Medicare Enrollment Periods

Trying to make sense of all those Medicare enrollment periods and what they mean for you and your coverage? You’re not alone.

The Medicare Initial Enrollment Period is a 7-month window to enroll in Parts A and B for the first time when you turn 65. You have 3 months before you turn 65, the month of, and 3 months after to enroll in Medicare. When you enroll in the 3 months after your 65th birth month, coverage is delayed. This same 7-month window is also used to enroll in a Medicare Advantage or Part D plan. Read More

The Annual Election Period (AEP) begins October 15th and ends December 7th of each year. Medicare beneficiaries that already have Part A and Part B can use this election period to enroll in, change, or disenroll from a Part D or Medicare Advantage plan. Read More

The General Enrollment Period is used to enroll in Medicare Part A and/or Part B if you missed your IEP and do not qualify for a special enrollment period. The GEP window starts January 1st and ends March 31st of each year and coverage will begin the first of the month after you apply. Read More

This enrollment period is for beneficiaries who already have a Medicare Advantage plan but want to leave it. During the MAOEP window, from January 1st-March 31st, you can switch from your current Advantage plan to another or enroll in Original Medicare with a Part D plan. Read More

A Special Enrollment Period is used anytime a beneficiary has a qualifying event. If you delayed Medicare past age 65 due to creditable coverage through active employment, you could use this enrollment period to apply for Medicare A and B. There are also Special Election Periods (SEP) for Medicare Advantage and Part D plans. If you have a qualifying event, you will have a 2-month window to enroll in either a Medicare Advantage plan or Part D plan. Read More

When you first enroll in Medicare Part B, you have 6 months before your Part B effective date and 6 months after, to enroll in a Medigap plan without answering health questions. If you are outside of this window and do not have a qualifying event, you may have to answer health questions to enroll in a Medigap plan. Read More

Medicare Initial Enrollment Period

Your Medicare Initial Enrollment Period is the most important date for you to know as you’re advancing towards the age of Medicare eligibility.

Trying to make sense of all those Medicare enrollment periods and what they mean for you and your coverage? You’re not alone.

For example, if you turn 65 on September 19th, your Medicare IEP would run from June 1st to December 31st.

One exception: if your birthday falls on the 1st of the month – your IEP will start one month early. For example, if your birthday is April 1st, your IEP will begin December 1st and your Medicare will begin one month early on March 1st.

During the IEP, you can enroll in Original Medicare (Part A and Part B) or a Medicare Advantage plan (Medicare Part C). Enrolling during your IEP avoids any late enrollment penalty.

includes Part D.

If you enroll in Original Medicare, you may want additional coverage with a Medicare Supplement Plan (Medigap). For this, you will use your Medicare Supplement Open Enrollment Period. This is a 6-month window starting on your Part B effective date. Using the Medigap OEP to enroll in a Medigap means:

You can’t be turned down for any Medigap plan available in your area regardless of your health status. Your insurance company cannot charge you higher premiums because of your health status or pre-existing conditions.

What happens if I miss my Initial Medicare Enrollment Period?

