What is Medicare?

Key Points

Medicare is a federally run health insurance program for people 65 and older and with certain disabilities and health conditions under 65.

Medicare provides coverage for a wide range of medically necessary services, preventative services, and more.

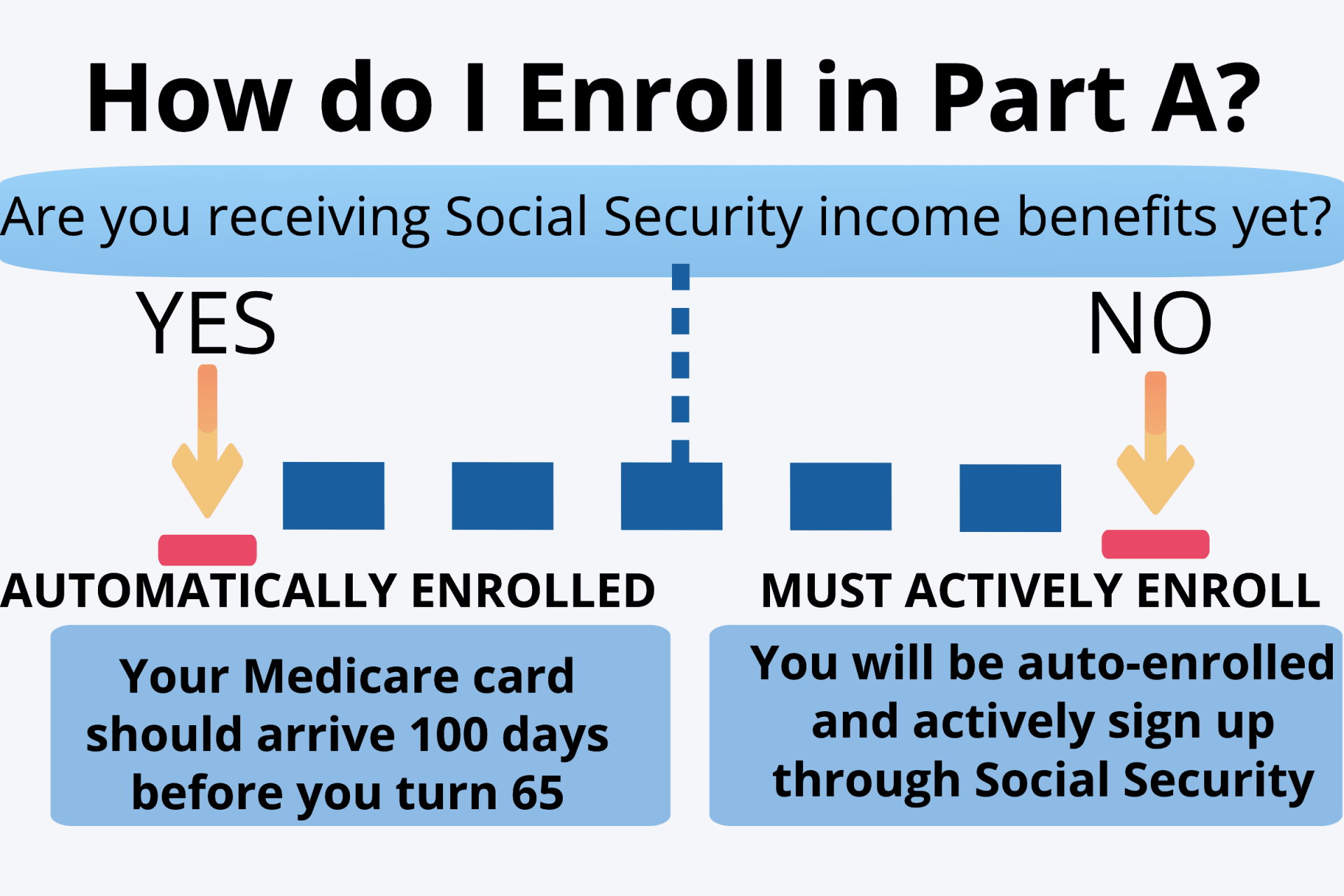

You enroll in Medicare through the Social Security Administration

- How does Medicare work? Also, what does Medicare cover? Is it insurance? The answer is somewhat complex, but you’ve come to the right place for education.

- Medicare is a national United States health insurance program made for people 65 and older. It is also for people with certain disabilities or end-stage kidney failure. This program is divided into various parts, so it’s important to learn how these fit together.

