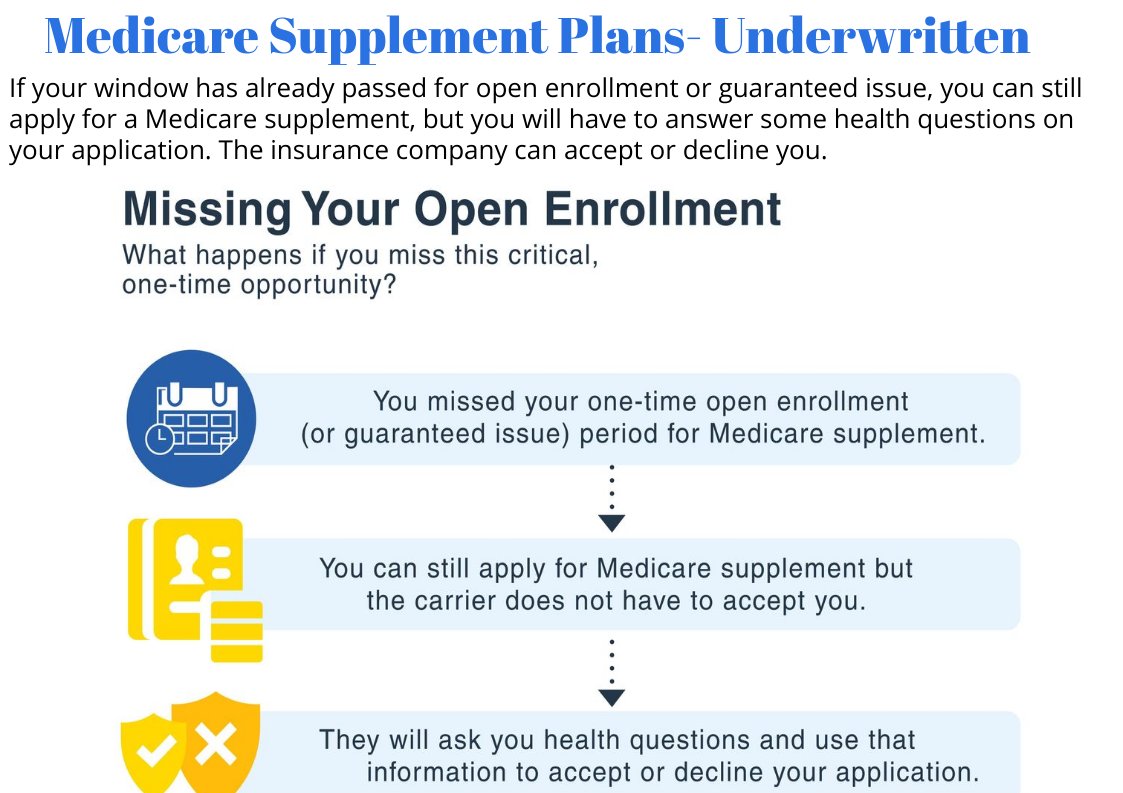

Turning 65 1/2 or Turning 66 Changes Everything: Going forward you must answer health questions and pass underwriting to enroll in a Medicare Supplement

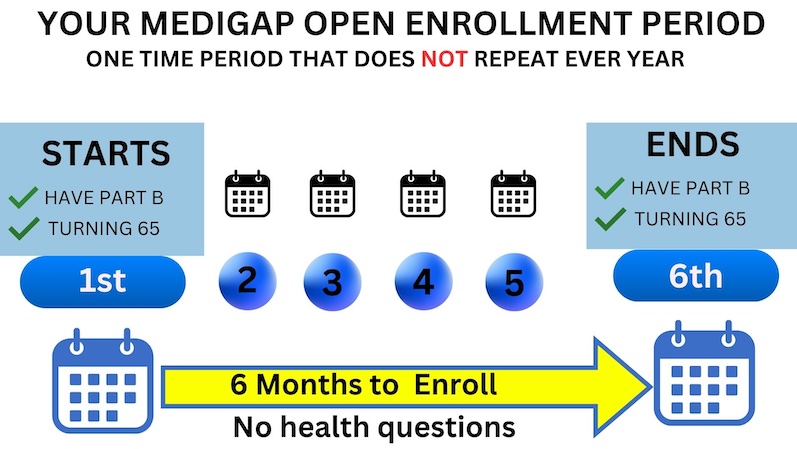

You have 6 months from the month you turn 65 to enroll in a medicare supplement with no health questions asked or medical underwriting required . This is known as your one time only medicare supplement open enrollment period.

