Plan G vs. Plan N: The Best Medicare Supplement Plan

Medigap Plan G| Medigap Plan N|How to Choose| FAQs

Key Points

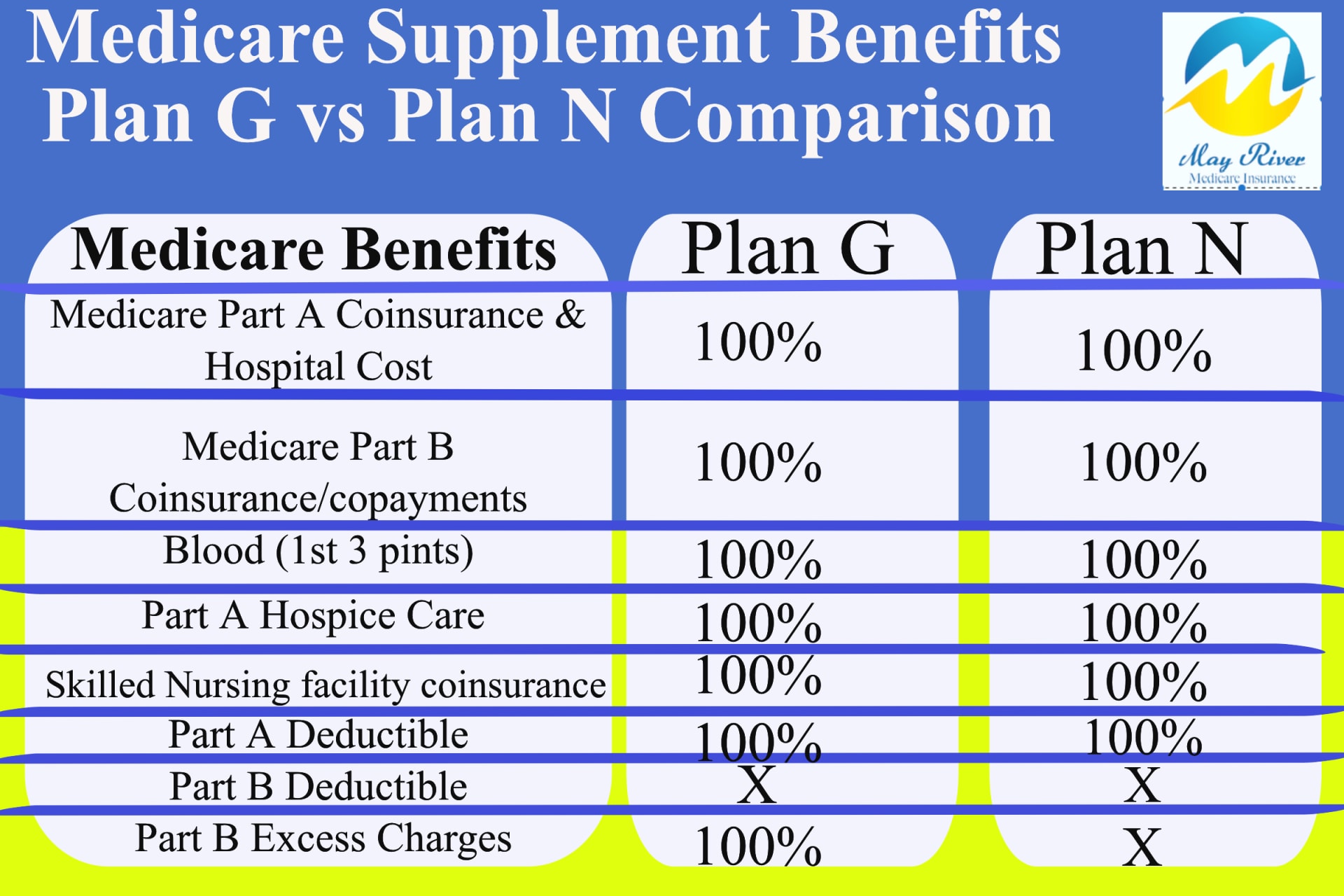

When comparing Medigap Plan G vs Plan N, they both offer substantial coverage benefits, but there are more out-of-pocket costs when enrolled in Plan N.

Plan G typically has higher premiums than Plan N, so you want to decide whether you want higher monthly premiums or if you prefer to reduce monthly premiums bit with copayments for certain doctor and emergency room visits.

With Plan G, Part B excess charges are fully covered, but with Plan N, you could be responsible for an additional 15% if you see a provider who charges more than the Medicare-approved amount.

Keep in mind only 2-3 percent of all doctors can charge excess charges.

How To Choose Between Plan G and Plan N?

