Medigap Plan K

Lower Premiums with Cost Protection

Medigap Plan K is designed for people who want a lower monthly premium while still having protection against catastrophic medical costs.

May River Medicare Insurance is a nationwide independent Medicare agency. We show Plan K pricing, benefits, and availability by ZIP code — transparently — before you ever need to speak with an agent.

Plan K pays a portion of Medicare costs instead of 100%.

Monthly premiums are typically much lower than Plan G or Plan F.

Annual out-of-pocket limit caps your medical spending.

Plan K covers a percentage of certain Medicare-approved expenses, helping reduce costs while keeping premiums affordable.

- 100% of Part A hospital coinsurance

- 50% of Part A deductible

- 50% of Skilled Nursing Facility coinsurance

- 50% of Part B coinsurance (after deductible)

- 50% of hospice coinsurance/copays

- First 3 pints of blood (50%)

- Foreign travel emergency (50%)

Once your out-of-pocket spending reaches Medicare’s annual limit, Plan K pays 100% of covered services for the rest of the year.

- 2026 out-of-pocket limit: $7,220 (indexed annually)

- Helps protect against unexpected medical expenses

Plan K is ideal for people who want lower premiums and are comfortable sharing some costs in exchange for a safety net.

- You want a lower monthly premium

- You want protection from catastrophic costs

- You rarely use medical services

Plan K pricing varies significantly by carrier and location — comparing options matters.

Compare Medigap Plan K in Your Area

See Plan K premiums, benefits, and carrier options by ZIP code. May River Medicare Insurance shows you everything clearly — before you apply.

Medigap Plan K Offers Great Benefits

Medigap Plan K Benefits

Medicare Plan K is the Medicare Supplement that covers the Part A hospital deductible while also covering about 50% of the other gaps in Medicare. Enrollment in Plan K increased by 28% from 2014 to 2015, according to a report by AHIP’s Center for Policy and Research. This is likely because consumers are beginning to be more interested in plans that offer lower premiums if they share in more of the cost-sharing.

Medigap Plan K: Fewer Benefits for Lower Premiums

Medicare Supplement Plan K offers you the same basic benefits as other Supplements, but with lower premiums. For example, this plan will still cover preventive care services and give you an extra year in the hospital. However, you split the cost-sharing with the insurance carrier on certain items like the Part A deductible. You also agree to pay the Part B deductible and any excess charges.

Medicare Plan K also includes a cap on your spending called an out-of-pocket maximum. For instance, let’s say you have a year with a lot of medical treatments. If your out-of-pocket spending reaches the maximum limit, then your Medigap K policy will kick in to pay all of the rest for that year.

Medicare Supplement Plan K – Maximum Out-of-Pocket

Medigap Plan K’s cap is $7,060 in 2024, so that is the maximum you would spend in any calendar year. This cap works very similar to the out-of-pocket maximums that you have had in the past on employer group health insurance plans. Your insurance carrier will track exactly how much out-of-pocket spending you’ve done for that calendar year. If, for any reason, you spend more than the cap, then the insurance policy must cover 100% of the rest of your expenses after that point.

Common questions asked about Medigap Plan K:

How does Medicare Supplement Plan K work?

The only benefits Plan K does not cover are the Part B deductible, Part B excess charges, and foreign travel emergency coverage. However, Medicare Plan K will only cover 50% of the costs after Medicare for Part B coinsurance, blood, hospice coinsurance, skilled nursing facility coinsurance, and the Part A deductible. So, you and the plan will split the costs equally after Medicare pays.

What is covered under Medicare Supplement Plan K?

Plan K pays 50% of the Part B coinsurance, Part A deductible, first three pints of blood, and hospice and skilled nursing facility coinsurance. However, it will cover all Part A hospital costs after Medicare pays.

Is Plan K available in my state?

Plan K may be available to you! Availability depends on your zip code and the carriers offered in your state. Give our team a call for more information on Medicare Supplement plans available in your area.

Get Quotes for Medigap Policy K

Finding Plan K quotes is not always easy for consumers because not every Medigap insurance carrier offers it. At Boomer Benefits, we know which carriers in your state offer this policy. We can easily pull rates for you so that you don’t have to hunt through 30 carriers to find the 2 or 3 that might be selling this particular option.

Since only a few carriers offer Plan K, we can help you quickly get quotes from the companies that do offer it.