Missing medicare initial enrollment

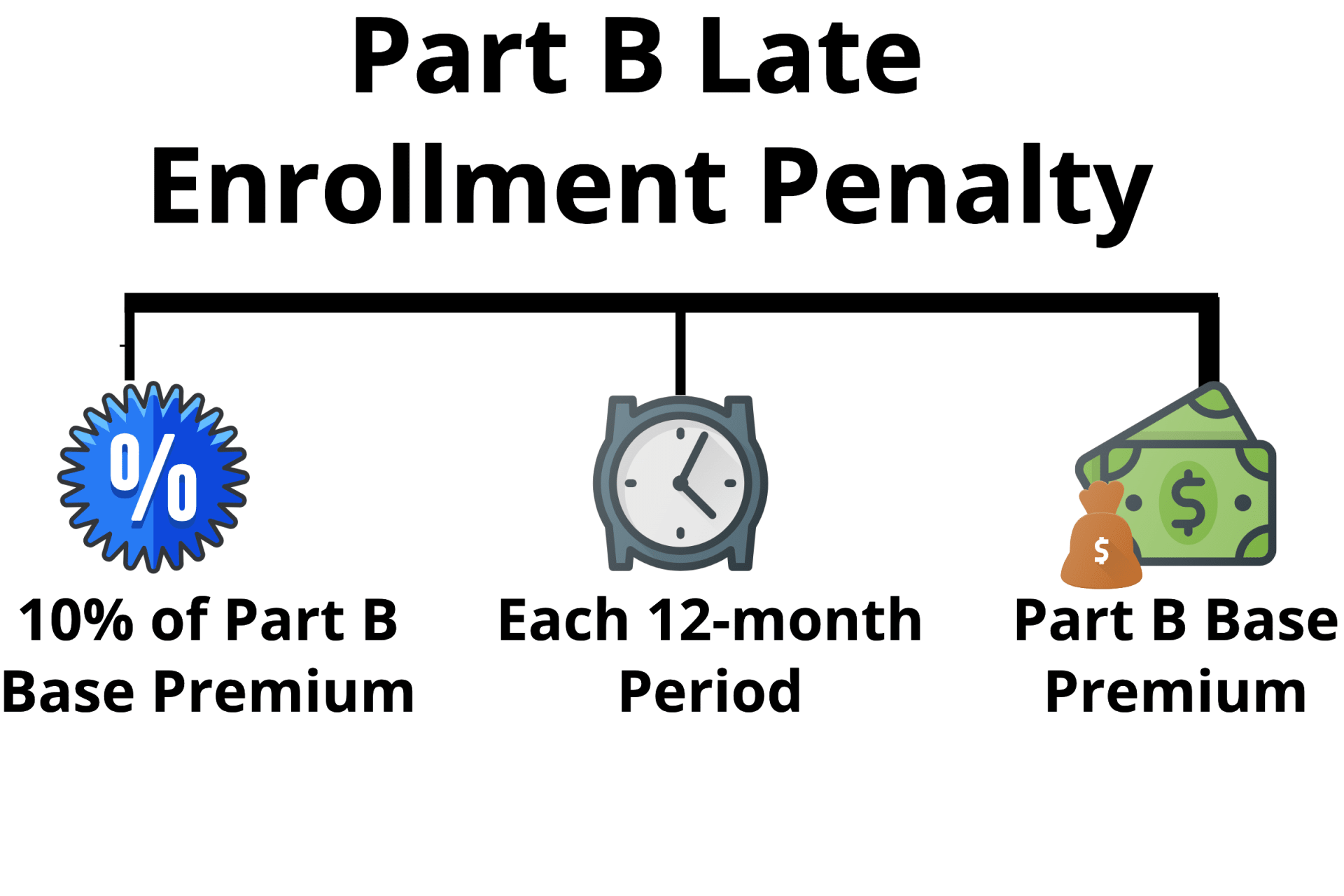

If you don’t enroll in Part B during your IEP, you’ll probably have to pay a late enrollment penalty-for as long as you have Medicare coverage. The penalty is 10% for every 12-month period you should have had Part B but didn’t enroll. In 2022, the standard premium for Part B is $170.10, which means you’ll pay an extra $17.01 every month. This will increase if the standard Part B premium goes up next year, which it likely will. You’ll pay this penalty even if you ultimately choose Medicare Advantage.

You may also go without Part B coverage for a significant chunk of time. If you don’t sign up during your IEP, you’ll have to wait until the next General Enrollment Period or GEP. Your coverage won’t start until July 1 that year.

If you don’t have creditable Part D prescription drug coverage and miss your IEP, you’ll pay a penalty with your Part D premium-again, as long as you have the coverage. The penalty is 1% per consecutive month that you went without coverage for prescription drugs. The national base premium is currently about $33 per month, so if you go without coverage for a year, you’ll pay an extra $3.96 a month (and quite possibly more if the Part D base premium increases) for as long as you have coverage.

In the rare situation where you don’t qualify for premium-free Part A because you don’t have enough work credits, and you don’t buy it during your IEP, you’ll pay a 10% premium penalty for twice the number of years you could have bought the coverage but didn’t.

When can I get Medicare Advantage or Medicare Part D if I miss my IEP?

