Medicare Advantage Plan versus Medicare Supplement

Your First Medicare Decision

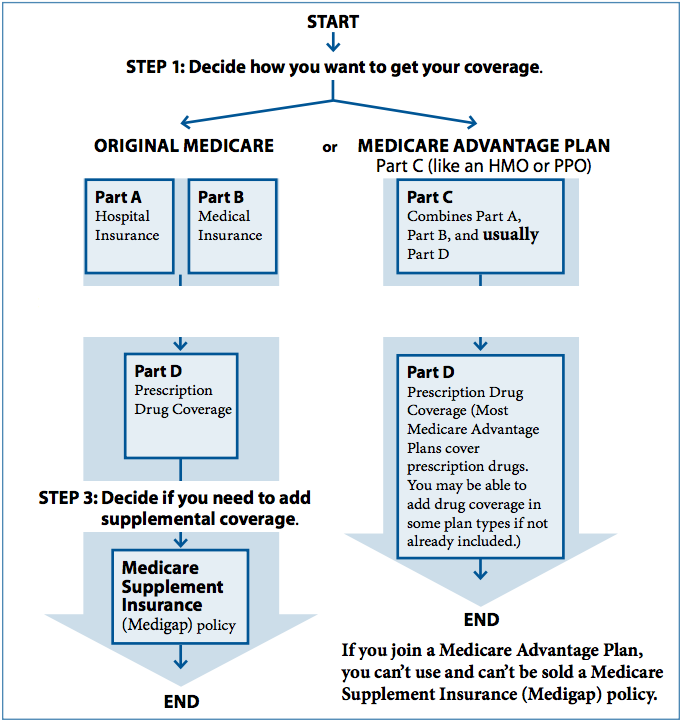

From there you can make one of three choices.

- 1) Do nothing. Just keep Medicare Part A and Medicare Part B (aka Original Medicare) as your insurance coverage and add Medicare Part D presciption drug plan. Of course, with just Medicare Part A and Medicare Part B and no other coverage, a person still has unlimited financial risk should you get sick or injured. Your portion of the medical costs may result in financial hardship.

- 2) A second option is to increase your insurance coverage by enrolling in a Medicare supplement plan and use that coverage in addition to Medicare Parts A and B.

- 3) A third option is to trade in your Medicare Part A and Medicare Part B for a Medicare Advantage Plan.

In Medicare, the two ways a person can limit their financial risk is to either increase their insurance coverage by selecting a Medicare supplement plan or by trading in their original Medicare coverage for a Medicare Advantage plan.

