Medicare Part D

Cost| Cost-Sharing| Enrollment| Get Help

Key Points

- The Medicare Part D program provides prescription drug coverage to Medicare beneficiaries.

- Each Part D Drug Plan will have a premium and cost-sharing for covered drugs.

- There are specific enrollment periods during the year for you to enroll in a Part D

plan or change to a different plan.

Medicare Part D , the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

Unless you have creditable drug coverage and will have a Special Enrollment Period, you should enroll in Part D when you first get Medicare. If you delay enrollment, you may face gaps in coverage and enrollment penalties.

Watch the Part D Coverage Stages Webinar published in March of 2024 by Medicare Interactive.

Medicare Part D Cost

How much is Medicare Part D?

Medicare Part D costs include several things. First, there is a monthly premium that you will pay for the insurance itself. Then there is cost-sharing that you will pay at the pharmacy for your medications. That cost-sharing may include some deductible spending if your Part D plan has a deductible.

Let’s break those down for you.

Medicare Part D Premiums

The monthly premiums for Part D drug plans vary depending on the specific plan that you choose. Each insurance company sets its own rates.

In 2024, there are many Medicare Part D plans to choose from in each state – sometimes 20 or more. Plans range from as low as $7 in some states to over $200+. Every insurance company sets its own formulary (list) of medications that are covered by the plan. Therefore, they can determine what monthly premium they will charge for the plan each year.

The cheapest Part D drug plan in your state is not always the best one for you. It’s important to choose a plan with a formulary that offers the medications you need. If you just enroll in the cheapest plan without checking the plan’s formulary, you may later learn – after you are locked in – that the plan does not cover one of your medications.

Some people with higher incomes may have to pay more for their Medicare Part D plan. If you earned more than a certain amount filing individually or jointly, then Medicare will also require you to pay extra for your Part D coverage. This is called the Income Monthly Adjusted Amount or IRMAA. You can read more about IRMAA costs on our Medicare cost page.

Medicare Part D Cost-Sharing

When you go to the pharmacy to pick up your prescriptions, you will pay your share of the costs. Some plans have a deductible, and then there are the copays that you pay for the medication itself.

Medicare Part D Deductible

The Center for Medicare and Medicaid Services sets the minimum guidelines for Part D plans each year. Each insurance company offering Part D plans must follow these guidelines. All drug plans have 4 stages, and Medicare sets the threshold for each stage each year.

The first stage is the Medicare Part D deductible. In 2024, this deductible is $545. This means that each insurance company can require up to a $545 deductible from you upfront before your benefits kick in. The insurance company can also charge a lower deductible if it chooses to do so. However, no plan can charge a higher deductible than what Medicare allows for that year.

Drug Plans that charge the highest deductible ($545) up front will have a lower monthly premium and a lower or no deductible drug plan will have a much higher premium and copays tend to be higher for drugs than plans that charge the high 545 deductible

