Medicare Part B-covered services

Key Points

In general, Medicare Part B covers a wide range of medically necessary outpatient services.

Most people pay the standard monthly premium for Part B, but you may pay more if your income level is above a certain amount.

Part B covers 80% of Medicare-approved services, leaving you responsible for 20%.

What is Medicare Part B? What does Medicare Part B cover? Who is eligible? What does Medicare Part B cost? Many people think of it as medical coverage, but it actually covers things both in and out of the hospital. Think of Part B coverage as any care administered by physicians.

6-Day New to Medicare Mini Video Course

Medicare Part B-covered services

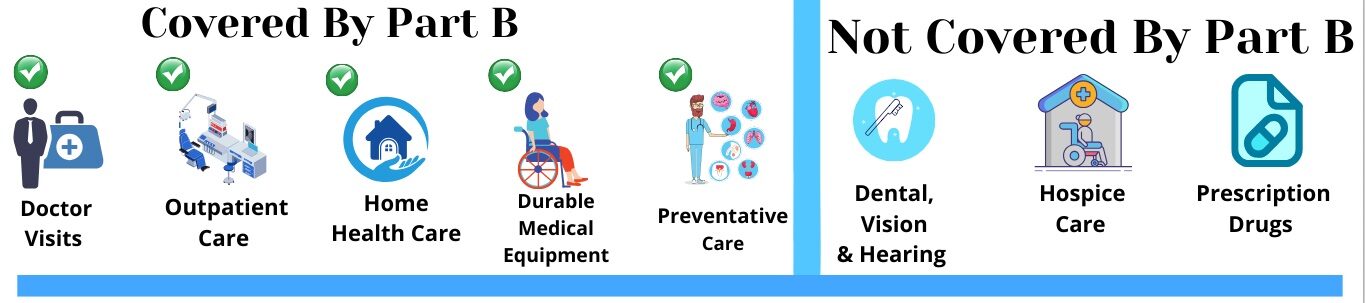

Medicare Part B provides outpatient /medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

Provider services: Medically necessary services you receive from a licensed health professional.

Durable medical equipment (DME): This is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Examples include walkers, wheelchairs, and oxygen tanks. You may purchase or rent DME from a Medicare-approved supplier after your provider certifies you need it.

Home health services: Services covered if you are homebound and need skilled nursing or therapy care.

Ambulance services: This is emergency transportation, typically to and from hospitals. Coverage for non-emergency ambulance/ambulette transportation is limited to situations in which there is no safe alternative transportation available, and where the transportation is medically necessary.

Preventive services: These are screenings and counseling intended to prevent illness, detect conditions, and keep you healthy. In most cases, preventive care is covered by Medicare with no coinsurance.

Therapy services: These are outpatient physical, speech, and occupational therapy services provided by a Medicare-certified therapist.

X-rays and lab tests.

Chiropractic care when manipulation of the spine is medically necessary to fix a subluxation of the spine (when one or more of the bones of the spine move out of position).

Select prescription drugs, including immunosuppressant drugs, some anti-cancer drugs, some anti-emetic drugs, some dialysis drugs, and drugs that are typically administered by a physician.

6-Day New to Medicare Mini Video Course

How Do I Get Medicare Part B?