If you enrolled in a medicare advantage plan when you turned 65, you have 12 months from your advantage plan’s effective date to switch back to original medicare and during this 12 month period you can enroll in a medicare supplement with no health questions asked or medical underwriting required

After this window passes, however, future insurance companies that you might apply with can accept or decline you based on your health. That is why the handbook states that open enrollment is the best time to enroll.

Please note: the Annual Election Period in the fall is NOT a time when you can change Medigap plans with no health questions. Many people mistakenly believe this. The Annual Election Period in the fall pertains to your Part D plan, not your Medigap plan. You can change medicare supplement plans anytime of year you want. A good time to consider changing is on your policy anniversary date when you get your rate increase letter from your company

Example of how the one year advantage trial right when a beneficiary enrolls into a Medicare Advantage plan once they are 65. The effective coverage date is May 1st which matches their Medicare Part A and Part B effective dates. The trial period ends on April 30th of the following year.

In this example, since Part A, Part B, and the Advantage plan have the same effective dates, the client will qualify for this trial right. They can pick up a prescription drug plan and a Medicare Supplement in their area without underwriting. However, they must apply before their 12-month window is up.

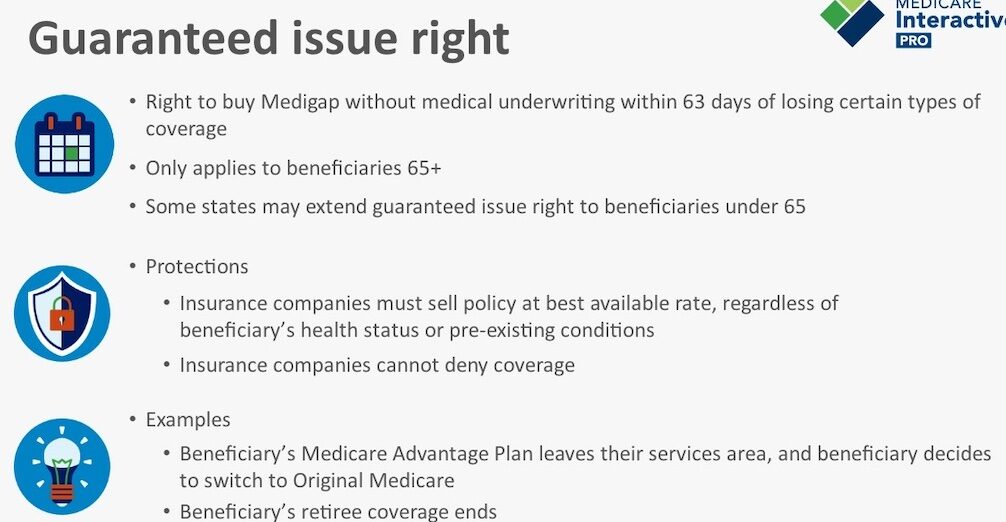

See if you qualify for a

Guaranteed Issue right

If you miss your open enrollment period, you can also buy a Medigap when you have a guaranteed issue right. If you are age 65 or older, you have a guaranteed issue right within 63 days of when you lose or end certain kinds of health coverage.

When you have a guaranteed issue right, companies must sell you a Medigap policy at the best available rate, regardless of your health status, and cannot deny you coverage. The best available rate may depend on a number of factors, including your age, gender, whether you smoke, your marital status, and where you live. A guaranteed issue right also prevents companies from imposing a waiting period for coverage of pre-existing conditions. Check with your SHIP to help ensure that you are getting the best available rate for your Medigap.

Below are your options if you granted a guaranteed issue right

Other Examples of Guaranteed Issue Rights

You have a Medicare Advantage Plan, and: Your plan is leaving Medicare Stops giving care in your area, or You move out of the plan’s service area.

