Medicare Part D Drug Plan

Key Points

- The Medicare Part D Drug plan started in 2006. It provides drug coverage for Medicare Beneficiaries.

- Each Part D plan will have a premium and cost sharing for drugs

- There are specific enrollment periods during the year for you to enroll in a Part D plan or change to a different plan

Medicare Part D is a federal program that began in 2006. It provides Medicare beneficiaries with access to retail

prescription drugs at affordable copays. Prior to 2006, people on Medicare paid mostly out-of-pocket for their

medications for over 40 years.

Medicare Part D is coverage for retail prescription drugs that you obtain from a retail pharmacy.

This voluntary program allows you to access medications at a more affordable rate. It also provides

insurance against catastrophic drug costs.

You do not enroll in Medicare Part D via Social Security. Instead, you will choose a Medicare Part D plan offered

by a private insurance company in your state.

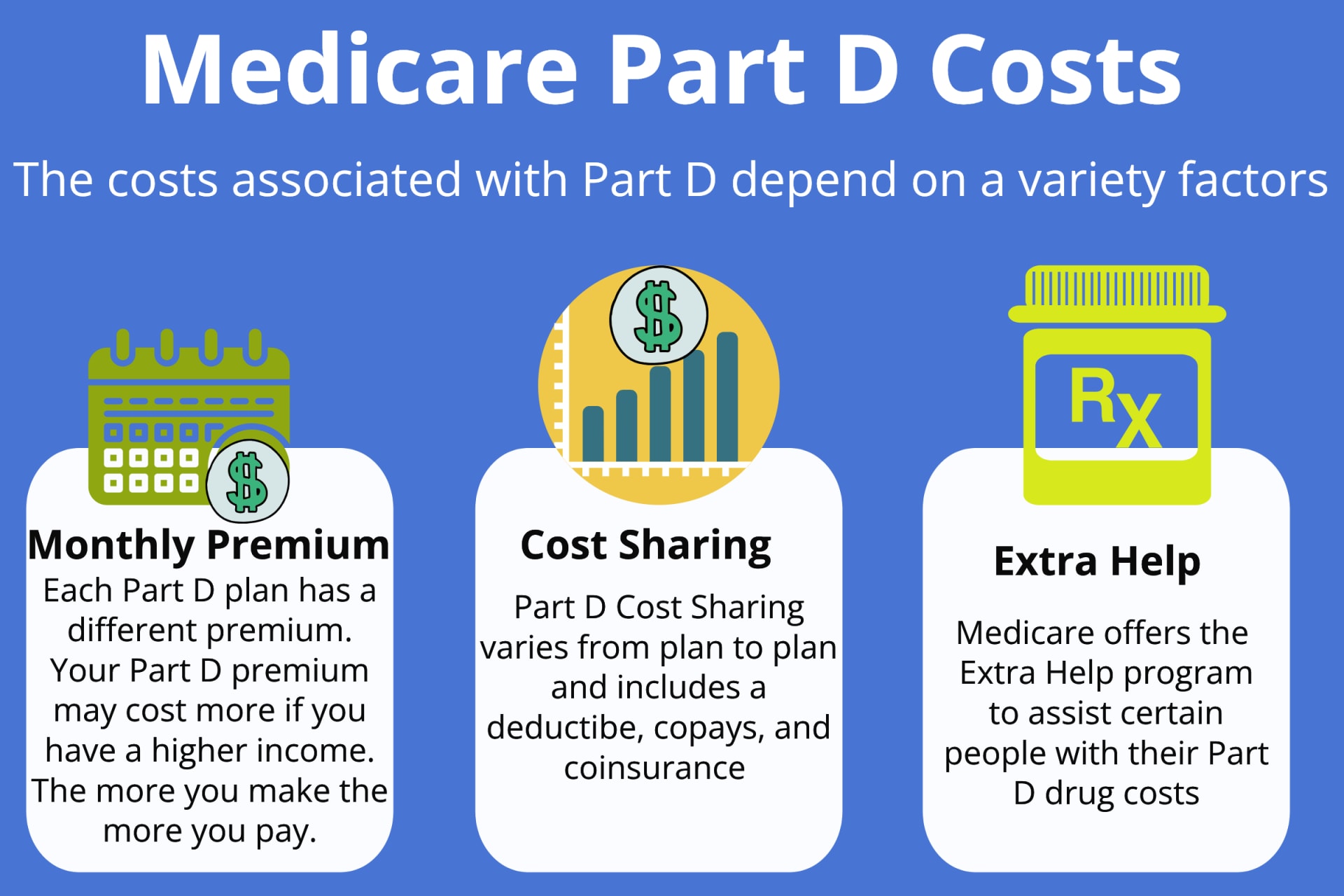

Medicare Part D Costs

Medicare Part D costs include several things. First, there is a monthly premium that you will pay for the insurance itself. Then there is cost-sharing that you will pay at the pharmacy for your medications. That cost-sharing may include some deductible spending if your Part D plan has a deductible.