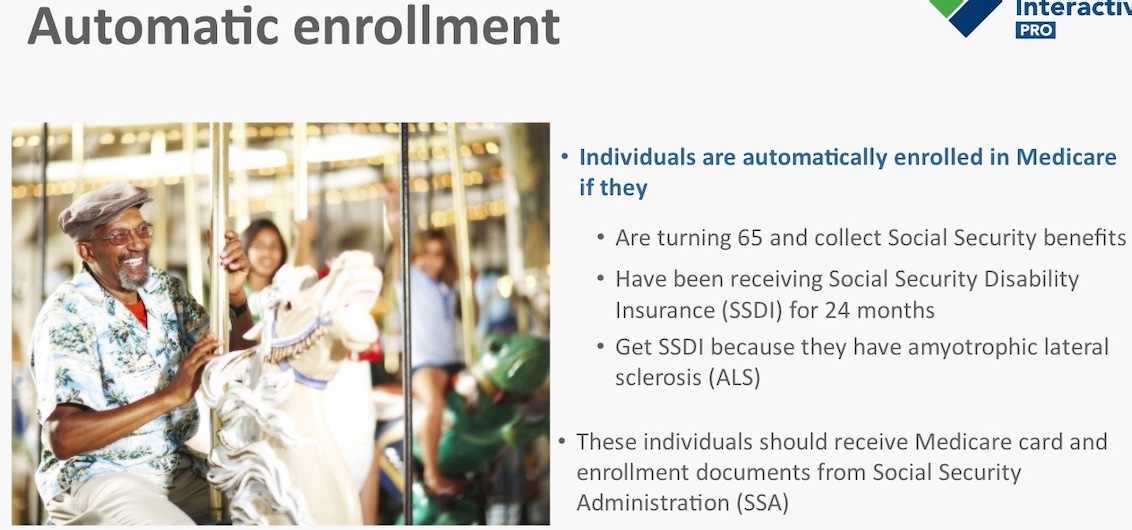

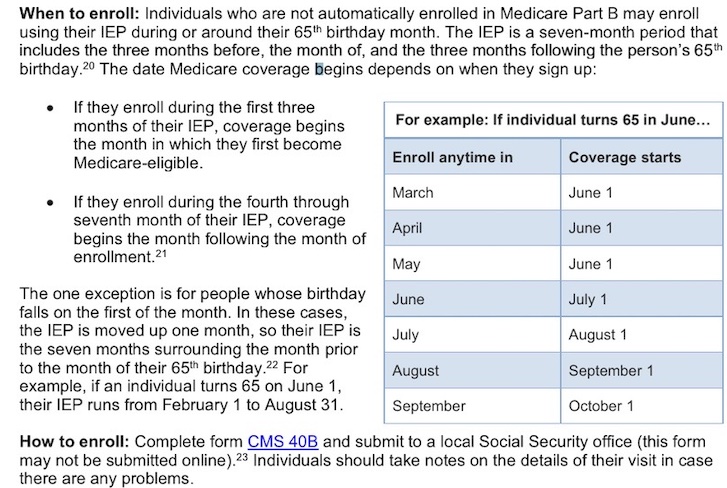

People who are already taking Social Security income benefits at age 65 do not need to enroll. The Social Security office will automatically enroll you. Your card will arrive in the mail approximately 100 days before your 65th birthday.

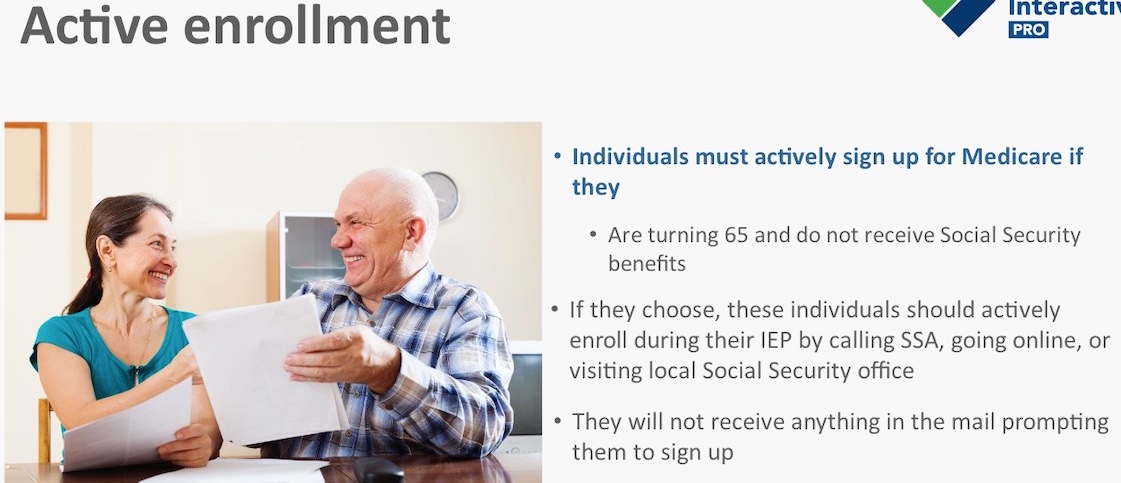

Everyone else needs to apply for Medicare Part B at age 65. You can apply online, over the phone, or in person at your local Social Security office. After you apply, it will take 2 – 3 weeks for your card to arrive, so you should plan to apply several weeks before you need the coverage.

