Medigap Plan M

Lower Premiums by Sharing the Part A Deductible

Medigap Plan M is designed to reduce monthly premiums by sharing part of the Medicare Part A hospital deductible while still covering most other Medicare gaps.

May River Medicare Insurance is a nationwide independent Medicare agency. We show Plan M carriers, pricing, and availability by ZIP code — transparently — so you can compare everything before you apply.

You pay part of the Part A deductible to keep premiums lower.

After hospitalization costs, Plan M covers most Medicare-approved expenses.

Use any provider in the U.S. that accepts Medicare — no networks.

Plan M covers most Medicare-approved expenses, except for part of the Part A deductible.

- 50% of the Part A hospital deductible

- 100% of Part A hospital coinsurance and extended stays

- Skilled Nursing Facility coinsurance

- Part B coinsurance (20%)

- Hospice coinsurance/copays

- First 3 pints of blood each year

- Foreign travel emergency coverage

- 50% of the Part A deductible

- Part B deductible

- Part B excess charges

- Prescription drugs (requires Part D)

- Routine dental, vision, and hearing

Plan M works well for people who want lower monthly premiums and are comfortable paying part of the hospital deductible if admitted.

- You want lower premiums than Plan G

- You rarely have hospital stays

- You still want nationwide Medicare access

Premiums vary widely by carrier and location — comparison matters.

Compare Medigap Plan M in Your Area

See Plan M pricing, coverage details, and carrier options by ZIP code. May River Medicare Insurance shows you everything clearly — before you enroll.

Medigap Plan M: the Deductible-sharing Plan

Medicare Supplement Plan M is one of the new Supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010. (Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.)

KEY POINTS

Plan M is a type of Supplement Plan that provides beneficiaries with additional coverage for their Medicare expenses.

In exchange for a lower monthly premium, you pay half of the Part A deductible.

Fewer carriers offer Plan M compared to other supplement plans, such as Plan G.

Medigap Plan M: the Deductible-sharing Plan

Medicare Supplement Plan M is one of the new Supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010. (Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.)

Medicare Plan M provides the same basic benefits as other Supplements. However, it has a slightly reduced monthly premium in exchange for your willingness to pay half of your hospital deductible and all of your annual outpatient deductible. By sharing in these deductibles as well as excess charges, you get the benefit of reduced premiums.

Plan M could be a good fit for someone who doesn’t expect to visit the hospital often and feels he can afford the occasional cost-sharing. However, it’s important to have a licensed agent who specializes in Medicare Supplements to help you. He or she will evaluate the differences in premiums and make sure that the savings are worth the risk of some expenses.

Medigap Plan M Insurance Carriers

Every Medicare Supplement carrier chooses which plans it will offer for sale unless state law requires the carrier to offer certain plans. Because most people don’t understand cost-sharing, they tend to fear it, and therefore we see few carriers offering Plan M for sale.

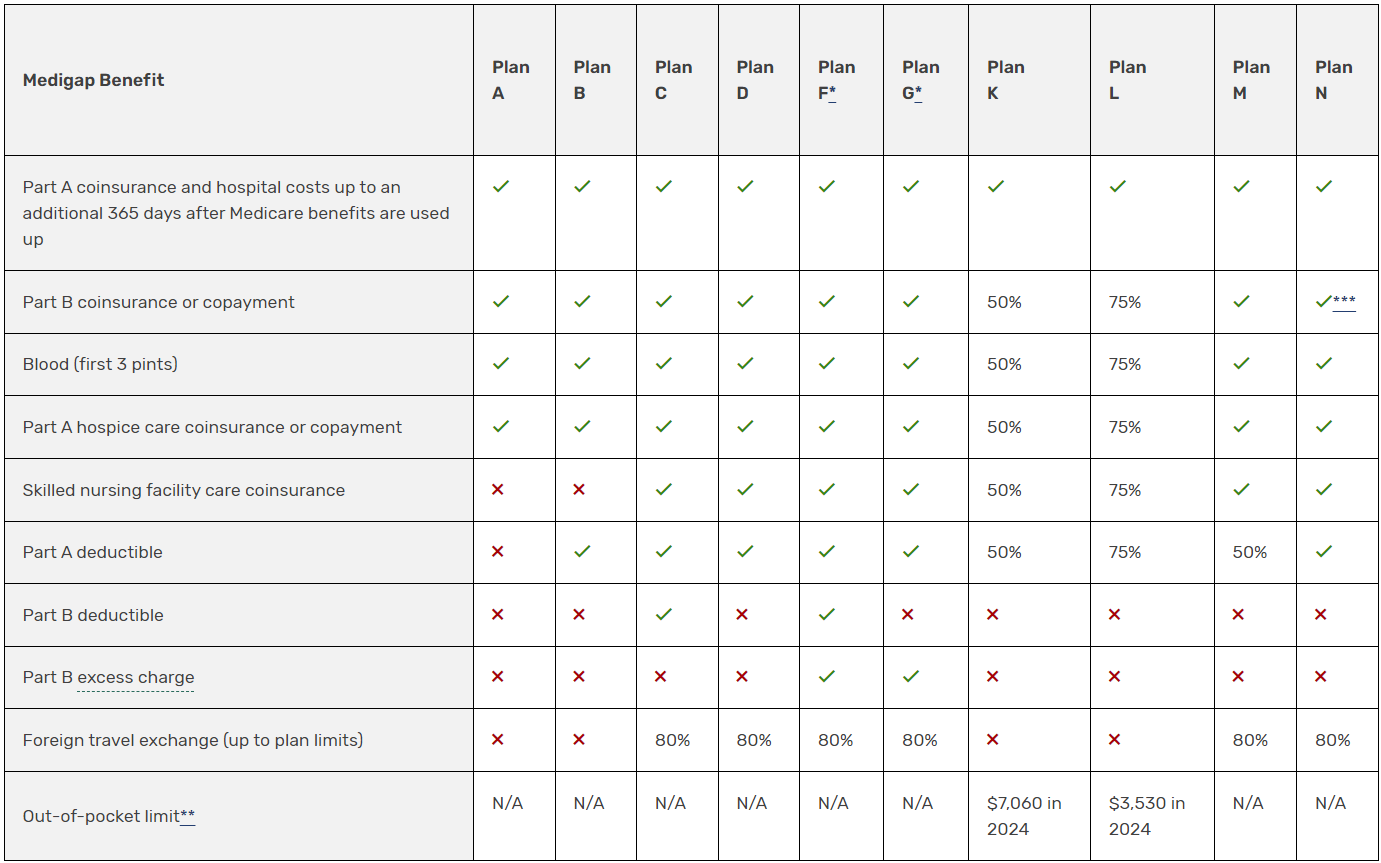

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).