If you have one of the seven medicare advantage plans leaving Beaufort and Jasper County then LISTEN: YOU QUALIFY TO ENROLL IN A MEDICARE SUPPLEMENT AT THE LOWEST RATE WITH THE BEST COMPANY WITH NO HEALTH QUESTIONS OR UNDERWRITING REQUIRED. BY LAW, IF YOUR ADVANTAGE PLAN LEAVES YOUR AREA YOU HAVE A GUARANTEED ISSUE RIGHT: COMPANIES CAN NOT ASK YOU ANYTHING ABOUT YOUR HEALTH AND MUST ISSUE A SUPPLMENT PLAN THAT PAYS ALL YOUR BILLS AFTER MEDICARE DOES.

Need Help Finding a new Plan? Get a Medicare supplement with no underwriting or health questions

When you turn 65 or enroll in Part B for first time you have a onetime 6 month open enrollment window to enroll into a supplement of your choice with no health questions or underwriting. After that window closes you must pass medical underwriting.

2025 Medicare Advantage Plans leaner than 2024: Cut Benefits but Increase your Costs while continuing to maximize overpayments by the government.

8 Medicare Advantage Plans Exiting Beaufort Japser for 2025

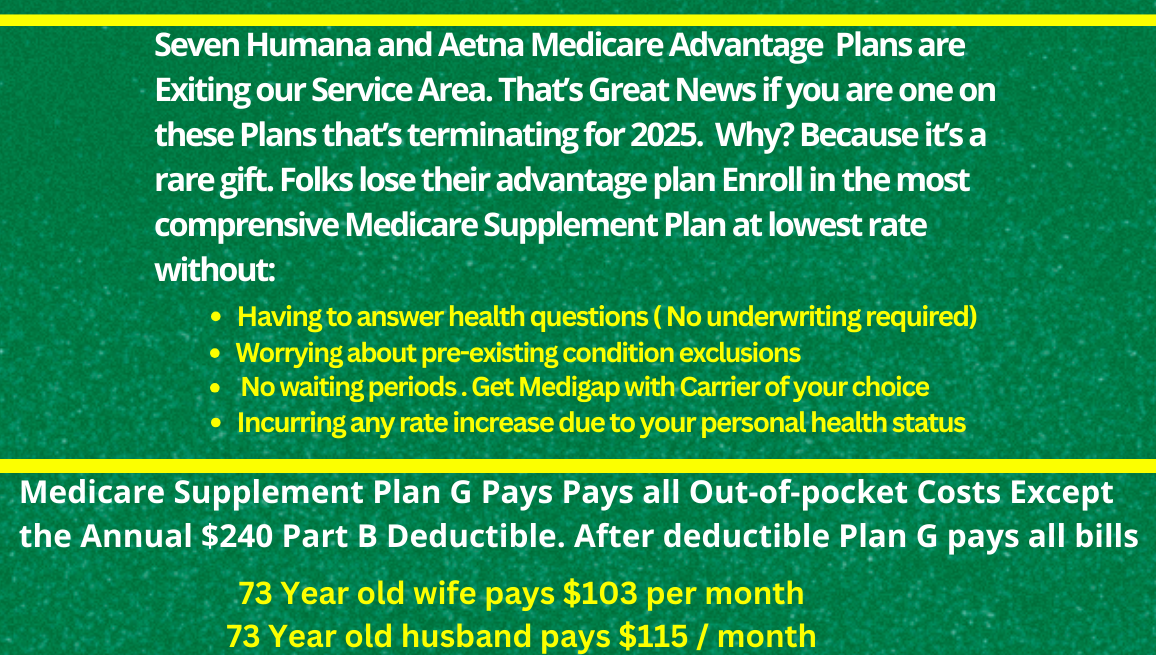

5 Humana Advantage Plans and 2 Aetna advantage plans leave the Beaufort Jasper county service area. Thousands of folks now have a Guaranteed Issue Right. What does this mean for you?

- 1. Zero Premium plans exit or now Plans with a Premium

- 2. Hospital Stay Costs Increase

- 3. Drug Tier and Formulary Changes: Tier 1 drug now Tier 3 drug.

- 4. Reductions in Dental, Vision, and over the counter benefits

- 5. Unbundling of Benefits means more copays itemized for one procedure such as knee surgery

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam

If you are one of the seven medicare advantage plans leaving beaufort or jasper county you can enroll in a medicare supplement with no health questions asked with any company at the lowest rate.

ADVANTAGE PLAN LEAVING OUR AREA

H5216-279-000 LPPO BEAUFORT JASPER COUNTY SC

H5216-280-002 LPPO BEAUFORT JASPER SC

H5216-345-000 LPPO BEAUFORT JASPER SC

H5216-347-000 LPPO BEAUFORT JASPER SC

H5525-071-000 LPPO BEAUFORT JASPER

H5619-152-000 HMO BEAUFORT JASPER

R3392-004-000 RPPO BEAUFORT JASPER

024 Aetna Medicare SmartFit Plan (PPO)

Aetna Medicare Essential Plan (PPO)

Need Help Finding a new Plan? Get a Medicare supplement with no underwriting or health questions

When you turn 65 or enroll in Part B for first time you have a onetime 6 month open enrollment window to enroll into a supplement of your choice with no health questions or underwriting. After that window closes you must pass medical underwriting.

- Guaranteed issue rights, also known as Medigap protections, are rights that allow people to purchase certain Medicare Supplement (Medigap) plans without medical underwriting.

- This means that insurance companies must offer coverage for pre-existing health conditions and cannot charge higher premiums due to health problems.

- If you have an advantage plan that is terminating, you can either enroll in a Plan G supplement or Plan F WITH NO HEALTH QUESTIONS OR UNDERWRITING ALLOWED. Your are guaranteed a medicare supplement with to be issued to you with any company at the lowest rate. (Use an Independent Broker licensed with all or most of the companies to get best rate.)

Massive Changes to Part D Drug Plan

Big Changes to the Medicare Prescription Drug Plan beginning in 2025. Who will benefits and who will lose from the Medicare Part D 2025 Changes. The changes are a Godsend for the minority of folks on expensive drugs, but for most, be prepared. Since the insurance companies not medicare or the Pharmaceutical Companies now incur the heavy cost burden of paying for drugs in 2025, be ready for the insurance company to make that money back by using tier and formulary changes next year, so open your annual notice of change, because the times they are a changing and soon.