Medigap Plan G Offers Great Benefits

Medigap Plan G Benefits

Medicare Supplement Plan G has become one of the most popular Medigap plans among beneficiaries in recent years.

Medicare Plan G coverage is very similar to Plan F, which is no longer available for people new to Medicare on or after January 1, 2020. Plan G offers excellent value for beneficiaries willing to pay a small annual deductible. After that, Plan G provides full coverage for all Medicare gaps, paying for your Medicare Part A hospital deductible, copays, and coinsurance.

It also covers the 20% that Medicare Part B doesn’t cover. Doctors and other healthcare providers must accept a Medigap Plan G if they accept Original Medicare. Medicare beneficiaries can use their Plan G policy across the U.S. since Medigap plans do not have network limitations. The premium costs can be reasonable for the coverage you receive.

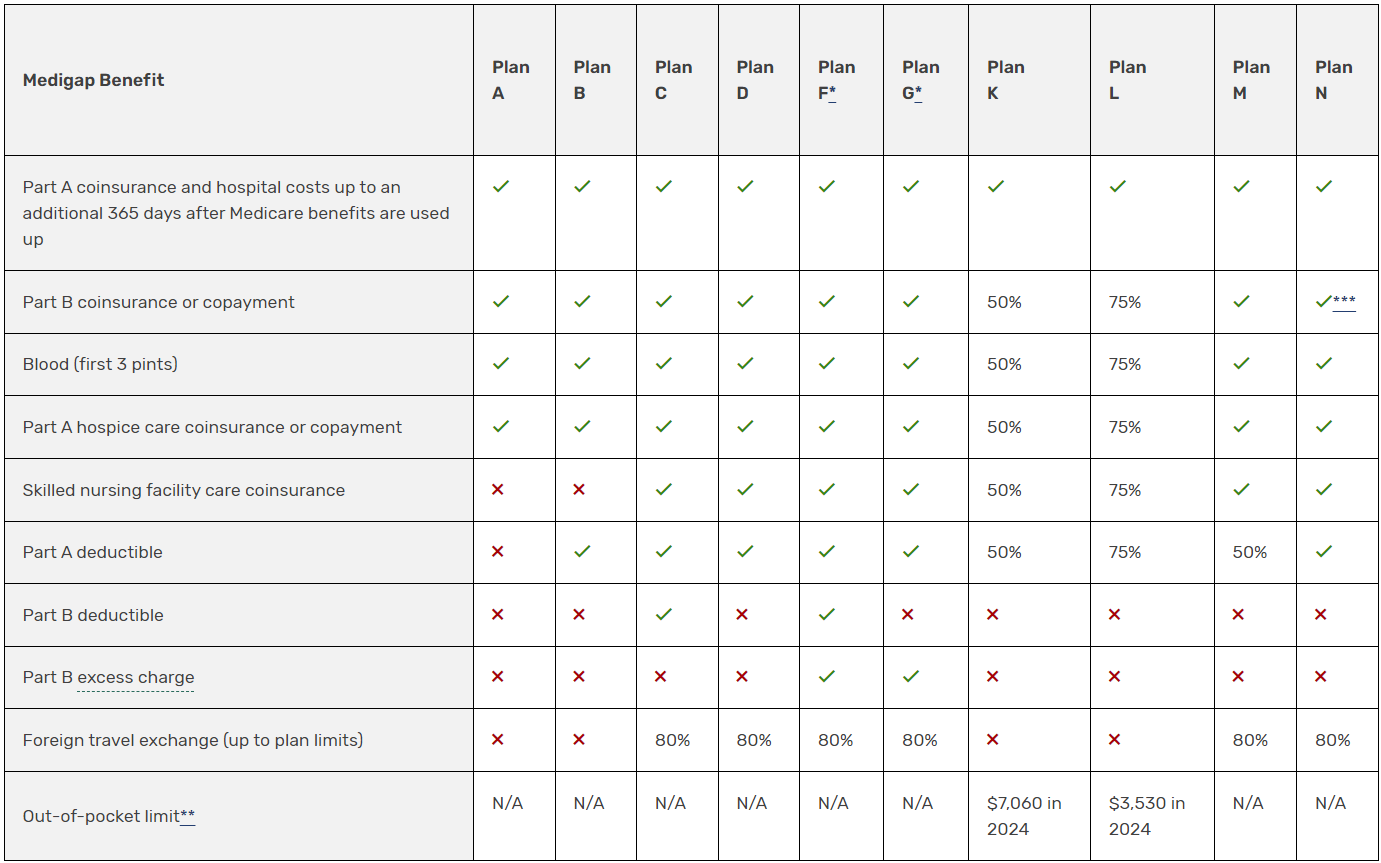

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Since Plan G is so popular, many people ask, “What does Plan G cover?” Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, cancer treatment, surgeries, and more. All Plan G products must provide you with the same coverage regardless of the carrier.

Quick Medicare Answer

Plan G does not cover the Part B deductible or any service that Medicare does not cover. For example, Medicare does not cover routine dental, vision, or hearing; therefore, Plan G won’t cover those services.

Medicare pays first, and then Plan G pays the remaining amount after you pay the once-annual deductible. In addition, Plan G Medicare Supplements offer up to $50,000 in foreign travel emergency benefits (up to plan limits).

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons.

First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $240 in 2024. In fact, if you have a Plan F that has been in place for years, our team might be able to help you with premium costs by looking at Plan G.

When we help you shop rates at Boomer Benefits, we often find a Supplement Plan G that saves quite a bit in premiums over Plan F, usually substantially more than the $240 deductible you’ll pay out.