You have Original Medicare and an employer group health plan (including retiree or COBRA coverage) or union coverage that pays after Medicare pays and that plan is ending

(Trial right) You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a policy) for the first time, you’ve been in the plan less than a year, and you want to switch back .

Sample Underwriting Question for Medicare Supplement Applications

When you are looking for a Medicare supplement, our team’s mission is to find the company that looks at your particular health conditions most favorably. They’ll know which carriers have underwriting questions that may be more lenient than another for certain health conditions. Nearly all applications will ask for information about ongoing conditions. For example: See left hand column below.

In the past 24 months, have you been diagnosed with, received any treatment, or been prescribed any medications for the following conditions:

- Internal Cancer-3-5 years

- Heart Conditions-24 months

- Atrial Fibrillation-24 months

- Stroke or Transient Ischemic Attack-24 months

- Stent-24 months

- Chronic Obstructive Pulmonary Disease-3 years

- Diabetes with insulin

- Osteoporosis

- Rheumatoid or disabling arthritis

Minor Health Conditions – Likely Approval

The first thing you’ll notice is that the health questions don’t concern minor things like seasonal allergies, or the flu. Likewise, they don’t really care if you had two colds last year or a urinary tract infection. Certain injuries are a non-issue as well, as long as you are fully healed and done with treatment.

Often things like high blood pressure and cholesterol are not an issue either as long as they are not occurring alongside another more serious condition. Minor arthritis is not a problem, but as you’ll see below, a more serious form of rheumatoid arthritis would cause a decline.

Carrying a few extra pounds is not a problem as long as you are not morbidly obese. Every carrier will have underwriting guidelines about this, so your agent can check your height/weight against the company’s guidelines to make sure you don’t apply if your BMI will cause a decline.

Pending Surgeries and Treatments – Finish them First

Now we’ll begin to move into potentially declinable situations, and expensive pending procedures top the list. Obviously, no insurance carrier wants to cover you just before a costly diagnostic test or major surgery. Remember that Medigap carriers will pay for 20% of that surgery. They want you to get that done with your old carrier before you apply with them.

This is the case even if your pending surgery is for something non-life-threatening – such as endometriosis or a gall bladder removal. You will need to complete the surgery and any follow-up visits or therapy before a new carrier will consider you.

Auto-Decline Drug Lists

Carriers also have a list of auto-decline medications. These are medications that treat major or chronic illnesses. By virtue of taking these meds, you indicate a health condition that might be expensive for the carrier to treat.

Sometimes a certain mix of medications is problematic. If you take diabetes meds along with high blood pressure and cholesterol meds, you may be denied. Carriers will look at your history with those meds and see how recently your dosages have changed. Frequent or recent changes can work against you.

One set of medications that can sneak up on you is pain medications. If you took a short-term round of hydrocodone while recovering from surgery, this usually won’t be a problem. However, if you have been taking it regularly, then that indicates an underlying and potentially costly problem. The Medigap carriers don’t usually like to take a chance on this. Similar problematic pain meds include fentanyl, morphine, oxycodone and oxycontin.

Chronic, Incurable Health Issues – Keep Current Plan

Some illnesses are treatable but incurable. If you have a serious illness that will require treatment forever, you’ll find that the questions on most Medigap applications will exclude you. Common examples would be dementia, chronic lung disorders, immune disorders such as RA, MS, Lupus, or AIDS, and nervous system disorders such as Parkinson’s. Osteoporosis with fractures will also be problematic. The insurance company knows these conditions will require lifetime expensive care.

Major heart disorders might also prevent you from changing carriers. Arterial and vascular diseases, history of heart attack and/or strokes, stents, pacemakers, and congestive heart failure are some examples. Many carriers decline for rhythm defects or valve problems. Kidney failure and/or organ transplants can cause a decline in most circumstances.

Dealing with Medical Records

Something we’ve uncovered over the years is that most folks don’t always know what’s in their medical records. If your doctor has told you that you are pre-diabetic, ask him what is written in your file. Did your doctor minimize that health condition in his conversation with you?

Perhaps he told you that you were pre-diabetic, but what matters is what he wrote in the file. If your chart says diabetes, that is what the carrier will include in its assessment. If you are unsure, ask your doctor before you apply.

