Medicare Plan C

is the most basic Medicare Supplement.

Medigap Plan C Benefits

Your hospital deductible is a per-incident deductible, not an annual one, so this is an important benefit. Medicare Plan B will pay the deductible even if you incur it more than once in the same year.

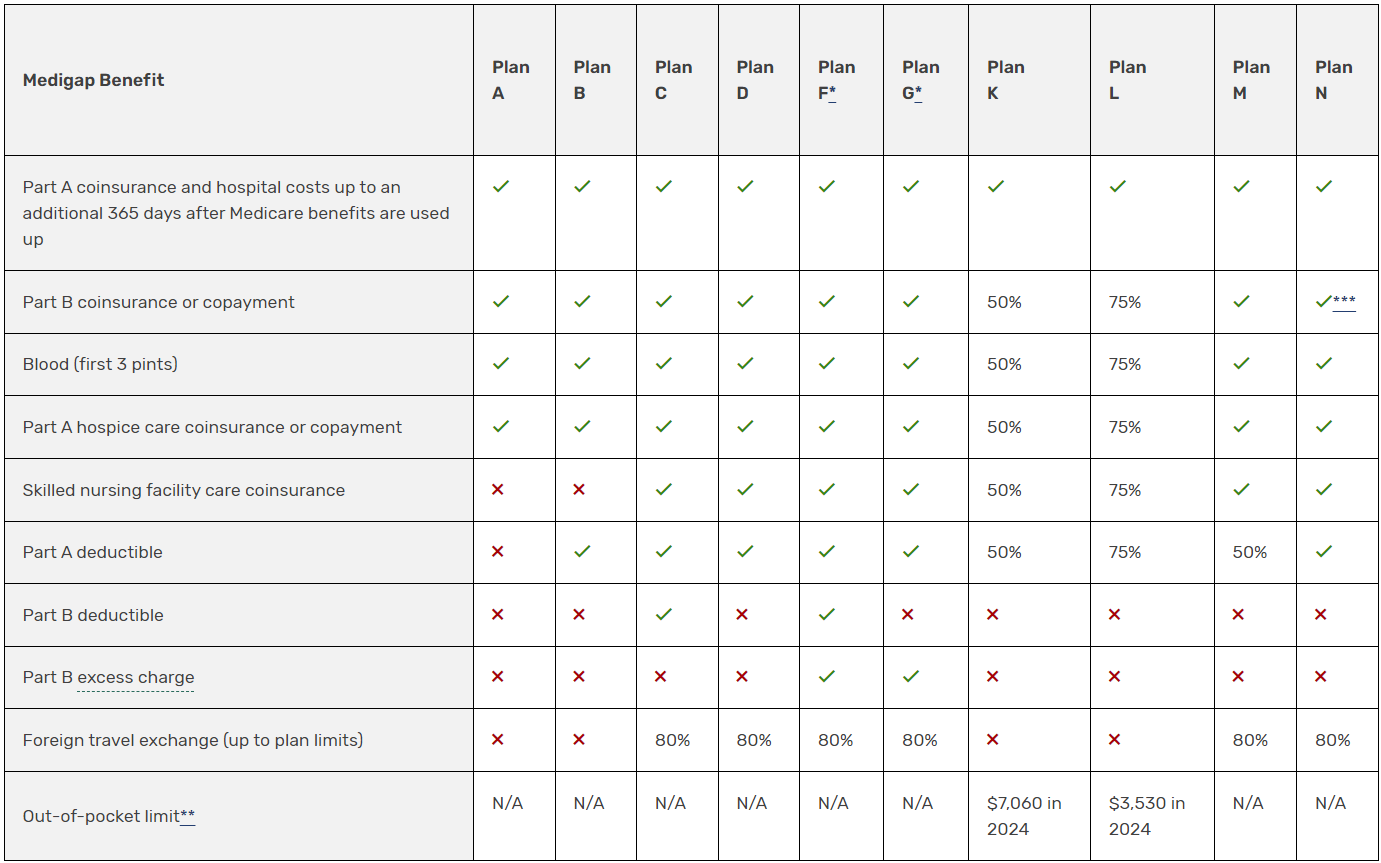

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Excess charges are surcharges your doctor can charge above and beyond what Medicare will reimburse. They are limited to 15% beyond what Medicare pays. Many doctors do not charge excess charges, but occasionally they do. If this concerns you, then Medigap Plan F or G might be a better choice for you than Medicare Plan C. Those two plans cover excess charges, so you won’t have to worry about asking.

Consider this scenario: Adrian purchases a Medigap Plan C policy. Most of his doctors are participating Medicare doctors so Adrian usually owes absolutely nothing. Adrian twists his ankle while walking his dog. Then he notices swelling, so he visits an urgent care clinic for an X-ray. The clinic does not accept Medicare assignment rates but chooses to bill an excess charge. The fee for the X-ray is normally $50 but at this clinic there is a 15% excess charge, bringing the cost to $57.50. Since Adrian’s Medigap Plan C does not cover excess charges, Adrian will owe the $7.50 difference to the medical facility.

Medicare Plan C is one of 10 different Medicare Supplement options available to you. (Part C, on the other hand, refers to Medicare Advantage policies. These are not Supplements and work very differently than Supplements.) If you buy a Plan C, you will enjoy the freedom of access to top physicians and hospitals that you already get with Original Medicare. You can also rest easy that your Supplement policy will pay for things like your inpatient and outpatient deductibles. This has made it a popular seller for decades.

Again, Medicare Plan C has benefits very similar to Plan F. So, if not having the coverage for excess charges worries you, then you might consider quotes for the F policy for comparison. You will find that in many areas the prices are nearly equivalent, making it quite cost-effective to buy the richer coverage if that appeals to you.

- Although Plan C covers everything but Part B excess charges, it’s not cost-effective for some as its monthly premiums may be too high. If this is the case for you, you may consider Plan N or Plan G instead.

- If you’re unsure if Plan C is a good fit for you, feel free to give our team a call at 817-249-8600 for free assistance.