Medicare Donut Hole

What is it| Is it Ending| FAQs| Exemptions| Reducing Costs

Key Points

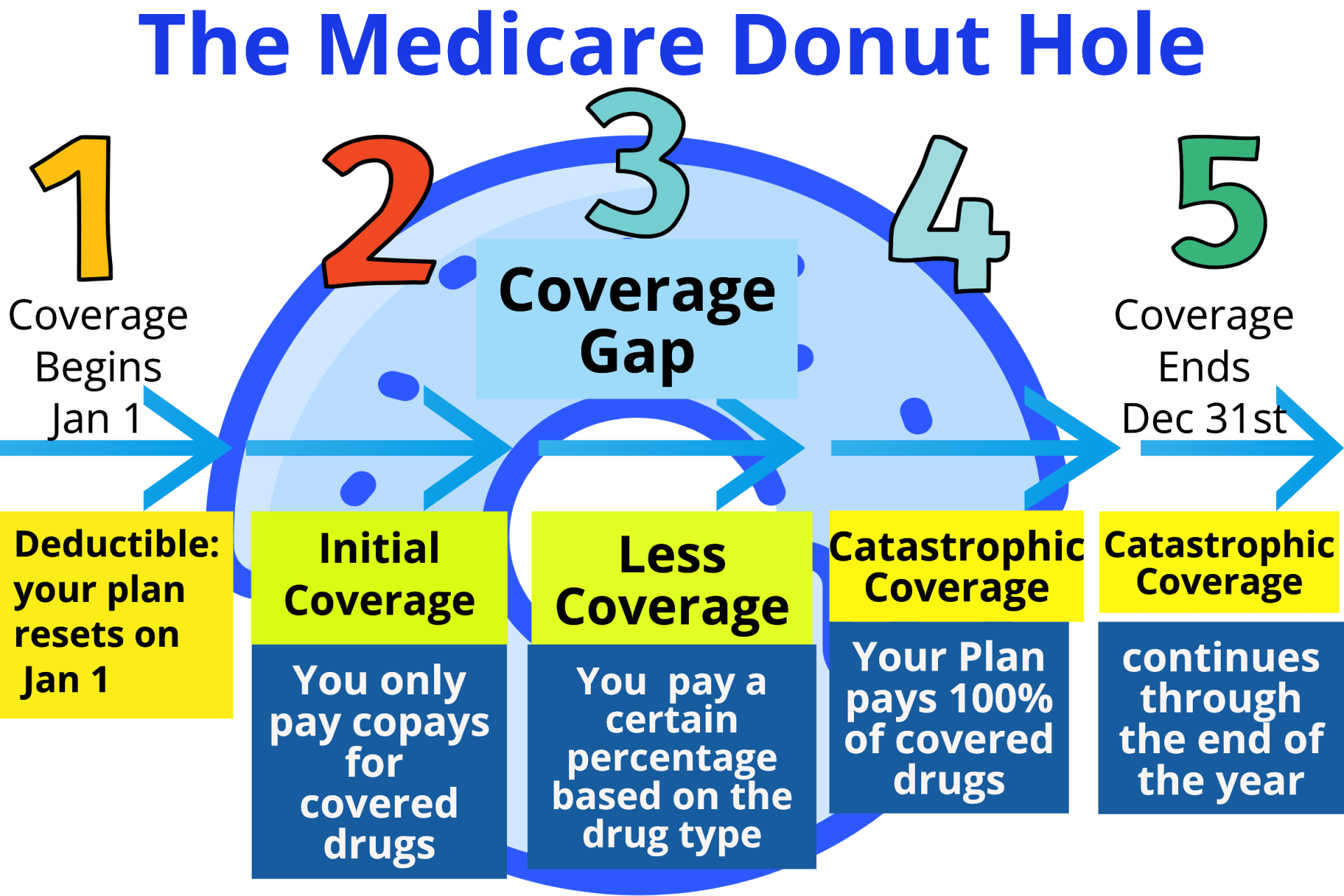

- The Donut Hole is also known as the Coverage Gap in Part D plans and Medicare Advantage plans with drug coverage.

- You enter the Donut Hole when you and the plan pay $5,030 towards your drugs.

- During this stage, you pay 25% of the cost of your covered drugs until your out-of-pocket costs reach $8,000 in 2024.

The Medicare Part D donut hole is just a term coined by ordinary people for the stage of Medicare Part D that is officially called the Coverage Gap. The reason they call it the Medicare Donut Hole is that it used to be a hole in the middle of your drug coverage during a calendar year.

All Medicare Part D plans have four stages, and the third stage is the Donut Hole. However, you may have heard about the Medicare Donut Hole ending. The reason people used to say that the Donut Hole was ending is that the percentage you pay for brand-name drugs in the Coverage Gap lowered.

Confusing, right? Keep reading, and we’ll break it down for you.

What is the Medicare Donut Hole?

The Medicare Donut Hole is a gap inside all Part D plans. When your spending reaches the threshold for the Coverage Gap, your medication costs can then be higher than they were prior to you reaching the Donut Hole. However, depending on what you paid during the Initial Coverage Stage, your coinsurance can be lower during the Coverage Gap.

Congress designed Part D so that it would provide coverage for the majority of your prescription drugs. However, a small percentage of people have medication costs that go well beyond average spending. Part D was designed so that those people would then share in a greater portion of the costs for their medications when they enter the coverage gap.

Medicare designed the Gap to encourage beneficiaries, whenever possible, to seek generics or drug alternatives that are lower in cost. This has helped a great deal to keep the total costs for the Part D program as low as possible

Is the Medicare Donut Hole Ending?

So, when does the Donut Hole end? Although it has shrunk, it hasn’t ended quite yet.