Medicare supplements Plan G and Plan N have a lot in common. Both plans cover inpatient care, foreign travel emergency care, hospice care coinsurance, skilled nursing facility care and no plan limits on coverage within the U.S. Our licensed agent staff at May River Medicare Insurance has been trained to help you find the right supplement plans with the out of pocket maximum that fit your situation.

The Plan G has higher premiums and higher price increases on average. Medicare supplement Plan N has a lower monthly premium and much lower rate increases to helping the Medicare beneficiary save money yet have robust coverage with little out of pocket costs.

The information below will help you in comparing Medicare Plan N and Plan G.

Plan N

Plan N has Full Inpatient Hospital Coverage

With the Medicare supplement Plan N you can spend a year as an inpatient in the hospital and it won’t cost you a dime. Medicare Part A is your inpatient coverage and when you add a Medigap Plan G, Medicare and your Medigap Plan pay 100% of your inpatient stay. It is full and complete inpatient coverage.m

Plan N pays all outpatient coverage with the exception of the following:

Medigap Plan N is full coverage, which means that just like the Medicare Plan G you can spend a year as an inpatient in the hospital and it won’t cost you a dime.

Also just like the Medigap Plan G you will be billed for the annual Medicare Part B deductible when or if you first see a doctor during a calendar year.

Now here is where Medicare supplement Plan N differs. There is also a small office visit copay when you have a doctor visit for diagnosis or evaluation. Only office visits for diagnosis or evaluation are eligible for the small copay, and that copay is between $0 dollars up to but never more than $20. But Medicare’s definition of office visits has changed since 2020. We will dive into that below, but the changes are minor. Telehealth and Urgent Care not Physical therapy copays. (see Below)

In addition, there is a $50 copay for an emergency room visit that does not result in inpatient hospital stay.

Plan G

Plan G Has Full Inpatient Hospital Coverage

With the Medicare supplement Plan G you can spend a year as an inpatient in the hospital and it won’t cost you a dime. Medicare Part A is your inpatient coverage and when you add a Medigap Plan G, Medicare and your Medigap Plan pay 100% of your inpatient stay. It is full and complete inpatient coverage.

Plan G Has Full Outpatient Coverage

For outpatient and physician services, your only expense will be the annual Medicare Part B deductible. This is Medicare’s deductible, not a Medicare supplement plan deductible. Part B is your outpatient services coverage, and with a Medigap Plan G everything is covered at 100% except you will pay the first $240 billed to you for 2024. That’s the 2024 Part B deductible. It can change from year to year.

Medicare supplement Plan G is what we call your “No worries, peace of mind plan.” You have no copays for doctor visits and no coinsurance. The plan covers everything except the Part B deductible. Your annual maximum out-of-pocket is the Part B deductible. Again, for 2024 that is $240.

Keep in mind, the term annual Maximum Out-of-Pocket (MOOP) refers to the maximum amount you are liable for your medical bills in any calendar year. It does not refer to your monthly premiums.

