Consider these 7 things When Choosing Coverage

How much are your premiums, deductibles, and other costs? How much do you pay for services like hospital stays or doctor visits? Is there a yearly limit on what you could pay out-of-pocket for medical services? Make sure you understand any coverage rules that may affect your costs.

Costs in Original Medicare

There’s no yearly limit on what you pay out of pocket, unless you have supplemental coverage—like Medicare Supplement Insurance (Medigap).

Costs in Medicare Advantage

Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B cover. Once you reach your plan’s limit, you’ll pay nothing for services Part A and Part B cover for the rest of the year.

How well does the plan cover the services you need?

Coverage in Original Medicare

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

Coverage in Medicare Advantage

Plans must cover all medically necessary services that Original Medicare covers. In many cases, you may need to get approval from your plan before it covers certain services or supplies. Plans may also offer some extra benefits that Original Medicare doesn’t cover—like certain vision, hearing, and dental services.

If you have other types of health or prescription drug coverage, make sure you understand how that coverage works with Medicare. If you have employment-related coverage, or get your health care from an Indian Health or Tribal Health Program, talk to your

benefits administrator or insurer before making any changes. Supplemental coverage in Original Medicare

You can choose to buy Medigap to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a current or former employer or union, or Medicaid.

Supplemental coverage in Medicare Advantage

Medicare Advantage Plans may offer some extra benefits that Original Medicare doesn’t cover— like certain vision, hearing, and dental services. If you’re in a Medicare Advantage Plan, you can’t buy Medigap.

Do you need to join a Medicare Prescription Drug Plan? Do you already have

creditable prescription drug coverage

? Will you pay a

penalty

if you join a drug plan later? What’s the plan’s overall star rating? What will your prescription drugs cost under each plan? Are your drugs covered under the plan’s

formulary

? Are there any coverage rules that apply to your prescriptions? Are you eligible for a free

Medication Therapy Management (MTM)

program?

Prescription drug coverage in Original Medicare

You’ll need to join a

Medicare drug plan (Part D)

to get drug coverage.

Prescription drug coverage in Medicare Advantage

Most Medicare Advantage Plans include drug coverage. If yours doesn’t, you may be able to join a separate Part D plan.

Do your doctors accept the coverage? Are the doctors you want to see accepting new patients? Do you have to choose your hospital and health care providers from a

network? Do you need to get referrals?Doctor and hospital choice in Original Medicare

You can use any doctor or hospital that takes Medicare, anywhere in the U.S. In most cases, you don’t need a referral to use a specialist.

Doctor and hospital choice in Medicare Advantage

In many cases, you can only use doctors and other providers who are in the plan’s network and service area (for non-emergency care). Some plans offer non-emergency coverage out of network, but typically at a higher cost. You may need to get a referral to use a specialist.

Are you satisfied with your medical care? The quality of care and services offered by plans and other health care providers can vary. How have Medicare and other people with Medicare rated your health and drug plan’s care and services? Get help comparing plans and providers.

Travel coverage in Original Medicare

Original Medicare generally doesn’t cover medical care outside the U.S. You may be able to buy a Medicare Supplement Insurance (Medigap) policy that covers emergency care outside the U.S.

Travel coverage in Medicare Advantage

Plans generally don’t cover medical care outside the U.S. Some plans may offer a supplemental benefit that covers emergency and urgently needed services when traveling outside the U.S.