Since the Affordable Care Act passed back in 2010, the Donut Hole has been slowly closing. It used to be that when you hit that point, you would pay 100% of the costs of your prescription drugs while you were in the Gap.

However, the government has been reducing that percentage steadily, and as of 2024, the percentage of the cost that you pay for prescriptions during the Medicare Donut Hole is no more than 25%.

$545

Copays

the initial coverage period ends after you have accumulated $5,030 in total drug costs.

25% of Retail price of the drug

You enter coverage after you reach $8,000 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay. and Drug Co. pay 100%

Donut Hole Expenses

Once you and your insurance plan have spent a total of $5,030 in 2024, you will move into the Medicare Donut Hole. In 2024, you pay 25% of the cost of your prescriptions, both brand-name and generic, while in this stage. So, if a certain medication costs $100, and you were paying a Tier 3 copay of $46 before you reached the Gap, the same medication will now cost you $25 when you are in the Gap. However, if that $100 drug were a tier 2 drug and you were paying a $10 copay prior to the coverage Gap, you’d now pay $25 in the Coverage Gap.

Medicare continues to tally the spending between you and your insurance company while you are in the Gap. If your total out-of-pocket drug expenses reach $8,000 in 2024, then you exit the Gap. You reach the fourth stage of Medicare Part D, called Catastrophic Coverage. As of 2024, the Catastrophic Coverage Stage cost-sharing has been eliminated. In this stage, your plan will cover your medications at 100% for the remainder of the calendar year.

Some medications fall outside of Part D altogether and therefore do not get tallied toward the Medicare Donut Hole. See our list of medications not covered by Part D for more information on that.

While the Coverage Gap can be painful, it’s important to remember that, just a few years ago, there was no prescription drug program for Medicare beneficiaries. Medicare Part D has greatly helped reduce drug spending for millions of Medicare recipients.

Most Part D carriers negotiate discounted drug rates with pharmaceutical manufacturers, too. You get the benefit of these discounts just for being a plan member.

What Counts Toward Exiting the Coverage Gap

When you are in the Gap and paying 25% of covered drugs, your spending counts toward exiting the Gap. The manufacturer’s drug discount of 70% also counts and will help you exit the Gap faster.

There are two things, though, that don’t count toward closing the Gap. These are:

- The amount that your drug plan pays toward the cost of the drug, which is 5% of the Gap

- The amount that the drug plan pays toward the pharmacy’s dispensing fee, which is 75% of the fee in 2024

Keep in mind that there are other things that don’t count toward reaching the Catastrophic limit, which is your plan premium and also what you spend on any drugs that aren’t covered by your Part D plan.

Watch Below Video to See How you can hit the Donut Hole fast with the popular 50 cent Drug Plan offered in all 50 states

