Costs of Medicare in 2025

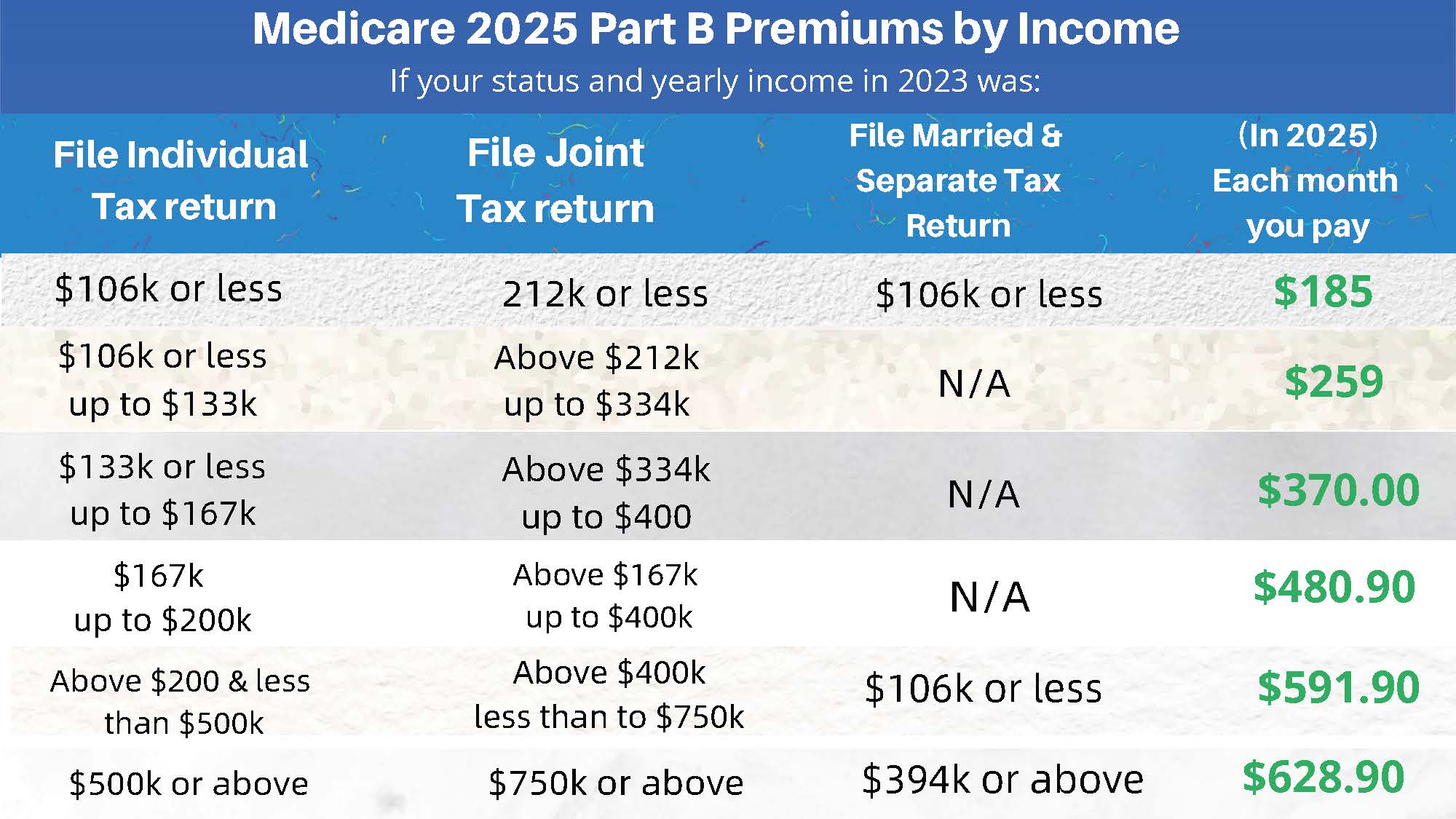

The standard monthly Medicare Part B premium for 2025 is $185.00, which is an increase of $9.30 up from $174.70 in 2024.

