Affordable Care Act (ACA) Insurance for Under 64 Years of Age

The comprehensive health reform law was enacted in March 2010

The law has 3 primary goals:

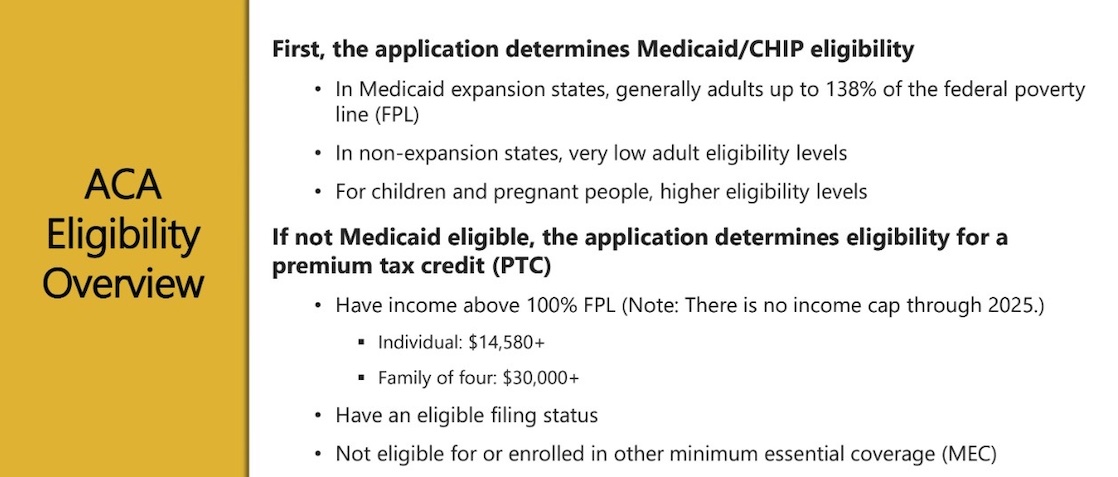

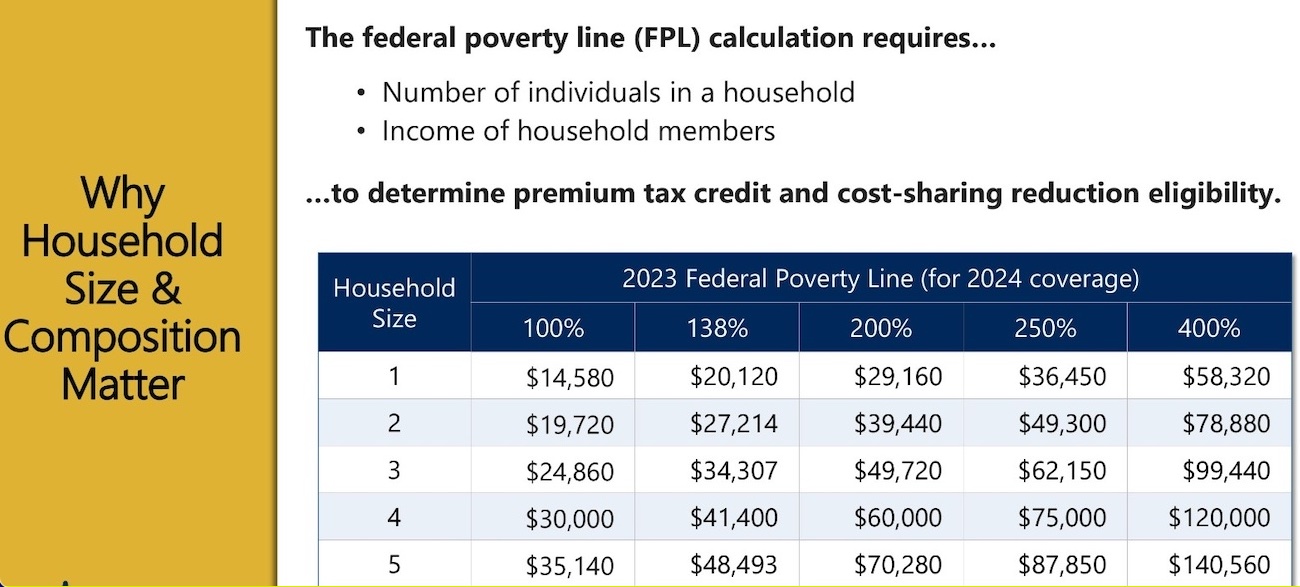

Make affordable health insurance available to more people. The law provides consumers with subsidies (the “premium tax credit”) that lowers cost for households with incomes 100% and 400% of the federal poverty level (FPL).

- If your income is above 400% FPL, you may qualify for the premium tax credit.

