Active Employer Coverage | Large Companies| Small Companies |HSA Account | Retiree Coverage | Where to Start

KEY POINTS

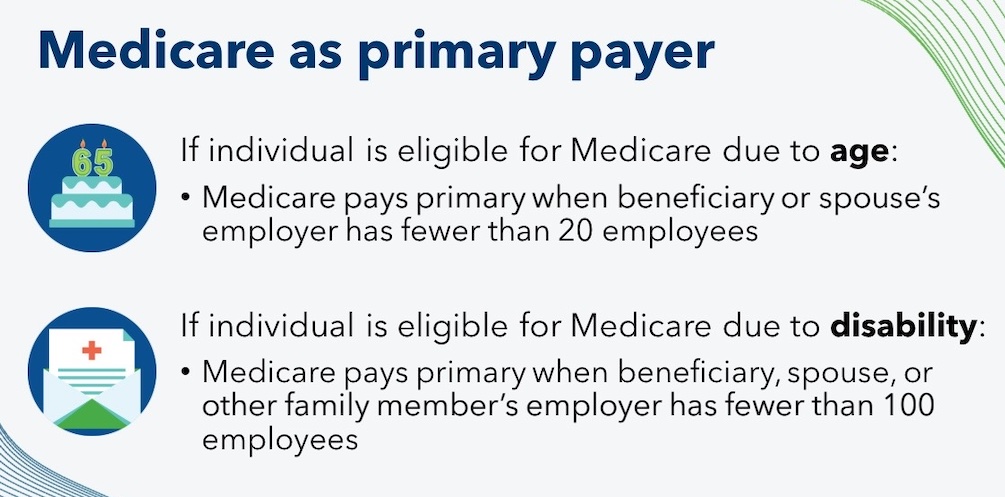

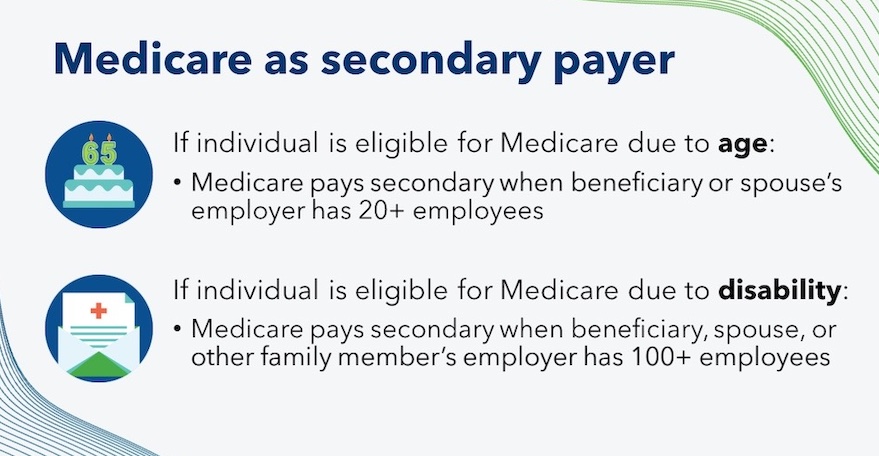

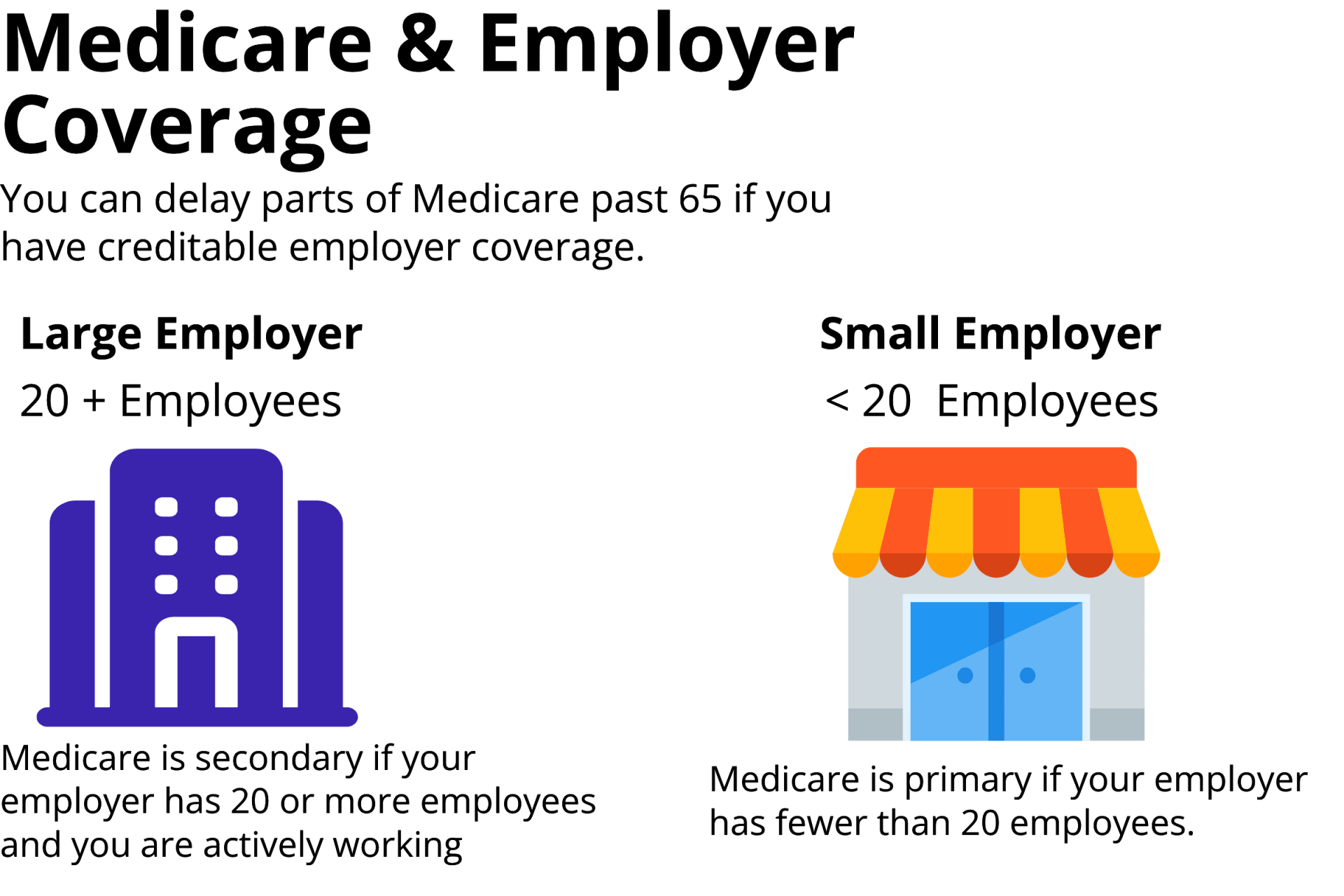

- If you actively work for an employer with 20 or more employees and are covered under that employer’s insurance, you can likely delay Medicare past 65 without penalty.

- If you actively work for an employer with fewer than 20 employees and are covered by that insurance, Medicare will be primary, and the employer insurance will be secondary.

- Retiree coverage, including COBRA, does not count as creditable coverage for Medicare.