Let’s take a look at the moving pieces that cost you.

Medicare Part D Monthly Premiums

The monthly premiums for Part D drug plans vary depending on the specific plan that you choose. Each insurance company sets its own rates.

In 2025, there are many Medicare Part D plans to choose from in each state – sometimes 30 plus plans. Plans range from as low as $a couple dollars in some states to over $200+. Every insurance company sets its own formulary (list) of medications that are covered by the plan and what Tier they will be priced at. The lower the Tier the less the drug will cost. Therefore, they can determine what monthly premium they will charge for the plan each year.

The cheapest Part D drug plan in your state is often time NOT the best one for you. It’s important to choose a plan with a formulary that offers the medications you need. If you just enroll in the cheapest plan without checking the plan’s formulary, because once the enrollment period is over your stuck until next year in most cases. And if that plan does not cover one of your medications you pay 100 percent of the cost.

Some people with higher incomes may have to pay more for their Medicare Part D plan. If you earned more than a certain amount filing individually or jointly, then Medicare will also require you to pay extra for your Part D coverage. This is called the Income Monthly Adjusted Amount or IRMAA. You can read more about IRMAA costs on our Medicare cost page.

Medicare Cost Sharing

When you go to the pharmacy to pick up your prescriptions, you will pay your share of the costs. Some plans have a deductible, and then there are the copays that you pay for the medication itself.

Medicare Part D Deductible

The Center for Medicare and Medicaid Services sets the minimum guidelines for Part D plans each year. Each insurance company offering Part D plans must follow these guidelines. All drug plans have 3 stages, and Medicare sets the threshold for each stage each year.

The first stage is the Medicare Part D deductible. In 2025, this deductible is $590. This means that each insurance company can require up to a $590 deductible from you upfront before your benefits kick in. The insurance company can also charge a lower deductible if it chooses to do so. However, no plan can charge a higher deductible than what Medicare allows for that year.

In general, the drug plans that charge the deductible upfront will have lower monthly premiums and lower drug copays. Some companies waive the deductible, but then you will see that the premiums and copays are usually higher than plans that charge the deductible.

Medicare Part D Copays

Medicare Part D plans usually have 5 tiers for their medications in their formularies. A Tier 1 is usually a preferred generic medication. Tier 2 would be non-preferred generic. Tier 3 would be the preferred brand, and so on. The insurance company will set the copay for each tier. For example, one company might charge a $3 copay for Tier 1 medications while another charges $5. This is why it’s important to review the plan’s formulary to make sure your medications are covered and to know what you can expect to pay for those medications.

Medicare offers a Drug Finder Tool, which can be found at www.medicare.gov. You can use this tool to enter your zip code and medications. The Drug Finder Tool will show you which plans in your state will be the most cost-effective for you.

You must do your annual homework with Part D to ensure the lowest out-of-pocket drug spending for the next year.

Medicare Prescription Payment Plan

- Starting in 2025, this new payment option works with your current drug coverage to help you manage your out-of-pocket drug costs,

by spreading them across the calendar year (January–December). This payment option might help you manage your expenses, but it

doesn’t save you money or lower your drug costs. If you select this payment option, each month you’ll continue to pay your plan premium (if you have one), and you’ll get a bill from your health or drug plan to pay for your prescription drugs (instead of paying the pharmacy). -

All plans offer this payment option, and participation is voluntary. It doesn’t cost anything to participate in the Medicare Prescription Payment Plan. -

Contact your plan or visit Medicare.gov/prescription-payment-plan for more information and to find out if this payment option is right for you.

This payment option might help you manage your monthly

expenses, but it doesn’t save you money or lower your drug costs.

Visit

https://www.medicare.gov/basics/costs… to learn about other programs that might save you money, if you qualify.

That’s the Medicare drug coverage (Part D) late enrollment penalty?

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium.

You may have to pay a late enrollment penalty if you enroll at any time after your Initial Enrollment Period is over and there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage.

You’ll generally have to pay the penalty for as long as you have Medicare drug coverage.

If you get Extra Help, you don’t pay an enrollment penalty.

1. Get Medicare drug coverage (Part D) when you’re first eligible for it. Even

If you don’t take drugs now, you should consider joining a separate Medicare

drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty.

You may be able to find a plan that meets your needs with little to no monthly premiums.

2. Add Medicare drug coverage (Part D) if you lose other creditable coverage.

Creditable prescription drug coverage could include drug coverage from

a current or former employer or union, TRICARE, Indian Health Service, the

Department of Veterans Affairs, or individual health insurance coverage. Your

plan must tell you each year if your non-Medicare drug coverage is creditable

coverage. If you go 63 days or more in a row without Medicare drug coverage

or other creditable prescription drug coverage, you may have to pay a

penalty if you sign up for Medicare drug coverage later.

