May River Medicare Insurance helps you compare all Advantage options and enroll in a plan that fits your health, doctors, and budget.

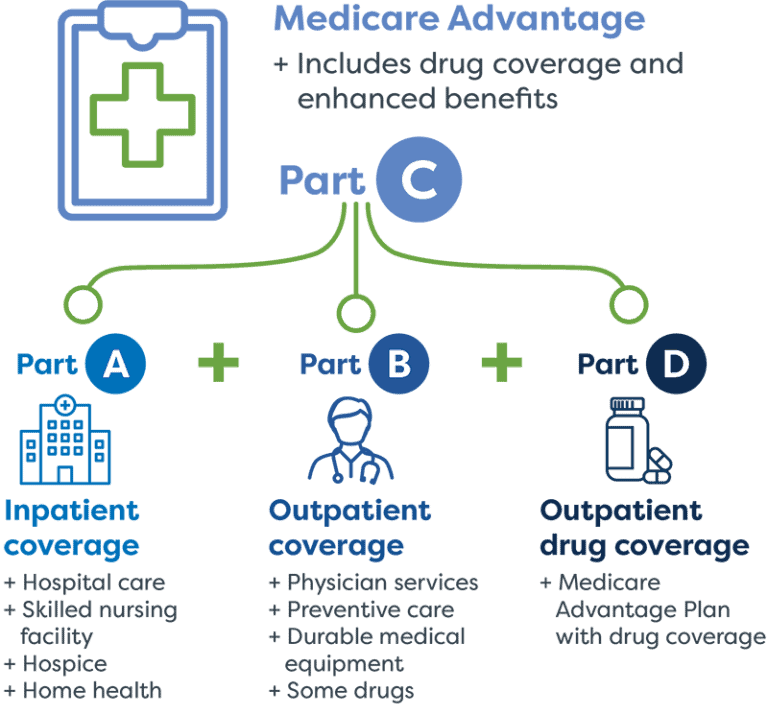

- Combines Medicare Parts A & B—hospital and medical coverage

- Most plans include Part D (prescription drugs)

- Extra benefits: dental, vision, hearing, wellness, OTC, transportation, fitness, and more

- All-in-one, convenient coverage—one ID card, one insurer

- Annual out-of-pocket maximum for covered services

- Usually HMO or PPO network—lower costs in-network

- Pay copays for most services, not the 20% coinsurance of Original Medicare

- Premiums and benefits vary by plan, county, and carrier

- Still must pay your Medicare Part B premium

Call (843) 227-6725 or book a free plan review online.

Our advisors compare every plan—so you get the right fit, every year.

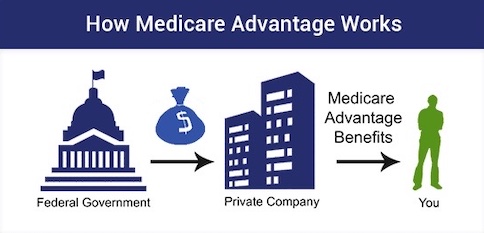

Yes, Advantage plans are offered by private companies approved by Medicare.

Yes, you can switch between Advantage and Original Medicare during certain periods each year.

Most do, but some do not. We’ll help you check before you enroll.

Yes—Advantage plans cannot deny coverage based on health history.

We compare every plan, check your doctors and drugs, and handle enrollment—at no cost.

Call (843) 227-6725 or book your Medicare Advantage review now.

Real answers from Real people.

Find a Medicare Advantage plan in 3 simple steps.

Key Points

1. When you enroll in an Advantage plan (Medicare Part C), you agree to receive your Medicare benefits through that private plan instead of through Original Medicare.

