Costs of Medicare in 2024

The standard monthly Medicare Part B premium for 2024 is $174.70, which is an increase of $9.80 from $164.90 in 2023. Medicare Part B helps pay for doctor visits and outpatient care.

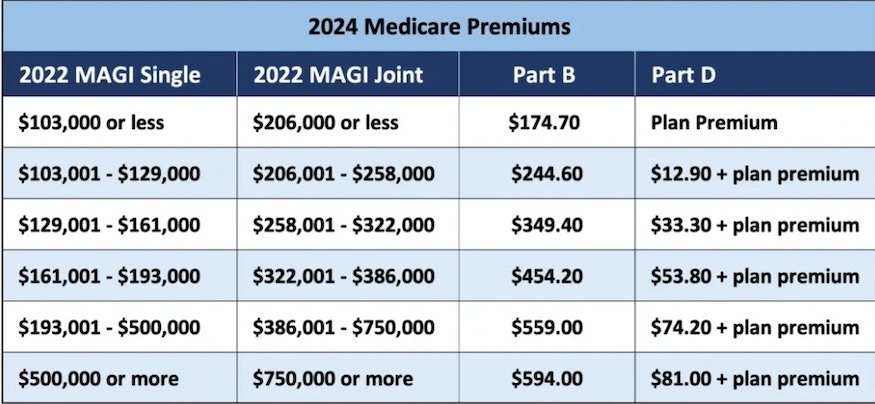

Most people will pay the standard Part B premium amount, but you could pay more based on your income. Medicare uses your reported income from two years ago to determine what you’ll pay. Medicare adds an income-related monthly adjustment amount (IRMAA) to Part B premiums for individuals with an adjusted gross income over $103,000and for couples with income over $206,000. High earners could pay up to $594.00 per month for Part B in 2024.

Other Part B costs include a deductible and coinsurance for those who have Original Medicare (Parts A & B). The 2024 Part B deductible is $240, an increase of $14 from the annual deductible of $226 in 2023.

The Medicare Part A deductible for 2024 is $1,632, an increase of $32 from $1,600 in 2023. A benefit period begins the day you’re admitted to the hospital and ends when you’ve been out for 60 days in a row. The deductible covers up to 60 days in the hospital. After that you pay daily coinsurance amounts.

Medicare Part A coinsurance amounts for 2024:

For hospital stays:

$0 for Days 1-60 of hospitalization

$408 per day for Days 61-90 of hospitalization

$816 per day for lifetime reserve days

For a skilled nursing facility:

$0 for Days 1-20

$204 per day for Days 21-100

Note: these amounts are per benefit period.

Best Medicare Supplement Insurance Companies in 2024

The Part A premium is only paid by individuals who worked less than 40 quarters with coverage. The Part A premiums for 2024 are as follows:

$278 for individuals who had at least 30 quarters of coverage, or who are married to someone with 30 quarters of coverage

$505 for certain uninsured individuals or with less than 30 quarters of coverage, and for people with disabilities who have exhausted other entitlement

Medicare Part A covers hospital and inpatient care.

If you have a Medicare Advantage plan (Part C), the Part A deductible and other Part A costs usually won’t apply. Each plan sets its own cost-sharing terms for hospitalizations. For example, you may have daily copays for a set number of days or a flat cost per hospitalization. After that, plans usually pay 100% of hospital costs. Check plan details for exact costs.

Is the Medicare Part D donut hole closed?

The Medicare Part D donut hole technically “closed” on January 1, 2020, but it’s not exactly going away completely. The donut hole – also called the “coverage gap” – is still one of the four Medicare Part D payment stages.

The donut hole is considered closed because as of January 2020 you no longer have to pay more for your drugs while you’re in that coverage stage. You will pay the same amount for your drugs from the initial payment stage through the donut hole. In 2024, you will pay no more than 25% of the cost for both brand-name and generic drugs in the donut hole.

You enter the donut hole once you and your plan have paid $5,030 for your drugs in 2024. You exit the donut hole when the total cost of your drugs for the year reaches $8,000.

You can get drug coverage through a standalone Part D plan or a Medicare Advantage plan.

Remember, the costs for Medicare can change each year. And the total costs you will have for your Medicare coverage will vary depending on the coverage you have along with the health care items and services you use.

There are certain guaranteed issue rights folks can use to get a medigap plan without answering health questions. Learn about these special medical protections and how, when, and why to use your GI rights. Also learn why Insurance companies offering medicap plans must accept chronically sick and dying folks into either the Plan G or possibly the Plan F with no underwriting or health questions asked. They must let you enroll in either the Plan G or the Plan F is you use your guaranteed issue right. Folks that turned 65 after January 1 of 2023 when the Macro Bill went into effect can only enroll in the Plan G with no underwriting but not the Plan N. The Plan N supplement does not accept these Guaranteed Issue Rights folks but the Plan G must absorb the high cost of these folks with high claims and those claims will force Plan G premiums to skyrocket compared to the Plan N.