Also, if a doctor prescribes a medication that you have no intention of filling, tell him that at the appointment and ask him not to prescribe it. Once it is prescribed, it’s in your medical record.

Submitting a Medigap Application

Once your agent has identified which insurance company you’ll apply with, she can usually take that application from you over the phone or by emailing you a printable application. You’ll complete the application and your agent will check to make sure that you have answered NO to all the questions that require a no.

Switching Medigap plans can take time, so I recommend applying for a future effective date that is 2 – 3 weeks out. This gives the new insurance company plenty of time to complete underwriting and give you an answer before the coverage takes effect.

Your agent forwards your application to the Medigap underwriting department. An underwriter will call you. The phone interview is an important part of a carrier’s decision process, but on occassion the phone interview will be waived with some carriers

Underwriters will usually have questions related to your medical records and prescriptions you’ve taken. Occasionally they may ask you to provide medical records if your doctor’s office is unwilling to forward them, but this is relatively rare.

Don’t volunteer any information more than what the underwriter asks you. Occasionally we see someone get declined for information that they voluntarily offered that was not an answer to a question asked by the underwriter. Use yes and no answers to questions whenever possible.

Don’t Cancel Until Your Medigap Eligibility is Confirmed

You are 66 or Above already on a Medicare Supplement and Relatively Healthy

When you first turn 65 and enroll in a medicare supplement, for the most part, your monthly premium will be similar to a large portion of other carriers, but that can change drastically with each passing year.

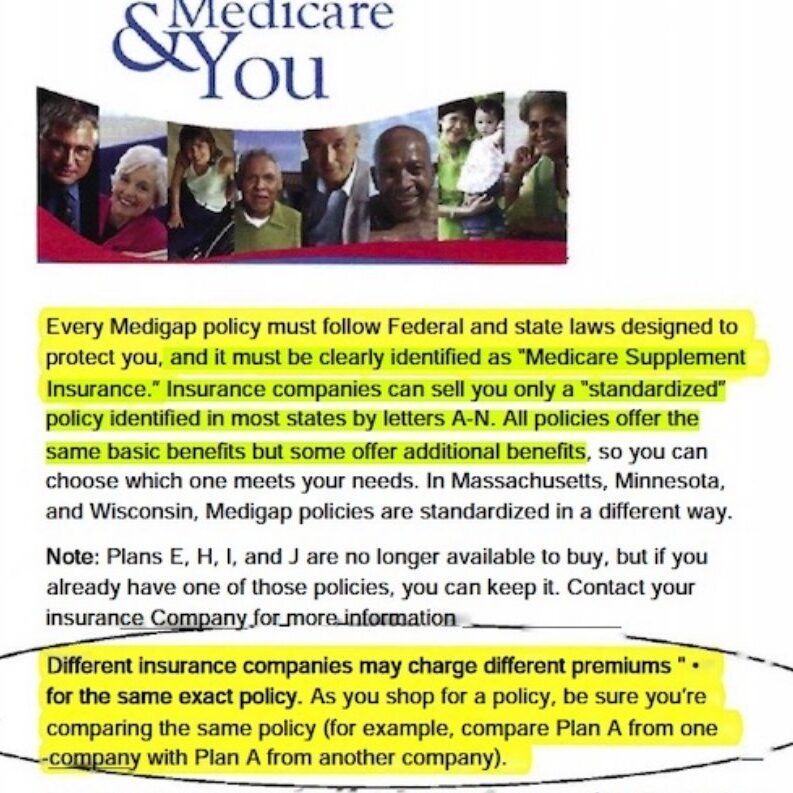

The biggest mistake I see folks making when they turn 65 is they get stuck on a Brand Name Carrier, when in fact medicare supplements are standardized, meaning they offer identical coverage based on which letter plan you choose. Too often I see folks who are familiar with a company because they had their employer coverage or perhaps they had ACA coverage (obamacare insurance) with a big brand name company and either the carrier flips them into their medicare supplement or the client simply goes with that carrier because they’ve used them in the past. These same companies sell Medicare Supplements and often charge a much steeper price. Why? Because they can! After all, folks typically are willing to pay for a recognizable name even if it goes against their best interest.