KEY POINTS

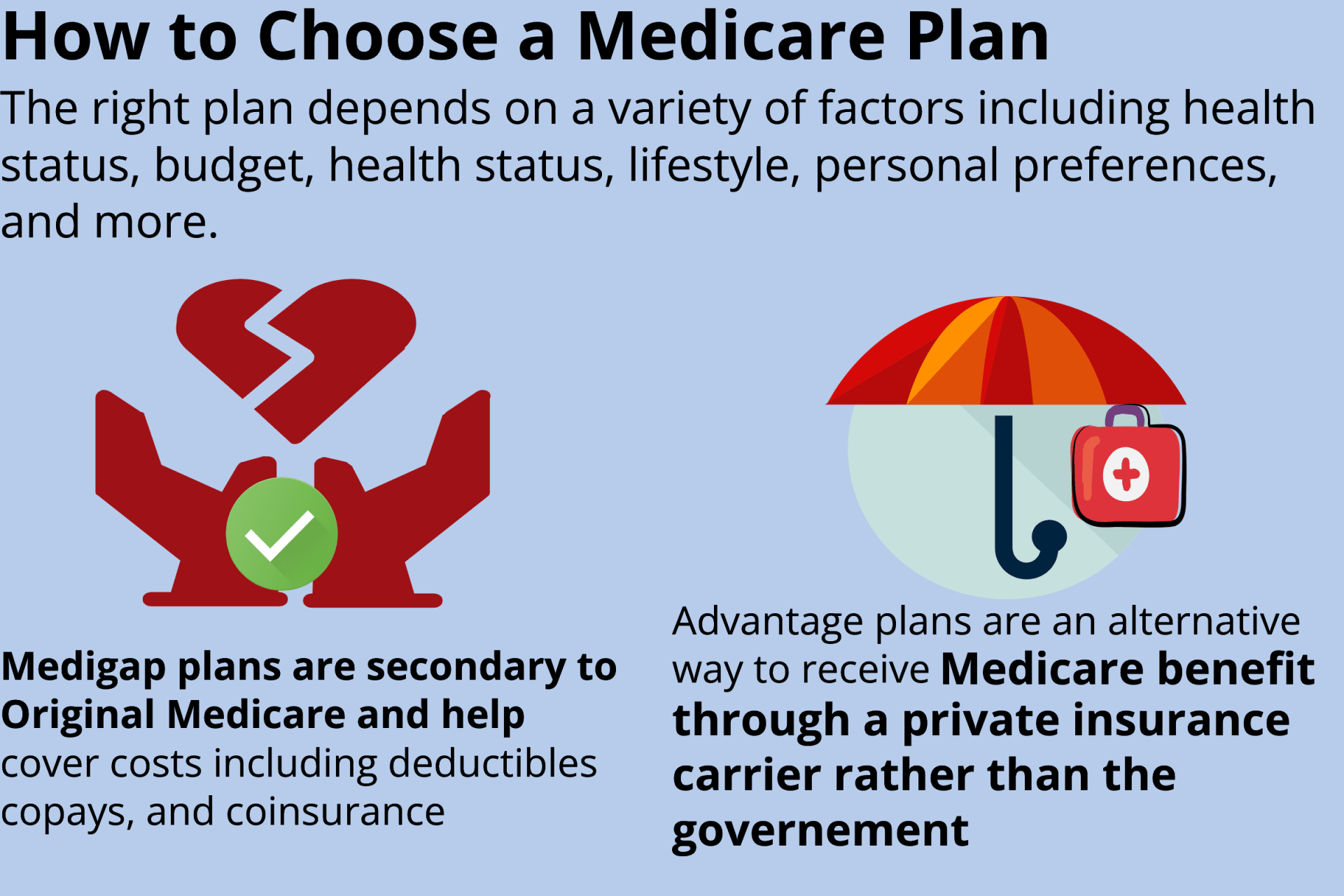

- There are two main plan options: a Medicare Supplement (Medigap) plan or a Medicare Advantage plan, which work very differently from one another.

- Because Medigap plans are standardized, you’ll want to look at carriers’ rate increase history and financial ratings to help you choose.

- There are different types of Advantage plans, including HMO and PPO plans, so you’ll want to see which type of Advantage plan best fits your needs.

Request A Quote

If you are wondering how to choose a Medicare plan and are dizzy from the marketing barrage of TV commercials, cold calls, and enough mail to the knock the legs of your coffee table, you are not alone

We frequently hear comments from Medicare beneficiaries about how they considered themselves to be reasonably intelligent people until they started trying to figure out Medicare.

Don’t be discouraged! Choosing a Medicare plan can be confusing to many people. We are here to help you.

Request A Quote

How to Choose a Medicare Plan

There are a few considerations to keep in mind as you begin searching for Medicare Supplemental insurance .