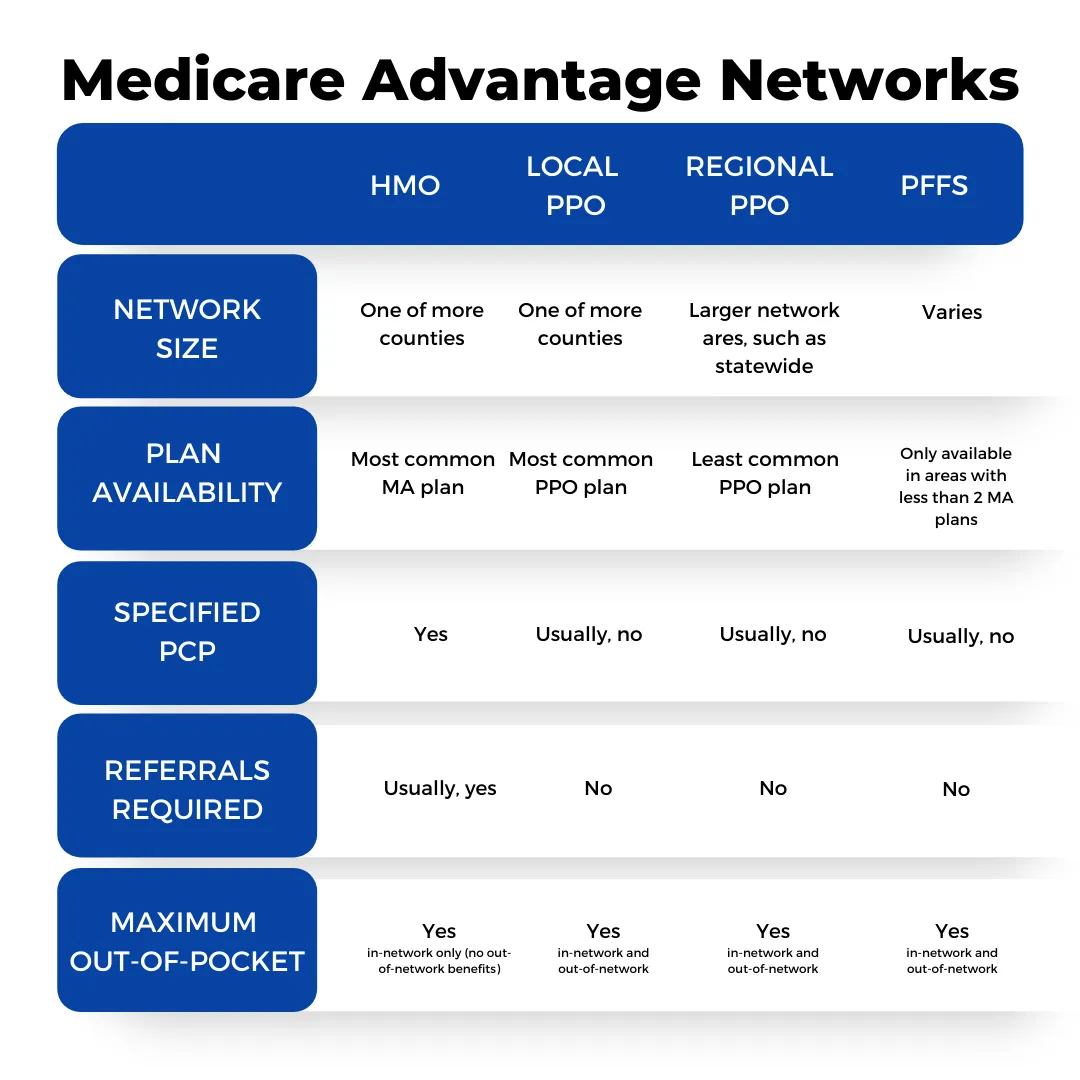

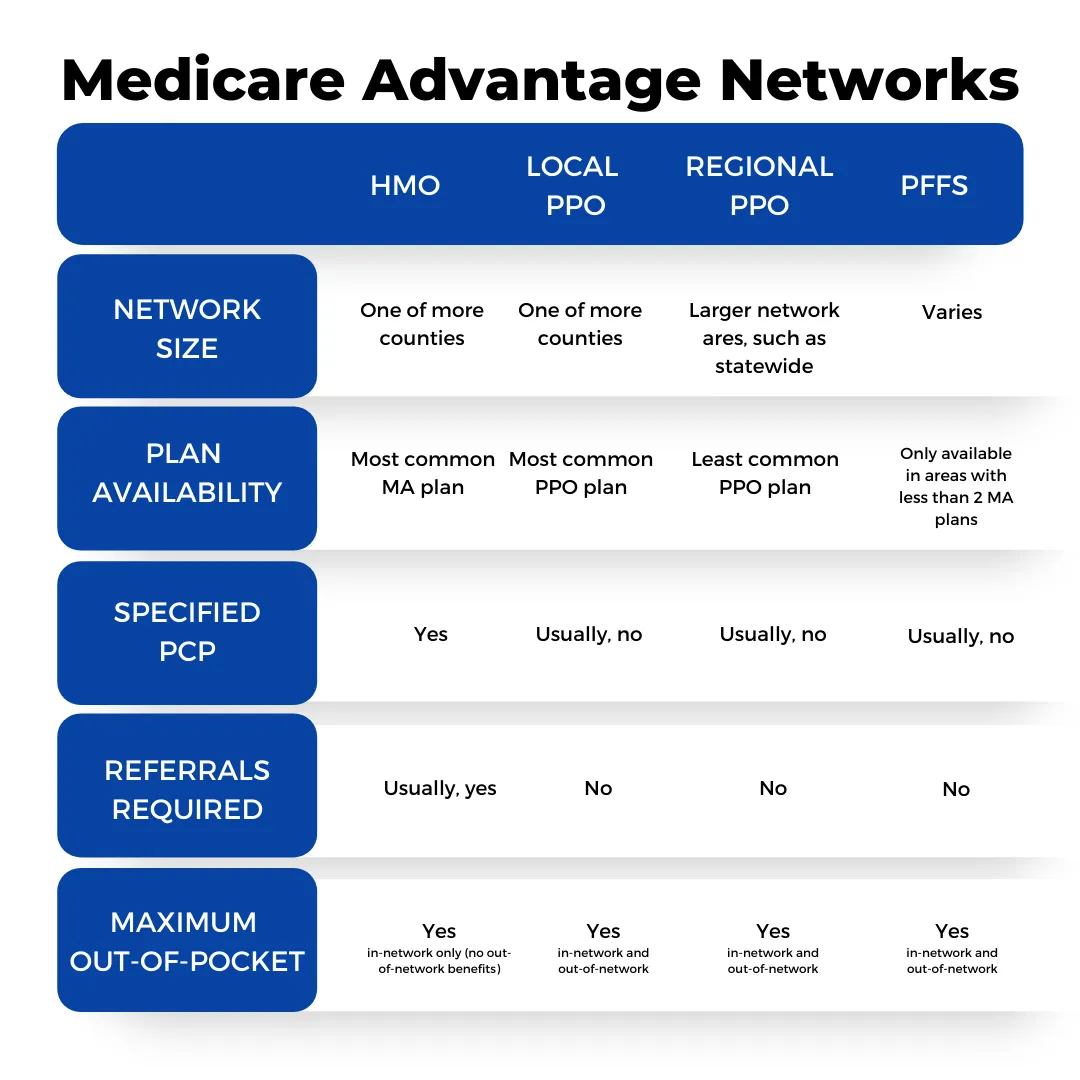

2. Advantage plans operate within network areas, some of which can be more strict or lenient, depending on the type of Advantage plan.

3. There are different times to enroll in an Advantage plan throughout the year, including your Initial Enrollment period, the Annual Election period, and more1.

What are Medicare Advantage Plans

???? What Is Medicare Advantage?

Medicare Advantage (also known as Medicare Part C) is an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and are required to provide at least the same coverage as Part A (Hospital Insurance) and Part B (Medical Insurance). Many plans offer extra benefits you don’t get with Original Medicare.

✅ Key Features of Medicare Advantage Plans:

- Includes Part A and Part B

- Most plans include prescription drug coverage (Part D)

- May include extra benefits like:

- Vision, dental, and hearing coverage

- Over-the-counter (OTC) allowances

- Transportation to medical appointments

- Fitness memberships (e.g., SilverSneakers®)

