Medigap Plan N

Lower Premiums with Smart Cost Sharing

Medigap Plan N is a popular alternative to Plan G for people who want lower monthly premiums and are comfortable with modest copays.

May River Medicare Insurance is a nationwide independent Medicare agency. We show Plan N carriers, pricing, and availability by ZIP code — transparently — so you can compare clearly before enrolling.

Plan N reduces premiums by requiring limited cost sharing.

Small copays apply for certain doctor and ER visits.

No networks — see any provider that accepts Medicare.

Plan N covers most Medicare-approved expenses while keeping premiums lower.

- Part A hospital deductible

- Part A hospital coinsurance and extended stays

- Skilled Nursing Facility coinsurance

- Part B coinsurance (after deductible)

- Hospice coinsurance/copays

- First 3 pints of blood each year

- Foreign travel emergency coverage

- Part B deductible

- Part B excess charges

- Up to $20 copay for office visits

- Up to $50 copay for emergency room visits (if not admitted)

- Prescription drugs (requires Part D)

Plan N works well for people who want lower premiums and don’t mind small copays for occasional doctor visits.

- You want lower premiums than Plan G

- You don’t frequently visit specialists

- You want nationwide Medicare access

Premiums vary by carrier and location — comparing options is critical.

Compare Medigap Plan N in Your Area

See Plan N pricing, benefits, and carrier options by ZIP code. May River Medicare Insurance shows you everything clearly — before you enroll.

Medicare Supplement (Medigap) Plan N

Medicare Plan N is a supplemental policy that typically has lower premiums. In return, you pay the Part B deductible, excess charges, and some copays for doctor and emergency visits. Plan N has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like paying a lower premium in exchange for taking on a small annual deductible and some copayments.

All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose. Plan N is available in many states from various well-known insurance companies.

In a survey, AHIP reported that Plan N enrollment grew by 20% between 2014 – 2017. Since Plan F will no longer be available for most people, Plan N has quickly become the runner-up for the most popular Medigap plan (after Plan G.)

(You will find that sometimes people refer to Plan N as Part N, but the proper term is Plan N. Medicare has parts, but when referring to supplemental insurance, use the word Plans.) Here’s a visual picture that demonstrates what Medicare Supplement Plan N covers and what is left for you to cover:

Plan N Coverage

What Does Medicare Plan N Cover?

This standardized Medicare Supplement covers the 20% that Medicare Part B doesn’t. It also pays for your hospital deductible and all your hospital costs. You will be responsible for Part B excess charges, the Part B deductible, and some small copays at the doctor’s office and the emergency room.

You can request a Medicare Plan N Outline of Coverage from your agent before you enroll, which will give further details.

What Does Plan N Cover at the Doctor’s Office?

First and foremost, your standard preventive care is covered entirely by Medicare, so you will not pay anything for these services. Plan N covers preventive services like screenings for cancer, diabetes, and cardiovascular conditions. Preventive services also include annual physicals, colonoscopies, vaccines, and various other tests.

Your Medicare Supplement Plan N coverage will also include visits to the doctor for injury and illnesses, durable medical equipment, ambulance, surgeries, home health, lab work and other imaging tests, diabetes supplies, and many more services. The main thing to remember is that if Medicare Part A or B covers it, your Supplement will also cover it. Medicare pays 80% and then sends the bill to your Medigap plan.

If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

What Does Plan N Cover in the Hospital?

Your Medicare Part A hospital benefits provide coverage for inpatient hospital services, including inpatient admission, skilled nursing facility care, home health, hospice care, and blood transfusions. While you would typically owe a deductible for your hospital stay, your Medigap Plan will pay that for you. Additionally, it is important to know the Part A deductible is per benefit period. If you are admitted several times within the year, your Plan N will cover all Part A deductibles you experience.

Here’s a quick list of items covered in the hospital by Medicare Supplemental Plan N:

The Part A Hospital deductible (in 2024, this is $1,632) and your coinsurance (20%)

An extra one year (365 days) of hospital benefits after Medicare’s coverage runs out

Hospice care coinsurance at any certified hospice center

Coverage for the first 3 pints of blood

Plan N also provides foreign travel emergency benefits up to the plan’s limit

Your Medigap Plan N Costs

Medicare Supplement Plan N offers identical basic benefits similar to the more popular Plan G, but you agree to pay a share of a few things that you wouldn’t pay on Plan G. First, you agree to pay the small annual Part B deductible ($240 in 2024). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay.

Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows. This is called an excess charge. Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time.

