“Smarter Medicare Choices: How to Avoid Mistakes and Save Thousands on Your Supplement Plan”

🎯 Approaching Age 65½ or 66? Don’t Miss This Medicare Deadline

If you’re turning 65½ or 66, it’s critical to act now. Your opportunity to get a Medicare Supplement (Medigap) plan without answering health questions is limited.

🚫 After This Window, Enrollment Gets Tougher

Once your initial enrollment window passes, applying for a Medigap plan may require:

- Answering detailed health questions

- Going through medical underwriting

- Risking denial or higher premiums based on pre-existing conditions

✅ Take Advantage of Your Guaranteed Enrollment Period

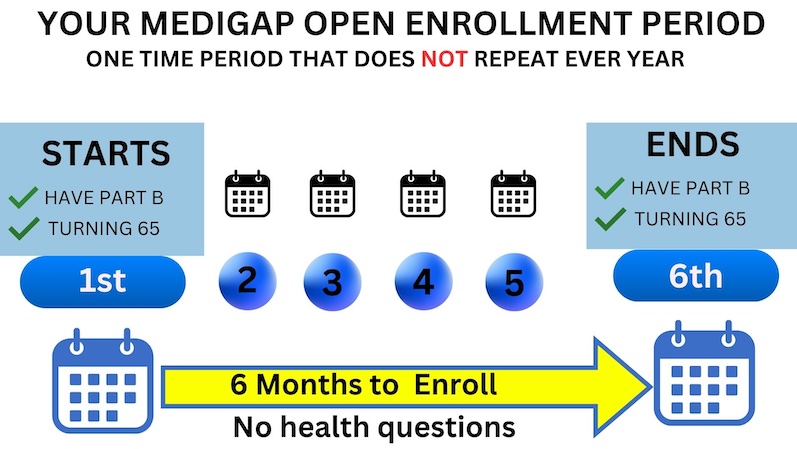

You have a one-time, 6-month Medigap Open Enrollment Period starting when you’re both 65 and enrolled in Medicare Part B. During this time:

- You can’t be denied coverage

- You won’t be asked health questions

- You’ll have access to any plan available in your area

If you initially enrolled in a Medicare Advantage plan, you have a 12-month “trial period” from your plan’s effective date to switch back to Original Medicare and still enroll in a Medigap plan with no underwriting .

💻 Take the Next Step Now

- 👉 Click here to start your self-enrollment using our Medicare Supplement Quote Tool

- 📅 Or schedule a free consultation with a licensed agent here

🕒 Your One-Time Medicare Supplement Open Enrollment Period

When you turn 65 and enroll in Medicare Part B, you are granted a 6-month window to sign up for a Medicare Supplement (Medigap) plan without any health questions or medical underwriting. This means you cannot be denied coverage, regardless of any pre-existing conditions.

This 6-month period begins the month you turn 65 and are enrolled in Part B — and it’s a one-time-only opportunity.

🔄 Switching from Medicare Advantage? You May Still Qualify

If you originally chose a Medicare Advantage (Part C) plan when you turned 65, you’re still protected — but the rules are a little different.

You have a 12-month “trial right” period from the effective date of your Medicare Advantage plan to switch back to Original Medicare and still enroll in a Medicare Supplement plan with no medical underwriting or health questions asked .

⚠️ Don’t Confuse Open Enrollment with the Fall Election Period

Once your Medicare Supplement Open Enrollment window ends, future applications may be subject to approval. Insurance companies are legally allowed to:

- Accept or deny your application

- Charge higher rates based on your health history

This is exactly why the Medicare & You Handbook recommends taking full advantage of your one-time open enrollment period — when your acceptance is guaranteed.

🚫 The Fall Annual Election Period Does Not Apply to Medigap

Many people mistakenly believe the Annual Election Period (AEP) in the fall is the time to switch Medicare Supplement (Medigap) plans. This is incorrect.

✅ The AEP only applies to Medicare Part D drug plans and Medicare Advantage plans, not Medigap.

Unlike Advantage plans, you can apply to change your Medigap plan at any time of year, but outside of your guaranteed window, you’ll be subject to health underwriting.

A great time to review your Medigap plan is during your policy anniversary, when many companies send out rate increase notices.

📆 Understanding the 12-Month Medicare Advantage Trial Right

If you enrolled in a Medicare Advantage plan at age 65, you are entitled to a one-time 12-month “trial right” to switch back to Original Medicare and enroll in a Medigap plan without underwriting.

Example:

- A beneficiary turns 65 and enrolls in both Part A, Part B, and a Medicare Advantage plan with an effective date of May 1st.

- Their trial period ends April 30th of the following year.