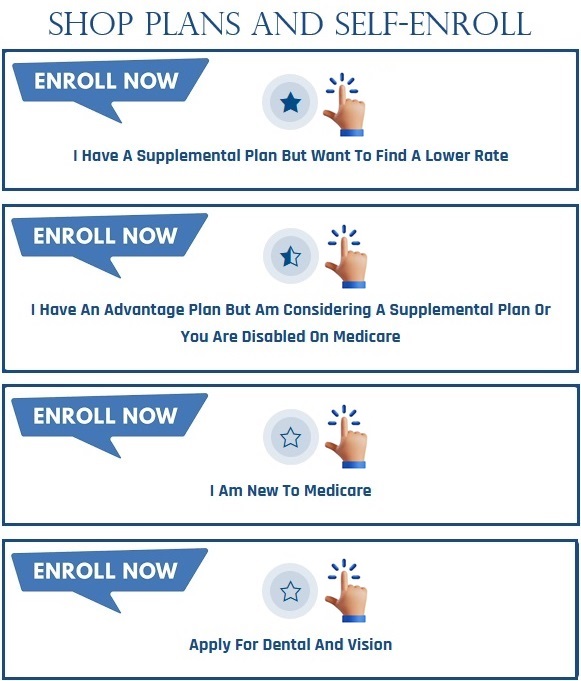

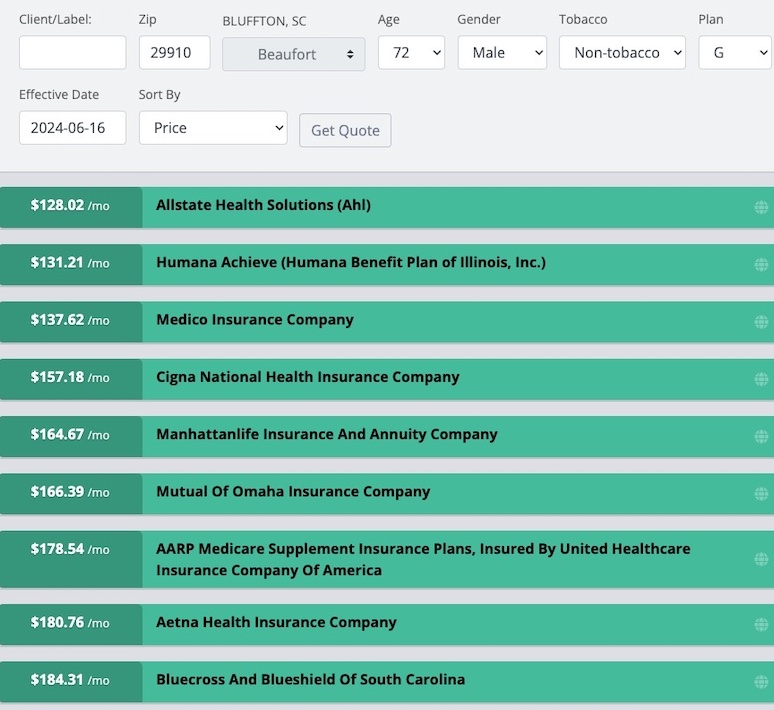

Plan N Rates for 72 Male in South Carolina (beaufort, Jasper county Below

Plan G Rates for 72 Male in South Carolina (beaufort, Jasper county Below

Medicare’s Original Guidance on Plan N Copays

In 2010 when Plan N was new, Medicare released a clarification on the copays that gave specific billing codes required to charge an office copay . The office visit copay is 20% of the bill up to a maximum of $20. Those billing codes were exclusive to in-office visits to your primary care physician or a specialist and can be no more than $20.

Medicare’s guidance specifically indicated there is to be no office visit copay for telehealth or urgent care visits.

Plan N and The Covid Pandemic

During the pandemic, under part of the emergency order, billing rules were bent for tele-health doctor visits and Urgent care. In both cases, Medicare quietly allowed doctors to bill these visits using the same billing code for in-office primary care visits.

Telehealth and urgent care visits were originally excluded from the $20 copay prior to the pandemic. Doctors are now allowed to charge the copay for those visits.

Originally, these were supposed to be short term exemptions during the “emergency phase” of the pandemic. But the emergency, as declared by the government, has extended much longer than anyone ever imageined, and Medicare has now said that changes in Medicare beneficiaries habits warrants a likely permanent change in the billing guidance.

New Definition of

Plan N Copays

What visits are excluded from the copay? There is still no copay charged for physical therapy. No copay for preventive care or flu shots. No copay for chemotherapy or infusion treatments. The copay is still just for medical consultations that are intended to diagnose or evaluate your condition. But that now includes Urgent Care and Telehealth visits.

The emergency room visit copay has not changed. It remains 50 dollars.

Medicare Part B Excess Charges

There is one other feature of Plan N that differs from the Plan G. That is that Plan N has no insurance against Medicare Part B Excess charges.

When a doctor decides to accept Medicare insurance, they must choose between one of two contracts with Medicare: A Participating contract or a non-participating contract.

What Does Part B Excess Charges Mean?

A Medicare Part B excess charge is when a physician charges the patient more than the Medicare approved amount for an outpatient service. Only Medicare providers with a non-participating contract are allowed to charge an excess charge, and they are limited to no more than 15% of the Medicare approved amount.

How Common Are Medicare Excess Charges?

Medicare Part B excess charges are rare. Only 2% of doctors contracted with Medicare are allowed to charge an excess charge and more than 40% of those are in the mental health industry. These doctors may charge an excess charge, but do not have to. You can request they charge the standard Medicare rate. Most people go through their entire Medicare experience without ever encountering a doctor that can charge an excess charge.

The thought of doctors charging Medicare beneficiaries more than the Medicare approved amount is frightening for some. However, as we will detail in this article, Medicare excess charges are rare, easily avoidable, and typically minimal in size. Keep in mind that original Medicare insurance does not cover excess charges. Still, with very little effort, you can avoid unwanted charges.

Participating Providers

According to Medicare, more than 98% of doctors choose what is called a Participating Provider contract. This is a fancy way of saying that they agree to accept Medicare assignment and only charge the Medicare approved amount. In return, they only bill Medicare. Medicare is their one-stop biller. Medicare then communicates electronically to the Medicare supplement plans and informs them how much to pay, and to whom.