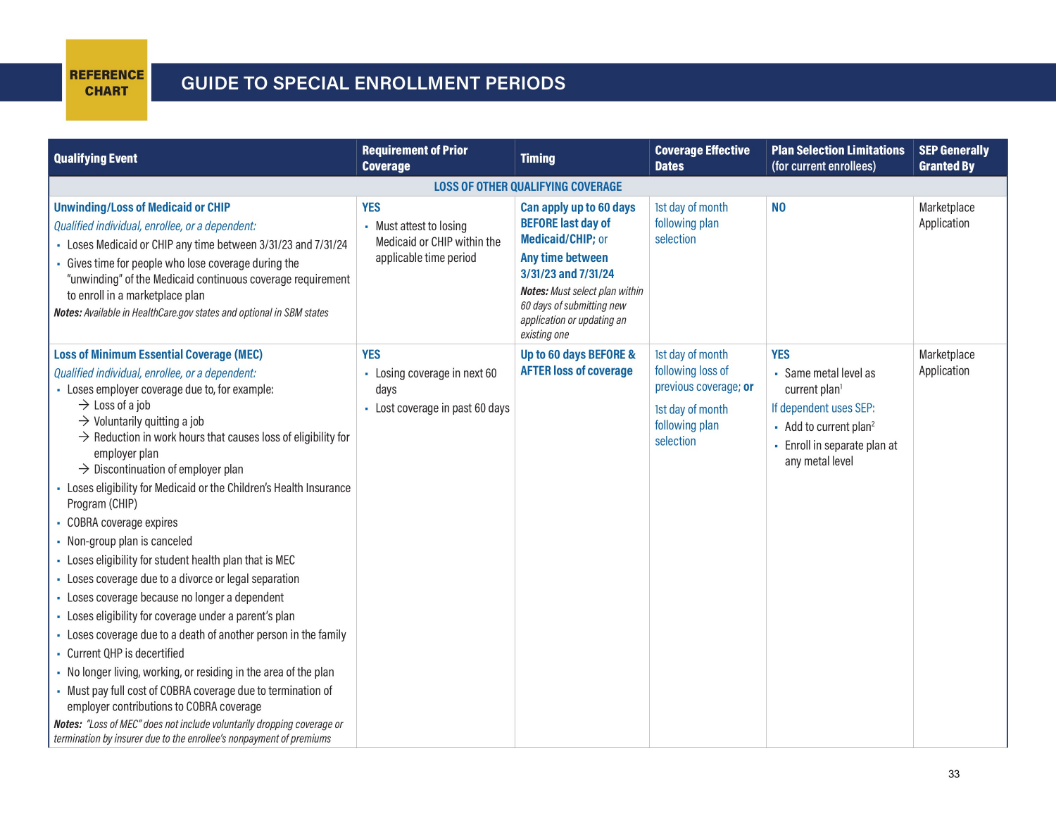

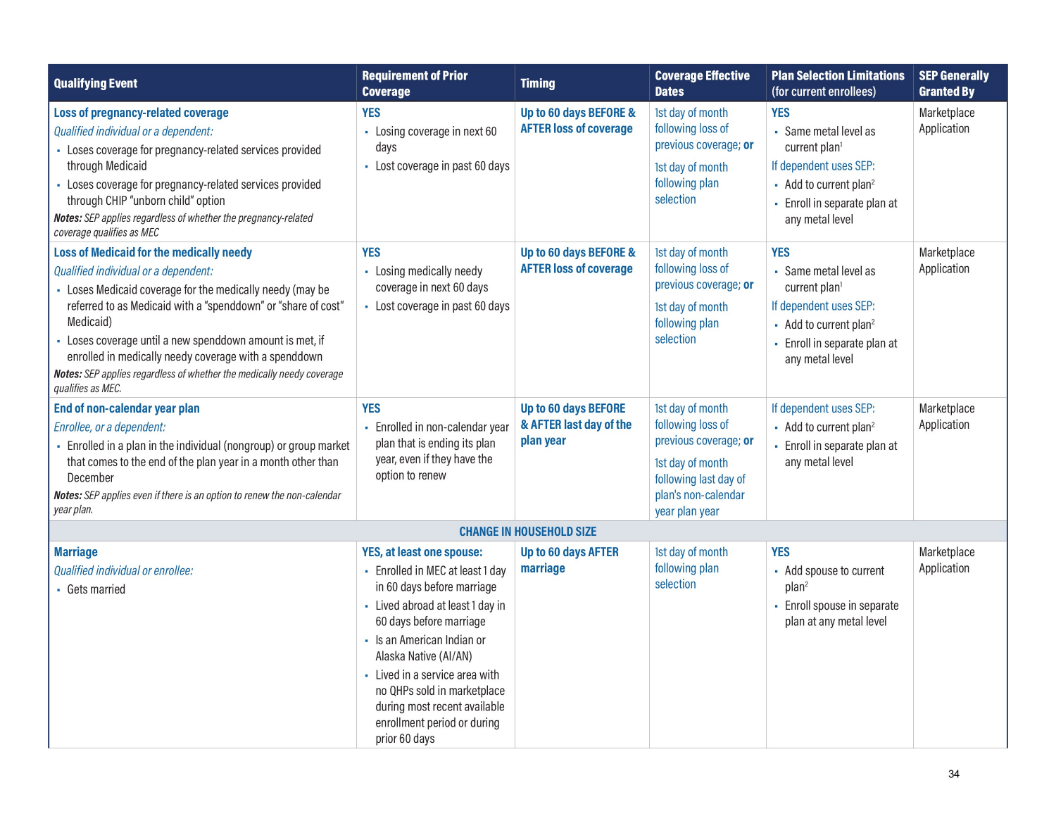

- If your income is at or below 150% FPL, you may qualify to enroll in or change Marketplace coverage through a Special

- Enrollment Period.

Expand Medicaid to cover all adults with income below 138% of the FPL. (Not all states have expanded their Medicaid programs.)

Support innovative medical care delivery methods designed to lower costs of healthcare generally.