- If they decide to return to Original Medicare before that deadline, they can apply for a Medicare Supplement and a standalone Part D plan without any medical questions asked .

📌 Important: The Medigap application must be submitted before the 12-month window closes.

✅ Ready to Enroll or Compare Options?

- 👉 Click here to start your self-enrollment using our Medicare Supplement Quote Tool

- 📅 Or schedule a free consultation with a licensed agent here

See if you qualify for a

Guaranteed Issue right

🛡️ Missed Open Enrollment? You May Still Have a Guaranteed Issue Right

If you didn’t enroll in a Medicare Supplement (Medigap) plan during your Open Enrollment Period, you may still qualify under a Guaranteed Issue Right.

This right applies if you’re age 65 or older and you lose or end certain types of health coverage . You typically have 63 days from the date your coverage ends to apply for a Medigap plan — no medical questions asked.

✅ What a Guaranteed Issue Right Means for You

When you have a Guaranteed Issue Right:

- Insurance companies must offer you a Medigap policy

- You’ll receive the best available rate, no matter your health

- Coverage can’t be denied, and

- No waiting period can be imposed for pre-existing conditions

⚠️ Keep in mind: “Best available rate” still depends on factors like your age, gender, tobacco use, marital status, and location.

To ensure you’re getting the best rate, consider speaking with a licensed agent or contacting your local State Health Insurance Assistance Program (SHIP).

📋 Situations That May Trigger a Guaranteed Issue Right

Below are examples of situations where you might qualify:

- Your Medicare Advantage plan is leaving your area, or you move out of the plan’s service zone

- You lose employer or union health coverage

- Your current insurance company goes bankrupt or misleads you

- You leave a Medicare Advantage plan during your trial right period

Each of these events could qualify you for guaranteed Medigap access without underwriting — but the 63-day clock starts as soon as your other coverage ends.

💡 Take Action While You’re Eligible

- 👉 Start your self-enrollment with our Medicare Supplement Quote Tool

- 📅 Schedule a consultation with a licensed agent here

Other Examples of Guaranteed Issue Rights

📌 Examples of Guaranteed Issue Rights

If any of the following situations apply to you, you may qualify for a Guaranteed Issue Right — allowing you to enroll in a Medicare Supplement (Medigap) plan without medical underwriting and at the best available rate, regardless of your health status.

Here are some common examples:

🚨 1. Your Medicare Advantage Plan Is Ending or You Move

You may qualify if:

- Your Medicare Advantage Plan is leaving Medicare,

- The plan stops providing care in your area, or

- You move out of your plan’s service area

👔 2. You Lose Employer, COBRA, or Union Health Coverage

You’re eligible for guaranteed issue if you have:

- Original Medicare and an employer group health plan, including retiree or COBRA coverage

- That employer or union coverage is ending

- The group plan pays after Medicare, and it is terminating coverage

🔄 3. You Tried Medicare Advantage but Want to Switch Back

This applies if:

- You dropped a Medigap plan to join a Medicare Advantage Plan , or to try a different Medigap plan

- You joined for the first time and have been enrolled for less than one year

- You now want to switch back to your original Medigap policy or a new one

This is often referred to as your “Trial Right” — and it’s a one-time opportunity .

📝 Take the Next Step Now

If you believe you qualify for one of these rights, don’t wait — the 63-day deadline applies from the time your other coverage ends.

- 👉 Click here to start your self-enrollment using our Medicare Supplement Quote Tool

- 📅 Schedule a consultation with a licensed agent here

Sample Underwriting Question for Medicare Supplement Applications

🔍 Sample Medicare Supplement Underwriting Questions

When applying for a Medicare Supplement (Medigap) policy outside of your guaranteed enrollment window, most insurance companies will require you to answer health questions.

Our licensed agents work with multiple carriers and will match you with a company whose underwriting guidelines best fit your unique health profile — making it more likely that your application is approved.

📋 Common Underwriting Questions: What Carriers Want to Know

Most carriers ask if you’ve been diagnosed with, treated for, or prescribed medications for specific conditions in the last 24 to 36 months. Here’s a sample of common questions found on Medigap applications:

ConditionLook-back PeriodInternal Cancer3–5 yearsHeart Conditions24 monthsAtrial Fibrillation24 monthsStroke or Transient Ischemic Attack (TIA)24 monthsStent Placement24 monthsChronic Obstructive Pulmonary Disease3 yearsDiabetes with InsulinVariesOsteoporosisVariesRheumatoid or Disabling ArthritisVaries

Note: Each company may define timelines and severity differently. That’s why it’s important to work with an experienced agent.