According to my discussions with upper management at the major insurance companies, on average, 85% of medical bills are paid by the Medicare supplement plans within 48-hours and with no human intervention .

Non-Participating Providers

According to KFF.org, fewer than 2% of doctors in the U.S. who accept Medicare choose the N contract. These are the ones that are contractually allowed to charge an excess charge. They are paid 5% less by Medicare than a providers that accept Medicare assignment. They are allowed to charge up to 15% more than what Medicare paid them. That is the excess charge. Up to 15%, no more than the 95% they are paid.

Very few doctors will choose this contract because Medicare penalizes them. Medicare will not be their one stop biller. They must bill Medicare, but they cannot bill your supplement, they don’t have a contracts with Medicare: A Participating contract or a non-participating contract.

More on Excess Charges RULES:

Any doctor or medical provider that charges excess charges must state this publicly in advance. They usually will post on their website or the individual doctor may post this fact in the lobby.

There are No Excess Charges allowed for emergency procedures, so no surprise billing aloud.

There are no excess charges for Physical Therapy

There are no Excess Charges for inpatient (hospital services) Only select outpatient services.

There are no Part A excess charges; they do not exist.

All or none rule: if a hospital, medical group. or Doctor group such as Optim Orthopedic, accepts medicare assignment, they all must accept and excess charges are not allowed. Either every doctor in that group charges an excess charge or no one can.

Does the Mayo Clinic charge excess charges

As of 2020, Mayo Clinic in Florida accepts full Medicare Assignment.

This means that they will not bill Excess Charges. Those on Medicare Supplement Plan N will not see an additional bill for Excess Charges when visiting the Mayo Clinic in Florida.

The Arizona Mayo Clinic facility does not (yet) accept Medicare Assignment, so those on Plan N might see an Excess Charge billed from Mayo in Arizona.

Medicare Supplement plans only supplement what is APPROVED by original Medicare. If Medicare approves the procedure and pays their 80%, the Supplement plan, also known as Medigap, will fill in the remaining portion, subject to your deductible and possible co-payment, depending again on which Medicare Supplement plan letter you signed up for.

Does my Doctor Charge an Excess Charge

So, the easy way to tell if your doctor charges an excess charge is that they will ask you to pay up-front for their services. You can also find out by looking them up on Medicare.gov.

A couple quick, but important points on excess charges.

There are no excess charges for Part A inpatient services.

There are no excess charges for emergency services.

And lastly, if you go to a doctor or hospital, either everyone in that doctor’s group or hospital charge an excess charge, or no one does. It’s all or none. There is an exception for teaching hospitals, but the truth is that doctors who charge an excess charge are so rare that you are unlikely to come across one for the entire time you have Medicare. Less than 2% of doctors that accept Medicare, charge an excess charge, and 40% of those are Psychiatrist’s. source KFF.org

FYI Medicare Advantage Plans do allow excess charges.

CMS Medicare’s Letter to Providers in late 2023

Why Become a Participating Medicare Provider:

All physicians, practitioners and suppliers – regardless of their Medicare participation status – must make their calendar year (CY) 2024 Medicare participation decision by December 31, 2023. Those who want to maintain their current PAR status or Non-PAR status do not need to take any action during the upcoming annual participation enrollment period. If you wish to become a PAR provider, you will need to sign a participation agreement, as described below. To sign a participation agreement is to agree to accept assignment for all covered services that you provide to Medicare patients in CY 2024.

The overwhelming majority of physicians, practitioners and suppliers choose to participate in Medicare each year. During CY 2023,

98 percent of all physicians and practitioners are billing under Medicare participation agreements.

If you participate in Medicare and bill for services paid under the Medicare physician fee schedule (MPFS), your fee schedule amounts are 5 percent higher than if you do not participate. Your Medicare Administrative Contractor (MAC) publishes an electronic directory of providers that choose to participate.