There are two types of Medicare plans. You need to understand the difference between a Medicare Supplement and a Medicare Advantage plan.

The two plans operate quite differently, and the health and financial consequences can be significant. Each has, well, advantages — and disadvantages .

Once you understand how each plan works… ask yourself some of these questions to help you filter down to which kind of plan might best suit yo u:

- Do your important physicians participate in any Medicare Advantage plans, or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? If so, you might find Original Medicare with a Medicare Supplement to be a good fit for you since you can use it for any doctor or hospital in the nation that accepts Medicare.

- What is your risk tolerance? If you have a year of heavy health spending, do you have enough savings to spend the possible out-of-pocket maximum that a Medicare Advantage plan might require?

- How about peace of mind? Are you a person who will sleep better at night if you have a lower premium and just pay for services as you go? If so, you might be a good candidate for a Medicare Advantage plan. By contrast, if you tend to worry about unexpected expenses, a Medicare Supplement could give you the peace of mind of knowing exactly what medical spending you will incur regardless of your health.

Request A Quote

How to Choose a Medicare Supplement

Medicare Supplement plans were standardized by the government in 1990. This was done to make it easier to compare plans. You can find our Medicare plans comparison chart on this website for an overview of Plans A – N.

If you decide a Medigap plan would be better for you, our agency can run a list of plans in your area. As a large Medicare insurance broker, we have the means to invest in quoting software that will show us prices for all the plans in every state.

Premiums for Medicare Supplements vary by gender, age, zip code, tobacco usage, and eligibility for household discounts. Sometimes certain state rules can affect premiums as well.

At Boomer Benefits, we look for the top 3 lowest-priced carriers for the plan you want. We then compare which of those carriers has the lowest rate increases in recent years. While there is no crystal ball, we can use this data to make the best decisions possible.

6-Day New to Medicare Mini Video Course

How to Choose a Medicare Advantage Plan

When choosing a medicare advantage plan, the first thing you should do is check to see if your doctors are in the provider network and your drugs are on the plan’s drug formulary. You can use use the www.medicare.gov website to find options. The Medicare Plan Finder Tool will let us search for Medicare Advantage plans in your county based on your preferences. folks like the HMO PLAN because they offer more robust dental, vision and other perks. People prefer Medicare HMO plans for the lowest premiums, perks, and often lower income folks can get transportation and grocery card money included at zero premium

Others prefer Medicare PPO plans because they are more flexible and have out-of-network benefits if needed. Some counties also have other plan types like Medicare Cost plans, Special Needs Plans, and PFFS plans.

Our agents are familiar with all of these and can help you sift the results to find a plan that your doctors participate in.

Click button below to shop advantage plans in your area

Who Can Help Me Choose A Medicare Plan?

Who can help me choose a Medicare plan – look no further!

Our agency can help you identify which plan is right for you and how much the monthly premiums cost in your area. Working with us can be very helpful so that you get all the statistics you need before you decide. We have access to data like rate trend history and financial ratings for various Medicare-related insurance carriers.

May River Medicare Insurance is your one-stop shop for choosing a Medicare plan. We’ll provide you the information you need to decide. We assist our clients with finding plans that are accepted by their important physicians and that are also affordable for their budgets. We also find the drug or advantage plan with the lowest total cost for drugs over one year

We then provide free claim support for the life of your policy so you are never alone in dealing with Medicare. Click the orange button to get help from a friendly, low-hassle agent today.

Request A Quote

Key Takeaways

- The right plan choice for you depends on a wide range of factors, including your budget, health conditions, lifestyle, personal preferences, and more.

- Medigap plans are a great fit for those who visit the doctor often and have health conditions or are heath but want substantial coverage if something bad were to happen.Advantage plans can be good for those who are mostly healthy and don’t mind paying more out-of-pocket as they go in exchange for a lower monthly premium. But keep in mind, if you get a chronic disease or are hospitalized or start taking a new drug, remember you may be stuck on the advantage plan for life because after your 6 month medigap open enrollment period, underwriting and health questions will be required to leave your advantage plan to change to supplement