Key Points

Medicare Advantage vs Medicare Supplement Comparison Chart

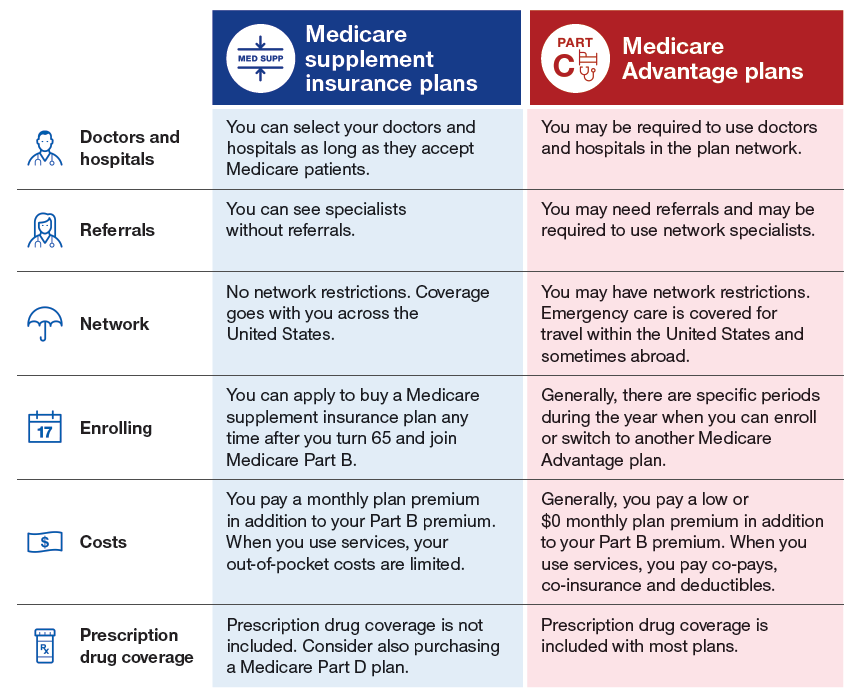

- Medicare Supplement plans allow you to see any provider that accepts Medicare and no referrals are required. You go to any doctor of your choice. you do NOT need your doctor to get a prior authorization for each service or procedure that must then be approved by the insurance company, which advantage plans require often. Prior authorization for each procedure is frequently required for anything expensive with medicare advantage plans and it can have devastating effects when you need care most.

- With a medicare supplement, if your doctor advices you to get an MRI ,Physical therapy, outpatient surgery, or skilled care no prior authorizations are required. Medicare pays first; your medicare supplement pays all or most of the remainder and it is rare for Medicare to deny a claim. I’ve seen it a couple times in 13 years for denials for durable medical equipment like motor scooters.

- Medicare supplements require separate Part D plans, and medicare supplements have a one-time Medigap Open Enrollment window where you can enroll in any supplement of your choice with NO UNDERWRITING OR HEALTH QUESTIONS.

- Medicare Advantage plans have network restrictions, include drug coverage (limited network) and added benefits, and have a maximum out-of-pocket limit. They only pay 80 percent of cancer treatments, medical supplies, and expensive Part B injectables or infusions. Keep this in mind if you get shot or infusion at your doctor’s office.

- You can change between the two types of plans, but you may need to answer health questions on the Supplement application, depending on the situation.

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

In most cases you don’t need a referral to see a specialist.

What is a MOOP or Maximum-out of-pocket?

Your MOOP is the most money you will be liable for in approved Medicare bills for in-patient or outpatient services during any calendar year. It’s a great way to measure the coverage of one health insurance plan versus another. The plan with your lowest MOOP has the most insurance coverage because your financial risk is the lowest. Once your out-of-pocket expenses has reached your MOOP you have 100% coverage for the remainder of the calendar year. Your MOOP resets every January 01.

Medicare Advantage-MOOP

(MAXIMUM-OUT OF-POCKET)

- Most Medicare Advantage PPOs have a separate MOOP for approved out-of-network services. Typically, that MOOP is much higher than in-network services. Of course, any procedure that is not approved or is performed by an out-of-network doctor that does not agree to accept your insurance is not included in your MOOP.

- The out-of-pocket costs that help you reach your MOOP include all cost-sharing (deductibles, coinsurance, and copayments) for Part A and Part B covered services that you receive from in-network providers. Part D cost-sharing does not count towards your plan’s MOOP. All Medicare Advantage Plans must set an annual limit on your out-of-pocket costs , known as the maximum out-of-pocket (MOOP). This limit is high but it may protect you from excessive costs if you need a lot of care or expensive treatments. After reaching your MOOP, you will not owe cost-sharing for Part A or Part B covered services for the remainder of the year. Some plans may also apply the MOOP to supplemental benefits, such as vision, hearing, or dental.

In 2024, the MOOP for Medicare Advantage Plans is $8,850, but plans may set lower limits. If you are in a plan that covers services you receive from out-of-network providers, such as a PPO, your plan will set two annual limits on your out-of-pocket costs. One limit is for in-network costs and the other is for combined in-network and out-of-network costs.

MEDICARE SUPPLEMENT-MOOP

(MAXIMUM-OUT OF-POCKET)

The three most popular medicare supplement are the Plan F, Plan G and the Plan F.

Plan F (Pays everything medicare does not pay) Your maximum out of pocket cost are simply your monthly premium. You have no out of pocket costs. Medicare Part A and B pay first, then Plan F supplement pays all of the rest. You have no MOOP other than your monthly premium.

Plan G Supplement pays everything Original Medicare does not pay except the annual Part B 240 dollar Medicare Part B annual deductible. Your maximum out of pocket is your monthly premium and the $240 dollar annual deductible.