Plan N

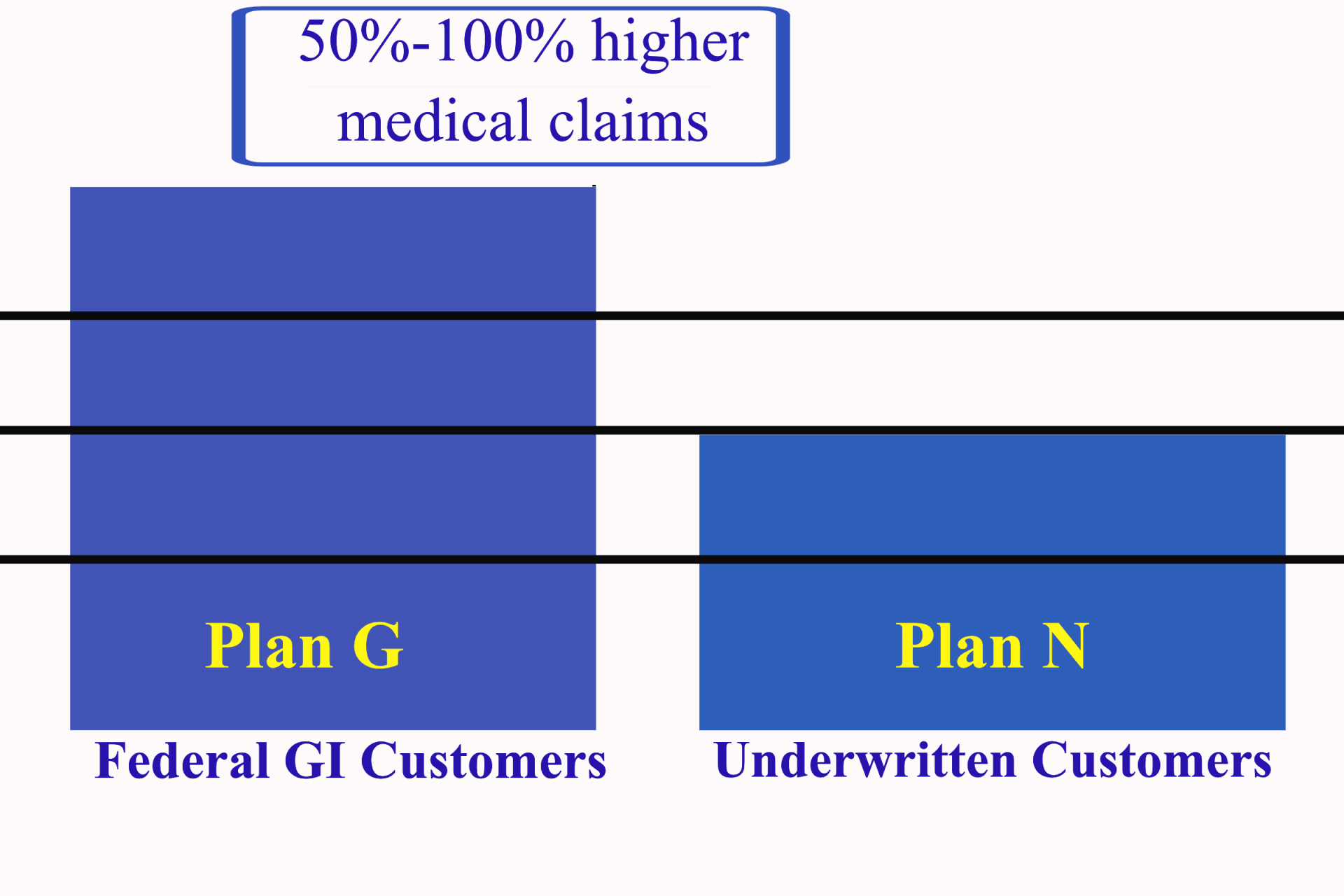

WON’T ACCEPT chronically ILL folks who use their Guaranteed Issue Right to get a Supplement with no Underwriting required. (only plan G takes those folks)

PLAN G

Plan G MUST ACCEPT chronically ILL folks who use their Guaranteed Issue Right to get a Supplement with No Underwriting Required.

How will Folks who Exercise their Guaranteed Issue Right effect the Plan G rates and how does it effect the Plan N rates?

What are Guaranteed Issues Rights?

There are certain situations where you may be able to buy a Medigap policy outside of your Medigap Open Enrollment Period. Situations where an insurance company can’t deny you a Medigap policy are called “guaranteed issue rights” or “Medigap protections.” What are guaranteed issue rights?

You have a guaranteed issue right when your other health coverage changes in some way, like if you lose your other coverage. You may also have a “trial right” to try a Medicare Advantage Plan (Part C) and still buy a Medigap policy if you change your mind.

