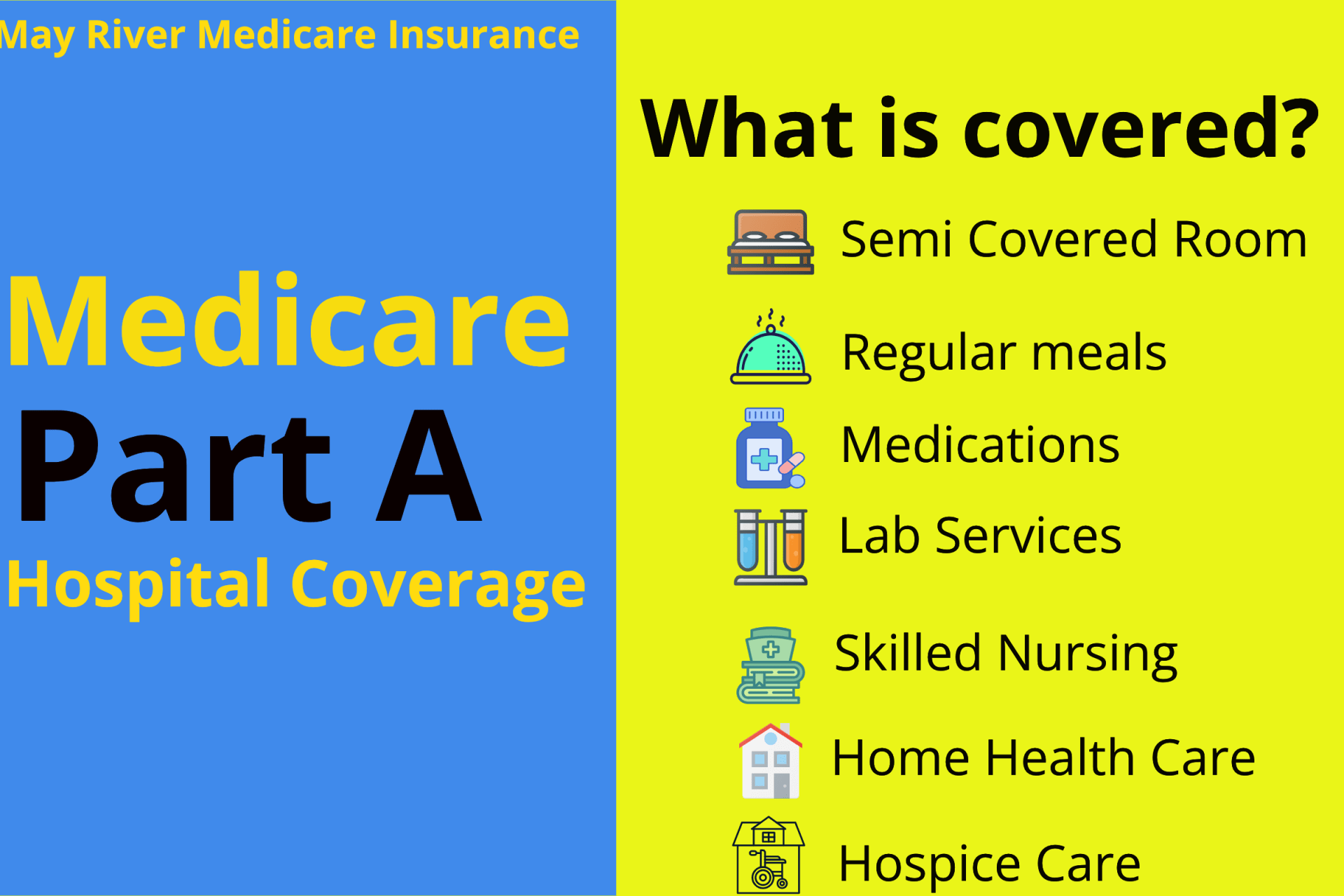

Medicare Part A-covered services

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility (SNF) care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care. (Note: You can get home health care through Medicare Part B if you do not meet all the requirements for Part A coverage.)

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing (deductibles, coinsurances, copayments) for Medicare-covered services.