- Low or $0 monthly premiums in many areas

- Annual maximum out-of-pocket cost protection

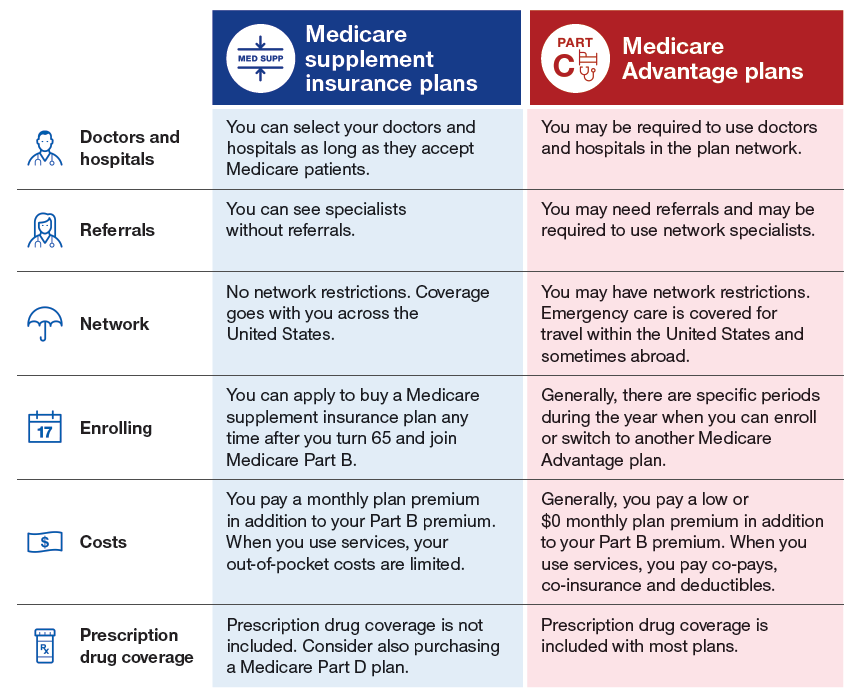

???? Medicare Advantage vs. Original Medicare

FeatureOriginal MedicareMedicare AdvantageProvider ChoiceAny doctor that accepts MedicareOften a local network (HMO or PPO)Drug CoverageRequires separate Part D planUsually includedExtra BenefitsLimited or noneOften includedOut-of-Pocket MaximumNo limitYes, annual limit on costsReferrals Needed?Not usuallyOften required with HMOs

???? Choosing the Right Plan

Every Medicare Advantage plan is different, so it’s important to compare:

- Monthly premiums

- Out-of-pocket costs

- Drug formularies (covered medications)

- Doctor & hospital networks

- Extra benefits important to you

???? Need Help Understanding Your Options?

Our licensed Medicare agents can help you:

- Compare plans in your area

- Confirm your doctors and prescriptions are covered

- Review benefits that meet your needs and budget

- Enroll at no cost to you

???? Call us today at (843) 227-6725

or

???? Schedule a free consultation with a licensed agent

Medicare Advantage Plans

???? Understanding Medicare Advantage Plan Benefits

Every Medicare Advantage plan comes with its own Summary of Benefits, which outlines what you’ll pay for various healthcare services — from routine doctor visits to hospital stays and diagnostic testing.

For example, a typical plan might include:

- $5 copay for a visit to your primary care doctor

- $40–$60 copay for a specialist visit

- Higher copays for services like MRI scans, surgeries, or inpatient hospital stays

It’s common to pay several hundred dollars in copays over the course of a year, depending on your usage. However, these costs vary widely by state and even county, so it’s essential to review plan details specific to your area.

???? Medicare Advantage Plans Offer Extra Benefits

Most Medicare Advantage plans include additional perks that Original Medicare doesn’t cover, such as:

- Dental, vision, and hearing care

- Over-the-counter (OTC) item allowances

- Gym memberships (like SilverSneakers®)

- Transportation assistance and more

At May River Medicare, our experts can help you compare these ancillary benefits between carriers — including sending you a quick link to preview a plan’s dental or vision provider network.

???? What’s the “Best” Medicare Advantage Plan?

We get this question all the time — and the truth is, the best plan depends on you.

Choosing a plan based on a friend or relative’s recommendation (like “Uncle Eddie’s favorite plan”) can backfire. Many new clients come to us after finding out too late that:

- Their doctor isn’t in-network

- Their prescriptions aren’t covered by the plan’s drug formulary

Don’t gamble with your health coverage. Let our licensed Medicare agents walk you through the plans available in your area, ensuring your doctors and medications are covered and that you understand all the benefits and costs.