6-Day New to Medicare Mini Video Course

Primary and secondary payers

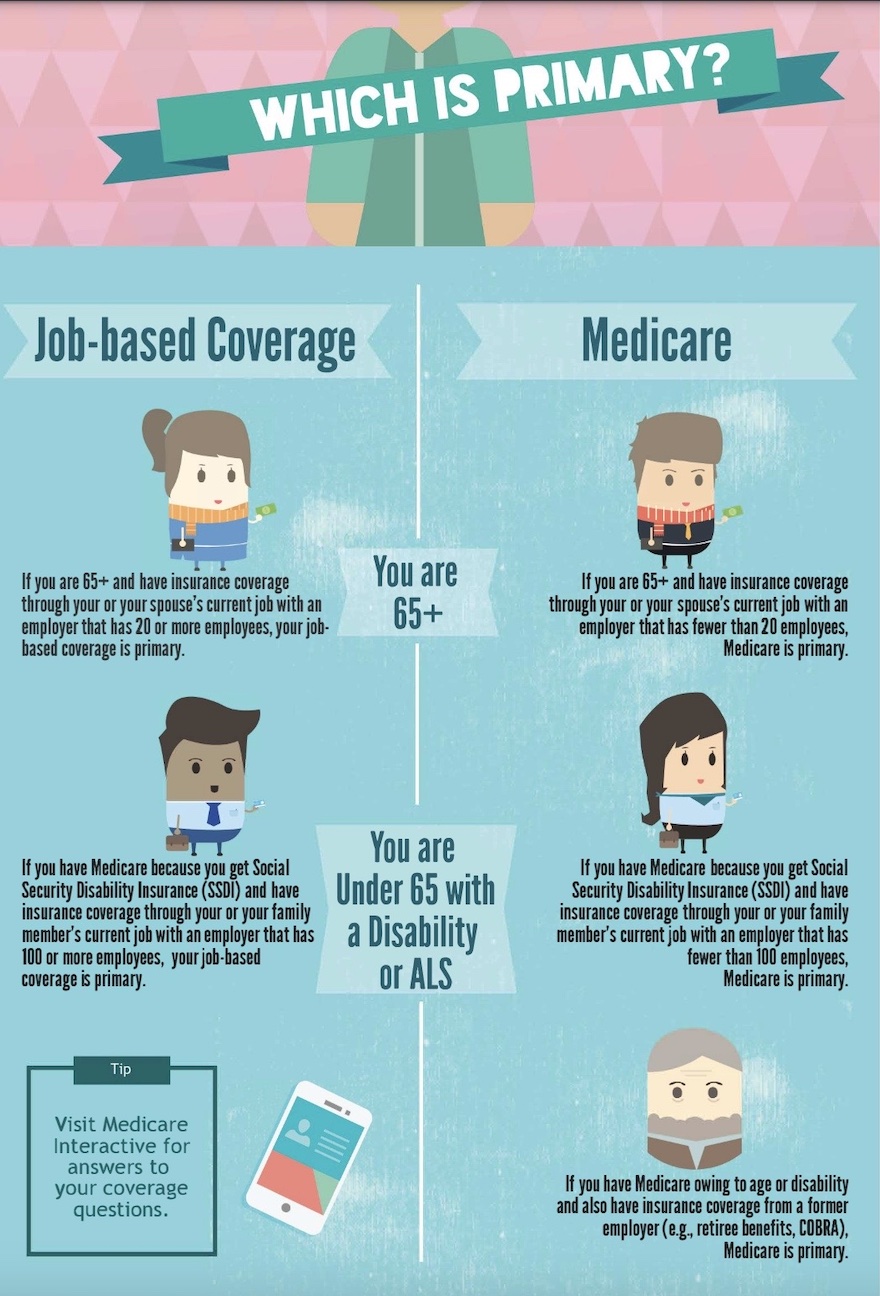

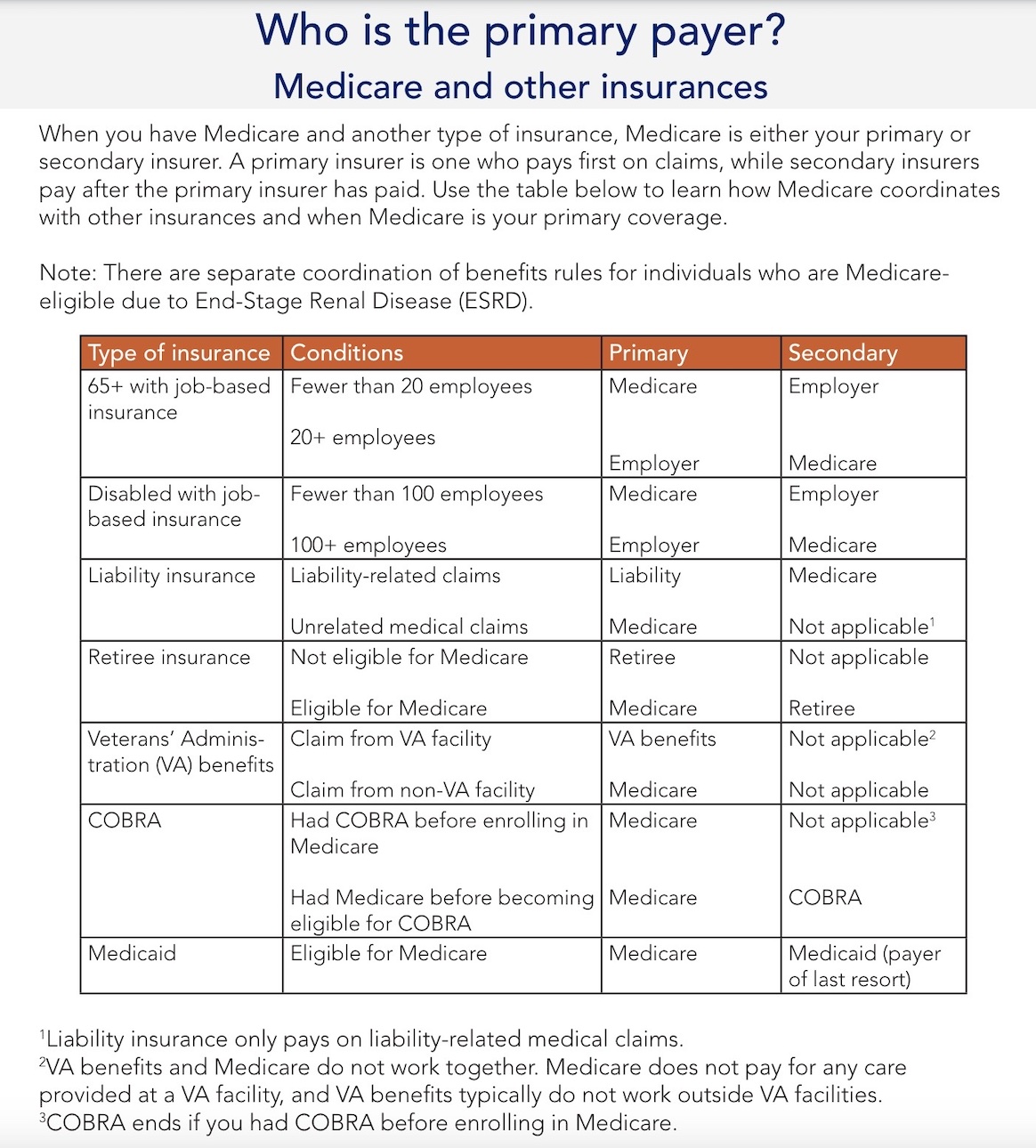

When you have Medicare and another type of insurance, Medicare will either pay primary or secondary for your medical costs.

- Primary insurance pays first for your medical bills.