Most people will pay the standard Part B premium amount, but you could pay more based on your income. Medicare uses your reported income from two years ago to determine what you’ll pay. Medicare adds an income-related monthly adjustment amount (IRMAA) to Part B premiums for individuals with an adjusted gross income over $106,000 and for couples with income over $213,000. High earners could pay up to $628.90. month for Part B in 2025.

Other Part B costs include a deductible and coinsurance for those who have Original Medicare (Parts A & B). The 2024 Part B deductible is $257, an increase of $17 from the annual deductible of $240 in 2024.

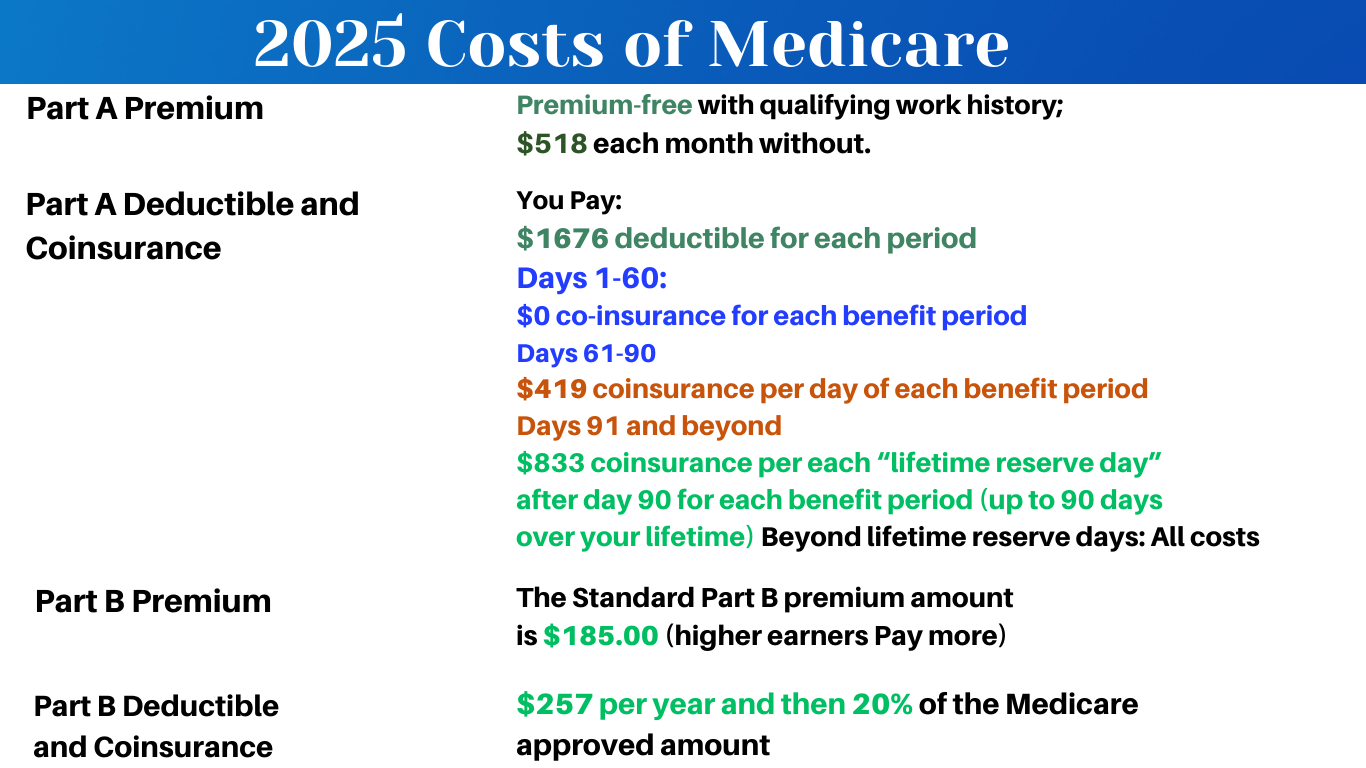

The Medicare Part A deductible for 2025 is $1,676, an increase of $44 from $1,632 in 2024 A benefit period begins the day you’re admitted to the hospital and ends when you’ve been out for 60 days in a row. The deductible covers up to 60 days in the hospital. After that you pay daily coinsurance amounts.