As you can see, it’s easy to sign up for Part B. It’s important to enroll in Part B during your Initial Enrollment Period unless you have other creditable coverage. Otherwise, you would be subject to a penalty!

For more information on each of these application options, visit our Apply for Medicare page.

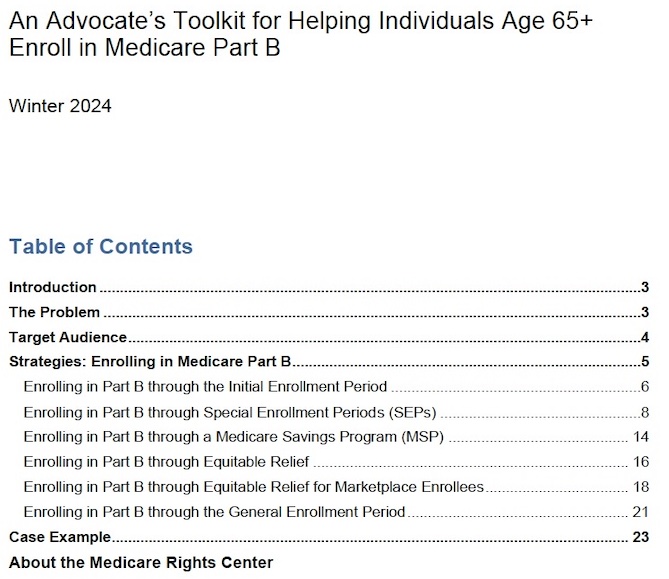

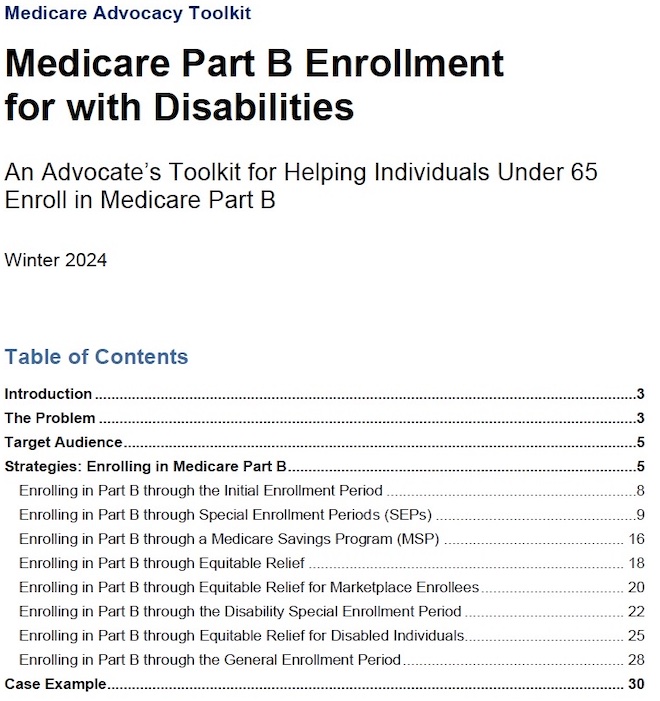

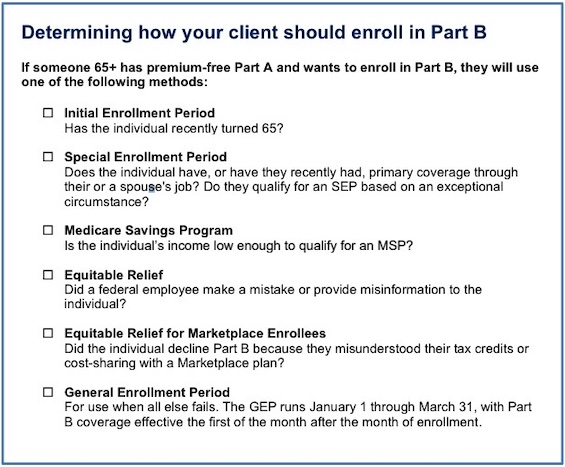

Here are the basic steps that Medicare Rights follows when counseling individuals in need of Part B enrollment:

1. Check the individual’s eligibility for the IEP or an SEP, since these are usually the easiest ways to enroll in Part B without penalty.