- Secondary insurance pays after your primary insurance

- Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). For example, if Original Medicare is your primary insurance, your secondary insurance may pay for some or all of the 20% coinsurance for Part B-covered services. You may find secondary insurance useful in lowering your health costs depending on how much coverage your primary insurer offers and its costs.

-

- If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance.

- If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

- If you are 65+ (or turning 65 soon) and will have both Medicare and Employer Coverage because you are still actively working, you will have a number of things to think through.

- You likely have options to keep your employer insurance and Medicare will coordinate with that coverage. You’ll also want to compare the cost of that employer coverage against what it would cost you to roll over to Medicare as your primary insurance.

-

- Doing your research will help you decide on which coverage option is most cost-effective. It can also help you avoid any Medicare late enrollment penalties wherever possible. Again, this info below is for beneficiaries age 65 or older. (Medicare coordination rules are different for people under age 65 on Medicare due to disability.)

Active Employer Coverage

Job-based insurance when you turn 65

Active employer coverage means you are still actively working, not retired. In this scenario, you have the right to remain on your employer’s group health insurance plan if you choose. Your Medicare benefits can coordinate with that coverage. HOW it coordinates depends on the size of your employer.

These same rules apply if your group health coverage is through your spouse’s employer.

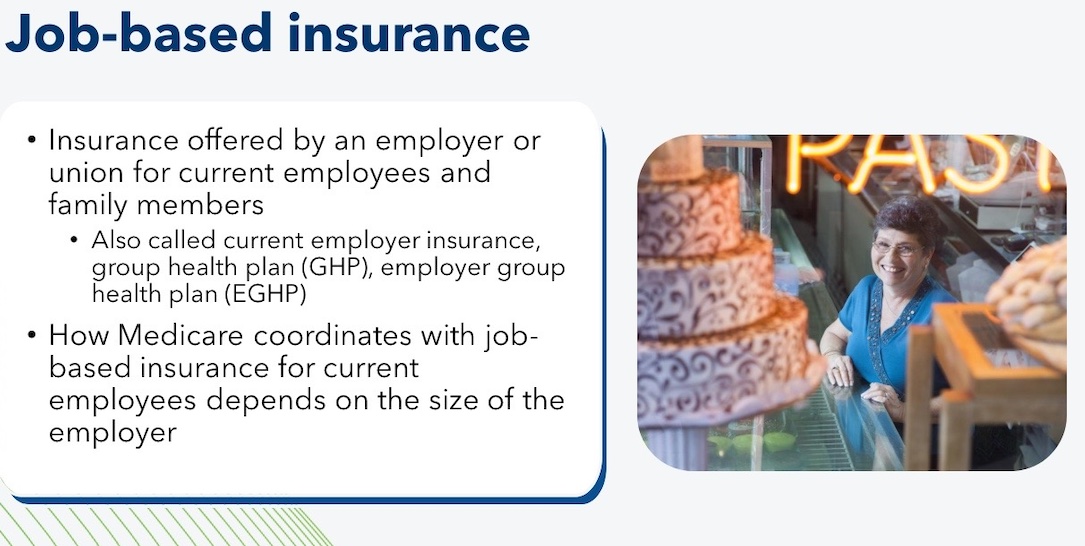

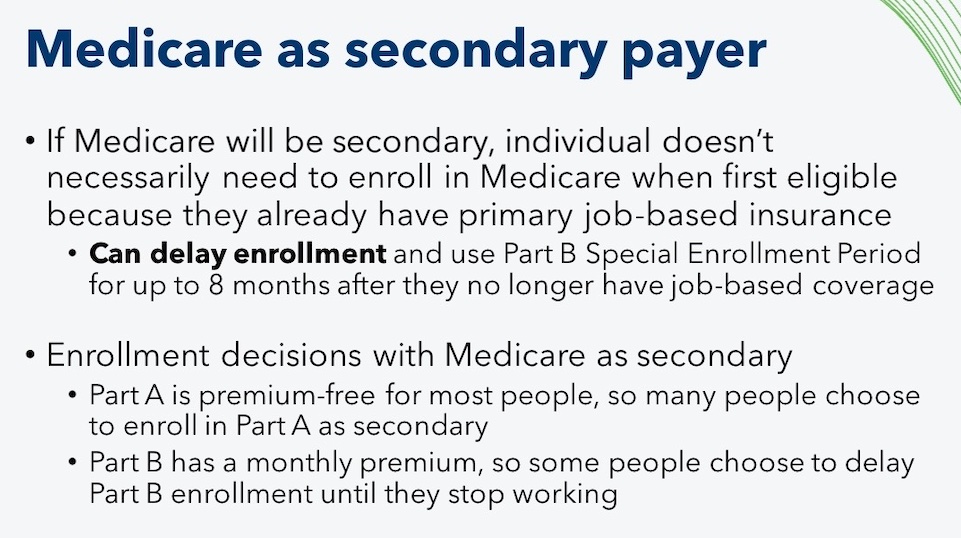

Job-based insurance is insurance offered by an employer or union for current employees and family members. Job-based insurance allows you to delay Medicare enrollment. However, you may want to enroll in Medicare depending on whether your job-based insurance pays primary or secondary. In most cases, you should only delay Part B if your job-based insurance is the primary payer (meaning it pays first for your medical bills) and Medicare is secondary.

