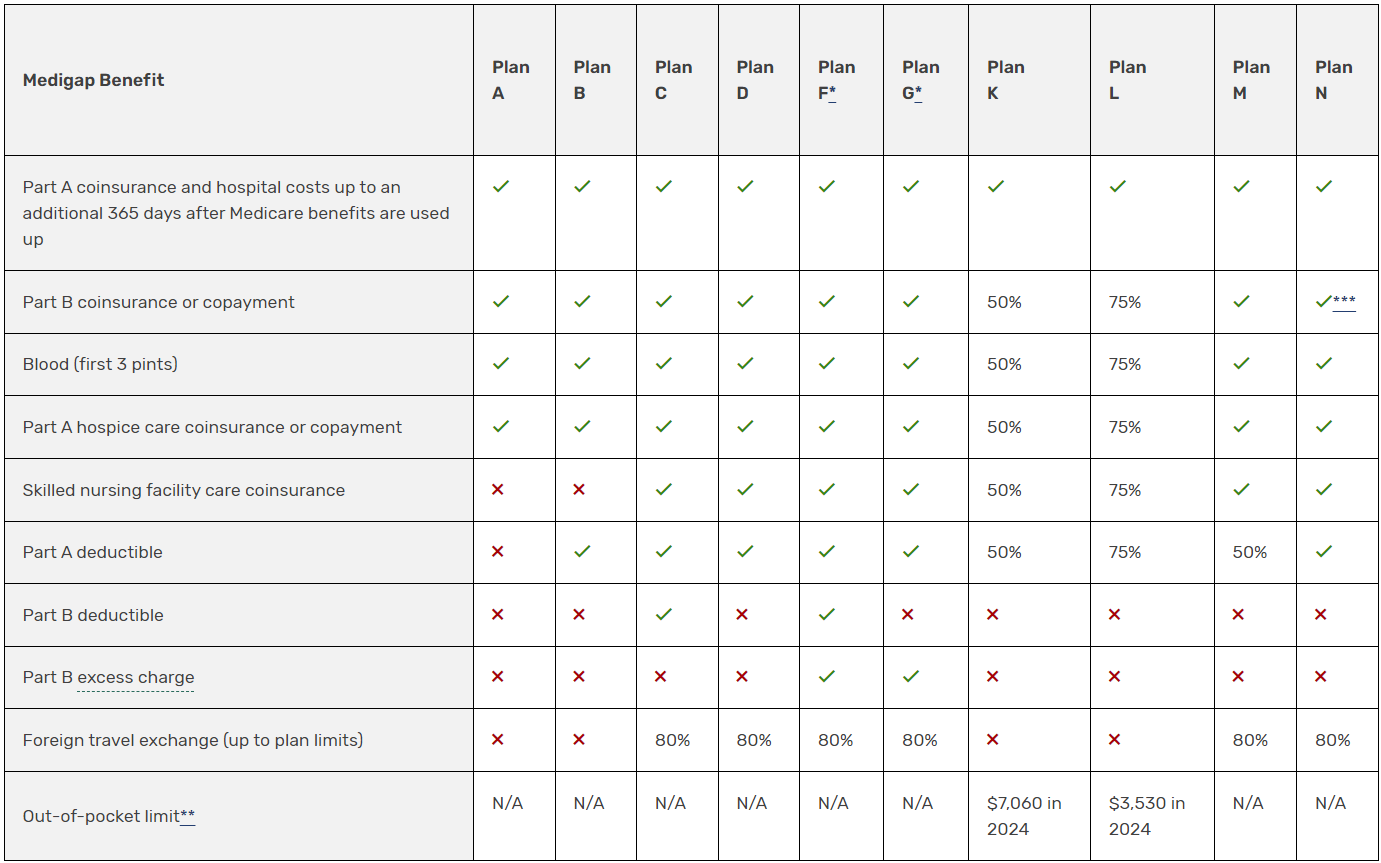

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

All Medigap plans supplement your Original Medicare benefits. So Medicare will pay its share, and you will pay your share.

Many people enroll in Plan F because they like the first-dollar coverage. However, cost-conscious consumers can consider a high deductible version of this plan and get lower premiums.

With High Deductible Plan F, Medicare first pays its share. Then you agree to pay the first $2,800 (in 2024) of your share. That is your maximum out-of-pocket on High Deductible Plan F.

Let’s say you had a hospital stay early in the year. Medicare Part A will pay for that hospital stay except for the $1,632 Part A deductible that you will owe. Since you have a $2,800 deductible on your Medigap plan, you will pay the $1,632. That money applies against the $2,800 that you are responsible for. If you have other charges throughout the year, you will pay your share only until you have reached the $2,800 limit.

The High Deductible Plan F is different from the standard Plan F.

- Medicare Part A and Part B pay their cost-sharing for services, and you pay the remaining amount until you satisfy the high deductible of $2,800 this year.

- Once you meet the high deductible, Plan F will cover you 100% for the remainder of the year.