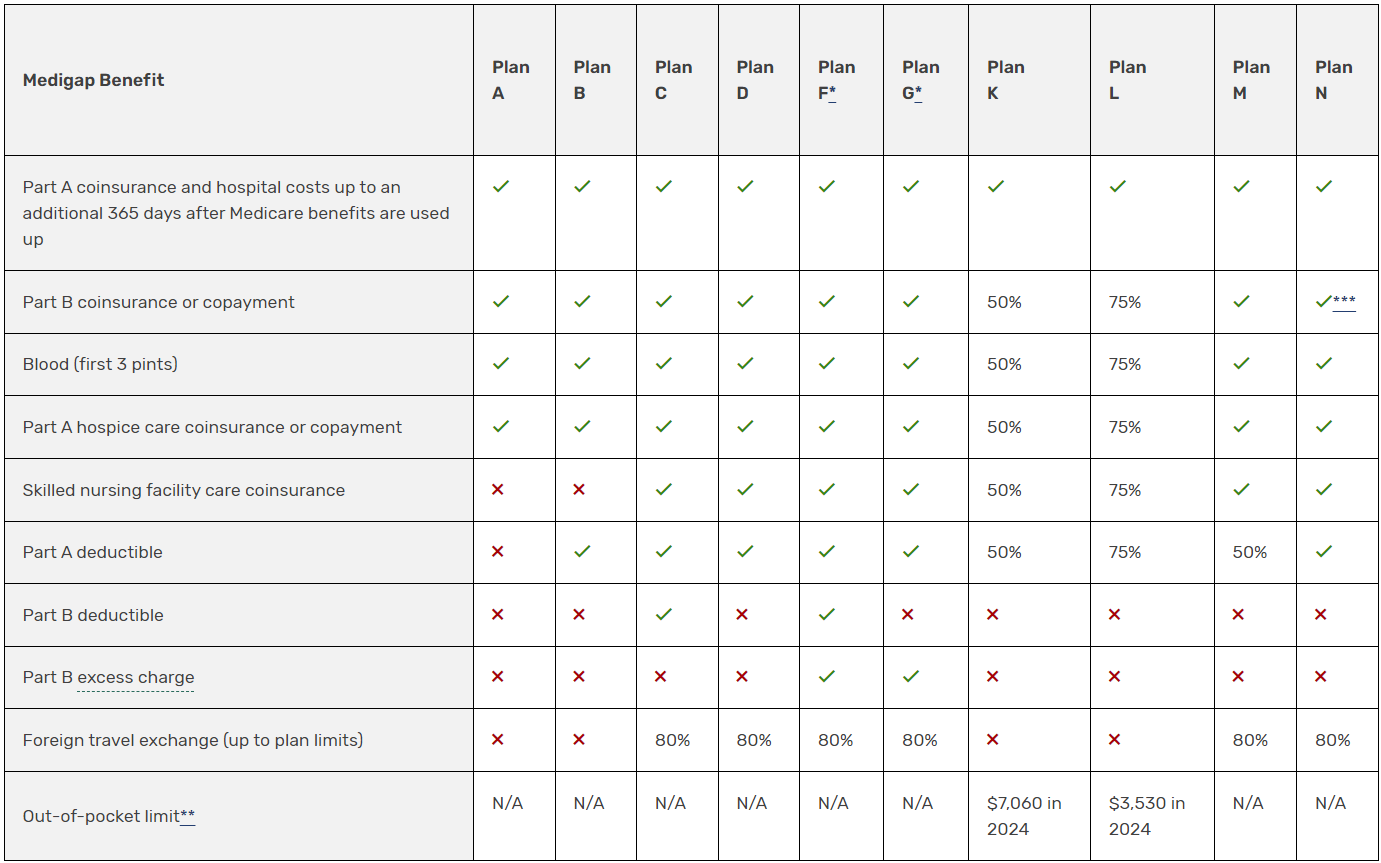

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Medicare Plan N is a supplemental policy that typically has lower premiums. In return, you pay the Part B deductible, excess charges, and some copays for doctor and emergency visits. Plan N has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like paying a lower premium in exchange for taking on a small annual deductible and some copayments.

All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose. Plan N is available in many states from various well-known insurance companies.

In a survey, AHIP reported that Plan N enrollment grew by 20% between 2014 – 2017. Since Plan F will no longer be available for most people, Plan N has quickly become the runner-up for the most popular Medigap plan (after Plan G.)

What Does Medicare Plan N Cover?

This standardized Medicare Supplement covers the 20% that Medicare Part B doesn’t. It also pays for your hospital deductible and all your hospital costs. You will be responsible for Part B excess charges, the Part B deductible, and some small copays at the doctor’s office and the emergency room.

Medigap Plan N is one of the most popular Medigap plans for beneficiaries.

Plan N covers all gaps in Medicare except the Part B deductible, Part B excess charges, and small copays for office and ER visits.

Plan N tends to offer lower premiums compared to Plan G, but has slightly more out-of-pocket costs.