If you have a guaranteed issue right, an insurance company:

- Must sell you a Medigap policy

- Must cover all your pre-existing health conditions

- Can’t charge you more for a Medigap policy because of past or present health problemsm

Most common Guaranteed Issue Rights occur when you lose or leave group or retiree coverage or you move to a new area on a medicare advantage plan and your your plan is not available in the new area. Also if your advantage plan is no longer available in your county you can enroll in Plan G with no underwriting

Two other Guaranteed Issue Rights are called trial rights: trial right 1 is when you joined a medicare advantage plan and within first year you decide to go back to original medicare with a supplement (no health questions asked. Must enroll in Plan G not plan N. See Below two trial rights

Below are the Four Most Common Guaranteed Issue Rights

Guaranteed Issue Rights Allow you to Enroll in Supplement with No Underwriting Required

You have a Medicare Advantage Plan, and:

- 1) Your plan is leaving Medicare

- 2) Stops giving care in your

- area, or

- 3) You move out of the

- plan’s service area.

You have Original Medicare and an employer group health plan (including retiree or COBRA coverage) or union coverage that pays after Medicare pays and that plan is ending.

(Trial right 1) You joined a Medicare Advantage Plan when you were first eligible for Medicare, and within the first year of joining, you decide you want to switch to Original Medicare.

(Trial right 2) You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you’ve been in the plan less than a year, and you want to switch back.

Plan N requires medical underwriting and health questions unless your are in your 6 Month

Medicare Supplement OPEN ENROLLMENT

(STARTS FROM THE MONTH YOU TURN 65 OR ENROLL IN PART B)

Plan G Must Accept Chronically sick patients with no underwriting or health questions allowed If they qualify for a Guaranteed Issue Rights.

Plan G must accept Federal Guaranteed Issue rights. These rights are Granted when:

› An employer transitions retirees from self-funded plans to defined-contribution plans when medical claims become too expensive.

› An MA plan reduces service area because medical claims exceed their payment from CMS to provide coverage.

› An MA customer decides to switch back to Original Medicare and buy a Medicare Supplement plan because cost-sharing from frequent use of health care services is a financial bur den.

Prior to January 1st folks enrolled in the Plan F or Plan C (those plans are not available to new to medicare folk turning 65, and now if you want to get a medicare supplement with no underwriting or health questions and you were eligible for medicare after 1/1/2020 you can only enroll in the Plan G. You can also enroll in the Plan A, Plan B, Plan D, or K or L but these outdated and very unpopular plans cost more than the Plan G and they have fewer benefits and coverage. That is why nobody enrolls in them.

Learn about the Impact of Plan G being forced to take

folks with no underwriting or health questions required since Jan 1, 2020

In these situations, insurers must offer certain Medicare Supplement plans without the ability to screen for high-cost chronic health conditions (medically underwrite). The portion of customers granted these rights is relatively small, but the impact on their health plan is significant.

The increase in medical claims is a problem because insurers need to cover the additional expense by increasing premiums. Medicare Supplement plans are required to maintain a claims-to-premium ratio of at least 65%. For most insurers, the ratio is between 75% and 85%. Therefore, every dollar increase in the average cost of care results in more than a dollar increase in the average premium charged to customers.

