Medigap Plan L

Balanced Coverage with Cost Control

Medigap Plan L strikes a balance between lower premiums and strong financial protection. It shares costs with you — but includes a built-in annual out-of-pocket limit for peace of mind.

May River Medicare Insurance is a nationwide independent Medicare agency. We show Plan L benefits, pricing, and carrier availability by ZIP code — transparently — so you can compare before making a decision.

Plan L pays a portion of Medicare costs rather than 100%.

Premiums are higher than Plan K but lower than Plan G or Plan F.

An out-of-pocket limit protects you from catastrophic costs.

Plan L covers a higher percentage of costs than Plan K, offering stronger protection with still-affordable premiums.

- 100% of Part A hospital coinsurance

- 75% of Part A deductible

- 75% of Skilled Nursing Facility coinsurance

- 75% of Part B coinsurance (after deductible)

- 75% of hospice coinsurance/copays

- First 3 pints of blood (75%)

- Foreign travel emergency (75%)

Once your out-of-pocket spending reaches Medicare’s annual limit, Plan L pays 100% of covered services for the rest of the year.

- 2026 out-of-pocket limit: $3,610 (indexed annually)

- Lower limit than Plan K

- Provides peace of mind for unexpected health needs

Plan L is ideal for people who want meaningful coverage without paying the higher premiums of comprehensive plans like Plan G.

- You want a middle-ground between Plans K and G

- You like having an annual spending cap

- You want predictable protection at a lower premium

Plan L premiums vary by carrier and location — comparing options is essential.

Compare Medigap Plan L in Your Area

View Plan L premiums, coverage levels, and carrier options by ZIP code. May River Medicare Insurance gives you clear, side-by-side comparisons before you enroll.

Medigap Plan L Offers Great Benefits

Medigap Plan L offers reduced premiums if you share costs

Medicare Supplement Plan L is another cost-sharing Medigap policy. In exchange for slightly lower premiums than what you might pay for a Plan F if you enroll in a Medigap Plan L, the insurance carrier will pay 75% of your covered medical expenses on most items, and you will pay the other 25%. You also agree to pay the deductible and any excess charges on your own.

Medicare Supplement Plan L – Out-of-Pocket Maximum Cap Protection

A Plan L Medigap policy also includes a cap on your expenses. This is referred to as your out-of-pocket limit or maximum. Medicare sets this limit annually, and in 2024, the limit for Plan L is $3,530. This means that if in any one calendar year, your spending reaches $3,530 in Medicare-approved covered expenses, then the Medigap insurance carrier pays the rest. The cap makes it much easier to agree to share in 25% of the costs on the items listed because you know that even if a year of bad health occurs, you won’t have more exposure than the maximum cap figure.

Plan L example

Let’s say that Mr. Jones purchases a Medigap Plan L policy. He has an outpatient surgery to remove his gall bladder. If Medicare’s approved amount for this surgery is $1,000, then his Plan L Supplement will pay $750, and Mr. Jones will be responsible for the other $250.

This amount is also tallied by his Medigap carrier against his out-of-pocket maximum, and if his costs in that calendar year go over $3,530 in 2024, then his Medigap Plan L will pay 100% of any Medicare-approved expenses for the rest of the year.

Mr. Jones’ policy also functions similarly for his share of outpatient expenses under Part B, except that he will be responsible for the once-annual Part B deductible.

Let’s assume Mr. Jones has already paid his deductible earlier this year when he had an ordinary doctor’s appointment. Later that year, his doctor orders an MRI. Medicare will pay 80% of the cost for that MRI, and his Medigap Plan L will pay 75% of the rest. If the MRI cost is $1,000, then Medicare pays $800, his Medicare Plan L pays $150 (75% of the remaining $200), and Mr. Jones is responsible for the $50 difference.

Medicare Plan L Carriers

In most states, each carrier gets to decide which Medicare Supplements it will offer to consumers for purchase. While it is easy to find carriers for the ever-popular Plan F, not as many carriers offer the Plan L Medicare Supplement. Working with a trusted insurance agent who specializes in Medicare insurance products doesn’t cost you a dime and can minimize the amount of time and effort you put into researching companies and prices.

Our agency works with the major insurance companies in most states. Call us or fill out our online form for quotes