✅ Minor Conditions: Typically No Problem

The good news? Minor or short-term health issues generally don’t affect approval. Carriers usually do not decline applicants for things like:

- Seasonal allergies

- Colds or the flu

- Minor infections like UTIs

- Temporary injuries that are healed

- Controlled blood pressure or cholesterol

- Mild arthritis

- Slightly elevated weight (depending on BMI)

Each carrier has its own height and weight chart, and our team can quickly determine if your BMI falls within their guidelines.

⛔ Pending Surgeries or Expensive Treatments? Wait Until Completed

If you have a pending major surgery or diagnostic test, most carriers will postpone or decline your Medigap application until the procedure and all follow-up care is complete.

This applies even to non-emergency surgeries such as:

- Gallbladder removal

- Hernia repair

- Endometriosis treatment

- Joint replacements or orthopedic procedures

📌 Why? Medicare Supplement carriers are responsible for 20% of surgery costs. They want to ensure major claims aren’t filed immediately after enrollment.

Before applying, it’s best to complete any planned procedures and recovery, then reapply with a clean record.

💬 Get Personalized Help Based on Your Health

- 👉 Click here to check your options with our Medicare Supplement Quote Tool

- 📅 Schedule a free one-on-one consultation with a licensed Medicare agent

📉 Don’t Ignore Market Trends: Why “Set It and Forget It” Could Cost You

Many people are told, “Plan G is the best — your only out-of-pocket cost is the $240 annual Part B deductible.” That’s a popular pitch, but blindly enrolling in Plan G — and never reviewing your policy again — could end up costing you thousands over time.

💤 Insurance Companies Count on You to Fall Asleep at the Wheel

It’s human nature to file your policy away and forget about it — especially if it’s covering claims. But here’s the truth:

💡 All Medicare Supplement plans are required by law to pay your approved claims. They get the bill directly from Medicare. If they don’t pay — they’re out of business.

So why do prices vary so much? Because insurance carriers raise rates every year, and many count on policyholders not noticing. Loyalty isn’t rewarded — it’s exploited.

If you ignore your annual rate increase letters, you may suddenly find yourself paying double or more than what a new customer is paying with a different company.

Worse? By the time you realize it, your health might prevent you from switching plans due to medical underwriting.

🔄 Why an Annual Policy Review Is Crucial

Medicare carriers regularly release new plans and updated rates in each state. Just a 10-minute conversation with your agent each year can help ensure:

- You’re not overpaying

- You’re with a financially strong, A-rated carrier

- You’re not missing out on better plan options (like Plan N)

📌 Smart Medicare consumers compare plans annually — just like they would with home or auto insurance.

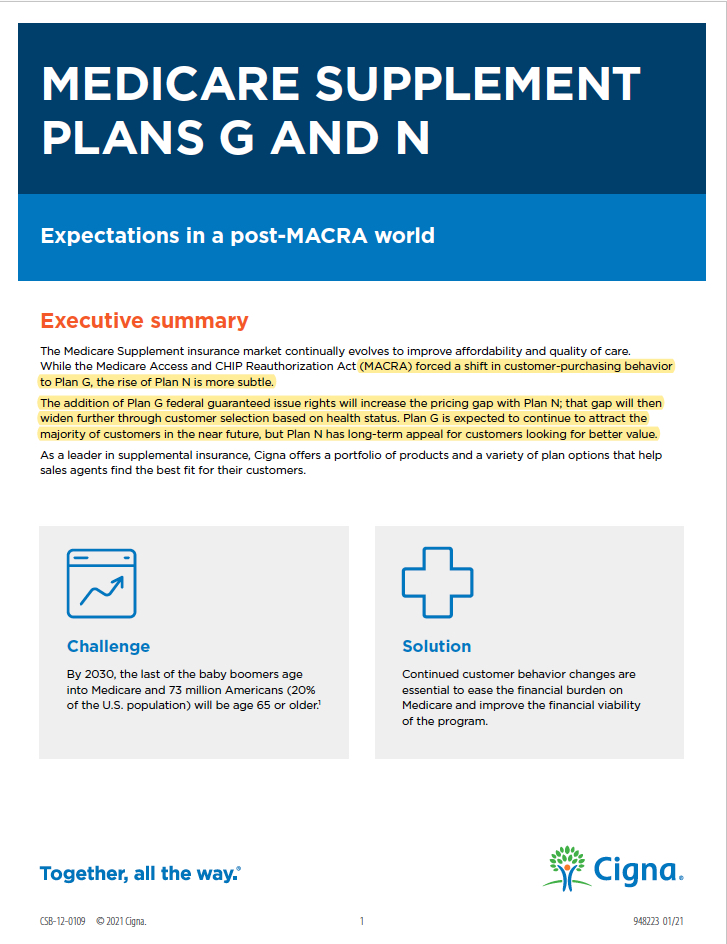

📊 Plan G vs Plan N: What Most Agents Won’t Tell You

Plan G became the default recommendation after MACRA legislation went into effect on January 1, 2020, which:

- Prohibited Plan F enrollment for new Medicare beneficiaries

- Flooded Plan G with chronically ill applicants, because it doesn’t require medical underwriting for certain applicants

As a result, Plan G rates have been increasing more aggressively each year, and the premium gap between Plan G and Plan N continues to widen.