2. If the individual has missed their IEP or SEP, check their income to see if they might qualify for a Medicare Savings Program (MSP). MSPs pay the monthly Part B premium for lower-income individuals and, importantly, will also enroll an individual in Part B without penalty (or will erase the penalty of an individual who already has one).

3. For those with incomes too high for an MSP or who need a significantly retroactive Part B effective date, check to see if misinformation or a mistake might allow them to request one of two forms of equitable relief. Equitable relief does not apply to most individuals, usually takes longer, and is less certain to be successful than other enrollment mechanisms.

4. Help the individual enroll in Part B through the GEP. Although it is available to anyone eligible for Part B, it is last on the list since it is the most likely to result in penalties and gaps in coverage.

Enrolling in Part B through a Special Enrollment Period (SEP) for People with Insurance from Current Work

Click on Image Below to get your Medicare Part B Enrollment for older adults over 65

There are a few SEPs that someone may qualify for to enroll in Medicare without penalty. The most common is the SEP for those with insurance from current work.

For tens of thousands of people today—including those who work past age 65—transitioning from other types of health insurance coverage to Medicare is not an automatic process. Roughly 20% of adults over 65 continue to work, and those with primary health insurance through their or their spouse’s job often choose to enroll in Medicare Part A and decline Part B in order to save money on the monthly Part B premium.These individuals should be eligible for a Part B Special Enrollment Period (SEP). (Note that there are different enrollment rules for individuals who are eligible for Medicare due to disability, and individuals who have Medicare due to ESRD do not qualify for the SEP even if they also have Medicare due to age.)

If an individual enrolls in Part B during this SEP, they will typically avoid a Part B late enrollment penalty. However, they will still be responsible for any health care costs incurred in the months after losing job-based coverage and before Medicare takes effect.

Individuals should consider enrolling in Part B if their job-based insurance is from a small employer.

Job-based coverage from an employer with fewer than 20 employees is secondary to Medicare for those eligible for Medicare due to age. Therefore, individuals coverage through small employers who delay Part B enrollment may have no primary health insurance; the job-based insurance may start denying primary payments and only pay their share as secondary insurer. People with Medicare due to age can still qualify for the Part B SEP with small employer coverage. Medicare Rights advises its client to speak with Social Security about any enrollment decisions they are making, document who they talked to, when, and what was said. If a mistake is made, that information can be used to apply for equitable relief, discussed later in this toolkit.

Who is eligible: To qualify for this SEP,

a beneficiary must be eligible for Medicare because of age and have:

1. Insurance from a current job (or their spouse’s current job), or must have had such insurance in the last eight months; and

2. Been continuously covered by job-based insurance or Part B since becoming Medicare eligible, including the first month they became Medicare-eligible.

It is important that the job-based insurance the individual is receiving is from current employment, rather than from a retirement plan, a severance package, or COBRA. An individual is not eligible for this SEP when these types of coverage end.

Individuals are also not eligible for this SEP as a result of their incarceration ending.

There is a small exception for individuals with hours’ bank arrangements (most commonly through a union). Such arrangements can provide temporary job-based coverage in-between active employment and after employment ends. As a result, this coverage is treated as coverage through current employment while the arrangement holds, even if the employment has ended.

This is a limited exception and only applies to hours’ bank arrangements, not to severances or other situations where coverage carries over after employment ends.

Does Medicare Part B Cover Everything Outpatient?

Part B usually covers anything that is deemed medically necessary. So, if a doctor documents your need for a certain procedure, it will usually be covered. If Medicare disagrees with the doctor on medical necessity, some additional documentation might be required.

What Doesn’t Part B Cover?

Part B does not cover hospital expenses covered by Part A. It also does not cover cosmetic procedures, routine dental, vision or hearing, or routine foot care. It also does not cover drugs that you pick up yourself at a retail pharmacy. For those, you will need a Part D drug plan.

In general, Part B doesn’t cover things that are not reasonable and necessary. Your doctor usually will know the rules for what is covered and what isn’t.

