Let us assist you in navigating Medicare options. Our knowledgeable team will guide you through the process, comparing top carriers and plans to find the best fit for you.

Parts of Medicare

Part A (Hospital Insurance)

Part B (Medical Insurance)

Part D (Drug coverage)

Medicare Supplemental Insurance (Medigap)

Medicare Part A

Part A is also free for most people as long as they have worked at least 10 years

in the U.S. or are married to someone who is at least 62 and has worked those quarters.

Think of Part A as your room and board in the hospital. Part A of Medicare provides

you a semi-private room for your hospital stay and with meals and medical services

while you are in the hospital.

Sometimes super healthy people ask us if it makes sense to only take Part A since

Part B costs 164.90 per month for most beneficiaries.. Maybe they never go to a

doctor or rarely use medical services presently and they wonder if they can get away

with Part A alone and save $164.90 a month by abstaining from enrolling in Part B?

Unfortunately, there are numerous procedures that are done in the hospital that fall

under another part of Medicare – Part B, so it’s important that you enroll in both A & B

unless you have other coverage coordinating with Medicare.

Medicare Part B

Medicare Part B covers your outpatient medical services. Part B of Medicare is for outpatient services that are deemed medically necessary. Medicare Part B includes coverage for services like doctor office visits, lab testing, diagnostic imaging, preventive care, surgeries, ambulance rides, chemotherapy and radiation, and even extensive dialysis care for people with renal failure. Many of these procedures may occur in a hospital. However, they fall under Part B because physicians provide them, so it’s not always easy to determine what is inpatient vs outpatient care.

People often ask us, “Do I really need Part B?” The answer is YES if Medicare will be your primary coverage or only coverage. Read our blog here to learn more:

Now those two different parts of Medicare – Parts A and B together – make up what we call Original Medicare.

They are only two parts that you will sign up for at the Social Security office or Railroad Retirement Board.

Medicare Part C

Medicare Part C is a term for private Medicare insurance

Part C of Medicare is somewhat confusing. Unlike the other parts of Medicare, which cover specific medical benefits, Medicare Part C is just another name for private Medicare insurance. The Balanced Budget Act of 1997 created Part C, which is now referred to as Medicare Advantage.

Medicare Advantage plans are private health plans that you can choose instead of Medicare. You would get your Part A, Part B, and sometimes also Part D all from one insurance carrier. Advantage plans usually have a network of providers from whom you will seek your care. Medicare pays the insurance company a set amount per person each month to manage your care and these plans typically have a restrictive doctor and hospital network, referrals for specialists are often required and unlike original medicare, advantage plans do have a maximum out of pocket. Medicare set the maximum out of pocket at $8300 per year (your responsibility) but some plans have a smaller max out of pocket.

Part C plans can often have lower premiums than Medigap plans. However, you’ll pay more copays as you go along so they are not necessarily cheaper over the long term.

Before enrolling in this part of Medicare, read our post on Medicare Advantage vs Medicare Supplement. You’ll be choosing one type of coverage or the other, so you’ll want a good understanding of how each type of coverage works.

Medicare Part D

Medicare Part D Plans provide retail prescription drug coverage Part D is a federally created program to help you lower the cost of your retail prescription drugs. Unlike Medicare Part A & B, you will not enroll in Part D through the Social Security office. Instead, you will select one of the Part D plans available in your county from private insurance carriers.

By signing up for that plan, you will have enrolled in Part D. You only need either Part A and/OR Part B to be eligible to enroll in a Part D stand alone drug plan.

Medicare drug plans are optional. You’ll have a monthly premium that you will pay to the insurance carrier. In return, they give you significantly lower copays on your medicines than you would pay if you had no Part D insurance.

There are rules for when you can enroll and dis-enroll from these drug plans, so be

sure to visit the Medicare Part D section of our website for more details about how

your drug coverage under Medicare will work.

For a quick video about the four parts ofMedicare, check out our following YouTube video

Many people confuse the terms Parts and Plans. There are only 4 Medicare Parts.

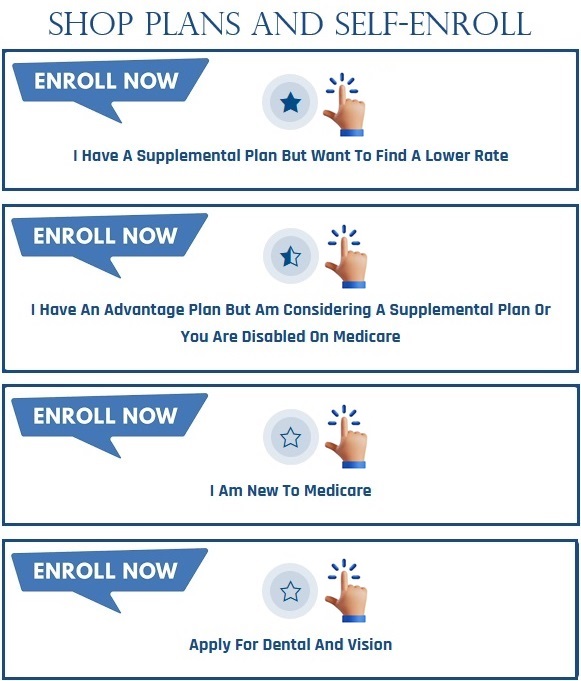

All the other letters are Medigap plans. Medigap plans are optional supplemental coverage that you can buy to fill in the gaps in Medicare. You don’t enroll in these at the Social Security office. You will choose your supplemental coverage after you have joined Medicare and received your new Medicare card in the mail. That’s where our agency comes in – we help people like you choose the right supplemental and drug plan options. Our service is free.

If Medicare is your only coverage, you definitely need both parts of Original Medicare – Parts A and B. You must have both of these parts to be eligible to enroll in either a Medicare supplement plan or a Medicare Advantage plan.

Most people need Part D as well. You can add this as standalone coverage alongside your Original Medicare and Medicare supplement, or you can look into Medicare Advantage plans that have a built-in Part D drug plan. Part D is voluntary because some people with other drug coverage may not need it. You will pay substantial penalties for enrolling late if you didn’t have other creditable

To avoid those penalties, you must enroll in both Medicare Parts A and B during your Initial Enrollment Period (again, unless you have other creditable coverage). So while technically, Medicare is not mandatory.

Also, once you enroll in Social Security income benefits, you will automatically be enrolled in Medicare Part A. You cannot collect Social Security without having Part A – the two are linked.

Our friendly agents can walk you through these 4 parts of Medicare until you understand them well. Call 843-227-6727 for a free consultation. Our team is very experienced at explaining Medicare parts and how they work. You’ll soon be an expert on different parts of Medicare and what they cover.

What doesn’t Medicare cover?

This is a great question as many people are unaware that it does not cover every health expense that beneficiaries will encounter.

Medicare does not cover:

Long-term care

Hearing aids

Routine dental care

Routine vision care

Medical care outside of the U.S.

Dentures

Plastic and/or cosmetic surgery

Massage therapy

Get More Information From the Experts

Do you need help understanding your coverage options? The first step to setting up affordable health insurance is knowledge. Let our experts help you learn your basic benefits, and then we can help you with choosing the appropriate supplement plan. Call 843-227-6725 today!

We’ve got representation available in

all 43 states.

May River Medicare beneficiaries are served in 43 states. Unlike other agents and brokers, we provide lifelong support for your policy and deliver exceptional customer service.

Phone: +1843 227 6725