🧾 Plan N provides nearly identical coverage, with just a few minor differences — and often at a much lower monthly premium.

📎 Independent Study: Cigna even issued a formal bulletin to its agents warning of ongoing Plan G rate volatility.

Ask your licensed agent to show you the

Plan G vs Plan N comparison study developed by Cigna’s underwriting department.

💬 Want a Policy Review or Plan Comparison?

Let us help you avoid overpaying for outdated coverage.

- 👉 Click here to use our Medicare Supplement Quote Tool

- 📅 Schedule a free plan review with a licensed agent here

Click on Image Below to Download Cigna’s Underwriting Department’s Independent Study Emailed to all its Agents Regarding the Future of Plan G rates versus Plan N rates and why Plan offers more value

What if I’m on an Advantage Plan and I am not healthy enough to Pass Medicare Supplement Underwriting?

WATCH VIDEO BELOW TO Learn the three fastest ways to get hurt on a Medicare Advantage plan AND LEARN HOW TO AVOID BIG HOSPITAL OR CANCER BILLS

✅ Medicare Advantage Plan Checklist

Before choosing a Medicare Advantage (Part C) plan, it’s important to look beyond just the premiums. Use this checklist to help ensure the plan you choose truly fits your health needs and financial goals.

🔎 What to Look For

- ✅ **Choose a plan with the lowest possible Maximum Out-of-Pocket (MOOP)

- ⚠️ Avoid carriers with a history of improper denials, lawsuits, or overuse of prior authorizations

- ⭐ Consider a 5-Star Plan, if available in your area

📋 1. Are Your Doctors, Hospitals, and Pharmacies In-Network?

Medicare Advantage plans have their own provider networks.

Make sure your favorite doctors, specialists, hospitals, and local pharmacies are

in-network to avoid unexpected costs.

🌐 2. Can You See Out-of-Network Providers?

Some MA plans allow visits to non-network providers, but you may pay higher out-of-pocket costs

for those visits.

Double-check the network flexibility of the plan.

💊 3. Are Your Prescription Drugs Covered?

Most Medicare Advantage plans include Part D drug coverage, but formularies vary.

Check:

- Are your medications covered?

- What are your copays?

- Do any of your prescriptions have $0 copays?

- Has the formulary changed this year?

Be sure to review the plan’s drug list annually.

🏋️♀️ 4. Do You Want Fitness, Dental, Vision, or Hearing Benefits?

Many MA plans offer extra perks like:

- Dental, vision, and hearing coverage

- Access to fitness programs like SilverSneakers

- Wellness incentives or home exercise kits

If these benefits are important to you, make sure the plan includes them.

💰 5. Does the Plan Fit Your Budget?

Out-of-pocket costs include:

- Monthly premiums

- Deductibles

- Copays and coinsurance

In 2024, the maximum out-of-pocket limit (MOOP) for Part C plans is $8,850 , but many plans offer lower caps. Be sure to understand all potential costs before enrolling.

🆘 6. Are Assistance Programs Available to Help?

If you need financial assistance, you may qualify for:

- Extra Help with drug costs

- Medicare Savings Programs (MSPs)

- Dual-Eligible Special Needs Plans (D-SNPs) for those on both Medicare and Medicaid

- SNPs tailored to people with chronic conditions or disabilities

Your agent can help determine if you qualify and guide you through the application process.

🚗 7. Would Non-Medical Benefits Improve Your Daily Life?

Some Medicare Advantage plans include non-traditional benefits, such as:

- Transportation to medical appointments

- Grocery and food delivery assistance

- Over-the-counter (OTC) allowance

- Fall prevention devices

- Companionship programs

- Help with utility bills

If these services would add value to your day-to-day routine, consider plans that offer them.

💬 Ready to Compare or Enroll?

Let us help you find the right Medicare Advantage plan for your needs.

- 👉 Click here to use our Medicare Quote & Enrollment Tool

- 📅 Schedule a free consultation with a licensed Medicare agent here