3. Keep records showing when you had other creditable prescription drug

coverage, and tell your plan when they ask about it. If you don’t tell your

plan about your previous creditable prescription drug coverage, you may

have to pay a penalty for as long as you have Medicare drug coverage.

What is Credible Coverage?

Creditable drug coverage is, on average, as good as or better than the basic Part D benefit . You should receive a notice from your employer or plan around September of each year, informing you if your drug coverage is creditable. If you have not received this notice, contact your human resources department, drug plan, or benefits manager. Be aware that this information may not come as a separate piece of mail; it can be included with other materials, such as a plan newsletter.

Several types of plans offer creditable drug coverage, including:

- Veterans Affairs (VA) benefits

- TRICARE for Life (TFL)

- Federal Employee Health Benefits (FEHB)

- Some job-based and retiree plans

If you are considering delaying Part D enrollment because you already have prescription drug coverage, make sure to find out if your coverage is considered creditable. Maintaining enrollment in creditable drug coverage means you will not incur a late enrollment penalty (LEP) for delaying Part D enrollment. Additionally, having creditable coverage means that if you learn that you are going to lose such coverage and you want Part D coverage, you will have a two-month Special Enrollment Period (SEP) to enroll in a Part D plan.

If you have no drug coverage, or have drug coverage that is not creditable, Part D may help you. Even if you do not take prescription drugs, it is important to enroll in Part D so that if you later need to access prescriptions you do not face penalties or gaps in coverage.

Remember, if you decide to delay enrollment in any part of Medicare, keep a record of your insurance until you enroll in Medicare. You may need this documentation in order to sign up for Medicare later.

How much more will I pay for a late enrollment penalty?

- The cost of the late enrollment penalty depends on how long you didn’t have creditable prescription drug coverage. Currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium 36.70 in 2025) by the number of full, uncovered months that you were eligible but didn’t have Medicare drug coverage (Part D) and went without other creditable prescription drug coverage. The final amount is rounded to the nearest $.10 and added to your monthly premium. The “national base beneficiary premium” may increase or decrease each year. If that happens, the penalty amount you pay may increase or decrease. After you get Medicare drug coverage, the plan will tell you if you owe a penalty and what your premium will be.

Eliminating the Part D LEP

For most people, you have to pay the LEP as long as you are enrolled in the Medicare prescription drug benefit. There are some exceptions:

*If you receive Extra Help, your penalty will be permanently erased

*If you are under 65 and have Medicare, your LEP will end when you turn 65.

*If you qualify for a state pharmaceutical assistance program (SPAP), it may pay your penalty for you.