- Medicare mainly covers those 65 and up, but you can also qualify if you have certain disabilities or illnesses.

Medicare:

Medicare is a US federal government health insurance program that subsidizes healthcare services. The program covers folks over age 65, others who meet specific eligibility criteria, and individuals with certain diseases.

Who Qualifies for Medicare?

Medicare mainly covers those 65 and up, but you can also qualify if you have certain disabilities or illnesses.

Understanding Medicare Coverage

Once you have become Medicare-eligible and enroll, you can choose to get your Medicare benefits from Original Medicare, the traditional fee-for-service program offered directly through the federal government, or from a Medicare Advantage Plan, a type of private insurance offered by companies that contract with Medicare (the federal government). Original Medicare includes:

- Part A (Inpatient/hospital coverage)

- Part B (Outpatient/medical coverage)

What is Part A? What Does Medicare Part A Cover?

6-Day New to Medicare Mini Video Course

Most people don’t pay the Medicare Part A premium. You do not pay for Part A if you or your spouse worked and paid Medicare taxes for at least 10 years. If you or your spouse did not, then you will have a Part A premium to pay each month. As of 2024, the Part A premium can cost up to $505 per month.

The cost of Part A for most people at age 65 is $0. This is because, during your working years, you have paid taxes to pre-fund the premiums for your hospital benefits. You can also get Part A for $0 through a spouse or ex-spouse’s work history. Even if you don’t automatically qualify for premium-free coverage, most people age 65 can still get it – they would just pay a hefty premium for it.

