Medigap Plan D Offers Great Benefits

Medigap Plan D Benefits

A Medigap Plan D policy covers most of the gaps in Medicare for you, except for the Part B deductible and any excess charges. An excess charge is an additional amount you will pay if a provider charges more than the Medicare-allowed amount. You will pay out-of-pocket for these two minor items if you purchase a Medicare Plan D. However, the policy DOES cover all of the most important things, like the 20% of outpatient services you would otherwise owe.

It’s important to compare pricing between Medigap Plan D and Plans F or G, which have richer benefits. This will help you determine if the savings are worth the additional financial exposure to you. Some people would rather pay more for their Supplement if they know all the gaps will be covered. Others don’t mind a little cost-sharing to get lower premiums. It’s completely up to you.

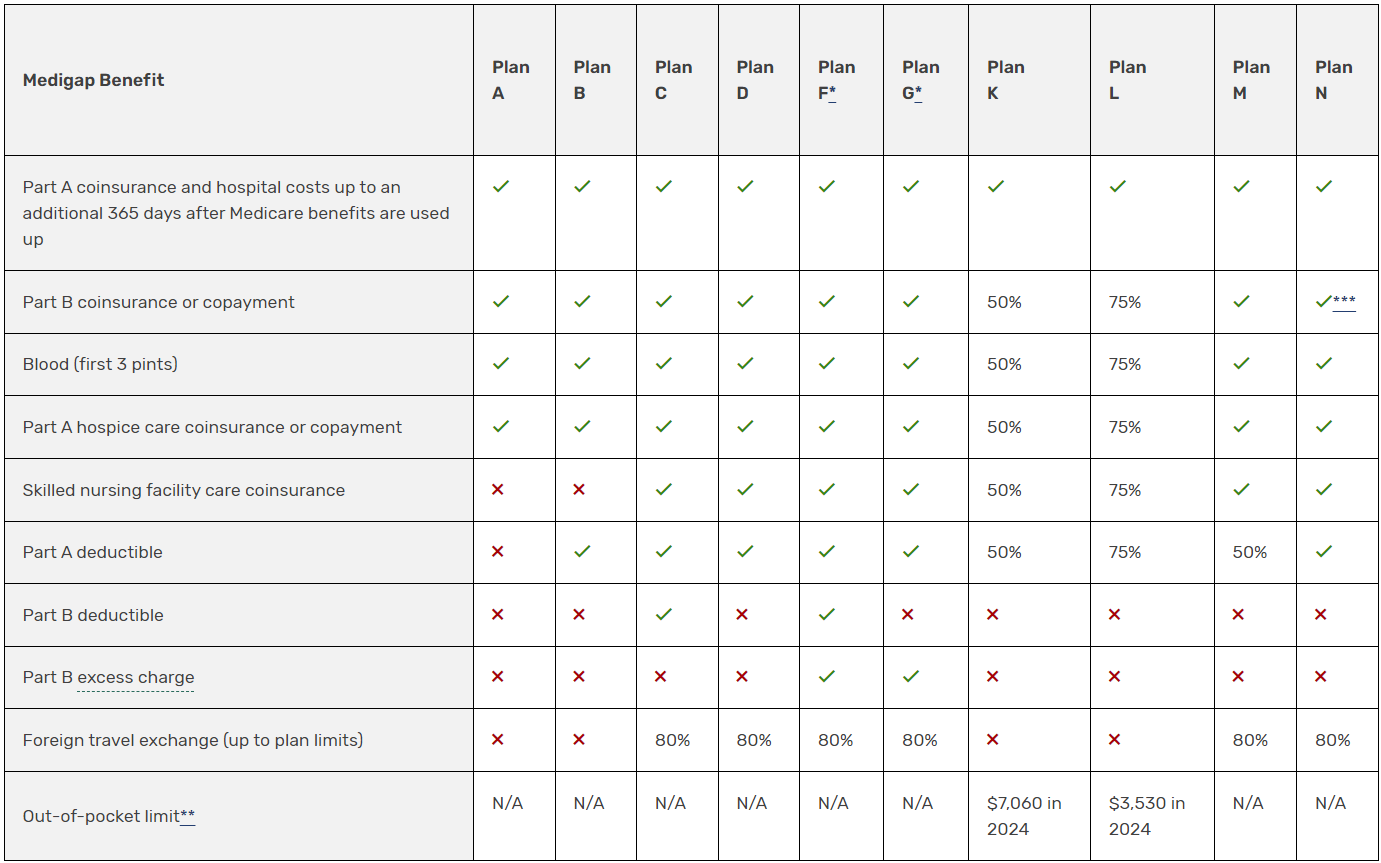

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

A Medigap Plan D policy covers most of the gaps in Medicare for you, except for the Part B deductible and any excess charges. An excess charge is an additional amount you will pay if a provider charges more than the Medicare-allowed amount. You will pay out-of-pocket for these two minor items if you purchase a Medicare Plan D. However, the policy DOES cover all of the most important things, like the 20% of outpatient services you would otherwise owe.

It’s important to compare pricing between Medigap Plan D and Plans F or G, which have richer benefits. This will help you determine if the savings are worth the additional financial exposure to you. Some people would rather pay more for their Supplement if they know all the gaps will be covered. Others don’t mind a little cost-sharing to get lower premiums. It’s completely up to you.

If you find this confusing, call us, and we’ll help break it down. Our agency offers what we call Medicare 101, which we explain in plain English about your basic benefits work, and how any Supplemental insurance benefits you. Understanding the coverage you already have is essential before buying Supplemental policies.

People frequently confuse Part D and Plan D. It’s no wonder. With all these letters floating around, it’s hard to get the terms down. Medicare Part D is the prescription drug program available to all beneficiaries. It is essentially a pharmacy card. Medigap (Medicare Supplement) D, on the other hand, is just one of the ten Supplements available to you.

- Medicare Supplement Plan D is one of the more comprehensive Medicare Supplement plans, but you’ll want to compare the monthly premium to other plans such as Plan G.

- Do not confuse Medicare Supplement Plan D with Medicare Part D, as those are two different programs.