When to Enroll in Part D

Creditable drug coverage

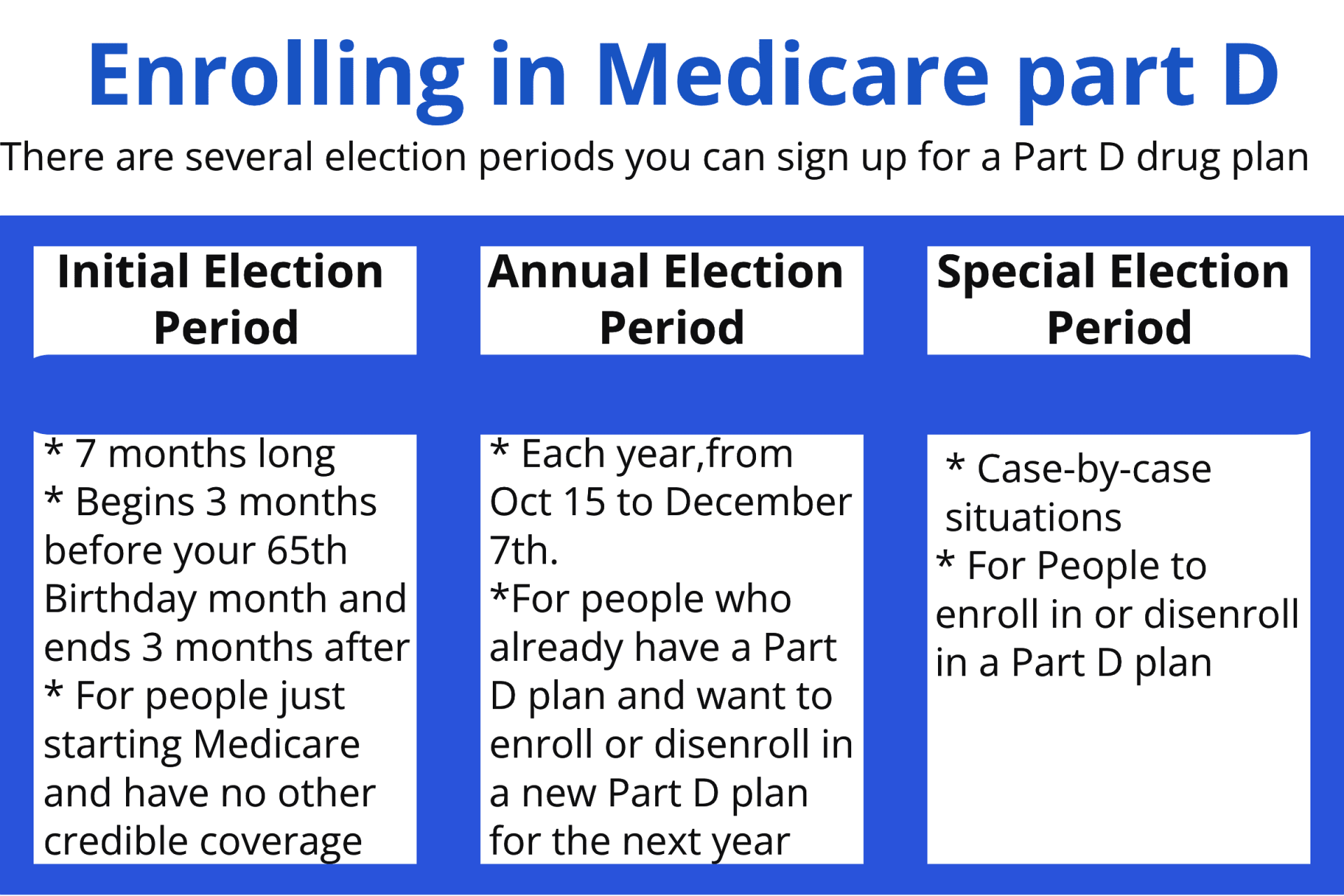

If you need to enroll in Medicare Part D for the first time, typically you will do so either during your Initial Enrollment Period (IEP), the Fall Open Enrollment Period, or if you qualify for a Special Enrollment Period (SEP). Additionally, you must:

- Have Part A and/or Part B

- And, live in the Part D plan’s service area

Your Part D IEP is usually the same as your Medicare IEP: the seven-month period that includes the three months before, the month of, and the three months following your 65th birthday. For example, let’s say you turn 65 in May. Your IEP runs from February 1 to August 31.

The date when your Part D coverage begins depends on when you sign up:

- Enrolling during the first three months of the IEP means coverage begins the first day of the fourth month.

- Enrolling during the fourth month of the IEP or any of the three months afterwards means coverage begins the month following the month of enrollment .

You should enroll in Part D as soon as you are eligible to avoid a potential late enrollment penalty (LEP) and gaps in coverage. If you do not enroll in Part D during your IEP, you can also enroll in or make changes to Part D coverage during the Fall Open Enrollment Period—but you may have a late enrollment penalty if you are using Fall Open Enrollment to enroll in Part D for the first time.

Under certain circumstances, you may have an SEP to enroll in a Part D plan, including if you:

- Had creditable drug coverage

- Have job-based drug coverage through your or your spouse’s employment

- Are eligible for Extra Help

If you enroll in premium Part A and/or Part B during the General Enrollment Period (January 1 to March 31 of each year), you have an SEP to join a Part D plan starting the date you submit your application for premium Part A or Part B. The SEP lasts for the first two months of enrollment in premium Part A or Part B. Your Part D coverage would begin the first day of the month following the month you enroll in Part D.

Note: If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty. This is because you will qualify for a new Part D IEP when you turn 65.

Part D Enrollment Penalty

For each month you delay enrollment in Medicare Part D, you will have to pay a 1% Part D late enrollment penalty (LEP), unless you:

- Have creditable drug coverage

- Qualify for the Extra Help program

- Prove that you received inadequate information about whether your drug coverage was creditable

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

How do you calculate your premium penalty?