Request A Quote

Part A covers medically necessary inpatient hospital care, which is care that you receive as a formally admitted hospital inpatient. You must be formally admitted into the hospital by a physician in order for your care to be considered inpatient hospital care. You may face different costs if you are a hospital outpatient. If you are a hospital inpatient, Part A covers:

- A semi-private room and meals

- Note: A semi-private room is a hospital room that contains two or more beds (generally just two), usually with a curtain separating the beds

- General nursing care

- Medically necessary medications

- Other hospital services and supplies

Medicare does not cover:

- Private duty nursing

- A private room (unless medically necessary or if it is the only room available)

- Personal care items (such as razors or socks)

- A television or telephone in your room

After meeting your Part A deductible, Original Medicare pays in full for the first 60 days of your benefit period. After day 60, you will pay a daily hospital coinsurance. Part B continues to cover any outpatient provider services you receive while in the hospital. You usually owe a separate 20% coinsurance for these services.

Skilled nursing facility (SNF) care is post-hospital care provided at a SNF. Skilled nursing care includes services such as administration of medications, tube feedings, and wound care. Keep in mind that SNFs can be part of nursing homes or hospitals.

Medicare Part A may cover your SNF care if:

- You were formally admitted as an inpatient to a hospital for at least three consecutive days

- You enter a Medicare-certified SNF within 30 days of leaving the hospital, and receive care for the same condition that you were treated for during your hospital stay

- And, you need skilled nursing care seven days per week or skilled therapy services at least five days per week

Note: The day you become an inpatient counts toward your three-day inpatient stay to qualify for Medicare-covered SNF care. However, the day you are discharged from the hospital does not count toward your qualifying days. Also remember that time spent receiving emergency room care or under observation status does not count toward the three-day hospital inpatient requirement for SNF coverage.

If you meet all of the above requirements, Medicare should cover the SNF care you need to improve your condition, maintain your ability to function, or prevent your health from getting worse.

Speak to your doctor or hospital discharge planner if you need help finding a SNF that meets your needs. Ask them to find Medicare-certified SNFs in your area that will address your medical needs. If you are in a Medicare Advantage Plan, contact your plan to find out which SNFs are in their network .

Home health care includes a wide range of health and social services delivered in your home to treat illness or injury. Services covered by Medicare’s home health benefit include intermittent skilled nursing care, therapy, and care provided by a home health aide . Depending on the circumstances, home health care will be covered by either Part A or Part B.

Medicare covers your home health care if:

- You are homebound, meaning it is extremely difficult for you to leave your home and you need help doing so.

- You need skilled nursing services and/or skilled therapy care on an intermittent basis.

- Intermittent means you need care at least once every 60 days and at most once a day for up to three weeks. This period can be longer if you need more care, but your care needs must be predictable and finite.

- Medicare defines skilled care as care that must be performed by a skilled professional, or under their supervision.

- Skilled therapy services refer to physical, speech, and occupational therapy .

- You have a face-to-face meeting with a doctor within the 90 days before you start home health care, or the 30 days after the first day you receive care. This can be an office visit, hospital visit, or in certain circumstances a face-to-face visit facilitated by technology (such as video conferencing).

- Your doctor signs a home health certification confirming that you are homebound and need intermittent skilled care. The certification must also state that your doctor has approved a plan of care for you and that the face-to-face meeting requirement was met.

- Your doctor should review and certify your home health plan every 60 days. A face-to-face meeting is not required for recertification.

- And, you receive care from a Medicare-certified home health agency (HHA).

Note: You cannot qualify for Medicare home health coverage if you only need occupational therapy. However, if you qualify for home health care on another basis, you can also get occupational therapy. When your other home health needs end, you can continue receiving Medicare-covered occupational therapy under the home health benefit if you need it.

If you meet all the requirements, Medicare should pay for skilled care in your home and/or home health aide services. If you have questions or experience billing issues, call 1-800-MEDICARE.

Hospice is a program of end-of-life pain management and comfort care for those with a terminal illness . Medicare’s hospice benefit offers end-of-life palliative treatment, including support for your physical, emotional, and other needs. It is important to remember that the goal of hospice is to help you live comfortably, not to cure an illness.