???? Call May River Medicare today at (843) 227-6725

or

???? Schedule a free consultation online

Basic Medicare Advantage Rules

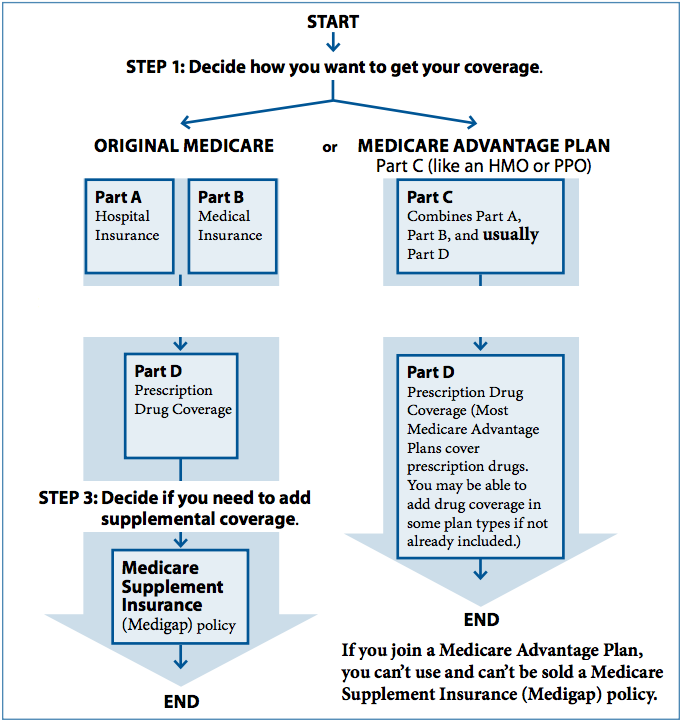

???? Before You Enroll: Medicare Advantage vs. Medigap

If you’re considering Medicare Advantage or Medigap (Medicare Supplement) , it’s important to understand the basic rules before enrolling.

To join a Medicare Advantage plan, you must:

- Be enrolled in both Medicare Part A and Part B

- Live within the plan’s service area

⚠️ Important: Some people mistakenly believe they can drop Part B after joining a Medicare Advantage plan — this is incorrect. If you drop your Part B coverage while enrolled in a Medicare Advantage plan, you will be immediately disenrolled from that plan.

???? Ready to Get Started?

Complete our secure Preliminary Medicare Application to begin the process:

???? Click here to fill out the form

Once submitted, one of our licensed agents will review your information and contact you to go over your plan options.

???? Or call us anytime at (843) 227-6725 for personalized assistance.

???? Understanding Medicare Advantage Networks & Billing

To get the lowest out-of-pocket costs with a Medicare Advantage plan, it’s important to use in-network doctors, hospitals, and facilities . Most plans are built around either HMO or PPO networks:

- HMO (Health Maintenance Organization) plans typically do not cover any care received outside the network, except in emergencies.

- PPO (Preferred Provider Organization) plans offer more flexibility, but seeing out-of-network providers will cost you more .

Additionally, Medicare Advantage plans often require:

- Referrals from your primary care doctor before seeing a specialist (especially in HMO plans)

- Prior authorization for certain procedures, tests, or services

???? Protect Your Medicare Card & Understand How Billing Works

Once you enroll in a Medicare Advantage plan, your red, white, and blue Medicare card should be stored in a safe place — do not present it to providers.

Why? Because:

- Original Medicare is no longer your primary insurance

- Your care is now handled by your Medicare Advantage insurance company

- Providers must bill your plan, not Medicare directly — otherwise, the claims will be denied

By enrolling in a Medicare Advantage plan, you are choosing to receive your Medicare-covered services through the plan for the rest of the calendar year , instead of through Original Medicare.

???? Want to Learn More?