Let’s say you delayed enrollment in Part D for seven months (and you do not meet any of the exceptions listed above). Your monthly premium would be 7% higher for as long as you have Part D (7 months x 1%). The national base beneficiary premium in 2024 is $34.70 a month. Your monthly premium penalty would therefore be $2.43 ($34.70 x 0.07 = $2.43) per month, which you would pay in addition to your plan’s premium.

Note: The Part D penalty is always calculated using the national base beneficiary premium. Your penalty will not decrease if you enroll in a Part D plan with a lower premium.

Extra Help For Part D Drug Costs

The Extra Help program (also called the Part D Low-Income Subsidy) offers the following benefits:

Extra Help eligibility

Creditable drug coverage is, on average, as good as or better than the basic Part D benefit. You should receive a notice from your employer or plan around September of each year, informing you if your drug coverage is creditable. If you have not received this notice, contact your human resources department, drug plan, or benefits manager. Be aware that this information may not come as a separate piece of mail; it can be included with other materials, such as a plan newsletter.

Several types of plans offer creditable drug coverage, including:

- Veterans Affairs (VA) benefits

- TRICARE for Life (TFL)

- Federal Employee Health Benefits (FEHB)

- Some job-based and retiree plans

If you are considering delaying Part D enrollment because you already have prescription drug coverage, make sure to find out if your coverage is considered creditable. Maintaining enrollment in creditable drug coverage means you will not incur a late enrollment penalty (LEP) for delaying Part D enrollment. Additionally, having creditable coverage means that if you learn that you are going to lose such coverage and you want Part D coverage, you will have a two-month Special Enrollment Period (SEP) to enroll in a Part D plan.

If you have no drug coverage, or have drug coverage that is not creditable, Part D may help you. Even if you do not take prescription drugs, it is important to enroll in Part D so that if you later need to access prescriptions you do not face penalties or gaps in coverage.

Remember, if you decide to delay enrollment in any part of Medicare, keep a record of your insurance until you enroll in Medicare. You may need this documentation in order to sign up for Medicare later.