Rights & protections

How the health care law protects you

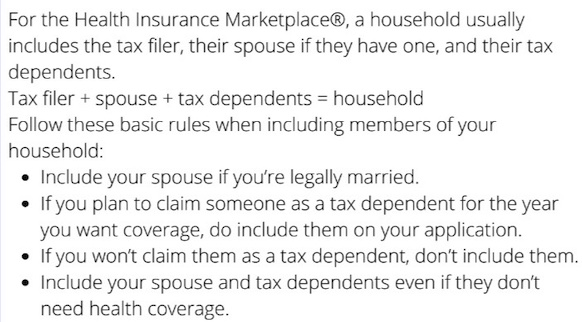

Why Household Size and Income Matter

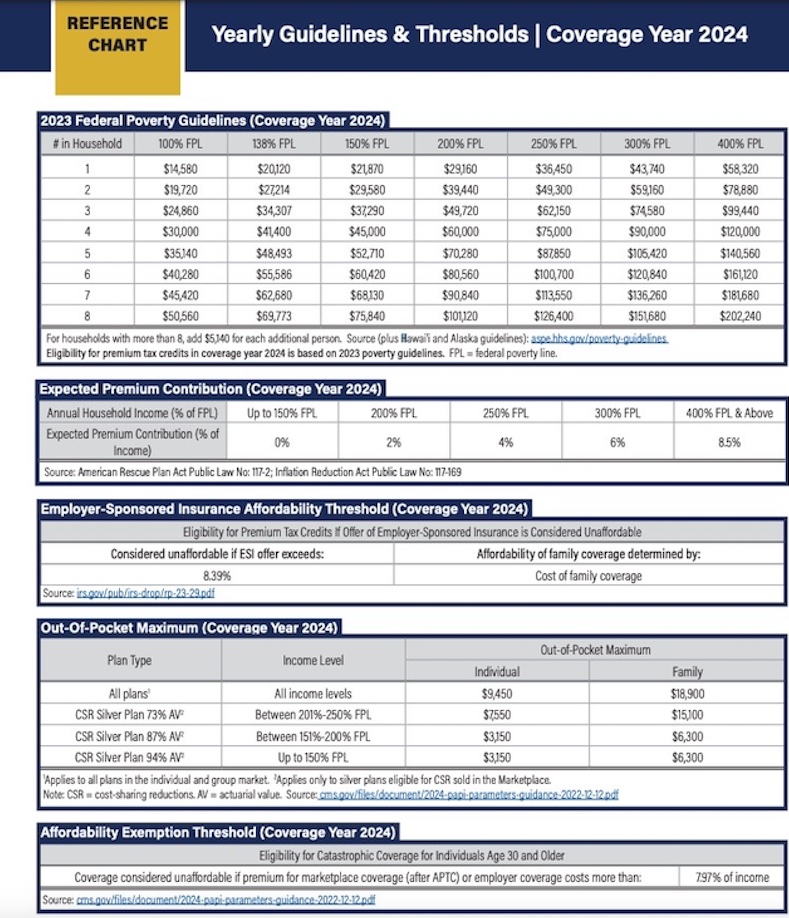

Below are Yearly Guidelines & Thresholds Reference Guide