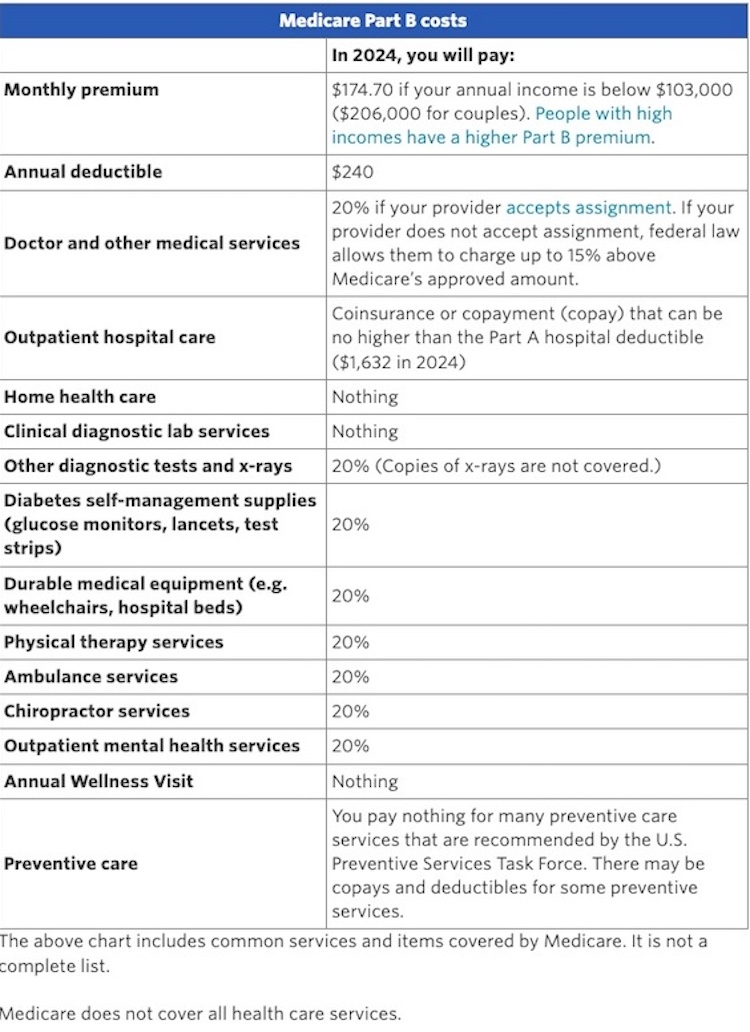

What is My Cost Sharing?

You will pay a percentage of the costs of your medically necessary Part B services. Generally, these costs are:

- *the annual Part B deductible ($240 in 2024)

- *20% of the remaining costs, with no limits or cap

- *any excess charges that a provider or facility may charge beyond what Medicare reimburses

What is most significant is the 20% that you will owe for outpatient medical care. For services like surgeries or chemotherapy, your expenses can add up to thousands of dollars. There is no reason for you to be subject to these expenses when there are supplemental coverage options available for any budget.