Watch our video on the Pros and Cons of Medicare Advantage Plans

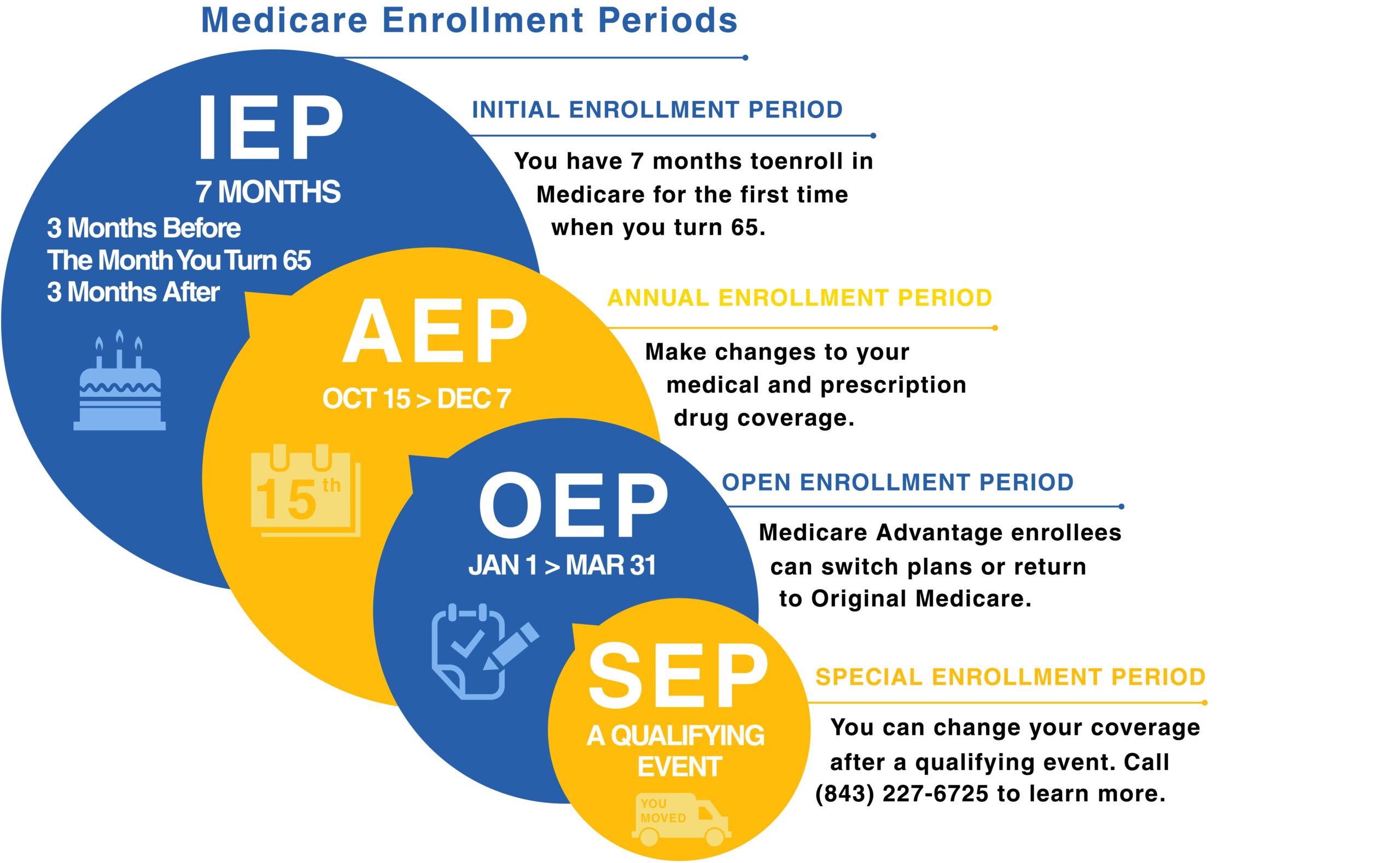

Medicare Advantage Enrollment Periods

???? Medicare Advantage Enrollment Periods: What You Need to Know

Medicare Advantage plans come with lock-in rules, meaning you can only enroll or make changes during specific times of the year.

You’re first eligible to join a Medicare Advantage plan during your Initial Enrollment Period (IEP) — this is the 7-month window around your 65th birthday.

After that, you can only enroll, switch, or disenroll during designated periods, such as:

- The Annual Enrollment Period (AEP): October 15 – December 7

- The Medicare Advantage Open Enrollment Period: January 1 – March 31 (for people already enrolled in a Medicare Advantage plan)

Once you join a Medicare Advantage plan, you are typically committed for the rest of the calendar year. You can only leave or change your plan mid-year if you qualify for a Special Enrollment Period (SEP) due to specific circumstances (like moving to a new service area or losing other coverage).

???? Annual Election Period (AEP): Your Opportunity to Make Changes

The Annual Election Period (AEP) is the primary window each year to review and change your Medicare Advantage plan. This period runs from October 15 to December 7.

During AEP, you can:

- Switch Medicare Advantage plans

- Enroll in a new plan

- Drop your Medicare Advantage plan and return to Original Medicare

Any changes you make will take effect on January 1 of the following year.

⚠️ Important:

If you choose to leave your Medicare Advantage Prescription Drug (MAPD) plan and go back to

Original Medicare, you must notify your Medicare Advantage insurance carrier. If you don’t, Medicare will continue to list you as enrolled in the Advantage plan, and you may experience delays or coverage issues.

???? Medicare Advantage Open Enrollment Period: A Second Chance to Make Changes

Every year, many people enroll in a Medicare Advantage plan during the Annual Election Period (October 15 – December 7) without fully understanding how these plans work. Some don’t consult with a licensed agent or review key details like provider networks and drug formularies.