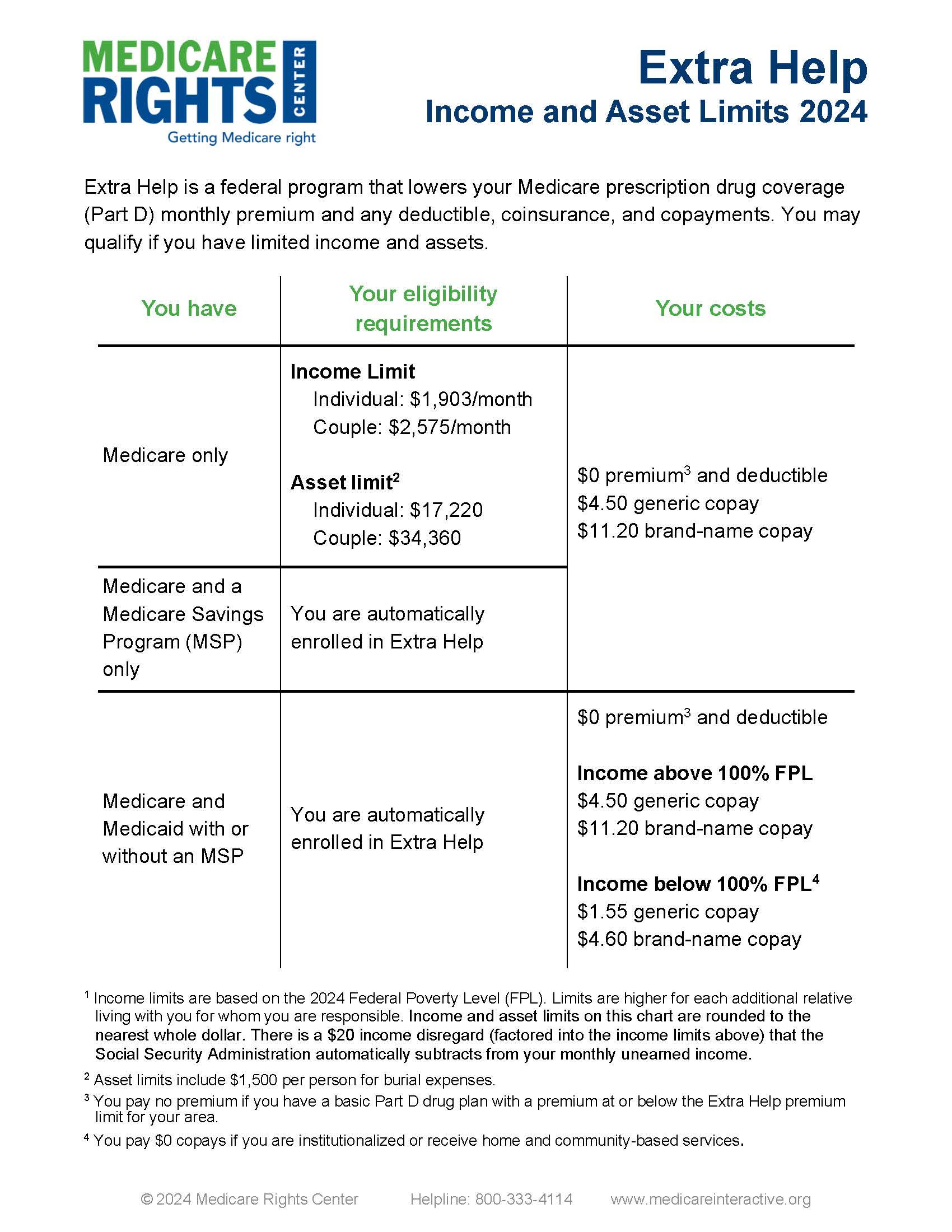

If your monthly income is up to $1,903 in 2024 ($2,575 for couples) and your assets

are below specified limits, you may be eligible for Extra Help (see the

Extra Help income and asset limit chart for details). These limits include a $20 income disregard that the Social Security Administration (SSA)

automatically subtracts from your monthly unearned income (e.g., retirement income).

Even if your income or assets are above the eligibility limits, you could still qualify for Extra Help because certain types of income and assets may not be counted, in addition to the $20 mentioned above.

- If you are enrolled in Medicaid, Supplemental Security Income (SSI), or a Medicare Savings Program (MSP), you automatically qualify for Extra Help regardless of whether you meet Extra Help’s eligibility requirements. You should receive a purple-colored notice from the Centers for Medicare & Medicaid Services (CMS) informing you that you do not need to apply for Extra Help

- If you are enrolled in Medicaid, Supplemental Security Income (SSI) , or a Medicare Savings Program (MSP), you automatically qualify for Extra Help regardless of whether you meet Extra Help’s eligibility requirements. You should receive a purple-colored notice from the Centers for Medicare & Medicaid Services (CMS) informing you that you do not need to apply for Extra Help.

Extra Help benefits

The Extra Help program (also called the Part D Low-Income Subsidy) offers the following benefits:

- Pays for your Part D premium up to a state-specific benchmark amount

- Lowers the cost of your prescription drugs

- Gives you a Special Enrollment Period (SEP) once per calendar quarter during the first nine months of the year to enroll in a Part D plan or to switch between plans (You cannot use the Extra Help SEP during the fourth calendar quarter of the year (October through December). You should use Fall Open Enrollment during this time to make prescription drug coverage changes.)

- Eliminates any Part D late enrollment penalty you may have incurred if you delayed Part D enrollment

Depending on your income and assets, you may qualify for Extra Help. To receive such assistance, your prescriptions should be on your plan’s formulary and you should use pharmacies in your plan’s network.

Remember that Extra Help is not a replacement for Part D or a plan on its own: You must still have a Part D plan to receive Medicare prescription drug coverage and Extra Help assistance. If you do not choose a plan, you will in most cases be automatically enrolled in one.

Drug Cost Under Extra Help

If you have Extra Help, throughout the year you will pay either the Extra Help Social Security Administration (SSA) or your plan’s copay for your unearned income drugs. You always pay the lower cost between the two. Note that plan copays for prescriptions may change during the year, meaning at times the price for your prescription drugs may differ.