Medicare Part A coinsurance amounts for 2025:

For hospital stays:

$0 for Days 1-60 of hospitalization

$419 per day for Days 61-90 of hospitalization

$833 per day for lifetime reserve days

For a skilled nursing facility:

$0 for Days 1-20

$209 per day for Days 21-100

Note: these amounts are per benefit period.

Part D Costs:

Part D premium: The estimated average enrollment-weighted monthly premium for Medicare Part D stand-alone PDPs is projected to be $45 in 2025, a modest increase from $42 in 2024

Is the Medicare Part D donut hole closed?

The Medicare Part D donut hole technically “closed” on January 1, 2025. There is now a $2000 Max out of pocket for Part D drug spending for Medicare beneficiaries and the dreaded donut hole is no more. The Part D drug deductible state is set at $590 by Medicare. Once you hit the $590 deductible you’ll fall into the initial coverage stage where you’ll pay copays and coinsurance until you reach the $2000 max out of pocket limit. Once you spend $2000 out of pocket you fall into the catastrophic state where you pay zero for the rest of the year/.

You can get drug coverage through a standalone Part D plan or a Medicare Advantage plan.

Remember, the costs for Medicare can change each year. And the total costs you will have for your Medicare coverage will vary depending on the coverage you have along with the health care items and services you use.

Key Points

How much does Medicare cost?

Do you have to pay for Medicare?

How are Medicare premiums calculated?

Who pays for Medicare Part A?

Is Medicare Part B free? What will be my Medicare premiums in 2025?

These are very common questions about the costs of Medicare. The costs for Medicare Part B and Part D, as well as supplemental coverage, are something that many don’t anticipate. It can surprise you when you turn 65 and enroll in Medicare and learn that Medicare is not free.

So, do you have to pay for Medicare? Yes, most people do pay Medicare premiums. Fortunately, it’s fairly easy to put together a Medicare cost estimate so that you can plan ahead.

When determining how much does Medicare cost for beneficiaries, remember most people qualify for premium-free Part A if they have worked 40 quarters in the U.S. (10 Full Years) and paid Medicare taxes during that time, but if not,

there is a monthly premium.

The Part B and D premiums are based on income, so you could pay more for Part B and Part D if you have a higher income.

The standard Medicare Part B premium in 2025 is $185.00.

Overview

How much does Medicare cost? Do you have to pay for Medicare?

How are Medicare premiums calculated? Who pays for Medicare Part A? Is Medicare Part B free? What will be my Medicare premiums in 2025?

These are very common questions about the costs of Medicare. The costs for Medicare Part B and Part D, as well as supplemental coverage, are something that many don’t anticipate. It can surprise you when you turn 65 and enroll in Medicare and learn that Medicare is not free.

So, do you have to pay for Medicare?

Yes, most people do pay Medicare premiums. Fortunately, it’s fairly easy to put together a Medicare cost estimate so that you can plan ahead.

Request A Quote

How Much is Medicare Part A in 2025

The cost for Medicare Part A for most people is usually zero. If you’ve worked 10+ years (40 quarters) in the U.S., you have already paid for Part A via payroll taxes. (99% of beneficiaries qualify for free Part A.)

If you have to buy Part A, the cost for Medicare Part A will be around $518/month. People with less than 40 quarters of work experience but more than 30 quarters can get a pro-rated premium of $278/month.

To be eligible to buy Part A, you must have been a legal resident or have had a green card for at least 5 years.

This part of Medicare covers your hospital stay. But, should you have a hospital stay, what is the Medicare Part A deductible? In 2025, the Part A Deductible will be $1,676. I medicare supplement pays all of your Part A Deductible. With a medicare advantage plan, you will pay a copay, on average, of $400 per day for four to six days.

How Much Does Medicare Part B Cost in 2025

In 2025, the standard monthly premium for Medicare Part B is $185. However, some individuals may pay more due to income-related adjustments (IRMAA).

Further breakdown of Part B costs:

- Standard Monthly Premium:

- Most beneficiaries will pay $185 per month for Part B coverage.