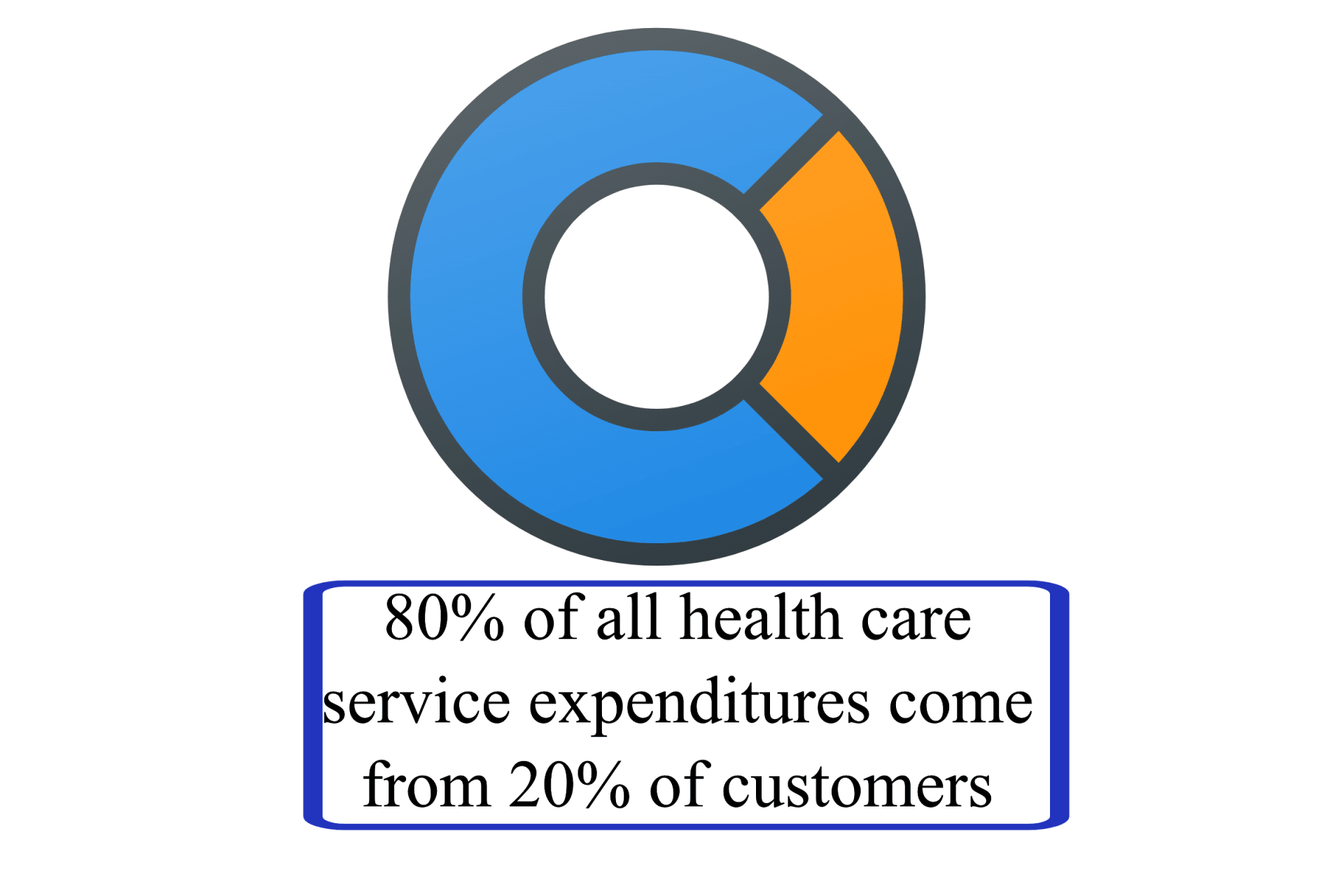

The impact of federal GI rights on premiums can be generalized by the 80/20 Rule. Therefore, a small increase in the number of high-cost customers in a plan can cause a large increase in the premium charged to all customers.

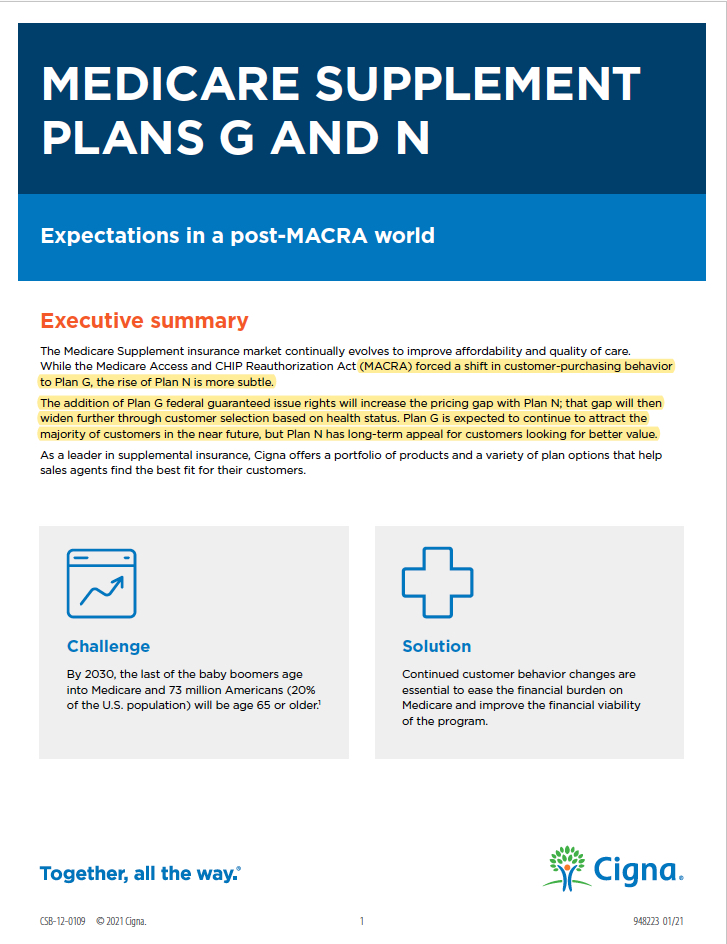

As a result of MACRA, MACRA was passed as a law on January 1st of 2020, and before January 1st of 2020, the Plan F was the plan that had to except folks with no underwriting or health questions who used their Guaranteed Right Issue to avoid underwriting, bit now the Plan G is the supplement that’s available to customers with six of seven federal GI rights for the first time. This will increase the portion of high-cost customers and place more and more pressure on insurers to raise premiums. In 2020, the pressure was low. There was only one year of newly eligible customers with federal GI rights, but the pressure will increase each year as more and more people age into Medicare.