Plan N Supplement pays everything Original Medicare does not pay except the $240 Part B deductible, but once you hit that deductible there is a doctor office visit copay of between $0 up to but never more than $20 dollars per office visit. And there is $50 dollar emergency copay. (Plan N does not cover excess charges.) 97% of doctors accept medicare assignment. The 3% that don’t accept medicare assigned rates can charge 15% over that assigned rate. It rarely ever comes into play and there is an easy way to avoid excess charges. Plan N has far lower rate increases than Plan G and Plan F, and they do not accept chronically ill folks with no underwriting or health questions, but the Plan G (if you were under 65 on January 1st of 2020 and the Plan F (if you were over 65 on January 1st of 2020) must accept sick folks with no health question or underwriting required if they have a Guaranteed Issue Right. Plan N offers lower projected rate increases as well.

Which Plan Will my Doctors and Hospitals Accept?

Medicare Advantage Plans Have Restrictive Provider Doctor Networks

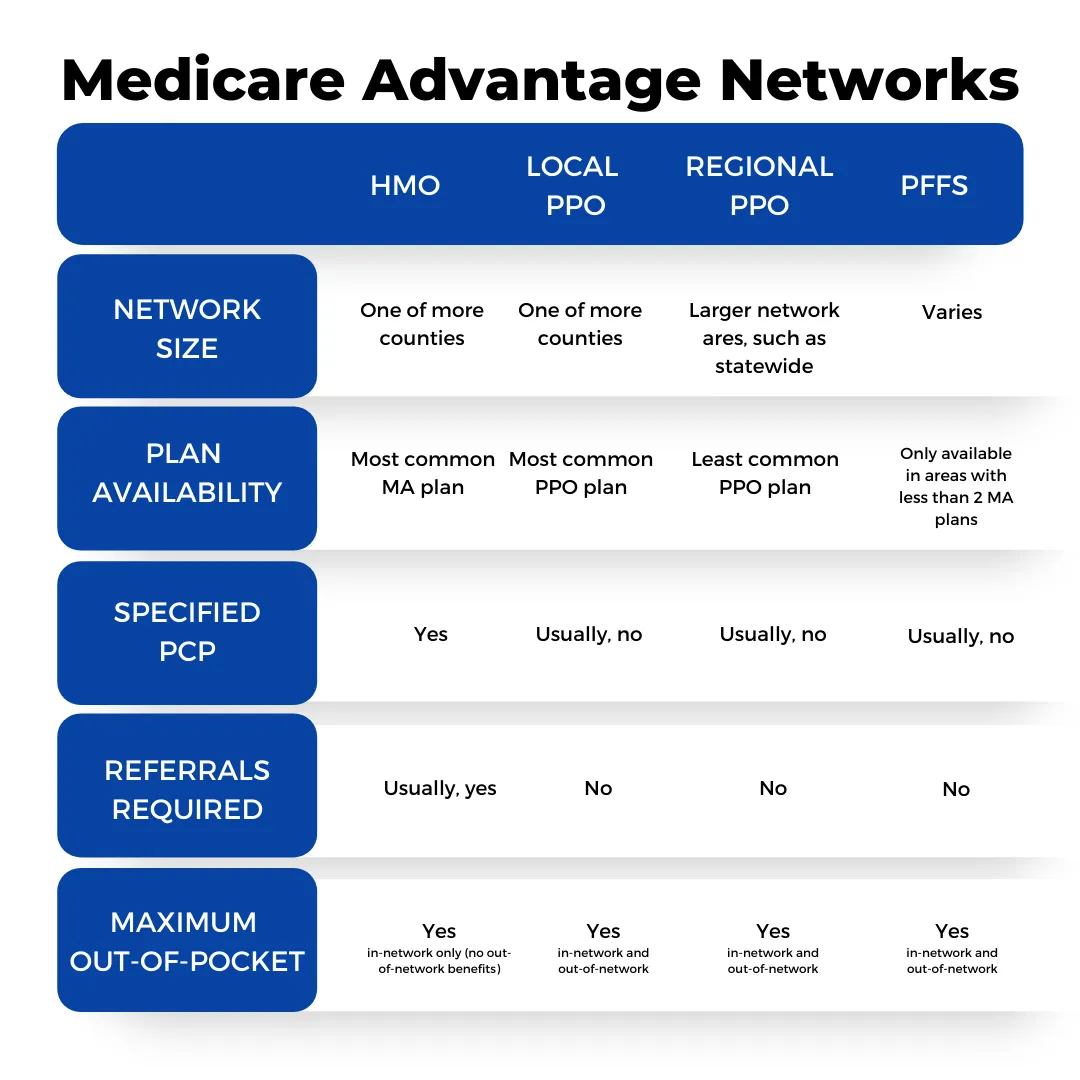

Medicare Advantage plans have restrictive doctor and provider networks that are designed to maintain the health of their patients in a cost-effective manner. These managed care plans offer Healthcare coverage with a network that may be confined by your county or a local area the size of most counties.

Typically, you must stay within the network of medical providers. 98 Percent of these plans are either HMO’S OR PPO’S

With and HMO if you go utside of the network you have no insurance, except for emergency and possibly urgent care. In other words, if you see a doctor not in the HMO network, you will pay 100% of the cost.

With most HMO’s you must designate a Primary Care Physician (PCP). That Physician will control your healthcare, is contracted with the HMO and typically compensated for helping the HMO control their costs.

You must obtain permission from your Primary Care Physician to see another doctor like a specialist. Without permission, the HMO will not pay for your care.

Any Doctor that accepts Medicare must accept ANY Medicare Supplement

Medicare Supplement insurance policies also offer you the most freedom of access to providers. You have the freedom to choose your own doctors and hospitals from among the 900,000+ Medicare providers in the country. Patients do not need referrals to see specialists on this type of coverage and have the flexibility to visit any doctor or medical facility across the United States and its territories, as long as they accept Original Medicare. Although your Medicare supplement premium may increase over time, the benefits provided by the plan remain consistent and never change. With a Medicare supplement plan, Medicare acts as your primary insurer, ensuring that decisions about your healthcare are made directly between you and your doctor. The Medigap plan has no say in your insurance coverage.