However, you should know that Medigap plans are standardized. This means that the policy sold by the Big Brand Company has exactly the same benefits as another company you aren’t as familiar with. Many times, the lesser known carrier offers lower rates.

The Below is Page from the Medicare and You Book stating, “Different Insurance Companies Charge Different Premiums for the exact same policy. As you shop be sure you’re comparing the same lettered Plan.”

May river Medicare let’s you compare all (updated to the second) from all carrier’s listed lowest to highest. Use our quote tool below to see for yourself if you are overpaying.

- Below is our self service quote tool you may use to compare rates in your area. These rates are accurate and up to date.

- Type in your zipcode and birthdate

Select gender and tobacco status and hit SUMBIT. - After hitting submit, you can select a Plan N or G or F-any plan letter-from the dropdown menu.

- Then the new screen will show all rates from all carrier’s lowest to highest.

- Again be sure to select which Supplement letter you want rates.

- Household Discounts are shown in these rates

Request A Quote

Insurance Company

Only sells plans from one carrier

Insurance Broker

Sells Multiple Plan with Dozens of carriers

Being Unaware of Market Trends

Don’t just enroll in the Plan G because everyone says. “It’s the best plan because your only out of pocket cost is the $240 Annual Part B Deductible.”

It is human nature to put away your policy and forget about it. After all, it’s paying my bills after medicare pays their share, so good enough, right? Wrong, they all pay your bills. they all must pay claims. Medicare sends them the bill. They better pay or else. But who enjoys shopping for insurance? The problem is if you don’t review your annual rate increase letters, you might wake up one day and realize this thing has gotten gotten out of control. Your carrier does not reward loyalty rather they jack up your rates hoping you fall asleep at the wheel until its too late! You can’t pass underwriting. Your stuck and they know it. Insurance companies roll out new products in your state all the time. It’s worth it to spend ten minutes reviewing your policy with your agent once a year to make sure that what you are paying is still competitive, and change to another carrier if the savings warrants it.

For example, most carriers have a financial rating score, and usually, there is at least one A-rated carrier offering very competitive rates. Carriers with high scores have enough financial reserves to weather a storm of claims. This should figure into your decision.