Annual updated FPL levels for current and prior year

Expected premium contributions

Employer coverage affordability threshold

Out-of-Pocket maximums, including for CSR plans

Tax filing thresholds

Repayment caps for APTC

Click on Image Below to See Presentation

on Determining Household Size and Income

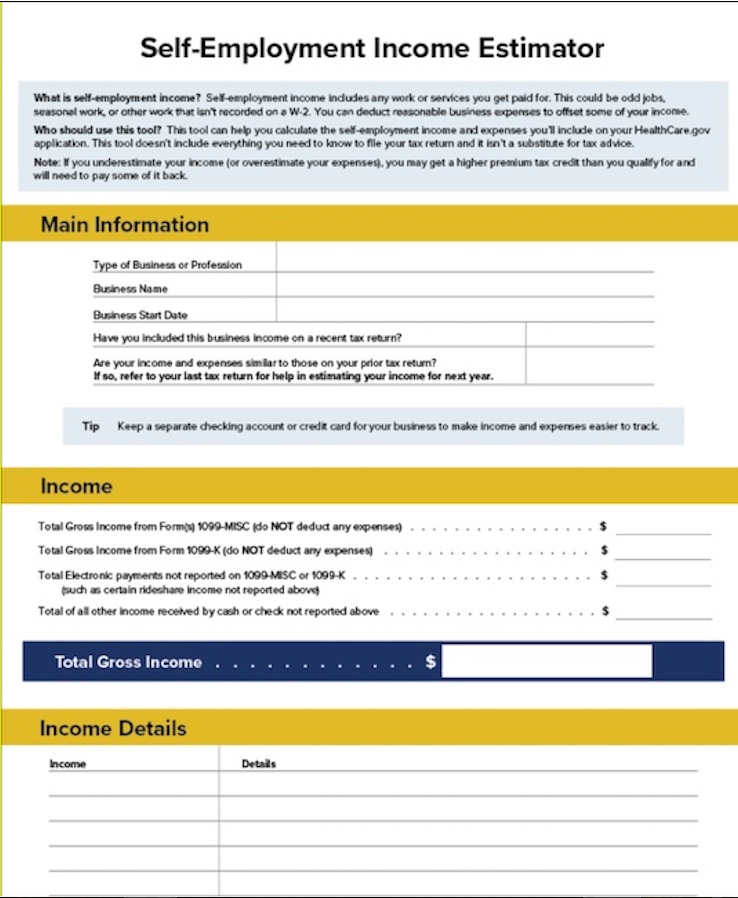

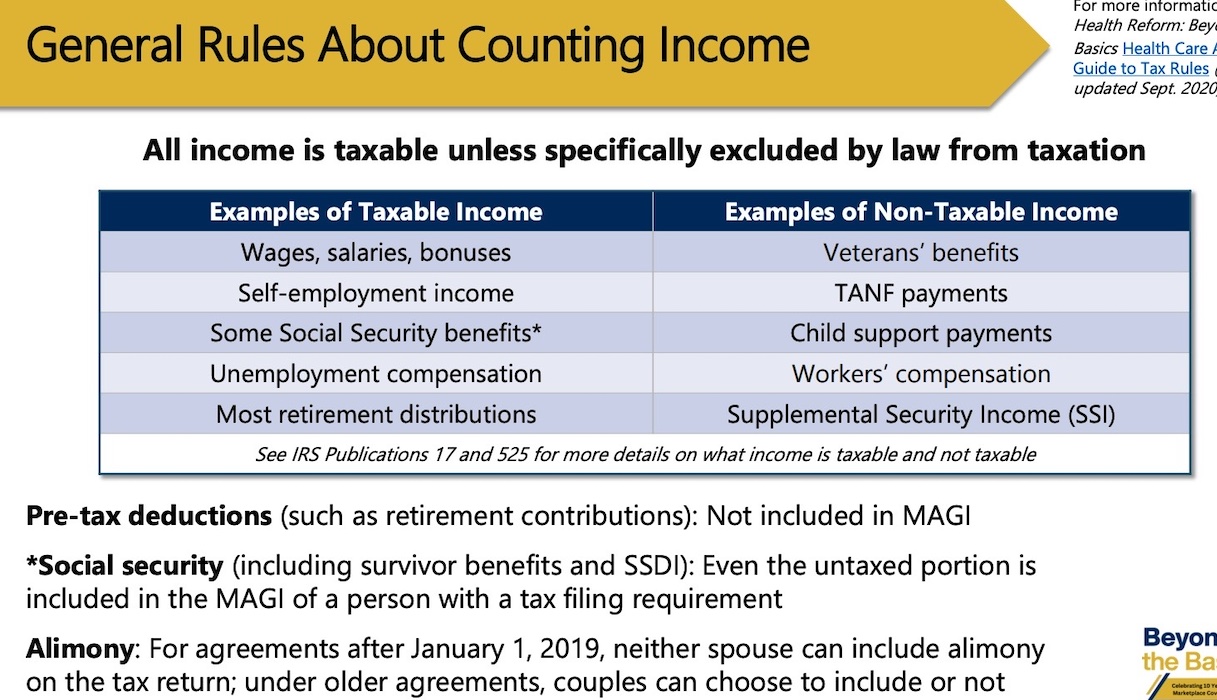

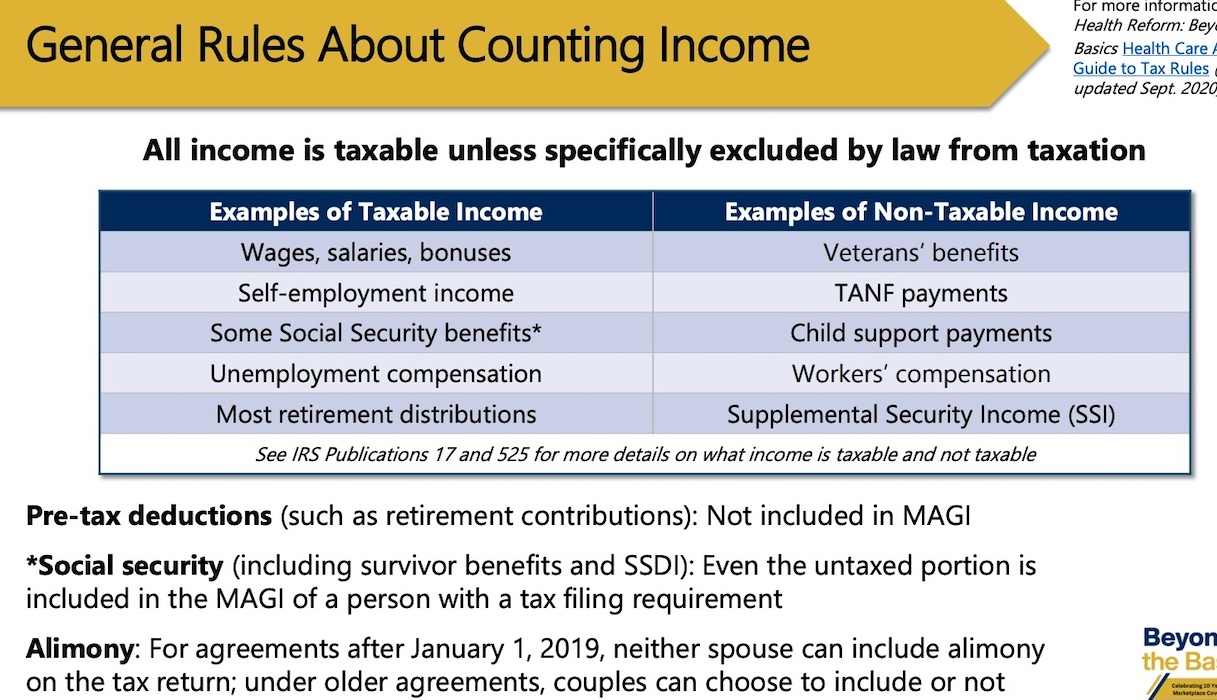

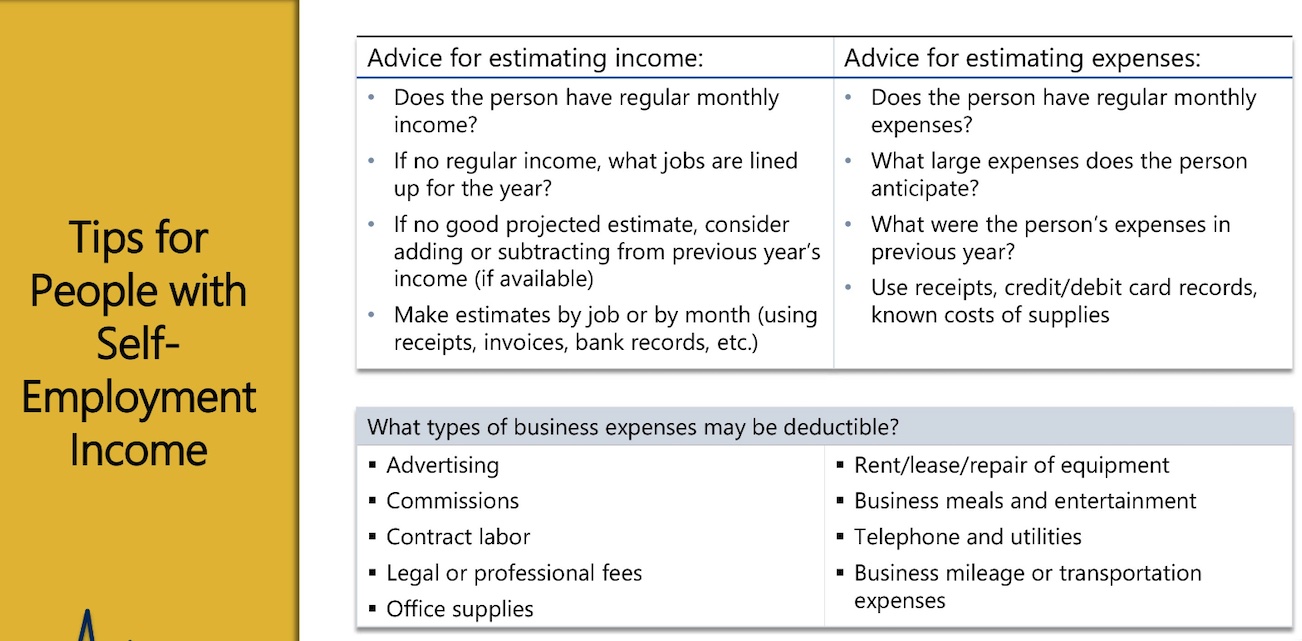

What Income is Counted?