Request A Quote

Prior authorization is a requirement that a health care provider obtain approval from Medicare to provide a given service. Prior Authorization is about cost-savings, not care. Under Prior Authorization, benefits are only paid if the medical care has been pre-approved by Medicare.

MEDICARE ADVANTAGE PLANS USE OF PRIOR AUTHORIZATIONS

Prior authorization was “intended” to ensure that health care services are medically necessary by requiring providers to obtain approval before a service or other benefit will be covered by a patient’s insurance.here are some concerns that current prior authorization requirements and processes may create barriers Inspector General. CMS runs This is CMS’sdelays to receiving necessary care, as well as exacerbate complexity for patients and thei.

Today, 99% of Medicare Advantage members are in plans that require prior approval for services including inpatient admissions, skilled nursing facility stays, mental health services, home health care, chiropractic services, outpatient surgery and services, ambulance transport, medical equipment, diagnostic tests, and laboratory and radiology services. (Plans cannot require authorization in emergency situations.)

Traditional Medicare, Historically, has rarely required prior authorization.

Medicare rarely ever requires a prior authorization for anything, but with a Medicare supplement plan, Medicare acts as your primary insurer, ensuring that decisions about your healthcare are made directly between you and your doctor. The Medigap plan has no say in your insurance coverage.Also, you have the flexibility to visit any doctor or medical facility across the United States and its territories, as long as they accept Original Medicare. Although your Medicare supplement premium may increase over time, the benefits provided by the plan remain consistent and never change.

Originally, the Social Security Act did not authorize any form of “prior authorization” for Medicare services. The law was subsequently changed to allow prior authorization of limited items of Durable Medical Equipment and physicians ’ services. Currently, Medicare does not pre-authorize coverage of any item or service that will receive payment under Part A or B, except for custom wheelchairs. Please advise all staff and inform your Medicare patients, as appropriate, that Medicare does not currently pre-authorize coverage for any item or service other than custom wheelchairs.