6-Day New to Medicare Mini Video Course

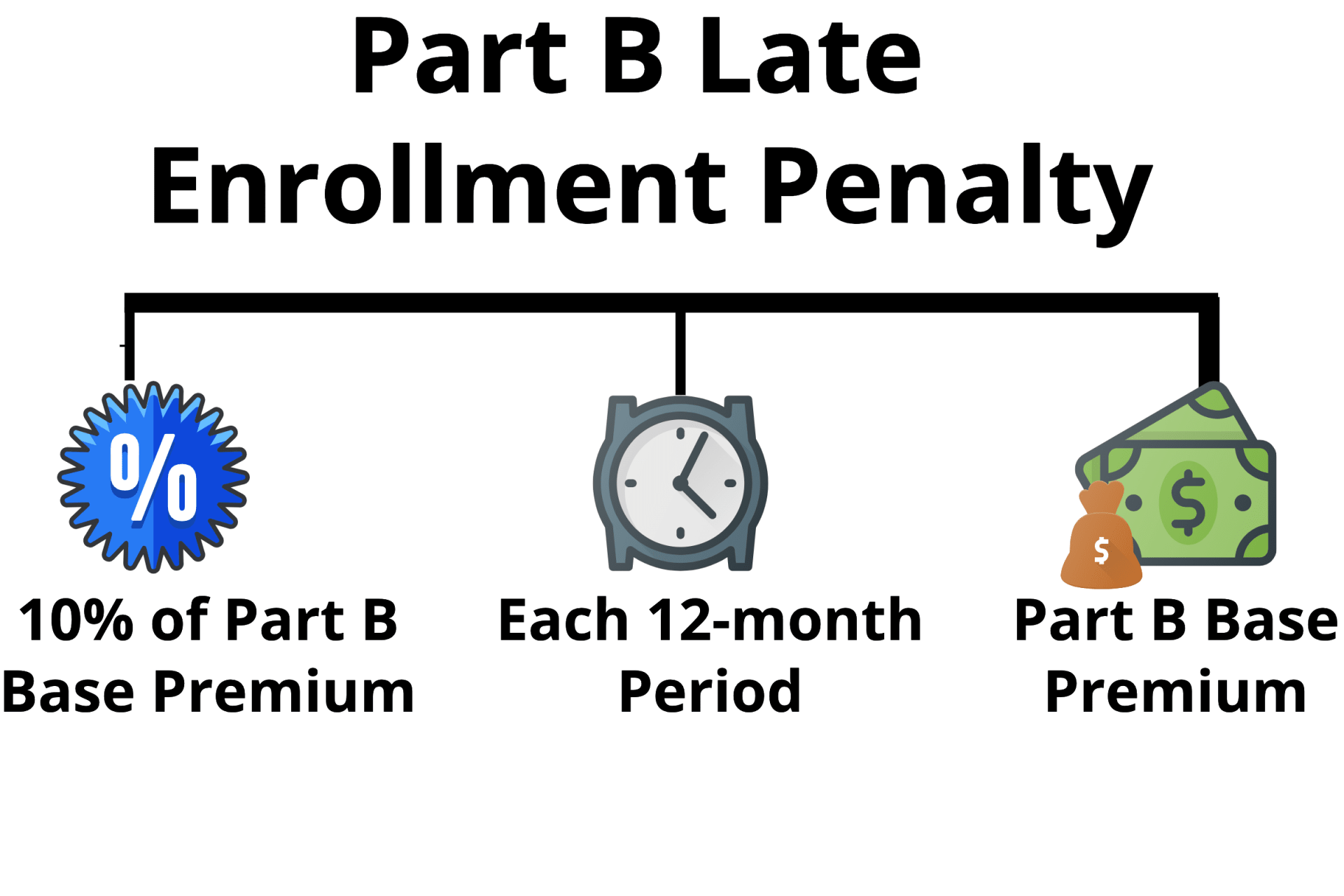

What is the Medicare Part B Late Enrollment Penalty?

If you failed to sign up for Medicare when you were first eligible and you didn’t have any creditable coverage, you will be subject to the Medicare Part B late enrollment penalty. This penalty is equal to 10% per year for every year (12 full months) that you waited to enroll. This penalty gets applied against the standard Part B premium, which in 2024 will be $174.70.

When you do finally enroll, you’ll need to wait for the Medicare General Enrollment Period to sign up for Part B. This period runs from January 1st to March 31st each year. Your benefits will then begin the 1st of the following month after you apply. This can be a double whammy because not only do you now owe a penalty, but you have to wait several months for your coverage to kick in.

Get Help with Medicare Part B

There are two main ways in which you can protect yourself against catastrophic medical spending:

1) Medicare supplements are available for purchase to cover the parts that A & B don’t.

2) Advantage plans are an option if you are open to getting your Part A & B benefits through a private health insurance plan with a smaller network than Medicare Medicare.

Read more about buying a Medicare supplement or

Enrolling in a medicare advantage plan or contact us for a free consultation at (843) 227-6725 today. Our experts can help you compare the options, explain your Medicare Part B coverage, and find the most suitable plan for you.

Key Takeaways

- * In addition to outpatient services, Part B covers certain medications, preventative care, and some services you receive in the hospital.

- * You can enroll in a Medigap or Advantage plan to help cover your portion of cost-sharing with Medicare.

- * Signing up for Part B at the right time is important to avoid late enrollment penalties.