What You Should Know About Medicare for People With Disabilities

- Does disability affect your Medicare coverage? Because millions of Americans are disabled before age 65, certain disability conditions can qualify individuals for Medicare coverage regardless of age.

- Do you qualify for Medicare early if you have a disability? This depends specifically on the type of disability and whether you have been receiving SSDI benefits for at least 24 months.

- Is Medicare free if you’re disabled? Typically, Medicare isn’t free for most people with disabilities, although financial assistance may be available to those with limited means through state Medicaid programs or a Low-Income Subsidy (LIS, sometimes referred to as extra help). Examples of Medicare expenses might include monthly premiums, copays, deductibles, and coinsurance, and these costs may go up annually.

- Do disabilities impact what type of Medicare you can have? Generally, no. Those qualifying for Medicare as a result of a disability will have the same range of options as those qualifying based on age. However, some options, such as a private Medicare supplement policy, may be more expensive for those with disabilities.

Health Coverage for People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid and Children’s Health Insurance Program (CHIP)

Medicaid is a federal and state health insurance program for people with a low income.

The Children’s Health Insurance Program (CHIP) offers health coverage to children. To be eligible, the child’s family must have an income that is:- Too high to qualify for Medicaid

- Too low to afford private coverage

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply. - Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease (permanent kidney failure requiring dialysis or a kidney transplant). Learn about eligibility, how to apply and coverage.

- Affordable Care Act Marketplace offers options to people who have a disability, don’t qualify for disability benefits, and need health coverage. Learn about the Marketplace, how to enroll, and use your coverage.

SSDI and Medicare Eligibility for People With a Disability

Getting Medicare with a disability is usually automatic for those receiving SSDI benefits. If you’re receiving SSDI benefits, you’ll be enrolled automatically in both Part A and Part B beginning on the 25th month of SSDI benefits.

Medicare for Disabilities Frequently Asked Questions (FAQs)

Is Medicare for disabilities free?

Medicare isn’t typically free for most people with disabilities. It includes copays, deductibles, coinsurance, and premiums along with specific guidelines for who qualifies.

Can someone on disability get Medicare?

Those age 65 and younger with a qualified disability who receive SSDI benefits for at least 24 months and people diagnosed with ALS or ESRD may qualify.

How long do you have to wait for Medicare after disability?

24 months after receiving SSDI benefits.

Does Social Security disability automatically enroll you in Medicare?

If you’re already drawing SSDI for 24 months, you’ll be enrolled in Original Medicare Part A and Part B automatically.

Will you lose disability benefits when you turn 65?

If you’re already drawing SSDI for 24 months, you’ll be enrolled in Original Medicare Part A and Part B automatically.

The Cost of Medicare for the Disabled

So once you’ve received your red, white, and blue medicare card in the mail, there are three things we always help our disabled folks new to medicare to immediately to help them with the costs of medicare. The first step is to apply for medicaid.

Medicare Savings Programs (MSPs) help pay your Medicare costs if you have limited income and savings. Additional benefits of enrolling in an MSP include:

- Allowing you to enroll in Medicare Part B outside of usual enrollment periods

- Eliminating your Part B late enrollment penalty, if you have one

- Automatic enrollment in the Extra Help program

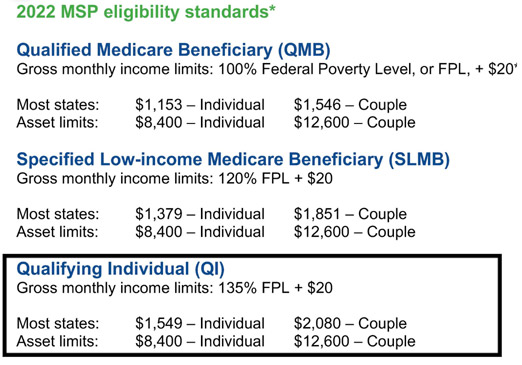

- There are three main MSPs, each with its own eligibility criteria:

Qualifying Individual (QI) - Specified Low-income Medicare Beneficiary (SLMB)

- Qualified Medicare Beneficiary (QMB)

- There are three main MSPs, each with its own eligibility criteria:

If you make less than 1,549 per month (we suggest you apply if you make less than 1600.) you can apply for QI or qualified individual status(partial medicaid) and social security will NOT take out your Part B 170 a month premium, and any advantage plan or drug plan premium is paid for you.