As a result, it’s common for people to realize — often in January — that:

- Their doctor is not in the plan’s network

- One or more of their prescriptions are not covered

- They’re unhappy with their coverage or out-of-pocket costs

To address this, Congress created the Medicare Advantage Open Enrollment Period (MA-OEP), which runs from January 1 to March 31 each year.

???? Medicare Advantage Open Enrollment Period (January 1 – March 31)

To help individuals who regret their Medicare Advantage choice after the Annual Election Period, Congress created the Medicare Advantage Open Enrollment Period , which runs each year from January 1 to March 31.

During this limited window, you can:

- Disenroll from your current Medicare Advantage plan and return to Original Medicare

- Enroll in a standalone Part D prescription drug plan

- OR switch to a different Medicare Advantage plan

⚠️ Note: You can only use this enrollment period once per calendar year , so it’s important to make informed decisions.

???? Thinking About Returning to a Medigap Plan?

If you’re considering leaving Medicare Advantage and going back to Original Medicare with a Medigap (Medicare Supplement) plan, be aware of the following:

- You are not guaranteed acceptance into a Medigap plan unless:

- This is your first time ever joining a Medicare Advantage plan

- You qualify for a guaranteed issue right

- Otherwise, you will likely need to pass medical underwriting, which includes answering health questions — and your application may be denied based on your health.

???? Very important:

If you’re planning to return to Original Medicare with a Medigap plan

, get approved for the Medigap policy first before enrolling in a standalone Part D drug plan. Enrolling in Part D signals to Medicare that you’re leaving Medicare Advantage, and it could lock you out of Medigap if you’re not already approved.

???? Watch the Video Below

Learn more about how the Medicare Advantage Open Enrollment Period

gives you one last chance each year to make a plan change.

Medicare vs Medicare Advantage

???? Why Medicare Advantage Plans Were Created

Congress created Medicare Advantage plans to give beneficiaries more choice and flexibility in how they receive their Medicare benefits.

Many people choose Medicare Advantage for several key reasons:

???? Lower Monthly Premiums

Most Medicare Advantage plans offer low or even $0 monthly premiums — though you must still pay your standard Medicare Part B premium. Instead of paying upfront like with Medigap, you pay for services as you use them through copays and coinsurance.

????️ Financial Protection

Unlike Original Medicare, Advantage plans come with an annual out-of-pocket maximum, which helps protect you from catastrophic medical expenses.

???? All-in-One Coverage

Many Medicare Advantage plans combine medical coverage and prescription drug coverage into a single plan — these are known as MAPDs (Medicare Advantage Prescription Drug plans).

???? Additional Benefits

Some plans include limited coverage for extra services, such as:

- Vision

- Dental

- Hearing

- Fitness memberships

⚠️ Note: These extra benefits often come with limitations, copayments, or prior authorization requirements , so it’s important to review the plan details carefully.

???? Medicare Supplement (Medigap) vs. Medicare Advantage: Which Is Right for You?

When choosing between Original Medicare with a Medigap plan and a Medicare Advantage plan , it’s important to understand how each option works — and which best fits your healthcare needs and lifestyle.

✔️ Medicare Supplement (Medigap) + Original Medicare

Medigap plans work alongside Original Medicare (Part A and Part B) to help cover the costs that Medicare doesn’t pay — like deductibles, coinsurance, and copays.

Key advantages:

- Freedom to see any doctor who accepts Medicare — no need to ask if they’re in-network with your insurance company

- Nationwide coverage with access to over 1 million Medicare-contracted providers

- Plans like Medigap Plan G cover nearly all out-of-pocket costs, giving you predictable, comprehensive coverage

- No referral requirements and no network restrictions

Keep in mind:

- Medigap plans do not include prescription drug coverage, so you’ll need to enroll in a separate Part D plan

- They also don’t cover routine dental, vision, or hearing, though you can often add standalone plans for these services

- Monthly premiums are typically higher than Advantage plans, but you pay very little when you use the coverage

✔️ Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurers and include your Medicare Part A and B benefits — often bundled with Part D drug coverage and extra perks like dental, vision, or gym memberships.