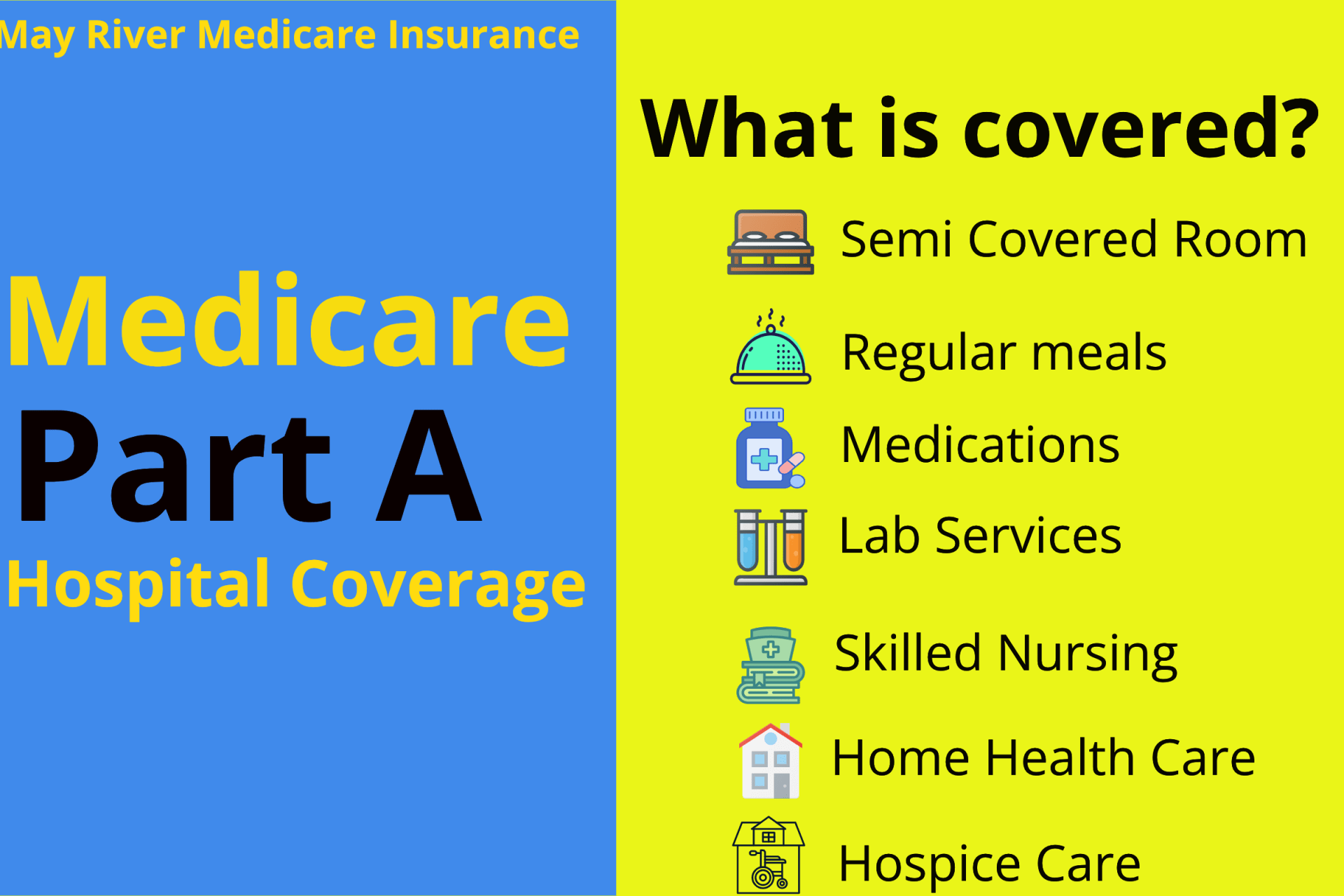

Medicare Part A is hospital insurance and typically covers costs in four specific areas.

1. Inpatient hospital care

Medicare Part A covers hospital services you get when you’re admitted to a hospital on doctor’s orders, including semi-private rooms, meals, general nursing and drugs for inpatient treatments

. If you want care outside of Part A’s coverage, such as a private room or a private-duty nurse, you’re on your own to pay the incremental costs.

It’s also important to note that if you need admittance to a psychiatric hospital for mental health treatment once you’re on Medicare, coverage falls under Part A

. You get fewer days of coverage — up to 190 days over your lifetime.

Fortunately, most hospitals accept Medicare, a criteria for using Part A. Note, however, that Veterans Affairs hospitals and other military hospitals usually take VA and military insurances, not Medicare.

Medicare Part A covers inpatient hospital care in a variety of facilities, including:

- Acute care hospitals.

- Critical access hospitals.

- Inpatient rehabilitation facilities.

- Inpatient psychiatric facilities.

- Long-term care hospitals.

- Inpatient care as part of a qualifying clinical research study.

What is Medicare Part B?

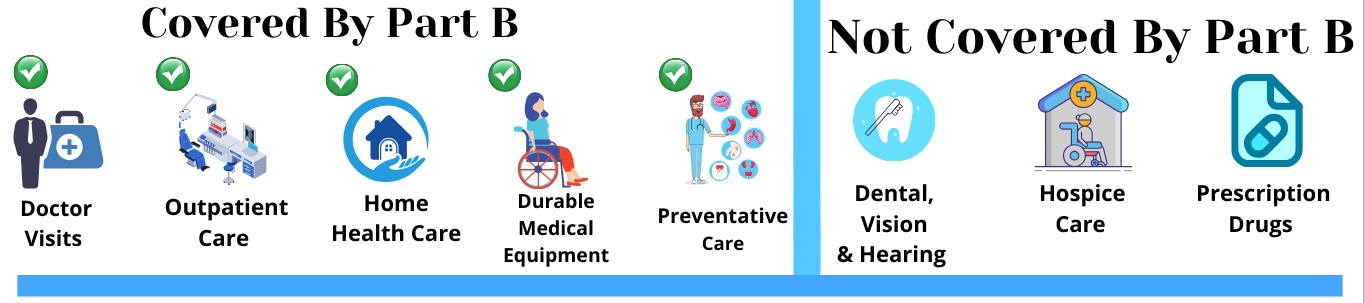

Medicare Part B provides outpatient/medical coverage or everything done outside the hospital. Without Part B you would have zero coverage for doctor’s visits, outpatient surgery, bloodwork, tests, MRI’S, CT scans, and cancer treatment as well as lab work, preventive services, ambulance services and kidney dialysis. Social Security sets the cost of Part B and changes it from year to year. Individuals in higher income brackets pay more than those in lower income brackets. Your modified adjusted gross income reported to the IRS determines what your Part B premium will be.

You can read more about the cost of Part B on our Medicare Cost page.

What is Medicare Part C?

While the majority of people with Medicare get their health coverage from Original Medicare, some choose to get their benefits from a Medicare Advantage Plan, also known as a Medicare private health plan or Part C. MA Plans contract with the federal government and are paid a fixed amount per person to provide Medicare benefits.

Remember, you still have Medicare if you enroll in an MA Plan. This means that you likely pay a monthly premium for Part B (and a Part A premium, if you have one) . If you are enrolled in an MA Plan, you should receive the same benefits offered by Original Medicare.