There’s an Annual Election Period, or AEP, that occurs between October 15 and December 7 each year that’s specifically for Medicare Part C and Part D, the Medicare Advantage plans and prescription drug plans. If you miss your initial Medicare enrollment period, you can use the next Annual Election Period to join a plan.

During the AEP, you can switch to Medicare Advantage from Original Medicare. You can also change Medicare Advantage plans if you’re currently enrolled in one. Should you join a Medicare Advantage plan and later want to leave it, you can use the AEP to return to your Original Medicare as well.

You can also enroll in a Medicare Part D prescription drug plan-or switch to a different plan if you’re currently enrolled. You can even drop your Part D coverage completely, without penalty, if you’ve obtained creditable coverage through an employer or other source.

When is the Medicare General Enrollment Period?

If you missed your IEP and you don’t qualify for a special enrollment period, you can sign up for Original Medicare during the General Enrollment Period (GEP). This runs from January 1 through March 31 each year.

Don’t be tricked into thinking the GEP is a protective umbrella so you don’t have to worry about your IEP, however. Even though you can enroll in Original Medicare during this time, you are still subject to the late enrollment penalties.

Keep in mind that the General Enrollment Period only applies to Original Medicare. If you want a Medicare Advantage plan or Medicare Part D coverage for prescription drugs, you’ll have to wait for the Annual Enrollment Period.

The Medicare Advantage Open Enrollment Period

The Medicare program also gives you a window of opportunity to change your mind about a Medicare Advantage plan. If you enroll in a Medicare Advantage plan and for any reason you don’t like it, you can disenroll during the new Medicare Open Enrollment Period from January 1 – March 31.

The Medicare Advantage Open Enrollment Period (January 1 to March 31st)

You can:

Return to Original Medicare and elect a

Part D drug plan to go alongside it

Switch Medicare Advantage plans once.

Keep in mind that if you return to your Original Medicare and plan on picking up a Medigap plan, that is not guaranteed. In many circumstances you may have to answer health questions for the Medigap plan, and the carrier does not have to accept to. Learn more about the Medicare Advantage Open Enrollment Period here.

6-Day New to Medicare Mini Video Course

Medicare Special Enrollment Period

There are certain situations that will trigger a Special Election Period (SEP) for a Part D or Medicare Advantage plan that are specific to you.

A Medicare Special Election Period is usually a two-month window when you can make changes to your coverage due to a special circumstance. For example, moving outside the plan’s service area will qualify you for a Special Election Period.

You can use the SEP to switch to a new Medicare Advantage or Part D prescription drug plan. Likewise, you can also return to your Original Medicare without penalty. You can sometimes also enroll in Medigap under guaranteed issue rights-with no medical underwriting, but this rule varies by state.

There are also other situations in which you may be eligible for a Special Election Period. If you don’t see your situation above, get in touch with us to learn what your options are.

Creditable Coverage

In many cases, people who are still working have group coverage through an employer or union plan. This allows you to delay enrollment in Part A and/or B. When you retire, you can sign up for those Parts during a Special Enrollment Period. Medicare credits you for having employer group coverage at any large employer (20+ employees.)

Medigap Open Enrollment Period

We mentioned above that once you are enrolled in Medicare Parts A and B, you will also qualify for a 6-month Open Enrollment window for Medigap plans. This starts with your Part B effective date and is a one-time election period. You can enroll in any Medigap plan that you like, with no health questions asked.

What’s most important to know about this enrollment period is that it happens only once for most people. Then it’s gone forever so it’s one of the Medicare enrollment periods that you cannot miss.

To learn more about the Medigap Open Enrollment Period, see our page about that here

Get Help with your Medicare Choices

You’re entitled to your Medicare benefits-after all, you worked hard to make sure you have health care once you retire. Nonetheless, it’s important to understand the rules and regulations, as well as your rights and benefits under the program.

Take a moment to learn the key Medicare enrollment periods so you get all your benefits under the Medicare program. Miss an important date, and you could pay the consequences for the rest of your life.

Want to make sure you don’t miss any deadlines? Reach out to May River Medicare today! We’ll help you with when to enroll so that you can avoid any Medicare late penalties.