Medigap Plan A

Medicare Supplement Basics

Medigap Plan A is a standardized Medicare Supplement plan that helps pay certain “gaps” in Original Medicare. It’s the most basic Medigap plan — designed to reduce surprises while keeping premiums as lean as possible.

May River Medicare Insurance is a nationwide independent Medicare agency. We show your options clearly by county + ZIP code up front — so you understand costs and coverage before you ever speak to anyone. Transparent. Simple. Nationwide.

Plan A supplements Part A + Part B. You keep Medicare as primary, and Medigap helps with certain costs.

Benefits are standardized by plan letter. Same medical benefits no matter which carrier offers it.

Rates vary by company, area, age, and rating method — that’s why comparing by ZIP code matters.

Plan A includes a core set of Medigap benefits. Exact carrier wording differs, but the standardized benefit set is consistent.

- Part A coinsurance + hospital costs (after Medicare benefits are used)

- Part B coinsurance or copayments (typically the 20% share under Original Medicare)

- First 3 pints of blood each year

- Part A hospice coinsurance/copayment

If you want fuller protection, Plan A may feel “too basic.” Many people compare it to Plan G or Plan N.

- Part A deductible

- Skilled Nursing Facility coinsurance

- Part B deductible (newly eligible generally can’t get it covered anyway)

- Part B excess charges

- Foreign travel emergency benefit

Medigap plans generally do not include routine dental, vision, hearing, or retail prescription drugs. You’ll typically pair Original Medicare with a Part D drug plan.

- Prescription drugs: usually Part D

- Dental/vision/hearing: separate coverage options

- Long-term custodial care: not covered

Plan A can work well if you want to reduce some Medicare cost exposure while keeping monthly premiums lower. It’s often considered when someone wants a Medigap policy but doesn’t need (or doesn’t want to pay for) broader coverage.

- You want a baseline Medigap option

- You understand it won’t cover the Part A deductible or SNF coinsurance

- You plan to pair it with a Part D drug plan

In many counties, Plan G or Plan N pricing can be surprisingly close to Plan A — which is why we run side-by-side comparisons.

The easiest time to get a Medigap plan is typically during your Medigap Open Enrollment window (often tied to being 65+ and enrolled in Part B). Rules can vary by state and situation.

Outside protected windows, companies may require medical underwriting. That’s why planning early — and comparing properly — matters.

Compare Medigap Plan A by ZIP Code

May River Medicare Insurance makes Medigap simple: compare carriers in your county, see prices clearly, and get help selecting the right level of protection — before you speak to anyone. When you’re ready, start online, talk to a licensed advisor, or download our mobile app.

Medicare Plan A

is the most basic Medicare Supplement.

Medigap Plan A Benefits

Medicare Supplement Plan A is also referred to as Medigap Plan A. This plan is sometimes overlooked because it has fewer benefits than other Medigap insurance plans.

What does Medicare Plan A cover though? It still covers the most important benefit, which is the 20% of outpatient medical care that Medicare doesn’t cover.