Keep in mind that your MA Plan may apply different rules, costs, and restrictions, which can affect how and when you receive care.

They may also offer certain benefits that Medicare does not cover, such as dental and vision care, caregiver counseling and training, and certain in-home support like housekeeping. Not all MA Plans cover additional benefits, so check with a plan directly to learn what benefits it covers.

To enroll in a Part C plan, you must first be enrolled in both Parts A and B. Even if you find a Part C plan with a very low premium, you will still pay for Part B. You must also live in the plan service area and apply during a valid election period.

Once you enroll, your Medicare coverage will come from the Advantage plan itself, not from the government.

The reason you don’t enroll in Part C at Social Security is that Part C is voluntary. Many people prefer to get their Medicare coverage from Original Medicare and traditional Medigap plans. These people do not want a Part C Advantage plan, so they will simply not enroll in one.

It is your choice whether you wish to opt for one as opposed to just staying with your original Medicare A & B and enrolling in Medigap in addition to a Part D plan.

What is Medicare Part D?

Medicare is the newest part of our national health insurance program for people age 65 & up. For 50 years, there was no Medicare coverage for prescription medicines. In 2006, our federal government rolled out Part D and tens of millions of Medicare beneficiaries signed up to get coverage for their outpatient drugs.

It covers retail prescription drugs that you pick up yourself at the pharmacy or order via mail order. You choose a carrier and enroll in their drug plan, and that’s how you sign up for a Part D drug plan. Most states have about 30 drug plans to choose from. However, the best way to determine which one is the right fit for you is to have your agent run a Part D analysis using Medicare’s prescription drug finder tool.

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam

What doesn’t Medicare cover?

- Medicare does not cover:

- Long-term care

- Hearing aids

- Routine dental care

- Routine vision care

- Medical care outside of the U.S.

- Dentures

- Plastic and/or cosmetic surgery

- Massage therapy

Medicare Part A does cover Skilled Care and in home health care but does not cover Long Term care

Common Medicare Myths

Despite what you may have heard, Medicare is not free.

The time and money spent during your working years only qualifies you to receive premium-free Part A. Everyone pays a premium for Part B.

The government will not notify you to sign up.

You are expected to know when you need to sign up. If you are not receiving SS benefits at least four months prior to your 65th birthday month, you will not be auto-enrolled and will need to apply on your own.

There are potential lifetime-enrollment penalties for not signing up on time.

If you fail to enroll during the correct time, you could face late-enrollment penalties that you’d have to pay for as long as you are enrolled in Medicare.

This transition can be confusing and risky. For this reason, one simple mistake means you could end up with lifetime consequences.

Get Help From the Medicare Advocated

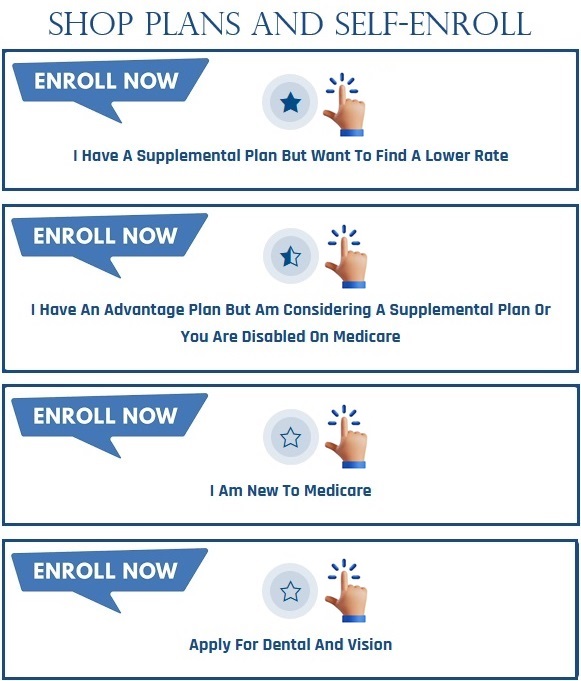

Do you need help understanding your coverage options or how Medicare works? The first step to setting up affordable health insurance is knowledge. Let our experts help you learn your basic benefits, coupled with helping you choose the appropriate supplement plan. Call 843-227-6724

Key Takeaways

The Medicare program has four different parts: Part A, B, C, and D. Part C, D, and Medigap plans are sold through private insurance carriers, not the federal government.

When you enroll in Part A and Part B, you have two main plan options. You can sign up for a Medigap plan and a Part D plan, or you can sign up for an Advantage plan.