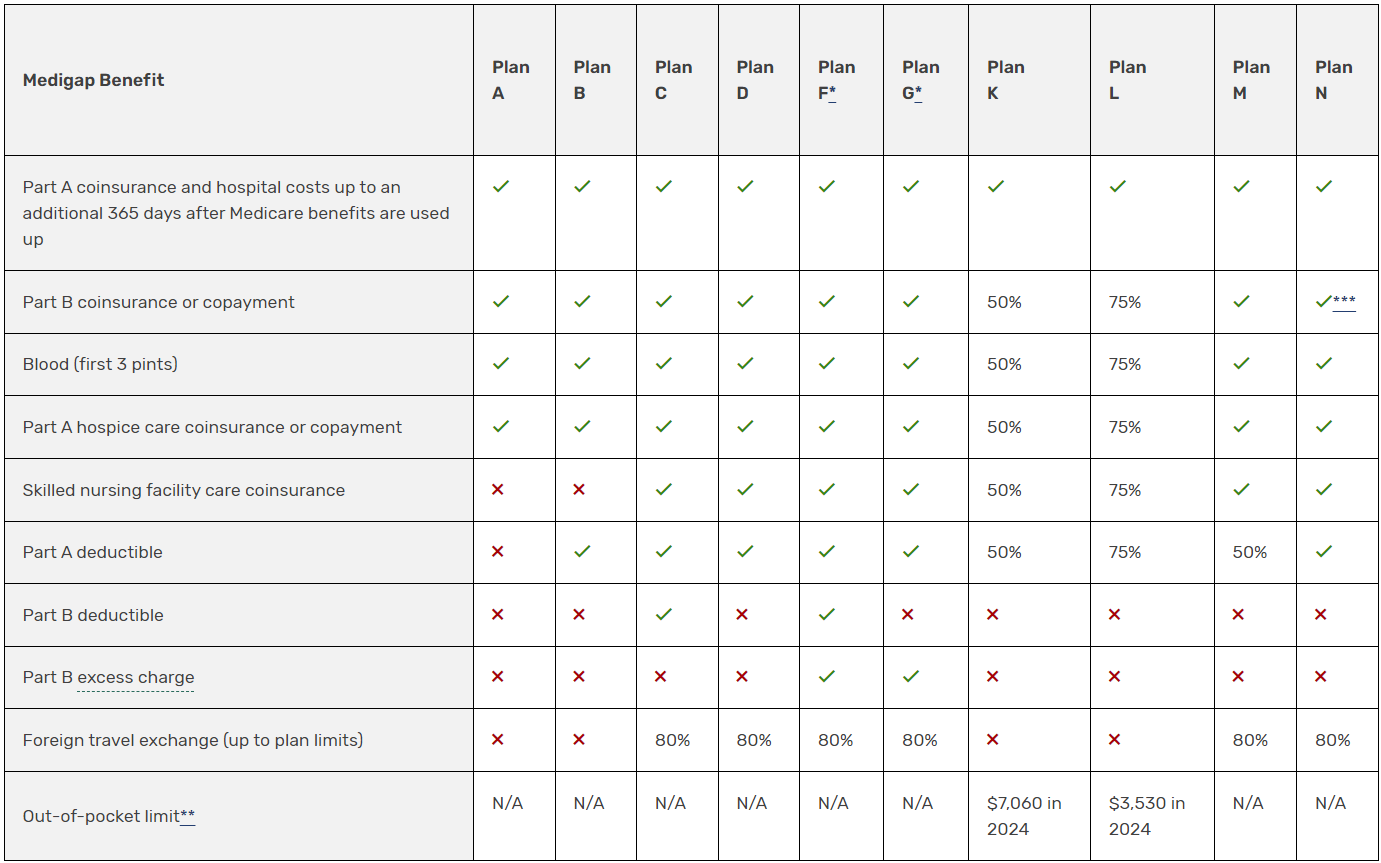

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Let’s say that Mr. Jones purchases a Medigap Plan L policy. He has an outpatient surgery to remove his gall bladder. If Medicare’s approved amount for this surgery is $1,000, then his Plan L Supplement will pay $750, and Mr. Jones will be responsible for the other $250.

This amount is also tallied by his Medigap carrier against his out-of-pocket maximum, and if his costs in that calendar year go over $3,530 in 2024, then his Medigap Plan L will pay 100% of any Medicare-approved expenses for the rest of the year.

Mr. Jones’ policy also functions similarly for his share of outpatient expenses under Part B, except that he will be responsible for the once-annual Part B deductible.

Let’s assume Mr. Jones has already paid his deductible earlier this year when he had an ordinary doctor’s appointment. Later that year, his doctor orders an MRI. Medicare will pay 80% of the cost for that MRI, and his Medigap Plan L will pay 75% of the rest. If the MRI cost is $1,000, then Medicare pays $800, his Medicare Plan L pays $150 (75% of the remaining $200), and Mr. Jones is responsible for the $50 difference.

In most states, each carrier gets to decide which Medicare Supplements it will offer to consumers for purchase. While it is easy to find carriers for the ever-popular Plan F, not as many carriers offer the Plan L Medicare Supplement. Working with a trusted insurance agent who specializes in Medicare insurance products doesn’t cost you a dime and can minimize the amount of time and effort you put into researching companies and prices.

Plan L tends to have lower monthly premiums because you will pay more out-of-pocket costs during the year.

Plan L covers 75% of the cost of approved benefits, but it does not cover the Part B deductible, Part B excess charges, or foreign travel emergency coverage.

Once you meet the maximum out-of-pocket limit, Plan L will cover 100% of your approved costs.