To elect hospice, you must:

- Be enrolled in Medicare Part A

- Have a hospice doctor certify that you have a terminal illness, meaning a life expectancy of six months or less

- Sign a statement electing to have Medicare pay for palliative care (pain management), rather than curative care

- And, receive care from a Medicare-certified hospice agency

Once you choose hospice, all of your hospice-related services are covered under Original Medicare, even if you are enrolled in a Medicare Advantage Plan. Your Medicare Advantage Plan will continue to pay for any care that is unrelated to your terminal condition. Hospice also should cover any prescription drugs you need for pain and symptom management related to your terminal condition. Your stand-alone Part D plan or Medicare Advantage drug coverage may cover medications that are unrelated to your terminal condition.

The hospice benefit includes two 90-day hospice benefit periods followed by an unlimited number of 60-day benefit periods, pending recertification by a doctor.

If you are interested in Medicare’s hospice benefit:

- Ask your doctor whether you meet the eligibility criteria for Medicare-covered hospice care.

- Ask your doctor to contact a Medicare-certified hospice on your behalf.

- Be persistent. There may be several Medicare-certified hospice agencies in your area. If the first one you contact is unable to help you, contact another.

Once you have found a Medicare-certified hospice:

- The hospice medical director (and your doctor if you have one) will certify that you are eligible for hospice care. Afterwards, you must sign a statement electing hospice care and waiving curative treatments for your terminal illness.

- Your hospice team must consult with you (and your primary care provider, if you wish) to develop a plan of care. Your team may include a hospice doctor, a registered nurse, a social worker, and a counselor.

How Much Does Medicare Part A Cost?

Is Medicare Part A free?

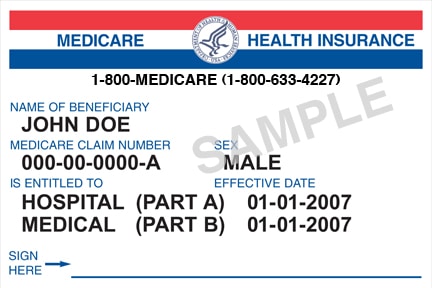

Well, not exactly. Most beneficiaries will pay nothing for Medicare Part A at age 65, though because they have already pre-paid it. You see, we all pay taxes during our working years that are specifically for our future Medicare hospital coverage during retirement. These taxes go to offset the cost of Part A later on.

As long as you have worked for 10 years in your lifetime in the United States, you will generally pay nothing at all for Part A. If you do not have this work history, you can purchase Part A as long as you have been a legal resident or green card holder for at least 5 years. Read more about the cost of Part A on our Medicare costs page.

If you do not have 40 quarters, you can pay for Part A. Premiums in 2024 are $505 if you have less than 30 quarters or $278 for people with 30 – 39 quarters.