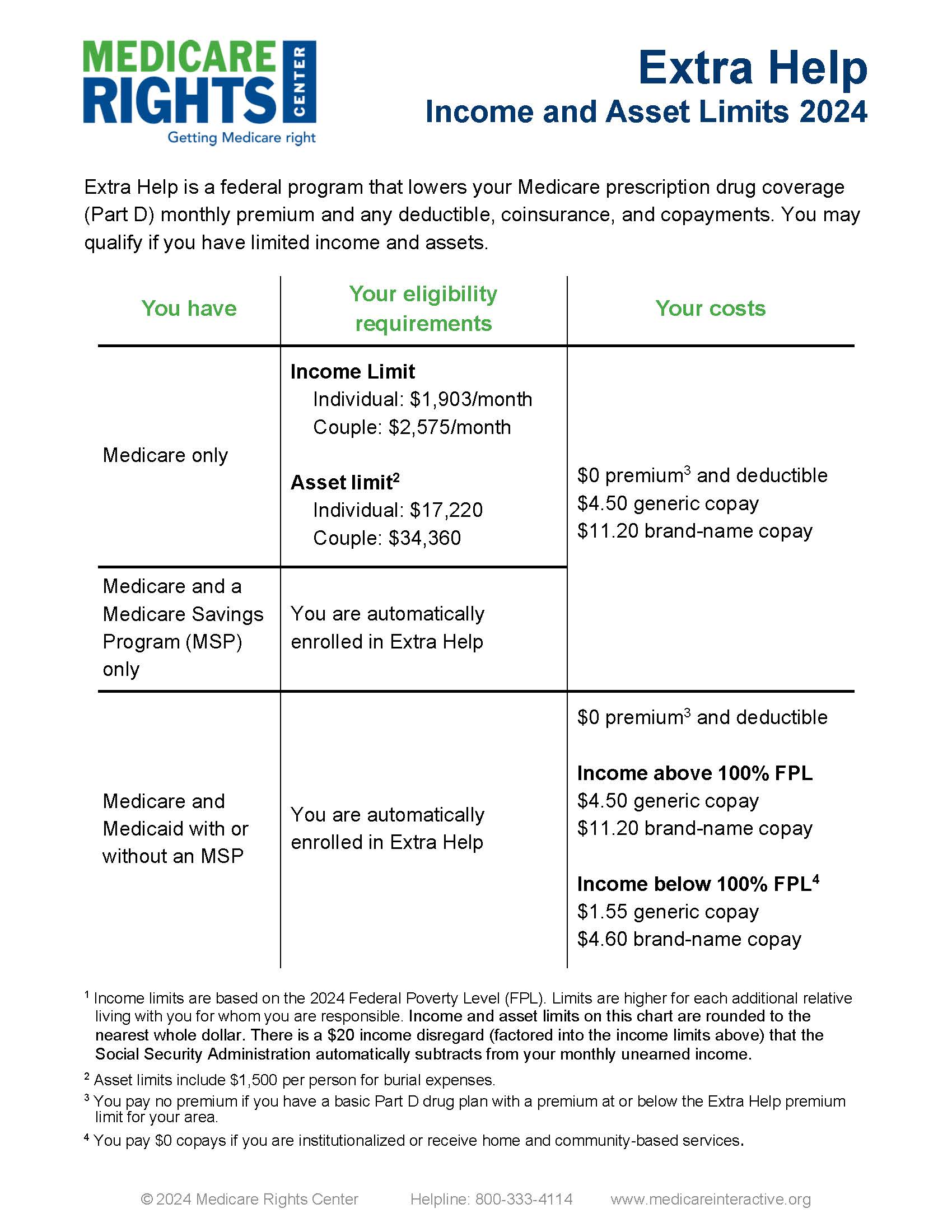

Extra Help for Part D Drugs

Our federal government offers help with paying for your Part D drug plan expenses if you qualify. This is called the Low-Income Subsidy. Anyone can apply for this at Social Security, but help is awarded based on proving low income and limited resources. You must have an annual income that falls below 150% of the Federal Poverty Level based on your household size.

Beneficiaries who qualify will receive assistance with paying their monthly Part D premiums, their annual Part D deductible, and their copays for retail medications. There are different levels of qualification. The subsidy level generally determines how much assistance you will get with your monthly premiums. Someone qualifying for a full subsidy would have 100% of their Part D premium paid for up to the benchmark allowed by Medicare for that year.

For example, if you get an award notice for a full subsidy, and the benchmark for the year is $42, then the LIS program will pay up to $42/month toward your premiums. Choosing a drug plan with a premium of $42 or less in that scenario would mean you pay nothing for your drug plan. Furthermore, you will pay no deductible if your plan has one. Your copays for medications are greatly reduced. If you think you may qualify, it is worth contacting Social Security for an application.

Click Shop Medicare Image Below to shop out plans and enroll.

- This Tool does not shop out or find plan information for medicare supplements. It will give you great information that will help you self enroll for Medicare advantage and Part D Drug Plans, but it does not show Special Needs Advantage Plans

When to Enroll in Part D

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam

If you need to enroll in Medicare Part D for the first time, typically you will do so either during your Initial Enrollment Period (IEP), the Fall Open Enrollment Period, or if you qualify for a Special Enrollment Period (SEP). Additionally, you must:

- Have Part A and/or Part B

- And, live in the Part D plan’s service aream

Your Part D IEP is usually the same as your Medicare IEP: the seven-month period that includes the three months before, the month of, and the three months following your 65th birthday. For example, let’s say you turn 65 in May. Your IEP runs from February 1 to August 31.

The date when your Part D coverage begins depends on when you sign up:

Enrolling during the first three months of the IEP means coverage begins the first day of the fourth month.

Enrolling during the fourth month of the IEP or any of the three months afterwards means coverage begins the month following the month of enrollment.

Our federal government offers help with paying for your Part D drug plan expenses if you qualify. This is called the Low-Income Subsidy. Anyone can apply for this at Social Security, but help is awarded based on proving low income and limited resources. You must have an annual income that falls below 150% of the Federal Poverty Level based on your household size.

Beneficiaries who qualify will receive assistance with paying their monthly Part D premiums, their annual Part D deductible, and their copays for retail medications. There are different levels of qualification. The subsidy level generally determines how much assistance you will get with your monthly premiums. Someone qualifying for a full subsidy would have 100% of their Part D premium paid for up to the benchmark allowed by Medicare for that year.

For example, if you get an award notice for a full subsidy, and the benchmark for the year is $34, then the LIS program will pay up to $34/month toward your premiums. Choosing a drug plan with a premium of $34 or less in that scenario would mean you pay nothing for your drug plan. Furthermore, you will pay no deductible if your plan has one. Your copays for medications are greatly reduced. If you think you may qualify, it is worth contacting Social Security for an application.

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam