Medigap Plan F

First-Dollar Coverage for Legacy Beneficiaries

Medigap Plan F offers the most comprehensive Medicare Supplement coverage ever created. It pays all Medicare-approved costs — leaving you with virtually no medical bills.

Important: Plan F is only available to people who became eligible for Medicare before January 1, 2020.

May River Medicare Insurance is a nationwide independent Medicare agency. We show Plan F availability and pricing by ZIP code — transparently — so you can see everything before speaking with an agent.

Plan F covers every deductible, copay, and coinsurance amount Medicare leaves behind.

See any doctor or hospital nationwide that accepts Medicare — no networks.

No surprise medical bills once your monthly premium is paid.

Plan F pays 100% of Medicare-approved expenses, including all deductibles, coinsurance, and excess charges.

- Part A hospital deductible

- Part A hospital coinsurance and extended stays

- Skilled Nursing Facility coinsurance

- Part B deductible

- Part B coinsurance (20%)

- Part B excess charges

- Hospice coinsurance/copays

- First 3 pints of blood each year

- Foreign travel emergency coverage

You may qualify for Plan F if you were eligible for Medicare (turned 65 or qualified due to disability) before January 1, 2020.

- You can keep Plan F if you already have it

- You may switch carriers (subject to underwriting)

- New Medicare beneficiaries cannot enroll in Plan F

Outside of guaranteed enrollment windows, medical underwriting may apply.

Pays everything — including the Part B deductible.

Pays everything except the Part B deductible — often lower premiums.

Check Plan F Availability in Your Area

Not sure if you qualify for Plan F? Compare eligible carriers, pricing, and alternatives by ZIP code — clearly and transparently — with May River Medicare Insurance.

Medigap Plan F Offers Great Benefits

Medigap Plan F Benefits

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers Medicare deductibles, copays, and coinsurance, leaving you with nothing out-of-pocket for Medicare-approved services.

Plan F was the top seller among Medicare beneficiaries for many years. According to a 2016 report from America’s Health Insurance Plans (AHIP), about 57% of all Medigap policies in force were Plan F policies. However, Plan F is now only available to those who became eligible for Medicare before January 1, 2020. Anyone who became eligible on or after January 1, 2020, is not eligible to sign up for Plan F.

In this case, you’ll find that Plan G is the most comprehensive Medigap plan available. Plan G has become one of the most popular Medigap plans in recent years.

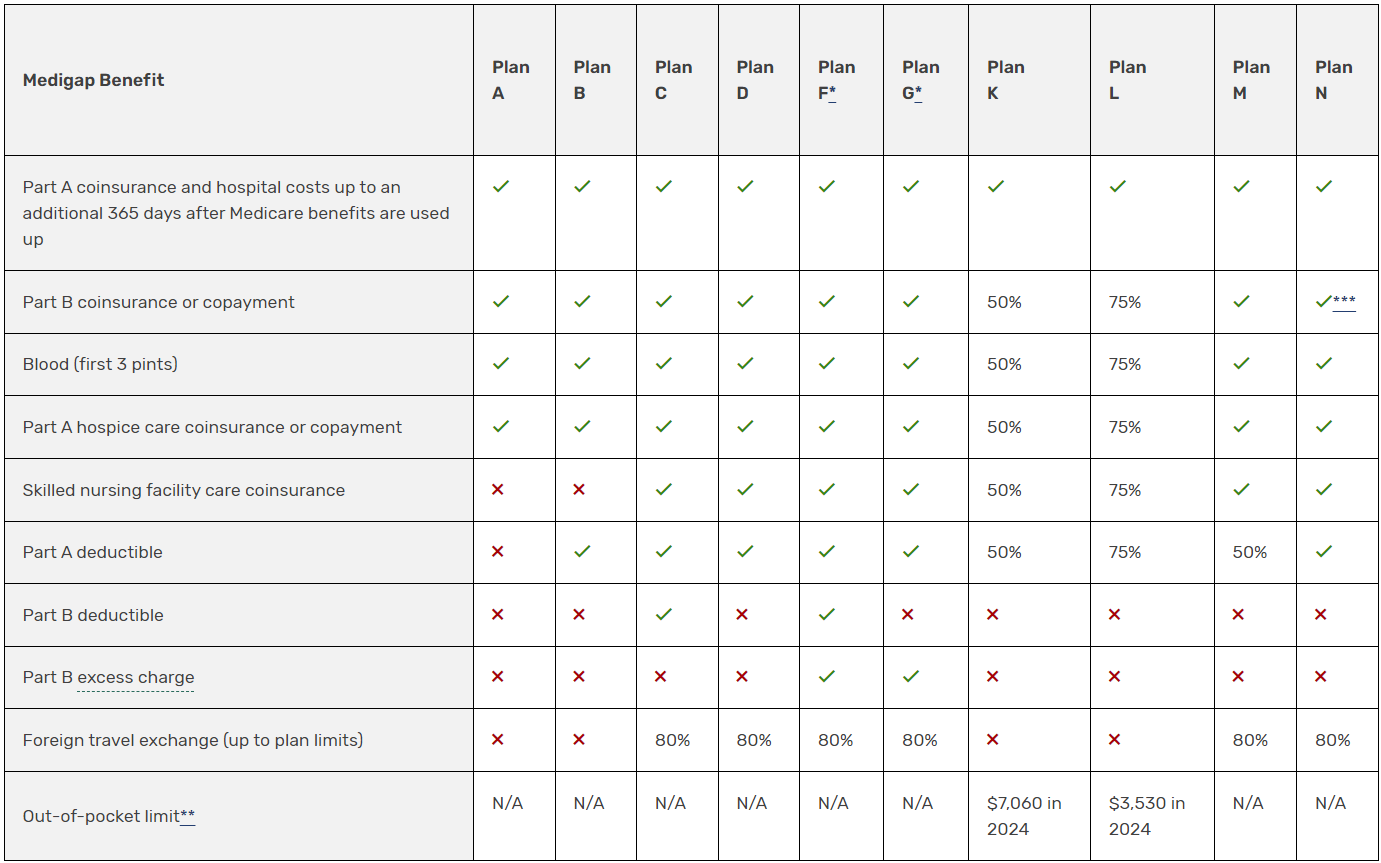

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Medicare Plan F policies are considered first-dollar coverage. After Medicare pays its share of your claims, Medigap Plan F pays the remainder, leaving you with $0 out of pocket.

- Plan F covers both your Part A hospital and your Part B outpatient deductible.

- It covers all of the 20% that Medicare Part B normally leaves you to pay.

- Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services.

- Choose and doctor in the United States that accepts Medicare insurance.

- No referrals are required! Medigap plans allow you to see any Medicare specialist whenever you like without a referral from your primary care doctor. However, some offices still may require a referral.

- You have guaranteed renewable coverage. Your policy cannot be canceled due to health conditions or the number of claims you file.

For example, if you have no Supplement, you would owe a $1,632 deductible (Part A deductible in 2024) when you go to the hospital. You would also pay 20% for expensive procedures like surgery because Part B only pays 80%.

If you had a Medigap F policy, though, all of these would be paid for by your insurance.

You might be surprised to learn that many solid insurance companies with good financial ratings offer rates lower than the big brand-name carriers.

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers Medicare deductibles, copays, and coinsurance, leaving you with nothing out-of-pocket for Medicare-approved services.

Plan F was the top seller among Medicare beneficiaries for many years. According to a 2016 report from America’s Health Insurance Plans (AHIP), about 57% of all Medigap policies in force were Plan F policies. However, Plan F is now only available to those who became eligible for Medicare before January 1, 2020. Anyone who became eligible on or after January 1, 2020, is not eligible to sign up for Plan F.

In this case, you’ll find that Plan G is the most comprehensive Medigap plan available. Plan G has become one of the most popular Medigap plans in recent years.