Medigap Plan L Offers Great Benefits

Medigap Plan L offers reduced premiums if you share costs

Medicare Supplement Plan L is another cost-sharing Medigap policy. In exchange for slightly lower premiums than what you might pay for a Plan F if you enroll in a Medigap Plan L, the insurance carrier will pay 75% of your covered medical expenses on most items, and you will pay the other 25%. You also agree to pay the deductible and any excess charges on your own.

Medicare Supplement Plan L – Out-of-Pocket Maximum Cap Protection

A Plan L Medigap policy also includes a cap on your expenses. This is referred to as your out-of-pocket limit or maximum. Medicare sets this limit annually, and in 2024, the limit for Plan L is $3,530. This means that if in any one calendar year, your spending reaches $3,530 in Medicare-approved covered expenses, then the Medigap insurance carrier pays the rest. The cap makes it much easier to agree to share in 25% of the costs on the items listed because you know that even if a year of bad health occurs, you won’t have more exposure than the maximum cap figure.

Plan L example

Let’s say that Mr. Jones purchases a Medigap Plan L policy. He has an outpatient surgery to remove his gall bladder. If Medicare’s approved amount for this surgery is $1,000, then his Plan L Supplement will pay $750, and Mr. Jones will be responsible for the other $250.

This amount is also tallied by his Medigap carrier against his out-of-pocket maximum, and if his costs in that calendar year go over $3,530 in 2024, then his Medigap Plan L will pay 100% of any Medicare-approved expenses for the rest of the year.

Mr. Jones’ policy also functions similarly for his share of outpatient expenses under Part B, except that he will be responsible for the once-annual Part B deductible.

Let’s assume Mr. Jones has already paid his deductible earlier this year when he had an ordinary doctor’s appointment. Later that year, his doctor orders an MRI. Medicare will pay 80% of the cost for that MRI, and his Medigap Plan L will pay 75% of the rest. If the MRI cost is $1,000, then Medicare pays $800, his Medicare Plan L pays $150 (75% of the remaining $200), and Mr. Jones is responsible for the $50 difference.

Medicare Plan L Carriers

In most states, each carrier gets to decide which Medicare Supplements it will offer to consumers for purchase. While it is easy to find carriers for the ever-popular Plan F, not as many carriers offer the Plan L Medicare Supplement. Working with a trusted insurance agent who specializes in Medicare insurance products doesn’t cost you a dime and can minimize the amount of time and effort you put into researching companies and prices.

Our agency works with the major insurance companies in most states. Call us or fill out our online form for quotes

