Medigap Plan B

Medicare Supplement Coverage

Medigap Plan B builds on Plan A by adding coverage for the Medicare Part A hospital deductible — helping reduce major inpatient out-of-pocket costs.

May River Medicare Insurance is a nationwide independent Medicare agency. We show Medigap pricing, benefits, and carrier availability by ZIP code up front — before you speak to anyone. Transparent. Independent. Nationwide.

Plan B pays the Part A hospital deductible — a major expense under Original Medicare.

Medical benefits are identical across carriers; pricing and underwriting vary.

See any doctor nationwide who accepts Medicare — no provider networks.

Medigap Plan B includes all core benefits from Plan A, plus coverage for the Medicare Part A hospital deductible.

- Part A hospital coinsurance and extended hospital days

- Part A hospital deductible

- Part B coinsurance or copayments (the 20%)

- First 3 pints of blood each year

- Part A hospice coinsurance/copayment

- Skilled Nursing Facility coinsurance

- Part B deductible

- Part B excess charges

- Foreign travel emergency coverage

- Routine dental, vision, or hearing

Retail prescription drugs are not included. Most beneficiaries pair Medigap with a separate Part D drug plan.

Plan B may appeal to beneficiaries who want protection from large hospital deductibles but don’t need the broader coverage offered by Plan G or Plan N.

- You want hospital deductible protection

- You’re comfortable paying SNF coinsurance if needed

- You plan to compare pricing carefully by ZIP code

In many markets, Plan B pricing can be close to Plan G — which is why side-by-side comparisons are critical.

Medigap Open Enrollment (typically when you’re 65+ and enrolled in Part B) offers guaranteed issue with no medical underwriting.

Health questions may apply. Carrier rules vary, which is why independent comparison matters.

Compare Medigap Plan B by ZIP Code

See Medigap Plan B rates from multiple carriers in your county. Compare coverage levels, understand trade-offs, and start your application online — all with full transparency from May River Medicare Insurance.

Medicare Plan B

is the most basic Medicare Supplement.

Medigap Plan B Benefits

Your hospital deductible is a per-incident deductible, not an annual one, so this is an important benefit. Medicare Plan B will pay the deductible even if you incur it more than once in the same year.

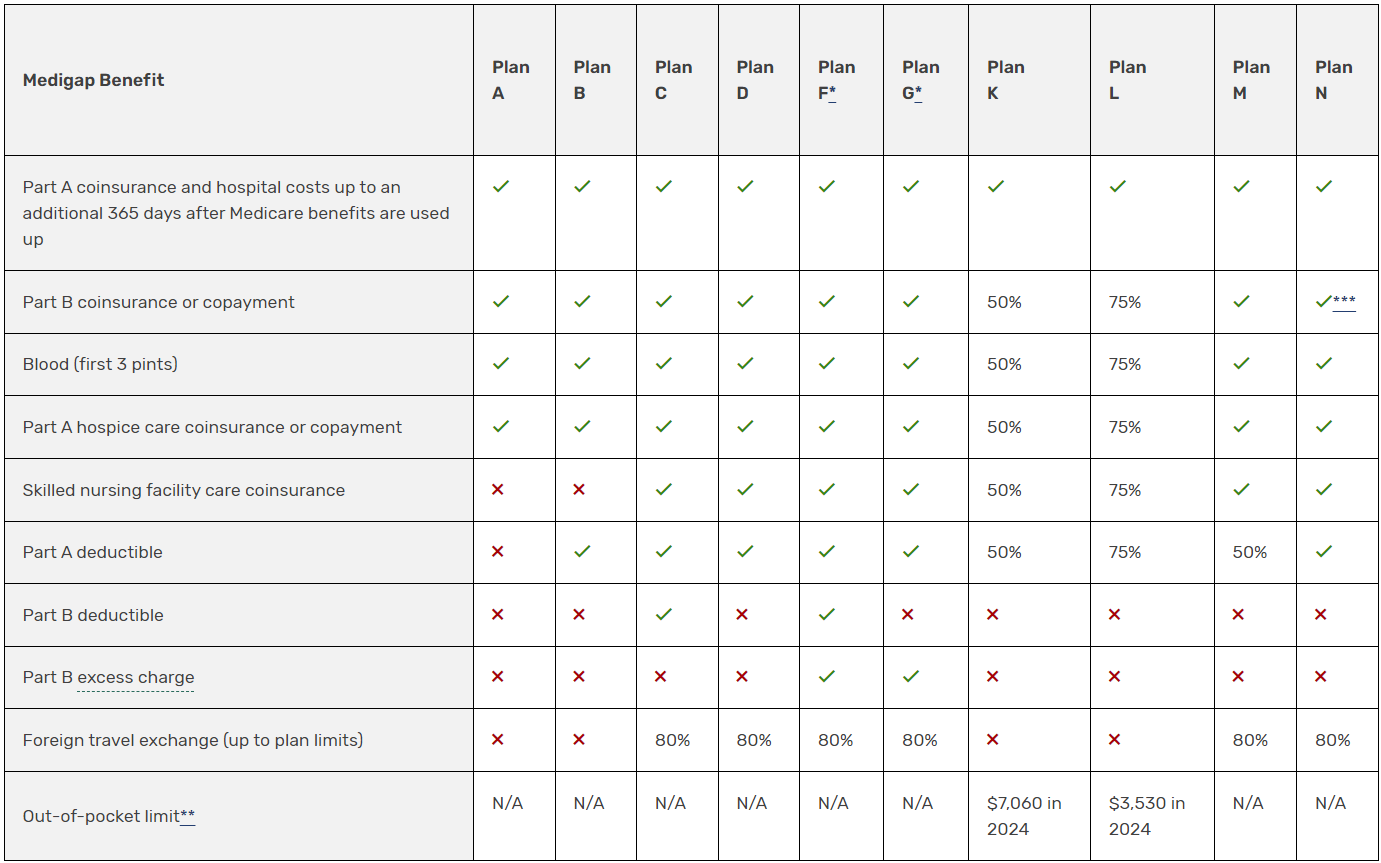

The chart below shows basic information about the different benefits Medigap policies cover.

✔ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

Medigap Plan B Costs

Each insurance company that offers Medigap Plan B sets its own rates. These rates can vary widely by region. Your zip code, gender, age, tobacco usage, and eligibility for household discounts also affect the rate.

The insurance companies also have different loss ratios from their existing clients. Just remember that the benefits are standardized so a Medigap Plan B with one carrier has the same benefits as Plan B with the next. Choose a carrier with low rates and a good, stable history of low-rate increases. Our quoting software can provide all of that information for you.

Medigap Plan B is just one of the many different Supplements you can purchase to help offset your medical expenses. It is not the same as Part B, which is the outpatient medical coverage you purchase directly from Social Security.

People must have Part B for outpatient coverage, and then they still need a Supplement to help them pay for the things that Original Medicare doesn’t cover. Just make sure not to confuse the two – and if you feel uncertain, give us a call.

Because these two things are similarly named, many people find the terminology hard to understand. It’s very important to understand the difference before you make an insurance choice.

- Medigap Plan B should not be confused with Medicare Part B, which provides coverage for outpatient services.

- Medigap Plan B offers the same benefits as Medigap Plan A, plus the Part A deductible.

- The cost of a Medigap plan such as Plan B depends on multiple factors, such as your age, zip code, gender, and tobacco use.