Key Points

How much does Medicare cost?

Do you have to pay for Medicare?

How are Medicare premiums calculated?

Who pays for Medicare Part A?

Is Medicare Part B free? What will be my Medicare premiums in 2024?

These are very common questions about the costs of Medicare. The costs for Medicare Part B and Part D, as well as supplemental coverage, are something that many don’t anticipate. It can surprise you when you turn 65 and enroll in Medicare and learn that Medicare is not free.

So, do you have to pay for Medicare? Yes, most people do pay Medicare premiums. Fortunately, it’s fairly easy to put together a Medicare cost estimate so that you can plan ahead.

When determining how much does Medicare cost for beneficiaries, remember most people qualify for premium-free Part A if they have worked 40 quarters in the U.S. (10 Full Years) and paid Medicare taxes during that time, but if not,

there is a monthly premium.

The Part B and D premiums are based on income, so you could pay more for Part B and Part D if you have a higher income.

The standard Medicare Part B premium in 2024 is $174.70.

Overview

How much does Medicare cost? Do you have to pay for Medicare?

How are Medicare premiums calculated? Who pays for Medicare Part A? Is Medicare Part B free? What will be my Medicare premiums in 2024?

These are very common questions about the costs of Medicare. The costs for Medicare Part B and Part D, as well as supplemental coverage, are something that many don’t anticipate. It can surprise you when you turn 65 and enroll in Medicare and learn that Medicare is not free.

So, do you have to pay for Medicare?

Yes, most people do pay Medicare premiums. Fortunately, it’s fairly easy to put together a Medicare cost estimate so that you can plan ahead.

Request A Quote

How Much is Medicare Part A in 2024

The cost for Medicare Part A for most people is usually zero. If you’ve worked 10+ years (40 quarters) in the U.S., you have already paid for Part A via payroll taxes. (99% of beneficiaries qualify for free Part A.)

If you have to buy Part A, the cost for Medicare Part A will be around $505/month. People with less than 40 quarters of work experience but more than 30 quarters can get a pro-rated premium of $278/month.

To be eligible to buy Part A, you must have been a legal resident or have had a green card for at least 5 years.

This part of Medicare covers your hospital stay. But, should you have a hospital stay, what is the Medicare Part A deductible? In 2024, the Part A Deductible will be $1,632. This is an increase of $32 from the Part A deductible in 2023, which was $1,600. (However, if you have a medigap plan it will likely cover this cost for you).

How Much Does Medicare Part B Cost in 2024

How is Medicare Part B Premium Calculated? The Cost for Medicare Part B is Based on Household Income

Part B is your outpatient medical insurance, but it comes at a cost. Determining what is the premium for Medicare Part B can be tricky as it is based on your modified adjusted household gross income (MAGI). The Social Security office will pull your IRS tax return from two years prior. They use that tax return to determine what you’ll pay for Parts B & D (Part D premiums are also based on income.)

The items that contribute to your modified adjusted gross income include any money earned through wages, interest, dividends from investments, and capital gains. It also includes Social Security benefits and tax-deferred pensions. Distributions from Roth IRAs and Roth 401(k)s, life insurance, reverse mortgages, and health savings accounts do not count in the MAGI calculation.

Request A Quote

If you filed jointly with a spouse, Social Security will base your premiums for each of you based on that married income. However, you will EACH pay your own Part B premium. Your premiums for Part B are always individual, not combined. Social Security simply uses your household income to determine where you fall individually in the Part B premiums chart.

Social Security will usually notify you of your next year’s premium annually in December or early January by mail. Fortunately, it is possible to appeal a higher Part B and Part D premium charge.

Medicare Cost for Part D for 2024

The cost for Medicare Part A for most people is usually zero. If you’ve worked 10+ years (40 quarters) in the U.S., you have already paid for Part A via payroll taxes. (99% of beneficiaries qualify for free Part A.)

If you have to buy Part A, the cost for Medicare Part A will be around $505/month. People with less than 40 quarters of work experience but more than 30 quarters can get a pro-rated premium of $278/month.

To be eligible to buy Part A, you must have been a legal resident or have had a green card for at least 5 years.

This part of Medicare covers your hospital stay. But, should you have a hospital stay, what is the Medicare Part A deductible? In 2024, the Part A Deductible will be $1,632. This is an increase of $32 from the Part A deductible in 2023, which was $1,600. (However, if you have a medigap plan it will likely cover this cost for you).

How Much Will You Pay for Medicare?