If you are eligible for Medicare due to age (meaning you are 65+) and are covered by your or your spouse’s job-based insurance, you have a Special Enrollment Period (SEP) to enroll in Part B up to eight months after you no longer have coverage from current work. This means that you are not required to take Part B during your Initial Enrollment Period (IEP). However, remember that in most cases you should only delay Part B enrollment if your job-based insurance is the primary payer.

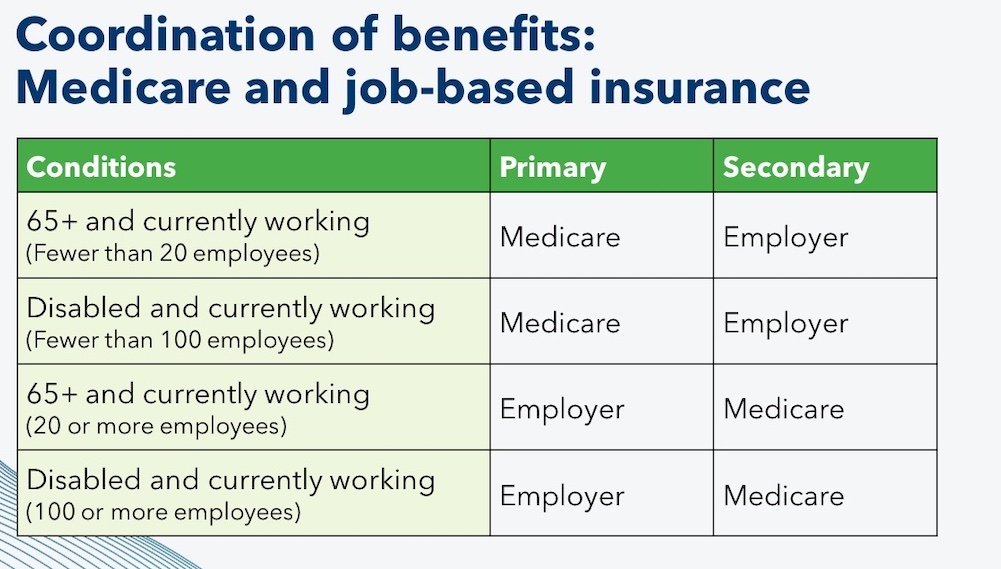

- Job-based insurance is primary if it is from an employer with 20+ employees. Medicare is secondary in this case, and some people choose not to enroll in Part B because of the additional monthly premium.

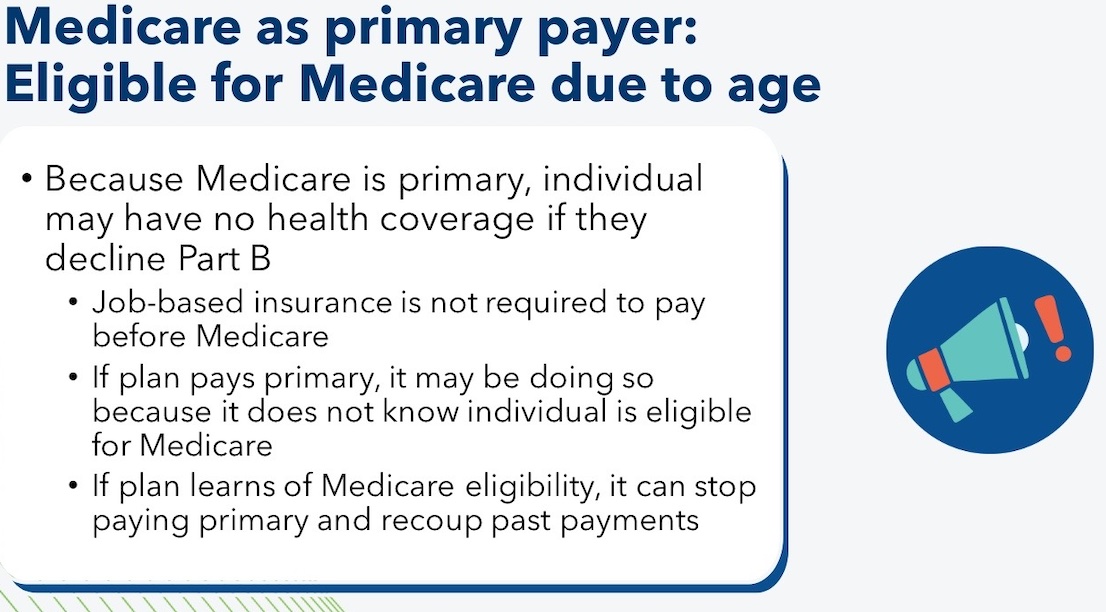

- Job-based insurance is secondary if it is from an employer with fewer than 20 employees. Medicare is primary in this case, and if you delay Medicare enrollment, your job-based insurance may provide little or no coverage. You should enroll in Part B to avoid incurring high costs for your care.