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam

IG Report On Medicare Advantage Denial Of Service

Prior Authorizations are the biggest reason why I steer folks towards original medicare with a supplement rather than managed care HMO style advantage plans run by huge for profit insurance companies that are accountable to stockholders. The most important issue for people on Medicare today is the improper use of prior authorizations by insurance carriers. Whether you are new to Medicare or have has Medicare for years this is important information if you ever decide to consider a Medicare Advantage plan.

Linked below is a brief report by the US Office of Inspector General for the U.S. Department of Health & Human Services. Inspector General. CMS runs This is CMS’s ( Center for Medicare & Medicaid Services to receiving necessary care, as well as exacerbate complexity for patients and thei r providers.

Inspector General did that ran from 2014-2016. In brief, the report found that each year more than half of all Medicare Advantage plans were denying Services or payment for procedures that are medically necessary and should have been performed. While the majority of the denials that were appealed were approved as a result of the appeal, the report found that only 1% of the beneficiaries that were denied service even attempted to appeal the process. This is not good. This means that people are harmed and even die because of delays or denials in care and are not receiving the medical treatment they need, deserve and expect from their Medicare insurance.

In addition, the Inspector General found that insurance companies were denying payment of approved services after the fact. In other words, the beneficiary would get the medical procedure they needed, but after it was complete the insurance company would deny payment, forcing both the health care provider and the beneficiary into financial hardship

“The high number of overturned denials raises concerns that some Medicare Advantage beneficiaries and providers were initially denied services and payments that should have been provided.” IG report dated September 2018

Please complete the quote request below if you would like more information on the Medicare supplement plans in your area.

You can read the Inspector General full report here full report here:

U.S. Department of Health and Human Services

Office of Inspector General Report on Medicare Advantage Plans

Request A Quote

One thing I tell each and every client after we have helped them with their Medicare supplement is that if you ever have a problem. If you are denied coverage you believe is medically necessary, if you have a denied payment or incorrect doctor bill, don’t bang your head against the wall trying to resolve these issues on your own. That’s our job! We help all our client through this process. I have on staff people with associates degrees in Medical billing who have been Medicare Analysts or who have managed billing departments for major medical facilities. WE CAN HELP and we love doing it. In the past two weeks alone we helped a client reverse an unpaid claim for $4500 down only $25. We helped another who needed a particular MRI that was denied, and we appealed and get the test approved. When you become a client of May Rivier Medicare Agency you have the comfort of knowing we have your back!

Please complete the quote request below if you would like more information on the Medicare supplement plans in your area.

You can read the Inspector General full report here full report here:

U.S. Department of Health and Human Services

Office of Inspector General Report on Medicare Advantage Plans

What should you do about prior authorization?

MAY RIVER MEDICARE has helped our clients with these requirements for 13 years. After determining that prior authorization applies in a specific situation, we follow a process that works

- 1) Find a copy of your insurance company’s form or process. Check the website or call a plan representative. Your physician may need it and you’ll know exactly what information must be included.

- 2) Confirm that whoever in your physician’s office is in charge of this process knows that you need an authorization and the date due.

Please complete the quote request below if you would like more information on the Medicare supplement plans in your area.

- You can read the Inspector General full report here

- Remember, if you move forward without authorization, you might have to pay the full cost.

Call (843) 227-6725 for Help

Medicare Agents are Financially Incentivized to Push Medicare Advantage Plans. Keep in mind whether you go direct to the carrier or use and agent you always pay the same premium just like Auto or Home insurance

Medicare Advantage Plan

Agent Commisions

Medicare Advantage Plan Agent Commissions for someone turning 65 New to Medicare or or new to Part B or you under 65 but new to medicare because of a disability, agents get paid a $611 dollar commision with a lifetime $306 dollar renewal. Short sighted agents will go to any lengths to steer you into these “free” managed care plans without explaining the pitfalls of these plan.

Medicare Supplement Agent Commisions

The average Medicare Supplement commission rate is 22% with a 12-month advance. The average yearly premium for Medicare Supplement plans FOR MY CLIENTS is $1200 which has a renewal rate of $29.33/month. Agents can earn renewal commissions for at least six years.

So on a $100 dollar per monthly premium, agents are paid a $264 dollar commission, much less than a $611 dollar advantage plan. After year one, we get $22 dollar per month renewal commission as long as they stay put as our clients. Now you can understand why you are bombarded with calls, mail, and TV commercials.

