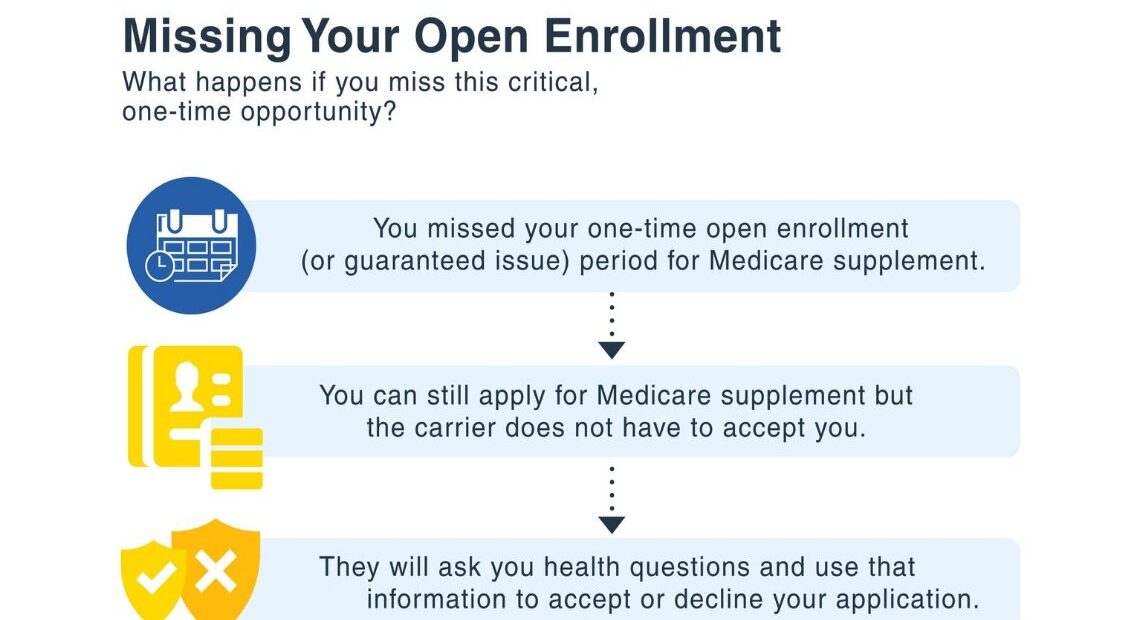

Medicare Supplement Plans Underwriting

If your window has already passed for open enrollment or guaranteed issue, you can still apply for a Medicare supplement, but you will have to answer some health questions on your application. The insurance company can accept or decline you.

Relax! Medicare Supplement Underwriting is a simple process. They will not send a nurse to your house for blood and urine samples but rather they will ask you a series of questions and do a medication check that goes back 2 years. You could have had a heart attack, but if it was over 24 months and you’ve stabilized you may qualify for a preferred rate

Different insurance companies have different underwriting standards so it is crucial to work with an independent medicare broker licensed with all the different medicare carriers, because our job is to pair you with the company that looks at your health conditions most favorably.

What is the Best Medicare Supplemental plan?

Medicare Supplemental Plan F is currently the plan with the highest level of coverage. It pays for all your Medicare cost-sharing, leaving you with nothing outof- pocket on covered services. You can buy a Medicare supplement from a variety of different insurance companies. However, plans of the same letter are standardized so that the benefits are the same. A Medicare Supplement Plan F with one company has the same benefits as the next company. Medicare Supplemental Plan G is the next most comprehensive plan. It works exactly like Plan F except that you pay for the Part B deductible once per year. Your premiums will be lower though, and sometimes this creates annual savings. The Medicare Supplement Plan N is virtually the same coverage as the Plan N but with doctor copays of $0 up to but never over $20 per visit. The Plan G rates are projected to double over the next 10 years unlike the more stable Plan N. To find the best Medicare supplemental plan in your area, contact us for a free report that includes quotes and rate trend histories. Since there are several standardized plans available to you in each state, you will want to think carefully about which one fits your needs the best.