If you are NOT new to medicare and apply and are approved to get the $170 back, you will also get the past 3 months retroactively out back into your disability check.

**Make sure if you are married but not living together that you check the box that says married but not living together or they will count both your wife and your income, which may put you over the limit

Contact your local Medicaid office or State Health Insurance Assistance Program (SHIP) for state-specific guidelines and information. Visit www.shiptacenter.org or call 877-839-2675 to locate your SHIP.

STEP ONE: The very first thing we do is verify what your monthly disability checks are. To qualify for a medicare savings plan we must check your monthly income to see if it’s under 1549 per month. If you are within 1549-1600 we apply for an MSP or partial medicaid. What happens if you are denied?

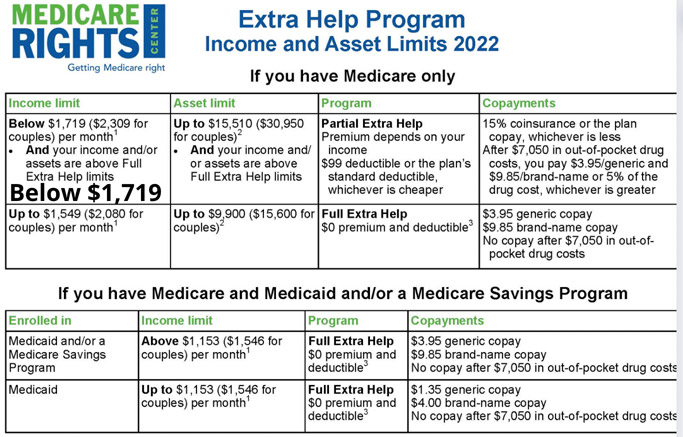

STEP TWO: If don’t qualify for medicaid then the next step is to apply for medicare extra help. Extra Help is a federal program that helps pay for some to most of the out-of-pocket costs of Medicare prescription drug coverage. It is also known as the Part D Low-Income Subsidy (LIS).

STEP THREE: If you don’t qualify for either program the next step is to get a list of your medications and doctors so we can pinpoint which medicare advantage plan will cover all your meds and docs and offer you free comprehensive dental/vision. Also if you have diabetes, heart or stroke issues or have ESRD then we will find a chronic condition plan to help. See below to see if you qualify

Chronic Condition SNP (C-SNP) eligibility requirements:

- You must get a note from your doctor confirming that you have the condition addressed by the SNP.

- The C-SNP may enroll you before getting confirmation from your doctor, but if it cannot verify your eligibility by the end of your first month enrolled, you will be disenrolled from the plan at the end of the next month.

- You will have a Special Enrollment Period (SEP) to enroll in a new plan, beginning when you are first notified by your plan that you are being disenrolled, and ending after two months.

What is this program?

The Qualified Disabled and Working Individuals (QDWI) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums only.

Who is eligible for this program?You may qualify if any of these apply to you: You’re a working disabled person under 65

You lost your premium-free Part A when you went back to work

You aren’t getting medical assistance from your state

You meet the income and resource limits required by your state

You must also meet the following income requirements, which can also be found on the Medicare Savings Programs page: The individual monthly income limit is $4,249

Married couple’s monthly income limit is $5,722

Individual resource limit is $4,000

Married couple’s resource limit is $6,000

Please Note: These limits change from year to year, so please check the Medicare Savings Programs page for the most up-to-date income requirements.

How do I apply for this program?

To apply call your state Medicaid Program or apply online at https://gateway.ga.gov/

It’s important to call or fill out an application if you think you could qualify for savings-even if your income or resources are higher than the amounts listed here.

Apply for Medicare Savings ProgramHow can I contact someone?