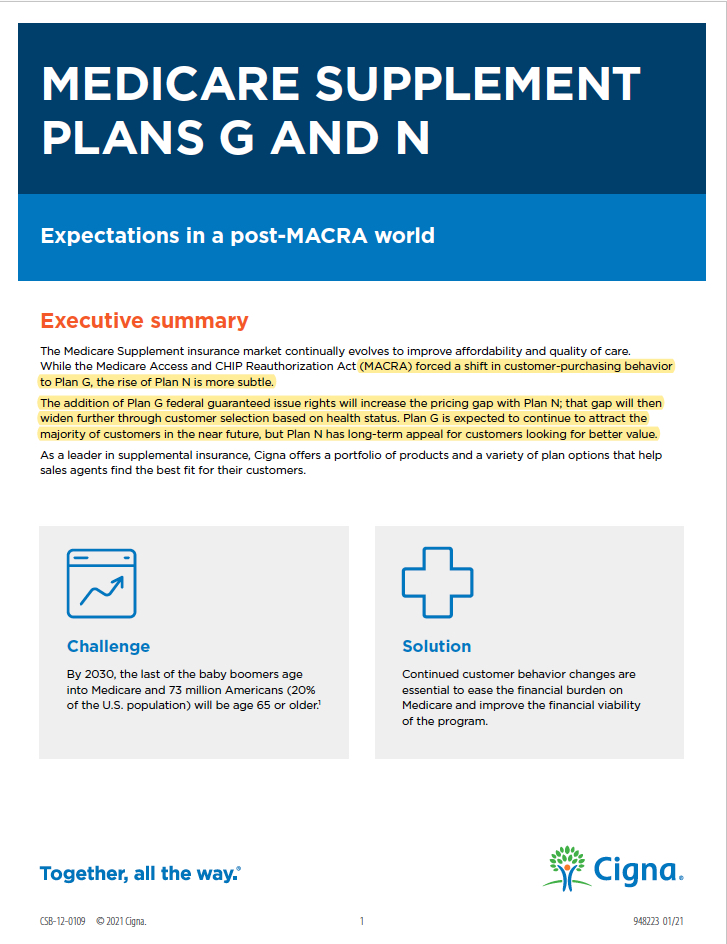

With Plan G you pay a higher premium than the Plan N, but what no one tells you is that the Plan G rates are getting worse each year, and the gap between the Plan G monthly premium versus the Plan N premium has been widening every year since the MACRA law went into effect on 01/01/2020 forcing the insurance companies to offer the Plan G to chronically ill sick people with no health question or medical underwriting. Below is the independent study Cigna sent to all its agents warning them of larger Plan G rate increases with each passing year. The Plan N offer virtually the same coverage minus a few small differences so open the Plan G vs Plan N study done by the underwriting deparment

Click on Image Below to Download Cigna’s Underwriting Department’s Independent Study Emailed to all its Agents Regarding the Future of Plan G rates versus Plan N rates and why Plan offers more value

What if I’m on an Advantage Plan and I am not healthy enough to Pass Medicare Supplement Underwriting?

WATCH VIDEO BELOW TO Learn the three fastest ways to get hurt on a Medicare Advantage plan AND LEARN HOW TO AVOID BIG HOSPITAL OR CANCER BILLS

Request A Quote

2024 Medicare Advantage Checklist

ALWAYS TRY TO FIIND THE PLAN WITH THE LOWEST MAXIMUM OUT OF POCKET.

RESEARCH WHICH CARRIERS HAVE A TRACK HISTORY OF IN-PROPER DENIALS OR ARE BEING SUED FOR FRAUD, OR OVERUSE OF PRIORAUTHORIZATIONS. TRY TO FIND A 5 STAR PLAN

1. Are your favorite doctors, hospitals, and pharmacies in the plan’s network?

Medicare Advantage plans have their own lists of doctors who are in-network, so it’s important to check that your preferred doctors are listed.

2. Does your plan allow you to visit a non-network provider?

Some plans permit you to see out-of-network doctors, but you will likely pay more money out of pocket for these visits.

3. Are there prescription drugs you take regularly and does your plan cover them?

Medicare Advantage plans include Original Medicare benefits and often have prescription drug coverage (Part D) as well. Find out if the specific prescription drugs you take are included under the plan you’re considering and what you will have to pay for them. For example, some MA prescription drug plans offer certain medications with $0 copays (depending on their drug list and drug-tier levels). Drug lists can change every year, so you’ll want to check annually whether your prescription medications are still covered under your plan and what you will have to pay for them.

4. Do you enjoy being active and exercising? Would a fitness benefit interest you?

In addition to extra benefits likE DENTAL, VISION AND HEARING, many MA plans offer fitness programs for older adults, such as SILVERSNEAKERS These programs can help you make WORKING OUT A part of your everyday life.

5. How much does your plan cost, and does it fit your budget?

Several factors determine Medicare Advantage out-of-pocket (OOP) costs, such as premiums, deductibles, copayments, and coinsurance. These costs may vary based on the plan you choose. Your costs also will be decided by how often you need medical services, and whether you see any specialists in addition to your primary care provider. MA plans have a yearly cap on how much you’ll pay out of pocket. For 2024, THE MAXIMUM-OUT-OF POCKET for Medicare Part C plans is $8,850 (but some plans set lower limits).

6. Are there programs available to help you with Medicare out-of-pocket costs?

Medicare can help cover some medical- and health-related costs, but it’s not free. If you need helping paying Medicare out-of-pocket costs, research income guidelines for availabl assistance programs like extra help for drugs or Medicare Savings Plans and apply if you think you might qualify.

If you have special health care needs, you might consider a medicare special needs plans (SNP), which is a type of MA plan. Some people are eligible for both Medicare and Medicaid and can enroll in a Dual-Eligible SNP (D-SNP). Those who qualify are either older adults with low income or people living with a disability or end-stage renal disease.

7. Would non-traditional benefits, such as transportation and food delivery services, be helpful to you?

Some Medicare Advantage plans offer other non-medical benefits, such as:

- Help with utility costs

- Access to and assistance with buying healthy foods

- An allowance toward over-the-counter items

- Fall prevention aids

- Companionship

If these types of services would make your life easier, it may be a good idea to find MA plans that include them.