May River Medicare is your trusted partner for understanding Medigap plans, pricing, enrollment, and support—nationwide.

No sales pressure. No fine print. Just the facts.

Plan N has a lower monthly premium, but you pay small copays for doctor visits and ER, and excess charges aren’t covered.

See our full Plan G vs. Plan N comparison

- Licensed, local advisors who answer every question—no pressure, just honest help.

- Personalized plan comparisons using your ZIP code, doctors, and prescription needs.

- Access to every major carrier—we’re independent, so we work for you, not the insurance companies.

- Annual reviews and support—our service doesn’t end after you enroll. We’re here for you every year, not just the first.

- Exclusive mobile app for quotes, coverage, and support on the go.

- Quick answers and real results—call, click, or schedule an appointment and we’ll do the rest.

Book a Free Consultation See All FAQs (843) 227-6725 Download Our App

Watch the Video Below to Learn about the 6 MostFrequently Asked Questions About Medicare Supplements

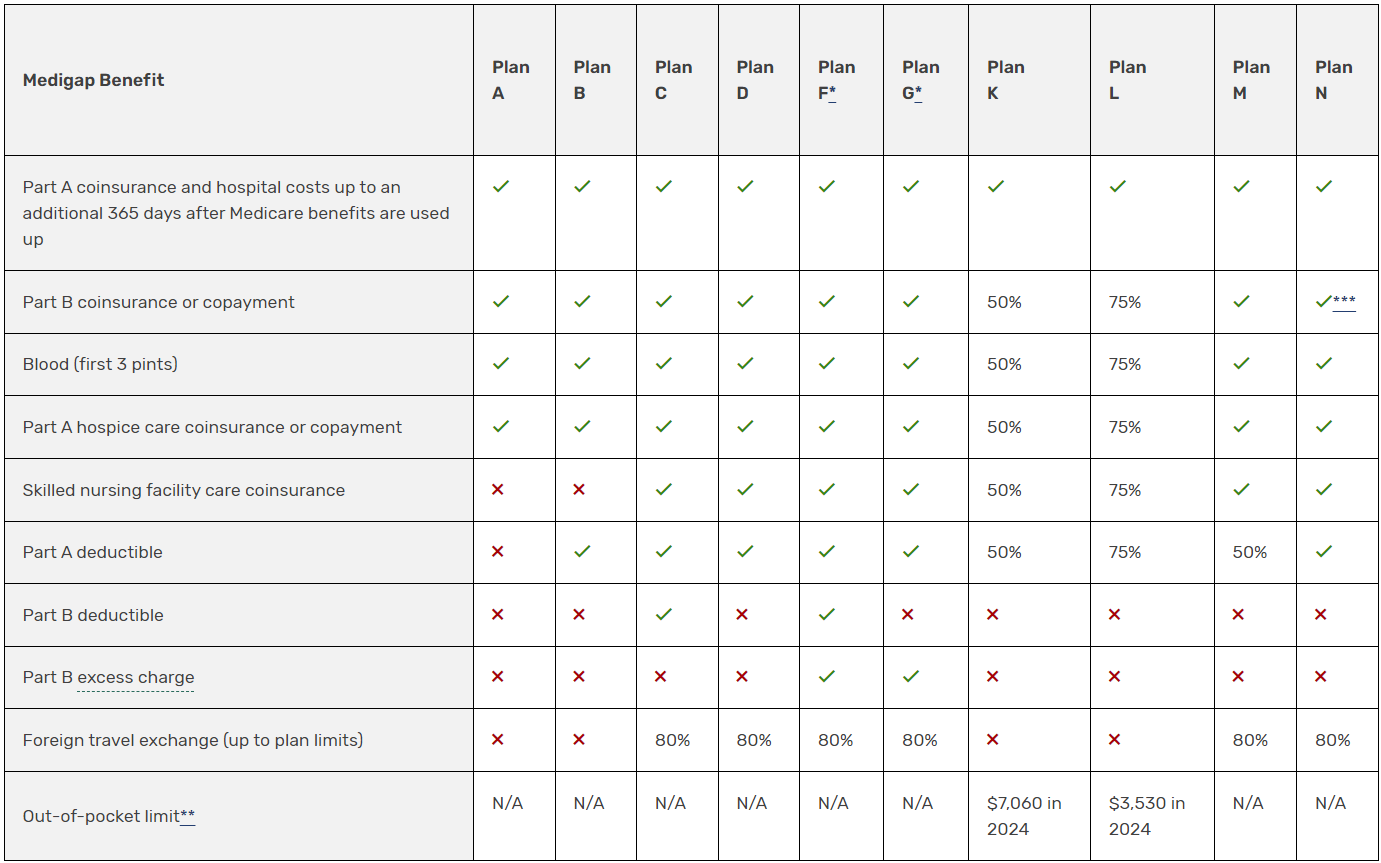

The chart below shows basic information about the different benefits Medigap policies cover.

= the plan covers 100% of this benefit

X

= the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).