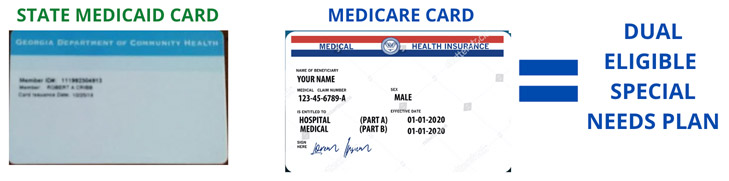

For more information, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048 One last thing about medicare saving plans, if you have a state Medicaid card AND a Medicare

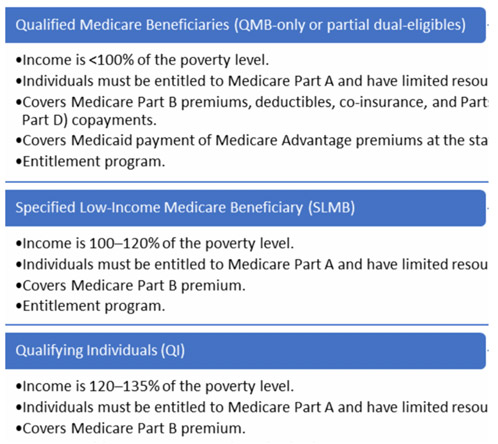

card as well, you qualify for the highest level of medicaid also known as Qualified Medicare Beneficiary (QMB):

Full Medicaid (you have a medicaid card) Pays for Medicare Parts A and B premiums. If you have QMB, typically you should not be billed for Medicare-covered services when seeing Medicare providers or providers in your Medicare Advantage Plan’s network, and you qualify to enroll in a Dual Eligible Special Needs Plan. These Special Needs Plans offer tons of extra benefits like 3,000 in comprehensive dental and vision.

MEDICARE, MEDICAID + DRUG PLAN ROLLED UP INTO ONE CARD

These plans give:

- Thousands in dental and vision

- Monthly grocery card 50-100 per month

- Hundreds in over-the-counter items each month

- Free transportation

- utility bill assistance and more

Dual Eligible SNP (D-SNP) eligibility requirements:

You must verify that you have Medicaid. You can show your Medicaid card or a letter from Medicaid, or you can fill out the plan’s enrollment form and the plan can verify your enrollment status with Medicaid.

Some D-SNPs only serve beneficiaries with Medicare and full Medicaid benefits. If you are enrolled in a Medicare Savings Program (MSP), you will not qualify and must find a D-SNP that serves people with an MSP, in addition to people with Medicaid. Plans cannot exclusively serve people with MSPs. If you meet the SNP’s eligibility requirements, you can join the plan during regular Medicare Advantage enrollment periods.

Even if your income and assets are higher than your state’s ABD Medicaid guidelines, you should still apply. This is because:

Certain kinds of income may not be counted (such as what you pay for health insurance), and all states exclude at least $20 of all income.Income limits may be higher if there are more than two people in your household.

The first $65 of your monthly earned income will not be counted.

One-half of your monthly earned income (after the first $65 is deducted) will not be counted.

In addition, some states offer a Medicaid spend-down program or medically needy program for individuals with incomes over their state’s eligibility requirements. This program allows you to deduct your medical expenses and some other health care costs from your income so that you can qualify for Medicaid. Contact your local Medicaid office to learn if a spend-down is available in your state.

What Is a Medicaid Spend Down?

A Medicaid spend-down is a financial strategy used when an individual’s income is too high to qualify for Medicaid. To be accepted into the program, some of the individual’s income must be spent down to ensure his or her income is low enough to qualify for Medicaid. You can apply for Medicaid through your state Medicaid agency, or you can fill out an application through the Health Insurance Marketplace. For more information, visit Medicaid.gov.

However, keep in mind, that each state regulates Medicaid spend-down eligibility differently and the process can be overwhelming and stressful since Medicaid won’t pay for medical or nursing care until you’ve submitted the medical bills that will make up the spend-down amount.

What Are the Rules, Exemptions and Limits of a Medicaid Spend Down?

To qualify for Medicaid, often individuals must first complete an income or asset spend down. That means some of the individual’s income or assets must be spent – generally on health care and medical-related costs. But you could also spend money on accrued debt, such as a mortgage, a vehicle or credit card balances.

Some examples of health care costs that you might put toward a Medicaid spend down include:

- Medical bills, past and current.

- Transportation services to get medical care.

- Home improvements to help with medical care, like a chair lift.

- Medical expenses, such as eyeglasses or a hearing aid.