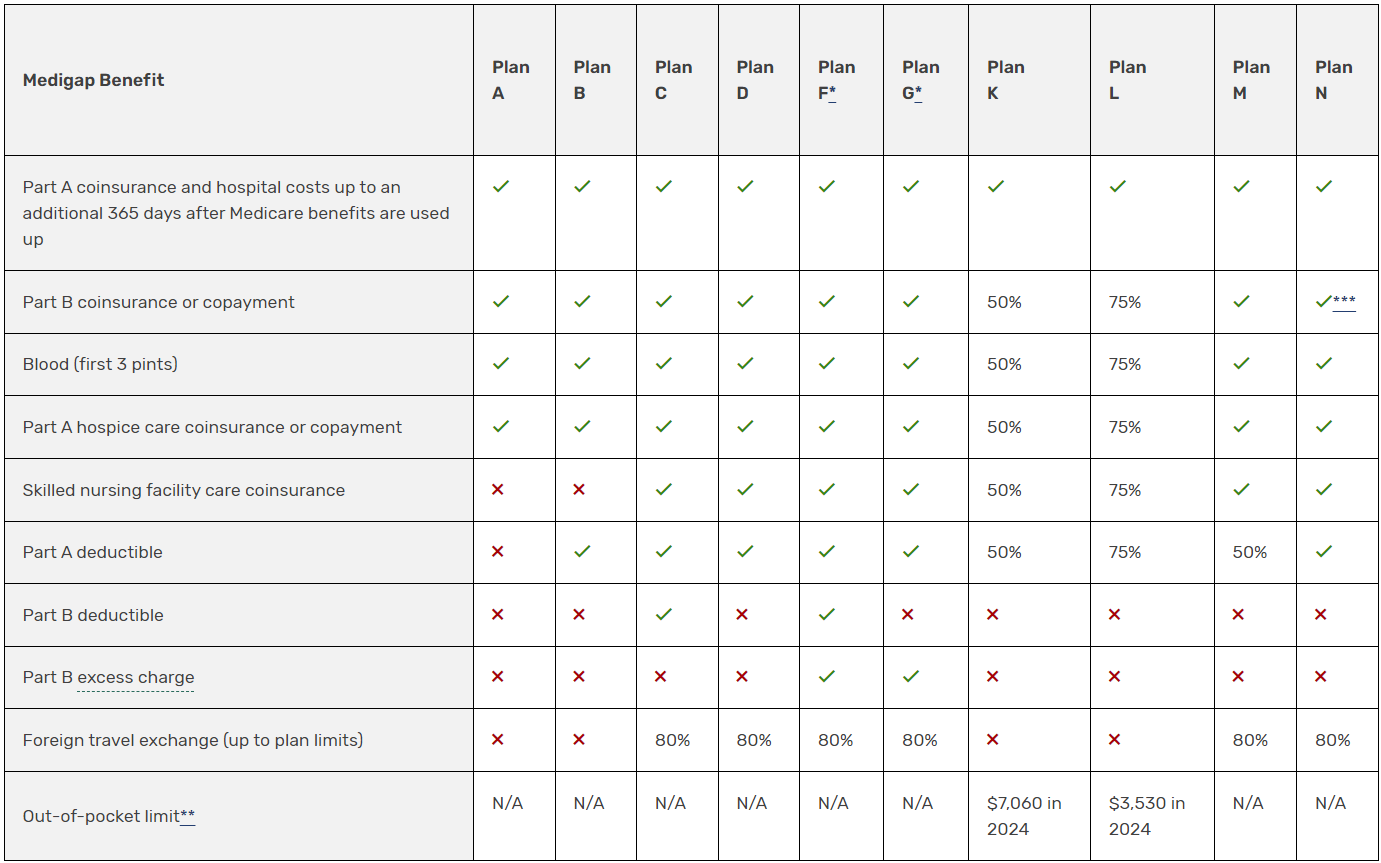

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Medigap Plan A is also the insurance policy that is made available to people under the age of 65 in most states. So if you qualify for Medicare early due to a disability, this policy is available for purchase during your Open Enrollment Period without underwriting.

Be aware, though, that the cost of this plan for people UNDER age 65, can be as much as 3 times what a 65-year-old will pay. This happens because people who qualify for Medicare due to a disability often have higher medical costs than the average 65 or older person. The loss ratios are higher and those costs get passed on to you in the form of rate increases.

For this reason, people on Medicare disability may want to look into Medicare Advantage plans. Why? Because on Medicare Advantage plans the rate is the same for anyone enrolled, regardless of age, gender, etc. Later when you turn 65, you can use the turning 65 Open Enrollment Period to change to a Supplement if you prefer that.

For people over age 65, Medigap Plan A will be priced just as any other Supplement, but not many people over age 65 do choose it. Generally, they choose more comprehensive plans like Plan F and Plan G that provide fuller coverage.

People often feel confused about whether Plan A is the same thing as Part A. It is not. Medicare Supplement Plan A is one of the Supplement plans that helps to fill in the gaps in Medicare. (Medicare Part A, on the other hand, is your original Medicare hospital coverage.)

If you find all this stuff mind-boggling, rest assured you are not the only one. Our agency can help you sort through the clutter and understand your options. Let us do all the work for you.

People often feel confused about whether Plan A is the same thing as Part A. It is not. Medicare Supplement Plan A is one of the Supplement plans that helps to fill in the gaps in Medicare. (Medicare Part A, on the other hand, is your original Medicare hospital coverage.)

If you find all this stuff mind-boggling, rest assured you are not the only one. Our agency can help you sort through the clutter and understand your options. Let us do all the work for you.

People often feel confused about whether Plan A is the same thing as Part A. It is not. Medicare Supplement Plan A is one of the Supplement plans that helps to fill in the gaps in Medicare. (Medicare Part A, on the other hand, is your original Medicare hospital coverage.)

If you find all this stuff mind-boggling, rest assured you are not the only one. Our agency can help you sort through the clutter and understand your options. Let us do all the work for you.

People often feel confused about whether Plan A is the same thing as Part A. It is not. Medicare Supplement Plan A is one of the Supplement plans that helps to fill in the gaps in Medicare. (Medicare Part A, on the other hand, is your original Medicare hospital coverage.)

If you find all this stuff mind-boggling, rest assured you are not the only one. Our agency can help you sort through the clutter and understand your options. Let us do all the work for you.

People often feel confused about whether Plan A is the same thing as Part A. It is not. Medicare Supplement Plan A is one of the Supplement plans that helps to fill in the gaps in Medicare. (Medicare Part A, on the other hand, is your original Medicare hospital coverage.)

If you find all this stuff mind-boggling, rest assured you are not the only one. Our agency can help you sort through the clutter and understand your options. Let us do all the work for you.

- Medigap Plan A should not be confused with Medicare Part A, which is your hospital coverage.

- Plan A does not cover the Part A or Part B deductible, excess charges, or foreign travel emergencies.

- The cost of a Medigap plan such as Plan A depends on multiple factors, such as your age, zip code, gender, and tobacco use.