Request A Quote

Plan N Versus Plan G

Why do agents only sell the Plan G Medicare Supplement and learn how agents get paid. It has a lot to do with it. Why do agents never present the Plan N? This video reveals how agents get paid and reveal if your agent is not presenting the Plan N, or worse, they scare you with Plan N excess charges, then you need to revaluate your situation. Plan G rates are projected to be double Plan N over the next 9 years, and the reason agents don’t sell Plan N comes down to commissions.

Medicare Supplemental Plans Open Enrollment

We are one of the few companies that will give you actual up to the second rates if you fill out the form below. These rates go from lowest to highest monthly premiums. We list actual rates but do not show you the company names because to often folks will call the carrier direct and think getting the lowest premium is the best deal. It isn’t. Many carriers low ball you early on and then jack the rates up quickly and if you get sick you are stuck on a low rated supplement with no chance to change. Work with an independent broker and never go direct. Our services cost you nothing but you’ll have a medicare advocate that is licensed with all the companies and we will call you each year to shop out the entire market each year and we work with only A rate companies that have a history of paying claims and that are financially stable

Common Questions about Medicare

Supplemental Insurance

What is the Average Cost of Supplemental Insurance for Medicare?

Pricing for Medicare supplement policies varies by state. In some states like Florida, the premiums are higher because the cost of healthcare services in that area is higher. For example, we might be able to find a Plan G for a turning-65 female non-tobacco user for around $90/month in South Carolina but in California or Florida it would be more like 138 while the same policy in New York will run you over $200 per month.

Most Medicare supplement companies also base their rates on gender, zip code, tobacco usage, and age. Some individuals may also benefit from household discounts. For quotes in your own zip code, give us a call at 843-227-6725

What is the Open Enrollment period for Medicare supplemental plans?

When people first activate Medicare Part B, they have 6 months to enroll in any Medicare Supplement without health questions. The insurance company will approve your application with no pre-existing condition waiting period. We call this the Medicare Supplement Open Enrollment Period. It is a one-time window.

Be aware that the Annual Election Period (AEP) that occurs each fall is NOT a time when you can get a Medicare supplemental Insurance plan with no health questions asked. The AEP has nothing to do with Medigap plans. Instead, it’s a time when you can change your Part D drug plan.

CAN YOU CHANGE MEDICARE SUPPLEMENTS ANYTIME?

You can apply to change your Medicare Supplement anytime, but if you are past your Open Enrollment window, you will have to answer health questions in most states.

The Medicare supplement insurance company will review your health history and medication history. They can accept or decline you.

There are a few states where the rules are different. For example, California, Oregon, Connecticut, and Washington have established exceptions to this rule.

What is Guaranteed Issue for Medicare supplemental insurance?

In certain circumstances, an insurance company must accept you for coverage without asking health questions. For example, if you are on

Medicaid and you lose your Medicaid eligibility, you have a short window to apply for Medigap without health questions.

Another example would be for someone coming off employer health coverage that is primary to Medicare. They will have a short window to apply for certain Medigap plans under guaranteed issue rules.

Find the Right Medicare Supplemental Insurance

When you buy your coverage directly from an insurance company, you give up a lot of benefits. Purchasing through May River Medicare Insurance costs exactly the same, but we provide these FREE value-added services for our policyholders.

What is Medicare: We explain your basic benefits first!

Quotes for over 33 companies

Free rate-trend history report so you can see which company has had the lowest rate increases

Free financial ratings for each company

Annual rate shopping assistance to keep you paying the least amount possible

Free claims support and help with appeals if Medicare denies a claim

Full-time Client Service Team to answer your Medicare questions

Exclusive Clients-only Webinars each fall to review the upcoming Medicare changes for next year.

Key Takeaways

- Medicare Supplements help pay for remaining out-of-pocket expenses, such as deductibles and coinsurance

- There are ten standardized plans, with Plan F, G, and N being the most popular.

- You can use a Medicare Supplement plan anywhere that accepts Medicare.

- You have a one-time open enrollment period based around your Part B effective date to apply for a Supplement plan with no health underwriting.

Get your Personalized Quote in Seconds

without the annoying calls afterwards.