Now if you find all that just a little confusing – don’t worry. Medicare premium increases happen almost every year, and our professionals can help you figure out exactly what your Medicare costs will be. Many people find that Medicare and a Medicare supplement cost less than private insurance they had prior to Medicare. Either way, you’ll want to get some estimates of your costs for Original Medicare before you retire. This way, you can plan ahead to have enough savings for the future.

We can help you determine your

potential costs right over the phone and provide you with an average cost of Medicare. We can also help you plan for how much are Medicare premiums and your estimated costs in 2024.

Call 843-227-6725 today or complete our online request form below. A friendly licensed insurance agent on our team will assist you.

To continue learning about Medicare, go next to: Apply for Medicare.

Takeaways

The standard Part B premium that most people pay is $174.70 in 2024, but you can pay more if you have a higher income.

Many beneficiaries qualify for premium-free Part A.

Your Part D premium is also affected by income.

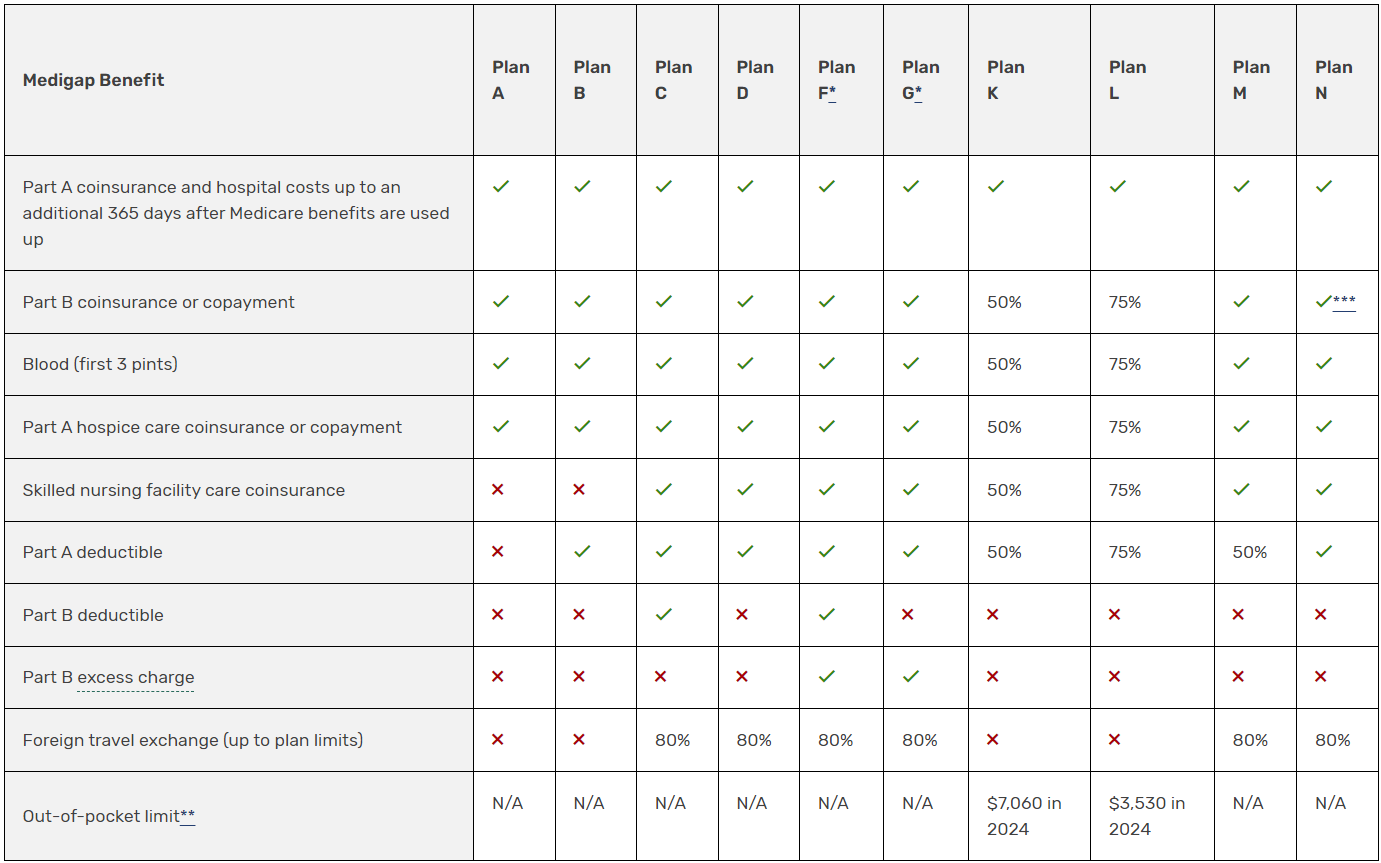

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Get your Personalized Quote in Seconds without the annoying calls afterwards.