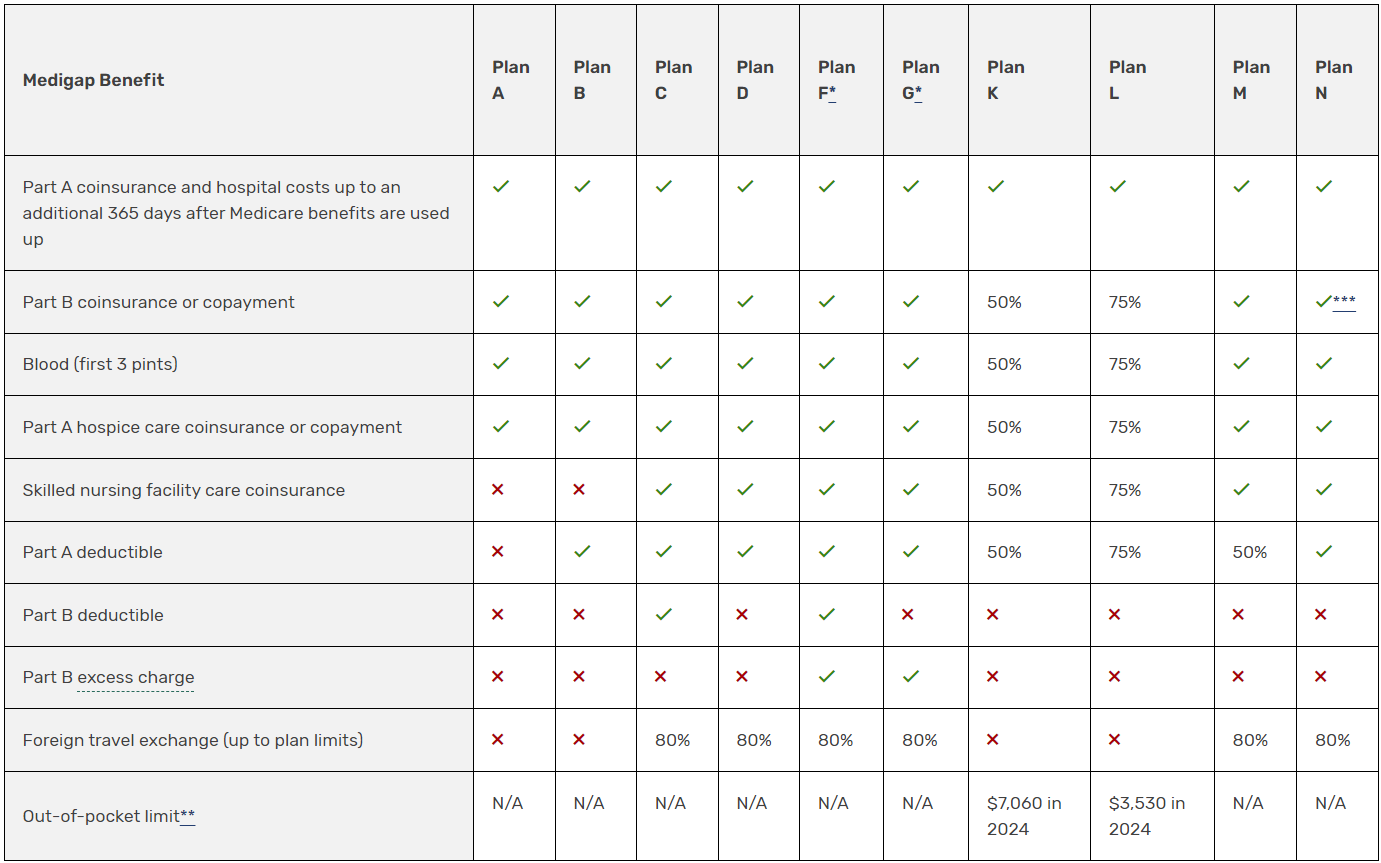

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Let’s say that Mr. Jones purchases a Medigap Plan L policy. He has an outpatient surgery to remove his gall bladder. If Medicare’s approved amount for this surgery is $1,000, then his Plan L Supplement will pay $750, and Mr. Jones will be responsible for the other $250.

This amount is also tallied by his Medigap carrier against his out-of-pocket maximum, and if his costs in that calendar year go over $3,530 in 2024, then his Medigap Plan L will pay 100% of any Medicare-approved expenses for the rest of the year.

Mr. Jones’ policy also functions similarly for his share of outpatient expenses under Part B, except that he will be responsible for the once-annual Part B deductible.

Let’s assume Mr. Jones has already paid his deductible earlier this year when he had an ordinary doctor’s appointment. Later that year, his doctor orders an MRI. Medicare will pay 80% of the cost for that MRI, and his Medigap Plan L will pay 75% of the rest. If the MRI cost is $1,000, then Medicare pays $800, his Medicare Plan L pays $150 (75% of the remaining $200), and Mr. Jones is responsible for the $50 difference.

In most states, each carrier gets to decide which Medicare Supplements it will offer to consumers for purchase. While it is easy to find carriers for the ever-popular Plan F, not as many carriers offer the Plan L Medicare Supplement. Working with a trusted insurance agent who specializes in Medicare insurance products doesn’t cost you a dime and can minimize the amount of time and effort you put into researching companies and prices.

Plan L tends to have lower monthly premiums because you will pay more out-of-pocket costs during the year.

Plan L covers 75% of the cost of approved benefits, but it does not cover the Part B deductible, Part B excess charges, or foreign travel emergency coverage.

Once you meet the maximum out-of-pocket limit, Plan L will cover 100% of your approved costs.