This means Plan G premiums will increase faster than those of plans with fewer GI rights, such as Plan N.

Growth in Plan N enrollment was strong during the first several years but slowed with the surge in Plan G popularity. This will increase the portion of high-cost customers and place more and more pressure on insurers to raise premiums. In 2020, the pressure was low. There was only one year of newly eligible customers with federal 48%;”>However, the impact of MACRA, through Plan G federal guaranteed issue (GI ri)ghts and customer plan-selection behavior changes, will shift some of the appeal from Plan G to Plan N.

Medicare Supplement Plan Selection before/after MACRA LAW

Before Jan 1st of 2020

Customers who preferred comprehensive coverage and no cost-sharing purchased Plan F.

Most customers who preferred a lower premium and some out-of-pocket costs purchased Plan G or Plan N.

After Jan 1st 2020

Typically, customers who anticipate frequent physician visits tend to gravitate toward the comprehensive coverage Plan G. Customers who are relatively healthy and anticipate infrequent physician visits tend to gravitate toward the lower premium Plan N.

Before January 1st of 2020 customers who anticipated frequent doctor visits tended to gravitate towards the most comprehensive coverage which was Plan F.

But the Plan F was discontinued in 2020 so if you were under 65 on January 1st you CAN NOT ENROLL IN PLAN F.

THE MOST COMPREHENSIVE PLAN AVAILABLE TO YOU IS NOW THE PLAN G.

This decision process changed for customers newly eligible to Medicare in 2020

› Customers who prefer comprehensive coverage purchased Plan G.

› Most customers who prefer a lower premium and additional cost- . sharing purchased Plan N.

Looking forward, we can expect that, at some point, higher Plan G premiums will exceed the additional Plan N physician copays for most customers, regardless of health status. The value proposition of Plan N will prove relative to Plan G just as the Plan G’s value proposition exceeded the Plan F before 2020.

So when customers choose between the two most popular plans, G and N, what determines their preference?

It depends on what’s important to the customer based on the best value for their health care needs. They evaluate options by comparing the difference in premium between plans against the difference they expect to pay in cost-share.

Conclusion: While the appeal of Plan N is currently overshadowed by the popularity of Plan G, current trends point to Plan N emerging as the value choice for more customers in the near future.

Which States Allow Medicare Part B Excess Charge

There are eight states who have adopted laws that override Medicare plans for the benefit of the consumer. These eight states are Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont. Residents of these states cannot be charged a Medicare Part B excess charge when visiting a medical provider in their state. In all other states, the consumer is responsible if they wish to avoid Medicare Part B balance billing.

Important Last Details on Medicare Excess Charges

Any doctor or medical provider that charges excess charges must state this publicly in advance. They usually will post on their website or the individual doctor may post this fact in the lobby.

There are No Excess Charges allowed for emergency procedures, so no surprise billing allowed.

There are no excess charges for Physical Therapy

There are no Excess Charges for inpatient (hospital services) Only select outpatient services.

There are no Part A excess charges; they do not exist.

Medicare uses an all or none rule regarding medical providers: If a hospital network, medical group or Doctor’s group such as Optim Orthopedics accepts medicare assignment, all the doctors must accept assignment and excess charges are not allowed.

To summarize, in any medical organization (i.e. hospital, doctor’s office, etc.), either all providers can charge an excess charge or none.The Post Covid changes for doctor copays are Telehealth visits are now $0-$20 per visit. Also urgent care visits-because of Covid-are now considered $0-$20 dollar doctor visits.

In Conclusion, just to reiterate: if you go to a doctor or hospital, either everyone in that doctor’s group or hospital charge an excess charge, or no one does. It’s all or none. There is an exception for teaching hospitals, but the facts are doctors who charge an excess charge are so rare that you are unlikely to come across one for the entire time you have Medicare.

Less than 2% of doctors that accept Medicare, charge an excess charge, and 40% of those are Psychiatrists.

How Common Are Medicare Part B Excess Charges?

Because of the rules Medicare put in place to dissuade and prevent doctors from becoming a non-participating provider and charging more than the Medicare approved amount, very few providers decide to become non-participating and charge Part B excess charges. According to KFF.org 98% of health care providers accept assignment and cannot charge Part B excess charges.