Here are the key differences between an income spend down and an asset spend down, and tips for spending down strategically

How an Income Spend Down Works

Let’s say your mother brings in $800 a month with a Social Security check, and the Medicaid income limit in her state is $600. Then, you’ll have to complete a $200 spend down before Medicaid will pay those nursing costs. That can be tricky, or easy to do, depending on your mother’s medical expenses. If your mother owes the hospital thousands of dollars you thought would never be paid off, she could pay $200 every month to the hospital until that debt disappears, and that would be part of the spend down. Or, if she has monthly medications and routine doctor visits, her medical spend down could go toward her regular medical care.

STEP ONE

The first thing to do if you are disabled on Medicare is to apply for a Medicaid program. There are three different levels of Medicaid so just because you don’t qualify to get a Medicaid card (Full Medicare/QMB) doesn’t mean you won’t qualify for partial Medicaid.

CLICK HERE TO APPLY TO GET PART B PREMIUM $170 BACK EACH MONTH IN STATE OF GEORGIA

CLICK HERE TO APPLY TO GET PART B PREMIUM $170 BACK EACH MONTH IN STATE SOUTH CAROLINA

CLICK HERE TO APPLY TO GET PART B PREMIUM $170 BACK EACH MONTH IN STATE OF GEORGIA

CLICK HERE TO APPLY TO GET PART B PREMIUM $170 BACK EACH MONTH IN STATE SOUTH CAROLINA

STEP TWO

The second step for under 65 on medicare is to apply for extra help for prescription drugs

Medicare beneficiaries can qualify for Extra Help paying for their monthly premiums, annual deductibles, and co-payments related to Medicare prescription drug coverage.

We estimate the Extra Help is worth about $5,100 per year. To qualify for Extra Help, you must be receiving Medicare and have limited resources and income. You must also reside in one of the 50 states or the District of Columbia.Find Out if You Qualify Apply for Extra Help

You can call us at 1-800-772-1213 (TTY 1-800-325-0778) to apply over the phone. You can also request a paper application, or you can schedule an appointment to apply at your local Social Security office.

For help completing your application, see Instructions for Completing the Application for Extra Help with Medicare Prescription Drug Plan Costs (SSA-1020-INST). The instructions are only guidelines and are not to be used as applications.

These instructions are also available in other languages in our Multilanguage Gateway.

STEP THREE

How to Choose the Best Advantage Plan in 2023 for disabled on Medicare

The best Medicare Advantage plan is generally the one that includes your doctors in the plan’s network and your medications on the plan’s formulary. You can find Advantage plans from major carriers like United Healthcare, Aetna, Cigna, Anthem/Blue Cross Blue Shield, Humana, and quite a few other carriers.

Keep in mind there is no best medicare advantage plan for everyone. One size does not fit all, and the only way to find the ideal plan for your needs is to check to make sure you check your doctors are in-network and double-check to make sure the medications you take are covered in the plan’s drug formulary.

Folks on disability live on a low fixed income and many have chronic conditions that require frequent visits to specialists as well as the occasional trip to the hospital. Also, disabled folks on medicare typically don’t have a lot of spare change to spend at the dentist or for glasses, and those doctor co-pays can add up, not to mention the hospital copays, which on average range from $300-450.

Tips for the disabled on medicare to cut costs drastically.

Consider an HMO Advantage Plan provided your primary care doctor is in-network and your specialists also take the plan. Why?

Many HMOs have no primary care copays and lower specialist copays, sometimes as low as $15 for specialists. HMO plans typically offer more robust dental and vision coverage (up to $,2000 in dental and $400 in vision along with transportation benefits as well as overo-counter and/or monthly grocery benefits. If you are new to medicare and are disabled and don’t have a regular primary doctor or particular doctors you regularly go to, an HMO may be the right solution for you if you’re concerned.

There are some PPOs that have no primary care copays and lower specialist copays, sometimes as low as $15 for specialists. The most overlooked variable of a Medicare Advantage Plan is what are the maximum out-of-pocket costs? It is important to know what your annual out-of-pocket costs will be. Every plan is different, but none will exceed $7,550 (in-network) in out-of-pocket costs in 2022. If the maximum out-of-pocket cost on a plan you are considering is more than you can afford, consider a plan that offers a lower annual out-of-pocket.

The best Medicare Advantage plan for you should offer cost-sharing that you can afford in the event of a medical emergency.