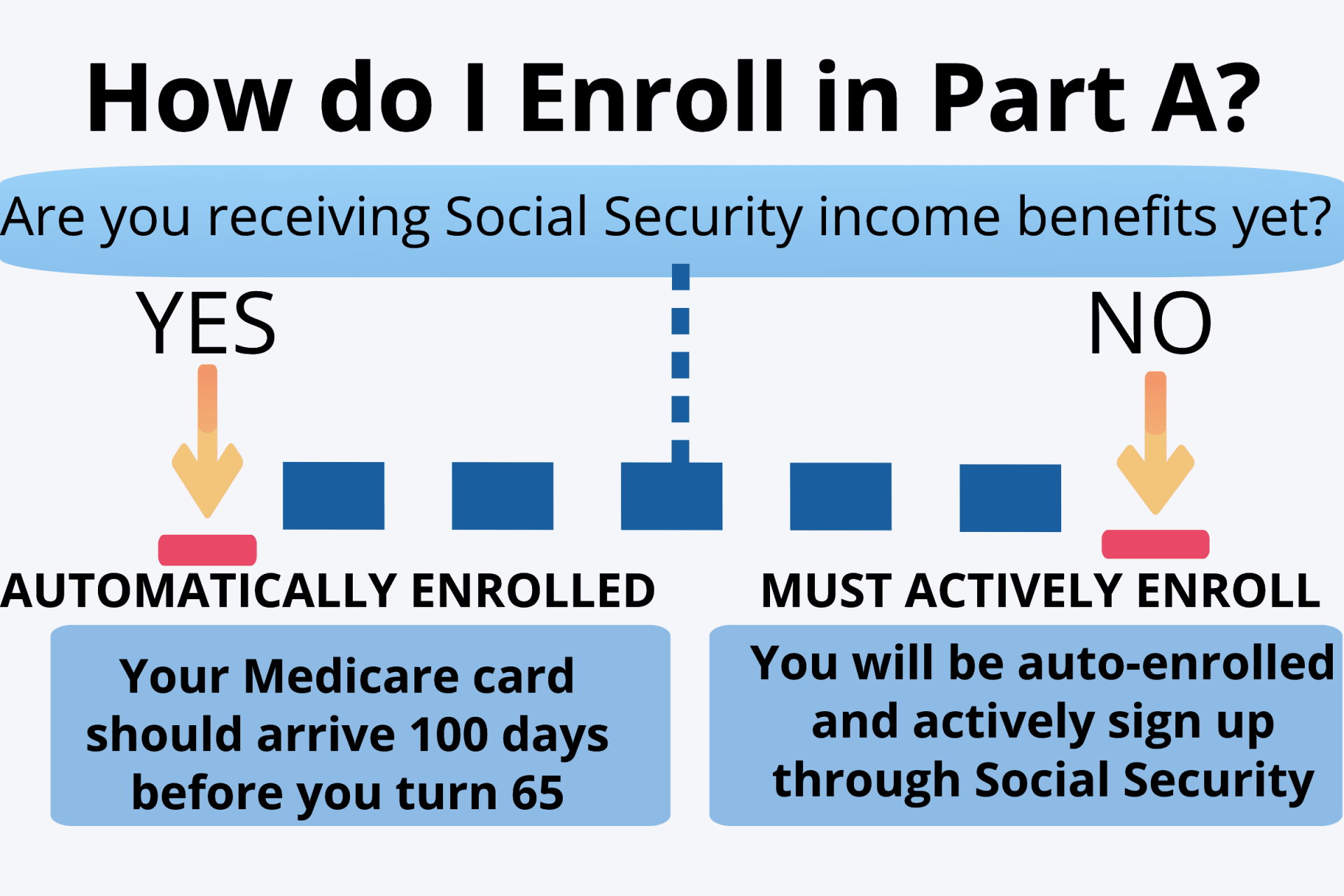

When do I enroll in Medicare Part A?

Enrolling in Medicare Part A is automatic for people already taking Social Security income benefits. When this happens, you’ll open your mailbox 2 – 3 months before you turn 65 and find your card waiting for you.

What are lifetime reserve days?

Unless you have a Medigap plan, Medicare Part A gives you 60 lifetime reserve days. You begin using these days if you have a hospital stay lasting more than 90 consecutive days. For example, if you have a hospital stay that lasts 100 consecutive days, you will have used 10 of your lifetime reserve days.

If you have another hospital stay the year after lasting 120 consecutive days, you will have used up 30 (10 + 20) of your lifetime reserve days total. Once you have used up all of your lifetime reserve days, you will be responsible for all Part A costs starting on day 91 for any hospital stay lasting longer than 90 days

Skilled-nursing facility costs

For skilled nursing facility stays Medicare covers the first 20 days. Your daily copay in 2024 for days 21-100 will be $204. Fortunately, both Medigap policies and Part C Advantage plans will help cover these costs. Either type of plan will help you significantly reduce your financial exposure.

Common questions asked about Medicare Part A:

How do I sign up for Medicare Part A only?

If you have creditable coverage, you can delay Medicare past 65. However, many people will enroll in Part A for secondary hospital coverage. You can apply for Part A only through the Social Security Administration website.

What is the difference between Medicare Part A and Part B?

Medicare Part A is inpatient hospital coverage, while Part B covers outpatient medical services.

Request A Quote

How much is Medicare Part A?

Many people will have a $0 monthly premium for Part A if they’ve worked at least 10 years in the U.S. However, if you don’t qualify for premium-free Part A, you could pay as much as $505 for Part A.

To get help with your Medicare insurance needs or learn more about Medicare hospital coverage, call our insurance experts at (843)227-6725 for a FREE consultation!

Key Takeaways

- Medicare Part A helps cover your inpatient room and board, daily meals, hospice care, skilled nursing, and home health care.

- Most people qualify for premium-free Part A, but others may have a premium if they have not worked for at least 10 years in the U.S.

- Before Medicare Part A helps cover most of your costs, you do need to meet the Part A deductible.