- Income-Related Monthly Adjustment Amounts (IRMAA):

- If your income exceeds certain thresholds (modified adjusted gross income over $106,000 for individuals or $212,000 for couples), you may pay higher premiums. These premiums can range from $259 to $628.90 per month depending on your income level.

- Annual Deductible:

- Before Medicare starts paying for Part B services, you’ll need to pay a deductible. In 2025, the Part B deductible is $257.

- Coinsurance:

- After you’ve met your deductible, you’ll typically pay 20% of the Medicare-approved amount for covered services, and Medicare will pay the remaining 80%.

In essence, your Part B costs in 2025 will include:

- Monthly premium: $185 (standard) or higher if subject to IRMAA.

- Annual deductible: $257.

- Coinsurance: 20% of the Medicare-approved amount for covered services after the deductible is met.

Part B is your outpatient medical insurance, but it comes at a cost. Determining what is the premium for Medicare Part B can be tricky as it is based on your modified adjusted household gross income (MAGI). The Social Security office will pull your IRS tax return from two years prior. They use that tax return to determine what you’ll pay for Parts B & D (Part D premiums are also based on income.)

The items that contribute to your modified adjusted gross income include any money earned through wages, interest, dividends from investments, and capital gains. It also includes Social Security benefits and tax-deferred pensions. Distributions from Roth IRAs and Roth 401(k)s, life insurance, reverse mortgages, and health savings accounts do not count in the MAGI calculation.

Request A Quote

How is Medicare Part B Premium Calculated? The Cost for Medicare starts paying for Part B services, you’ll need to pay a deductible. In 2025, the Part B deductible is $257. Coinsurance: After you’ve met your deductible, you’ll typically pay 20% of the Medicare-approved amount for covered services, and Medicare will pay the remaining 80%. In essence, your Part B costs in 2025 will include:

- Monthly premium: $185 (standard) or higher if subject to IRMAA.

- Annual deductible: $257.

- Coinsurance: 20% of the Medicare-approved amount for covered services after the deductible is met.

If you filed jointly with a spouse, Social Security will base your premiums for each of you based on that married income. However, you will EACH pay your own Part B premium. Your premiums for Part B are always individual, not combined. Social Security simply uses your household income to determine where you fall individually in the Part B premiums chart.

Social Security will usually notify you of your next year’s premium annually in December or early January by mail. Fortunately, it is possible to appeal a higher Part B and Part D premium charge.

Medicare Cost for Part D for 2024

Average monthly premium for Medicare Part D in 2025 is estimated to be around $46.50. This is a decrease from $55.50 in 2024.

Factors that affect the cost of Part D in 2025

- Plan details

- The total cost of a Part D plan depends on the plan details, such as the drug tier.

- Income

- High-income earners may pay a surcharge called the “income-related monthly adjustment amount” (IRMAA).

- Enrollment

- If you don’t sign up for Part D when first eligible, you may have to pay a late enrollment penalty.

- Deductibles and copayments

- The total cost of a Part D plan also depends on the yearly deductible and copayments.

Other changes to Part D in 2025

- The donut hole will be replaced by a $2,000 out-of-pocket cap.

- The Part D cap will increase each year after 2025.

- Fewer plans will be available for enrollment of LIS beneficiaries for no premium.

How Much Will You Pay for Medicare?

Now if you find all that just a little confusing – don’t worry. Medicare premium increases happen almost every year, and our professionals can help you figure out exactly what your Medicare costs will be. Many people find that Medicare and a Medicare supplement cost less than private insurance they had prior to Medicare. Either way, you’ll want to get some estimates of your costs for Original Medicare before you retire. This way, you can plan ahead to have enough savings for the future.

We can help you determine your

potential costs right over the phone and provide you with an average cost of Medicare. We can also help you plan for how much are Medicare premiums and your estimated costs in 2025.

Call 843-227-6725 today or complete our online request form below. A friendly licensed insurance agent on our team will assist you.

To continue learning about Medicare, go next to: Apply for Medicare.

Takeaways

The standard Part B premium that most people pay is $185.00 in 2025, but you can pay more if you have a higher income.