Note: There are different rules if you are Medicare-eligible due to disability or because you have ESRD.

Medicare and Employer Coverage – Large Companies 20+ Employees

You may choose to delay Part B enrollment if you are have insurance based on current work

from a large employer.

Job-based coverage from an employer with 20+ employees if you are eligible due to age or 100+ employees if you are eligible due to a disability is

primary to Medicare. Speak to your employer if you are unsure about the size of your organization.

You may choose to delay Part B enrollment without penalty until your insurance is no longer based on current work. You can also choose to take Part B while you have job-based insurance and it may pay secondary for your care.

You have a Special Enrollment Period (SEP) to enroll in Part B without penalty up to eight months after you no longer have job-based coverage.

It doesn’t necessarily work the same way with Part B, and Part B costs money (see next section), so that’s why most people choose Part A only when working for a large employer.

One exception would be if you are contributing to an HSA and plan to continue doing so. If that’s the case, do not enroll in Part A. Read more on that belowelow.

Medicare as Secondary Insurance Costs Money

Now Part B is not premium-free. You will pay a monthly premium for Part B based on your income. Some people who are eligible for Medicare and employer group health coverage choose to delay enrolling in Medicare Part B and Part D while still covered by their group health coverage (or their spouse’s group health coverage).

This saves them the premiums they would have paid for those parts. Your employer coverage already includes outpatient benefits so it may not be worth it to pay those Part B and D premiums.

When you DO delay Part B, your large group plan is considered creditable coverage. That means that you can enroll in Part B later without a late penalty when you decide to retire. Once you quit and leave the group plan, your insurance company will mail you a creditable coverage letter. Be sure you keep this. You will need it to show Medicare that you had other coverage so that you are not subject to late penalties for Parts B and D.

Read more about the coordination of your Medicare benefits and large employer coverage here.

Click on two forms you and employer must fill out and

Submit online to get Part B

What Happens if You Retire and then Later Go Back to Work?

Also, many people ask us what happens if they retire, get Part B, and then later get a new job with employer insurance. You can cancel Part B at that time. Later, when you retire again, you’ll have a second 6-month Open Enrollment window to get a Medigap plan with no health questions asked.

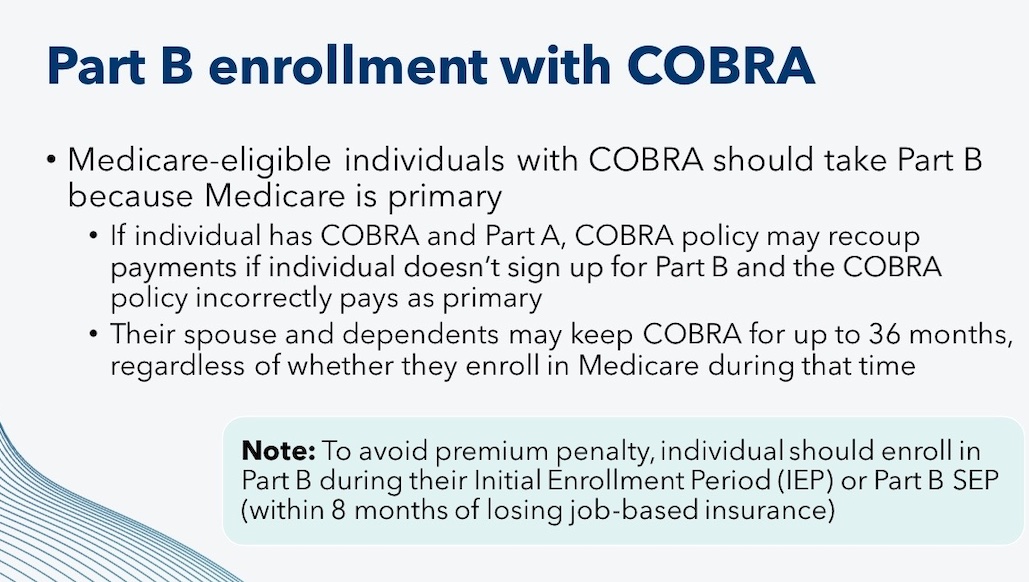

A Word About COBRA

The way that COBRA and Medicare coordinate depends on which form of insurance you have first. While it is possible to get COBRA if you already have Medicare, it is not usually possible to keep COBRA if you have it before you become Medicare-eligible. Specifically, whether you can have both COBRA and Medicare depends on which form of insurance you have first.

- If you have COBRA when you become Medicare-eligible, your COBRA coverage usually ends on the date you get Medicare. You should enroll in Part B immediately because you are not entitled to a Special Enrollment Period (SEP) when COBRA ends. Your spouse and dependents may keep COBRA for up to 36 months, regardless of whether you enroll in Medicare during that time.