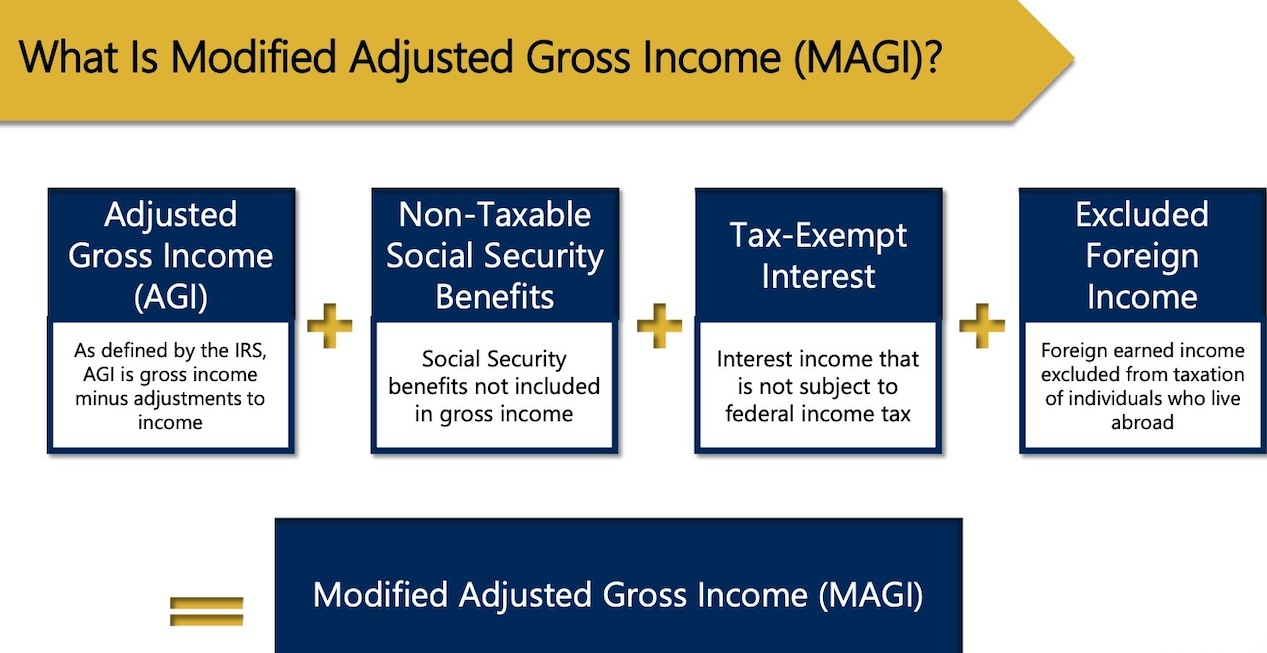

The Marketplace uses an income number called modified adjusted gross income (MAGI) to determine eligibility for savings. It’s not a line on your tax return.

See what’s included in MAGI and how to estimate it.

Your MAGI is the total of the following for each member of your household who’s required to file a tax return.

Resources

Reference Guide: Yearly Guidelines and Thresholds Coverage Year 2024

Reference Guide: Medicaid Household Rules

Guide: Health Assister’s Guide to Tax Rules

Key Facts:

Determining Households for Medicaid and CHIP

Determining Households for PTC

Income Definitions for Marketplace and Medicaid Coverage

Direct Link for 2023 Plan Comparision tool State-Based Exchanges