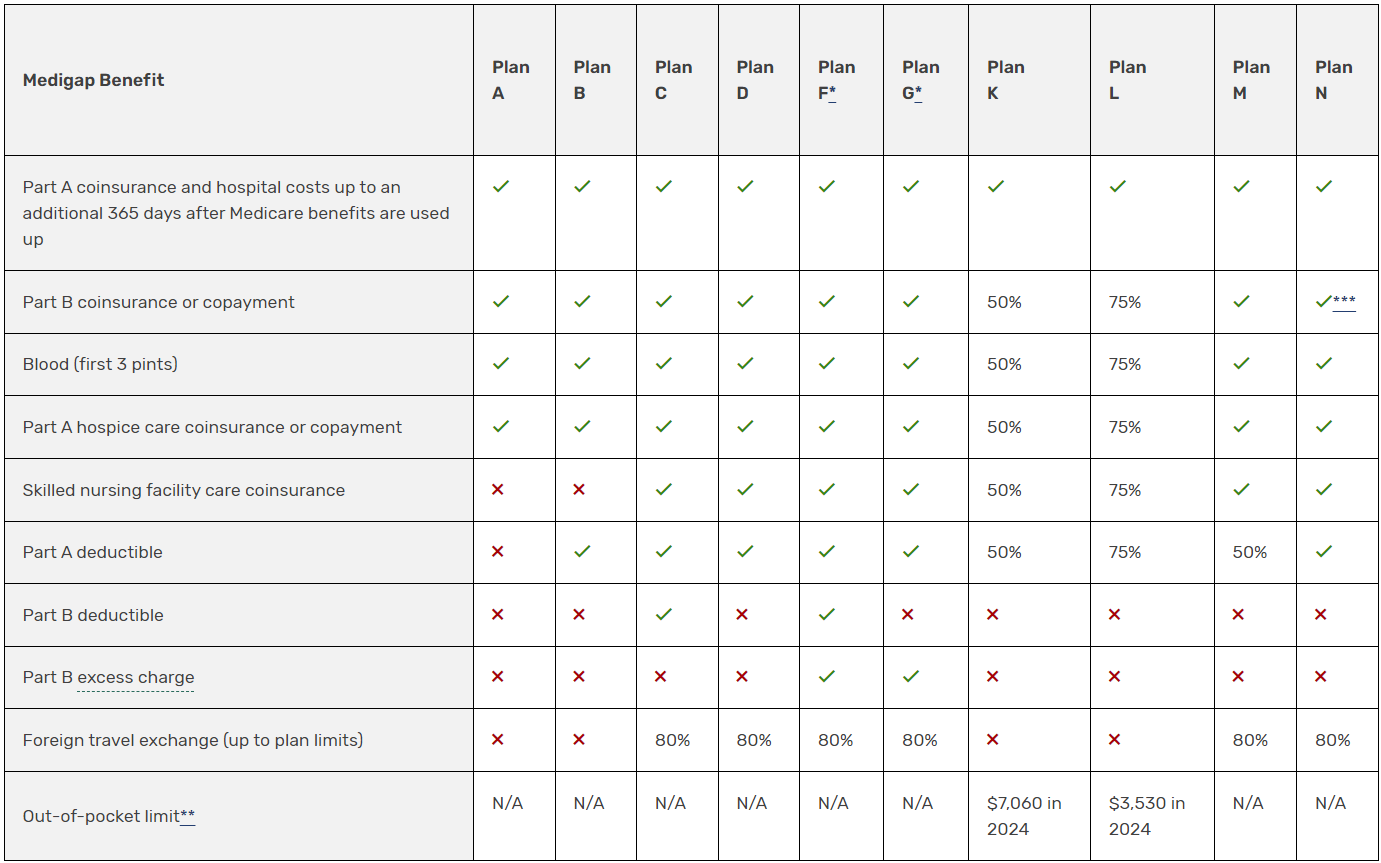

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Plan K pays 50% of the Part B coinsurance, Part A deductible, first three pints of blood, and hospice and skilled nursing facility coinsurance. However, it will cover all Part A hospital costs after Medicare pays.

Medicare Supplement Plan K offers you the same basic benefits as other Supplements, but with lower premiums. For example, this plan will still cover preventive care services and give you an extra year in the hospital. However, you split the cost-sharing with the insurance carrier on certain items like the Part A deductible. You also agree to pay the Part B deductible and any excess charges.

Medicare Plan K also includes a cap on your spending called an out-of-pocket maximum. For instance, let’s say you have a year with a lot of medical treatments. If your out-of-pocket spending reaches the maximum limit, then your Medigap K policy will kick in to pay all of the rest for that year.

How does Medicare Supplement Plan K work?

The only benefits Plan K does not cover are the Part B deductible, Part B excess charges, and foreign travel emergency coverage. However, Medicare Plan K will only cover 50% of the costs after Medicare for Part B coinsurance, blood, hospice coinsurance, skilled nursing facility coinsurance, and the Part A deductible. So, you and the plan will split the costs equally after Medicare pays.