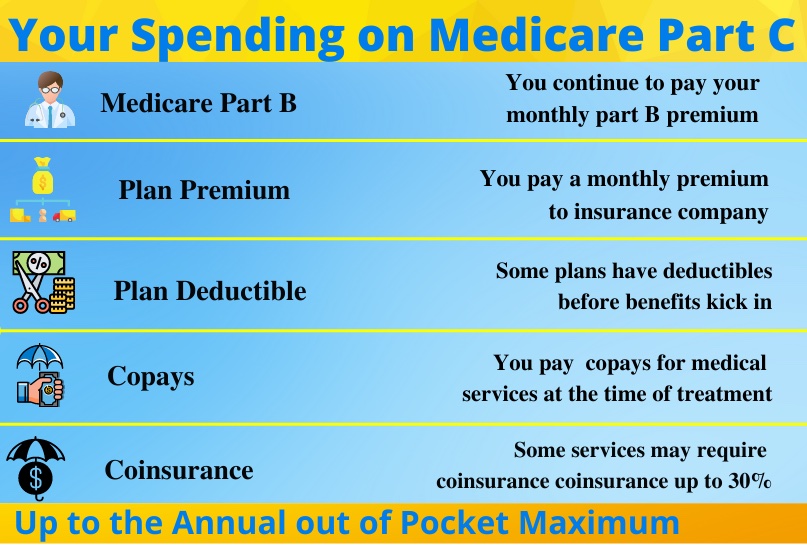

The Costs of Medicare Advantage

The Costs a Medicare

Supplement

Medicare Premium: Part B Monthly Premium is not paid by advantage plan. You must continue to pay that premium even when on an advantage plan. The 2024 Part B Medicare monthly premium is $174.70 per month.

Deductibles: Some Advantage plans have medical and or drug deductibles ranging from $500 to $1600. Don’t confuse your deductible with the maximum out of pocket costs. Your deductible is what you must pay before the plan kicks in and pays their share. Your Maximum out of pocket is the total a amount you have to pay out of your own pocket before the advantage plan must pay 100% of all costs for the rest of the year. Medicare set the 2024 max-out-of-of pocket at $8850, but out of network costs can be as high as 12k.

Copays: Advantage Plans have Copays for things like per day hospital copays, copays for doctors, specialist, outpatient surgery, and just about everything including physical therpay, skilled care, x-rays, blood work, etc. Preventative care has no copays.

Coinsurance: Advantage Plans also have 20 Percent Coinsurance rather than copays for certain service. For instance you’ll pay 20% of cancer treatments, Part B injectable drugs, and durable medical supplies. Stay clear of plans that have 20% coinsurance for things like outpatient surgery or MRI’s and CT Scans

LPart B Monthly Premium is not paid by by your medicare supplement. You must continue to pay that the 174.70 per month premim

Plan F-No deductible

Plan G: $240 Annual Deductible

Plan N: $240 Annual DeductibleP

Plan F: Never a copay, No bills ever

Plan G: No Pays. Pay $240 deductible then all bills paid

Plan N: $0-$20 doctor copay $50 Emergency room copay

20% of wh

- COINSURANCE: Medicare Supplement Plan F, Plan G, and Plan N pay the 20% Part B Coinsurance left over after Medicare pays 80% first. You will never have a cancer bill, MRI bill or any other form of Coinsurance, but the Plan N does have a $0-$20 dollar doctor’s office visit. A small copay is far better than a who knows what?

Costs of Medicare Advantage

Biggest Costs are copays and coinsurance for everything with a 2024 maximum out of pocket set by medicare at $8850 per year. Every January Medicare resets this Max-out-of-pocket, Carriers can charge less than this but will have a higher max-out-pocket for out of network doctors

Costs of Medicare Supplement.

Plan F: You pay monthly premium and have zero out of pocket costs.

Plan G: You Pay Monthly Premium an Annual $240 Deductible and the Plan N: Pay the annual $240 Deductible. Also $0 up to $20 Doctor copay (Applies only to doctor or specialist visits) and $50 ER Copay.