- You may be able to keep COBRA coverage for services that Medicare does not cover. For example, if you have COBRA dental insurance, the insurance company that provides your COBRA coverage may allow you to drop your medical coverage but keep paying a premium for the dental coverage for as long as you are entitled to COBRA. Contact your plan for more information.

- If you have Medicare Part A or Part B when you become eligible for COBRA, you must be allowed to enroll in COBRA. Medicare is your primary insurance, and COBRA is secondary. You should keep Medicare because it is responsible for paying the majority of your health care costs. COBRA is typically expensive, but it may be helpful if you have high medical expenses and your plan covers your Medicare cost-sharing or offers other needed benefits.

Note: If you are eligible for Medicare due to End-Stage Renal Disease (ESRD) , your COBRA coverage is primary during the 30-month coordination period. Be sure to learn about ESRD Medicare rules when making coverage decisions.

The Option to Choose Medicare as your Primary Insurance

People with large group employer insurance also have another option. You can leave your group health plan and choose Medicare as your primary insurance, and then add a Medigap plan. This can often be cheaper for you or your spouse. For many people, it will also reduce your deductible spending and eliminate all doctor copays.

Whether this is cost-effective depends on how much your employer coverage costs you each month in your payroll deductions. Your plan deductible, copays, and medication usage also are factors. If you are married and one spouse is younger, you must also consider the cost of health insurance for the spouse of the Medicare recipient.

Your May River Medicare agent can help you decide if you should enroll in Part B now or later. We often meet people that we advise to stay with their group plan for now if that makes more sense.

You can investigate more about your options for Medigap or Medicare Advantage plans in the next section, How to Choose a Plan.

6-Day New to Medicare Mini Video Course

Medicare and Employer Coverage – Small Companies under 20 Employees

Medicare is primary if you are age 65 or older and your employer has fewer than 20 employees. You will need both Part A & B for sure because Medicare will pay first, and then your group insurance will pay secondary. Occasionally we see some insurance companies who will cover claims even if you don’t have Part B. Don’t buy it. You run the risk of that insurance company changing that at any time without warning, and leaving you stuck with all the expenses that Part B would normally cover. It’s not worth the risk – we advise always enrolling in Parts A & B if your employer has fewer than 20 employees and Medicare will be primary.

However, you may be able to delay enrolling in a Part D drug plan without penalty if your group plan has RX benefits, as most do. Be sure to compare costs. It is sometimes cheaper to leave the group insurance altogether and enroll in Medicare, you can no longer contribute to your health savings account.

The HSA Exception

One exception on either large or small employer coverage is HSA-compatible health plans. If you have a qualified high-deductible health plan and you enroll in Medicare, you can no longer contribute to your health savings account.

You cannot contribute to a health savings account if you have ANY part of Medicare active. You also cannot accept any contributions from an employer if you have active Medicare.

So, if you work for a small employer, you must enroll in Parts A and B at 65 to avoid penalties. This means that if you plan to keep your HSA-qualified employer coverage, you must stop contributing to the HSA. Your spouse can still contribute if he or she is covered on your group plan and is not yet enrolled in Medicare.

Check with your tax adviser on rules for this.

Frequently Asked Questions

Can my employer pay my Medicare Part B premium?

In terms of your employer actually writing a check for your Medicare Part B premiums when Social Security invoices you for Part B, generally no.

However, employers can form a Section 105 Medical Reimbursement Plan, which will enable them to set funds aside for workers to use toward health insurance and dental insurance for their employees and families. This includes Medicare Part B premiums. A Section 105 plan allows tax-free reimbursement of the employee’s medical and other insurance expenses.

One popular type of Section 105 plan is a Health Reimbursement Arrangement or HRA. It is designed to reimburse eligible employees for their individual health insurance premiums and other qualified medical expenses.

6-Day New to Medicare Mini Video Course

Can my employer kick me off my group health insurance when I turn 65?

It’s illegal for an employer to force any actively working employee to choose Medicare instead of their group health plan. You have the option to leave the group health plan and choose Medicare as your primary insurance instead, but your employer cannot make you do so.

Be aware, though, that if you are on retiree coverage from a former employer where you are no longer actively working, the employer does not have to provide a retiree plan for former employees after age 65. If that former employer DOES offer coverage, your benefits will likely change when you turn 65. This is because when you are age 65 and have retiree coverage, Medicare becomes your primary insurance, and your group coverage now pays secondary.

Prices and benefits from your employer coverage may be different once you turn 65. For example, if their retiree plan for people age 65 and older is a Medicare Advantage plan, then you will need to choose whether you want to enroll in that at 65 or switch to Original Medicare as your coverage. There are many factors to consider, such as premiums, how the plan covers your medications, and whether you have a younger spouse who needs to stay on your plan.

Can you enroll in a Medigap plan even if you have employer coverage at a large employer, just to be sure?

This would be a waste of money. A Medigap cannot pay for anything unless Medicare is your primary insurance. The insurance company’s application will ask if you are still employed. When they see that you have large group coverage, they may reject your application because they know it will be of no use to you. Medicare and employer coverage will be good enough coverage.