If you are enrolled in prescription, Supplemental Security Income (SSI), or a Medicare Savings Program (MSP), you automatically qualify for Extra Help regardless of whether you meet Extra Help’s eligibility requirements. You should receive a purple-colored notice from the Centers for Medicare & Medicaid Services (CMS) informing you that you do not need to applyExtra Help

If you are enrolled in If Mr. S had Extra Help and a monthly income below $1,275, his copays would be $1.55 for generMedicaid, Supplemental Security Income (SSI), or a

Medicare Savings Program (MSP), you out-of-pocket costs

automatically qualify for Extra Help also change when you reach will pay nothing for covered drugs for the remainder of the calendar year.

Options for those whose Extra Help application is denied, or whose benefit is less than expected

If the Social Security Administration (SSA)Lowers the cost of your prescription drugs

Gives you a Special Enrollment Period (SEP) once per calendar quarter during the first nine months of the year to enroll in a Part D plan or to switch between plans (You cannot use the Extra Help SEP during the fourth calendar quarter of the year (October through December). You should use Fall Open Enrollment during this time to make prescription drug coverage changes.)

Eliminates any denies your Extra Help you may have incurred if you delayed Part D enrollment

Depending on your income and assets, you may qualify for Extra Help. To receive such assistance, your prescriptions should be on your plan’s formulary and you should use pharmacies in your plan’s network .

- If your application is going to be denied, you will receive a Pre-Decisional Notice before being formally denied. The Pre-Decisional Notice explains that you may not be eligible for Extra Help and why you will be denied (for example, the monthly income you reported in your application is over the limit). If you think that SSA’s rejection is based on incorrect information, you can correct your application.

Depending on your income and assets, you may qualify for Extra Help. To receive such assistance, your prescriptions should be on your plan’s formulary and you should use pharmacies in your plan’s network.

Remember that Extra Help is not a replacement for Part D or a plan on its own: You must still have a Part D plan to receive Medicare prescription drug coverage and Extra Help assistance. If you do not choose a plan, you will in most cases be automatically enrolled in one.

You have 10 days from the date on the notice to make corrections. It may be fastest to call or visit your local SSA field office using the telephone number or address on the notice. You can also call SSA’s national hotline at 800-772-12132. After the final decision

Once SSA makes a final decision, you will receive either a Notice of Award or a Notice of Denial, meaning you do not qualify. If you disagree with SSA’s decision, you can appeal. It is better to appeal than to reapply. This is because if your appeal is successful, your Extra Help will be effective from the first day of the month that you originally submitted an application.

Appeal process

- Request a hearing within 60 days of receiving notice of SSA’s decision. Note: If you have a good reason for missing your appeal deadline, you may be eligible for a good cause extension.

- If you do not want a hearing, you can request a case review where an SSA agent will review your application and any additional information you send in.

- Set a date for a hearing by calling your local SSA office or the national hotline at 800-772-1213. You can also download an online form and mail it to request a hearing. Generally, SSA will suggest a date at least 20 days after your request, giving you time to prepare. However, you can waive the 20-day preparation period if you want your hearing to be held sooner.

- Participate in your hearing. Hearings are held by phone. You will get a notice in the mail that confirms the date of your hearing and gives you a toll-free number to call. This notice also explains how to submit evidence supporting your case (for example, bank statements that show your assets). If you have a scheduling conflict, you can reschedule your hearing if you have good cause.

- After your hearing or review, SSA will send you a notice with the final decision on your case. If you still disagree with the decision, you can file an appeal in Federal District Court.

Good cause extensions for filing an appeal late

When initially filing an appeal and for each subsequent level, you have a limited amount of time to file. That said, after the deadline has passed, if you can show good cause for not filing on time, your late appeal may be considered. You can request a good cause extension at any level of appeal, and it is available for Original Medicare, Medicare Advantage, and Part D appeals. Extension requests are considered on a case-by-case basis, so there is no complete list of acceptable reasons for filing a late appeal, but some examples include:

- The notice you are appealing was mailed to the wrong address.

- A Medicare representative gave you incorrect information about the claim you are appealing.

- Illness—either yours or a close family member’s—prevented you from handling business matters.

- The person you are helping appeal a claim is illiterate, does not speak English, or could not otherwise read or understand the coverage notice.

If you think you have a good reason for not appealing on time, send in your appeal as you normally would and include a clear explanation of why your appeal is late. If the reason has to do with illness or other medical conditions, a letter or supporting documentation from your health care provider can be helpful.