Key advantages:

- Many plans offer low or $0 monthly premiums

- All-in-one coverage: medical, drug, and sometimes dental/vision in a single plan

- Annual out-of-pocket maximum to protect you from high medical costs

Things to consider:

- Most plans require you to use network doctors and hospitals (HMO or PPO)

- You may need referrals and prior authorizations for certain services

- Copays and coinsurance can add up, especially if you use the plan often

???? The Bottom Line

There’s no one-size-fits-all answer — both options have their advantages.

Choose the plan that best fits your:

- Health needs

- Budget

- Doctor preferences

- Travel habits

???? Need help deciding? Contact May River Medicare at (843) 227-6725

or

???? Schedule your free consultation

Watch The Below Video on Advantage Plans vs Medicare Supplements

Other Medicare Advantage Things to Consider

⚠️ Things to Consider Before Enrolling in a Medicare Advantage Plan

Before joining a Medicare Advantage plan, it’s important to understand how these plans work and whether they fit your personal needs. Here are the key factors to weigh before enrolling:

???? Not All Doctors and Hospitals Are In-Network

Unlike Original Medicare, not every provider accepts Medicare Advantage plans. Always ask your agent to help you verify that your preferred doctors, hospitals, and specialists are in the plan’s network before you enroll.

???? Plan Benefits Can Change Each Year

Medicare Advantage plans are renewed annually, and plan details can change from year to year.

Each

September, your plan will send you an Annual Notice of Change outlining updates for the upcoming year. Changes may include:

- Provider network

- Drug formulary

- Pharmacy access

- Copays and coinsurance

- Monthly premium

These changes take effect January 1, so it’s your responsibility to review this information carefully. Will you be proactive about reviewing your plan and contacting your agent if something important has changed?

???? Enrollment Is for the Full Calendar Year

Once enrolled in a Medicare Advantage plan, you’re generally locked into the plan for the entire year.

If you decide in April that the plan isn’t meeting your needs, you

must wait until the next Annual Election Period (October 15 – December 7) to make a change —

unless you qualify for a Special Enrollment Period (e.g., moving, loss of coverage, or other life events).

???? Be Cautious About Leaving Medigap Too Soon

If you enroll in a Medicare Advantage plan right when you turn 65, make sure you’re comfortable with it

long term.

Your guaranteed right to get a Medigap plan without medical underwriting only lasts

6 months from your Part B effective date. After that, if you try to return to a Medigap plan, you may:

- Be required to answer health questions

- Be denied coverage if you have pre-existing conditions

Don’t give up your Medigap rights without understanding the long-term impact.

???? Basic Medicare Advantage Rules

- You must be enrolled in both Medicare Parts A and B to join a Medicare Advantage plan — even if the plan has a $0 premium.

- You’ll continue to pay your Part B premium to Medicare each month, even if your Advantage plan doesn’t charge a separate premium.

???? Are Medicare Advantage Plans Really Free?

No — they are not free.

Some Medicare Advantage plans advertise $0 premiums

, but this only means:

- You don’t pay a monthly premium to the plan

- You still pay your Part B premium

- You’ll pay copays, deductibles, and coinsurance as you use services

Medicare pays the insurance company a monthly amount to take on your medical risk, which is why some plans offer low or no premiums.

???? What Is a MAPD Plan?

A MAPD is a Medicare Advantage Prescription Drug plan — it combines:

- Medical coverage (Parts A & B)

- Prescription drug coverage (Part D)

Plans that don’t include drug coverage are simply called MA plans

.

MA-only plans can be a great fit for Veterans who get prescription coverage through the VA

.

❓ What’s the Best Medicare Advantage Plan?

There’s no “one-size-fits-all” plan. The best option for you depends on:

- Your medications

- Your doctors and preferred providers

- Your budget

- Your travel habits

- Your need for extra benefits like dental or vision

What works for a friend or neighbor might not be right for you. Don’t take chances with your health coverage — get personalized help from a licensed Medicare agent.

???? Call May River Medicare today at (843) 227-6725

???? Or

schedule a consultation online

✅ Key Takeaways

- You still pay your Part B premium even with a $0-premium Medicare Advantage plan.

- Most Advantage plans include built-in Part D drug coverage.

- These plans operate very differently from Original Medicare + Medigap.

- Make sure you fully understand how Medicare Advantage works before enrolling.

???? Ready to Compare Plans?

Click the button below to access our Medicare Advantage Quote Tool. You can:

- Compare costs, benefits, networks, and drug coverage

- Download the Summary of Benefits

- Make an informed decision at your own pace