Retiree Coverage

If your company offers retiree coverage after you have stopped actively working, Medicare is primary to that coverage. Speak with the administrator of your retiree coverage to find out the costs of maintaining that coverage. If costs are high, you might consider leaving the retiree coverage for a Medigap and Part D drug plan instead.

Key Takeaways

- If you have creditable employer coverage, you can still choose to leave that coverage and enroll in Medicare as primary instead. Ultimately, it depends on what is more cost-effective for you.

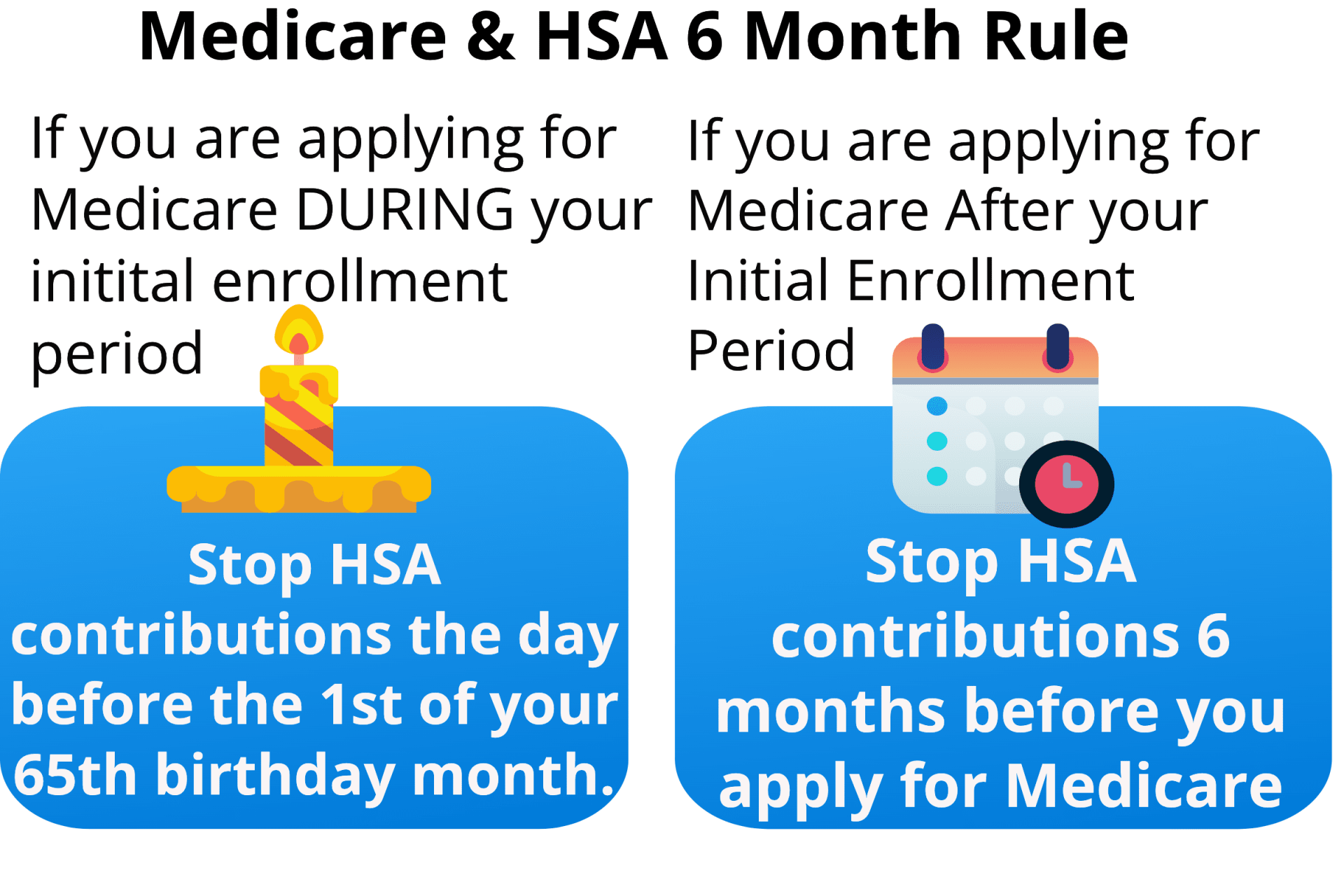

- Be aware of when you’ll need to stop contributing to your HSA account if you have one. This depends on whether you delay Medicare past your Initial Enrollment period or not.

Where to Start

So can you have private insurance and Medicare? Yes, but there are many factors to consider. Deciding all of these things requires some careful cost analysis between the costs for Medicare and the costs, copays, and deductibles of your group coverage. A May River medicare agent can walk through all of this and advise you on the parts you need to consider. If it makes sense for you to stay with your employer coverage, we’ll be the first to tell you.

This website has additional reading about Medicare coordination. See our posts for Medicare and Employer coverage for employer plans with less than 20 people. We also have a Medicare coordination of benefits post for employer plans with more than 20 people.

Still uncertain? Reach out to a licensed insurance agent here at May River Medicare Insurance today – we can help! (843)227-6725