Many beneficiaries qualify for premium-free Part A.

Your Part D premium is also affected by income.

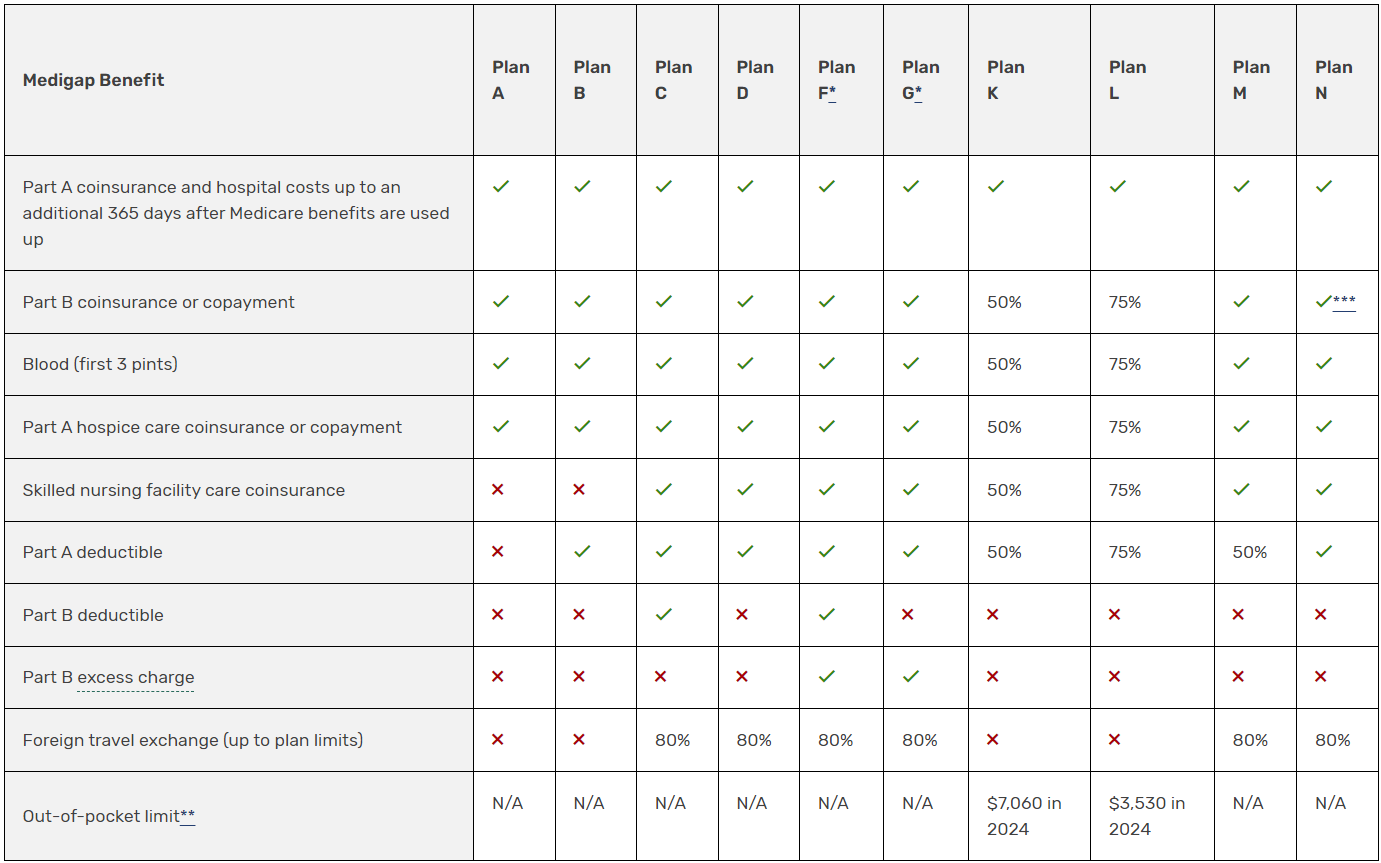

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Get your Personalized Quote in Seconds without the annoying calls afterwards.